Home Loan Paperwork Signing Requirements

Introduction to Home Loan Paperwork Signing Requirements

When it comes to finalizing a home loan, the paperwork signing process is a critical step that requires careful attention to detail. This process involves signing various documents that confirm the borrower’s agreement to the loan terms, including the interest rate, repayment schedule, and other conditions. In this blog post, we will delve into the world of home loan paperwork signing requirements, exploring the key documents involved, the signing process, and the importance of careful review.

Key Documents Involved in Home Loan Paperwork Signing

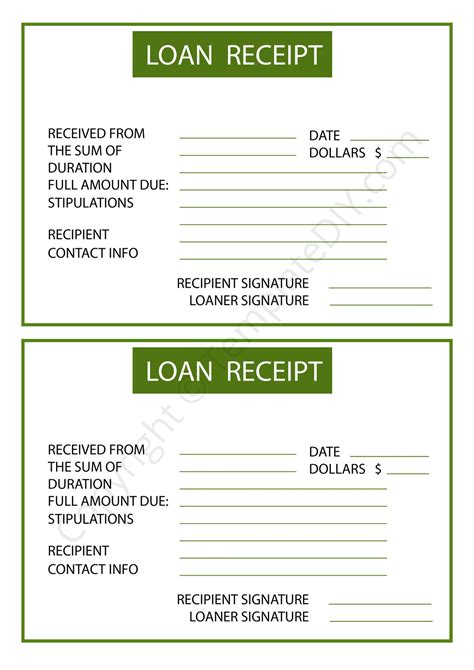

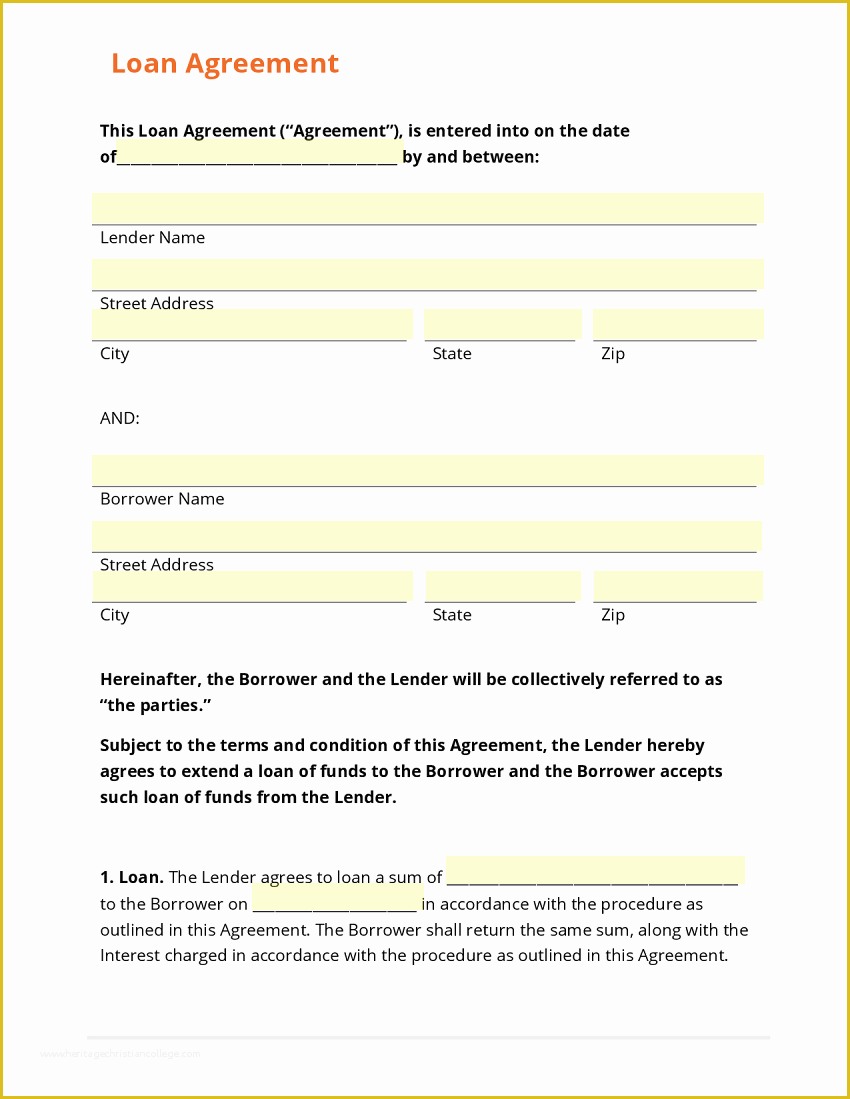

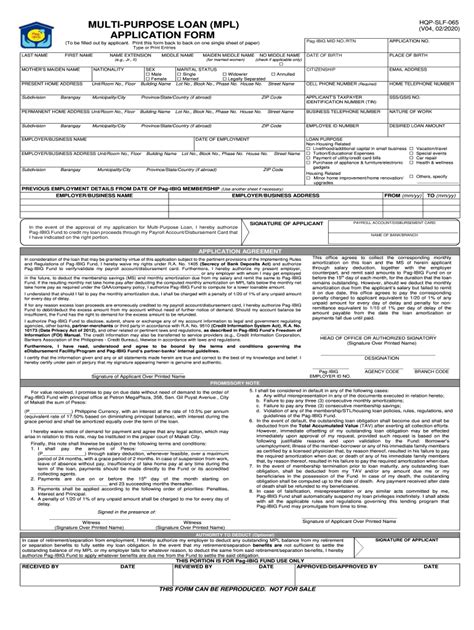

The home loan paperwork signing process typically involves a range of documents, including: * Loan Agreement: This document outlines the terms and conditions of the loan, including the interest rate, repayment schedule, and loan amount. * Mortgage Deed: This document transfers the ownership of the property to the lender as security for the loan. * Property Title: This document confirms the borrower’s ownership of the property and is typically held by the lender until the loan is repaid. * Insurance Documents: These documents confirm the borrower’s insurance coverage for the property, which is typically required by the lender. * Identification Documents: These documents, such as a driver’s license or passport, confirm the borrower’s identity and are required for verification purposes.

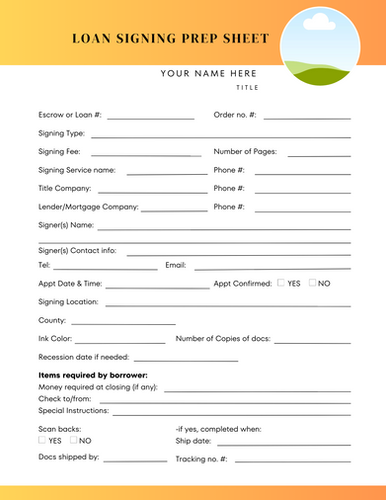

The Home Loan Paperwork Signing Process

The home loan paperwork signing process typically involves the following steps: * Pre-signing review: The borrower reviews the loan documents to ensure they understand the terms and conditions of the loan. * Signing: The borrower signs the loan documents in the presence of a witness or notary public, depending on the jurisdiction. * Verification: The lender verifies the borrower’s identity and confirms that the documents have been signed correctly. * Registration: The loan documents are registered with the relevant authorities, such as the land titles office.

📝 Note: It is essential to carefully review the loan documents before signing to ensure that the terms and conditions are understood and agreed upon.

Importance of Careful Review

Careful review of the loan documents is crucial to ensure that the borrower understands the terms and conditions of the loan. This includes: * Interest rate: The borrower should confirm that the interest rate is as agreed upon and understand how it will be applied to the loan. * Repayment schedule: The borrower should confirm that the repayment schedule is as agreed upon and understand the consequences of missing payments. * Fees and charges: The borrower should confirm that all fees and charges are as agreed upon and understand how they will be applied to the loan. * Loan term: The borrower should confirm that the loan term is as agreed upon and understand the consequences of repaying the loan early or late.

Common Mistakes to Avoid

When signing home loan paperwork, there are several common mistakes to avoid, including: * Rushing the signing process: Take the time to carefully review the loan documents to ensure that the terms and conditions are understood and agreed upon. * Not asking questions: If the borrower is unsure about any aspect of the loan, they should ask questions to clarify the terms and conditions. * Not verifying the lender’s identity: The borrower should verify the lender’s identity to ensure that they are dealing with a legitimate lender.

| Document | Purpose |

|---|---|

| Loan Agreement | Outlines the terms and conditions of the loan |

| Mortgage Deed | Transfers the ownership of the property to the lender as security for the loan |

| Property Title | Confirms the borrower's ownership of the property |

| Insurance Documents | Confirms the borrower's insurance coverage for the property |

| Identification Documents | Confirms the borrower's identity |

In wrapping up our discussion on home loan paperwork signing requirements, it is clear that careful attention to detail is essential to ensure that the borrower understands the terms and conditions of the loan. By taking the time to review the loan documents carefully and asking questions to clarify any uncertainties, borrowers can avoid common mistakes and ensure a smooth loan process.

What is the purpose of the loan agreement?

+

The loan agreement outlines the terms and conditions of the loan, including the interest rate, repayment schedule, and loan amount.

Why is it important to verify the lender’s identity?

+

Verifying the lender’s identity ensures that the borrower is dealing with a legitimate lender and reduces the risk of fraud or scams.

What happens if the borrower misses a payment?

+

If the borrower misses a payment, they may be subject to late fees and penalties, and their credit score may be affected. It is essential to communicate with the lender and make arrangements to catch up on missed payments.