Paperwork

Save Essential Paperwork

Introduction to Saving Essential Paperwork

In today’s digital age, it’s easy to overlook the importance of saving essential paperwork. However, having a well-organized system for storing and managing important documents can save you time, reduce stress, and even help you avoid financial losses. From tax returns to insurance policies, it’s crucial to keep track of your vital papers. In this article, we’ll explore the benefits of saving essential paperwork, discuss the types of documents you should keep, and provide tips on how to organize and store them effectively.

Benefits of Saving Essential Paperwork

Saving essential paperwork can have numerous benefits, including: * Easy access to information: Having your important documents in one place makes it easier to find the information you need when you need it. * Reduced stress: Knowing that your vital papers are safe and organized can give you peace of mind and reduce anxiety. * Financial protection: Keeping track of your financial documents, such as bank statements and investment records, can help you avoid financial losses and make informed decisions. * Compliance with regulations: Saving essential paperwork can help you comply with regulatory requirements, such as tax laws and industry regulations.

Types of Essential Paperwork

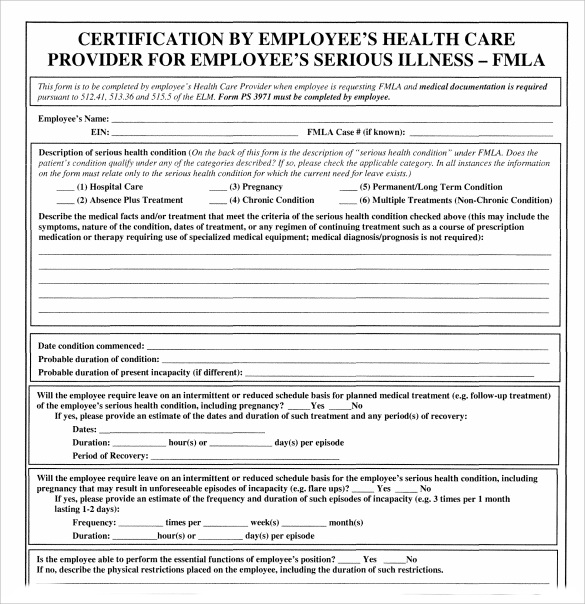

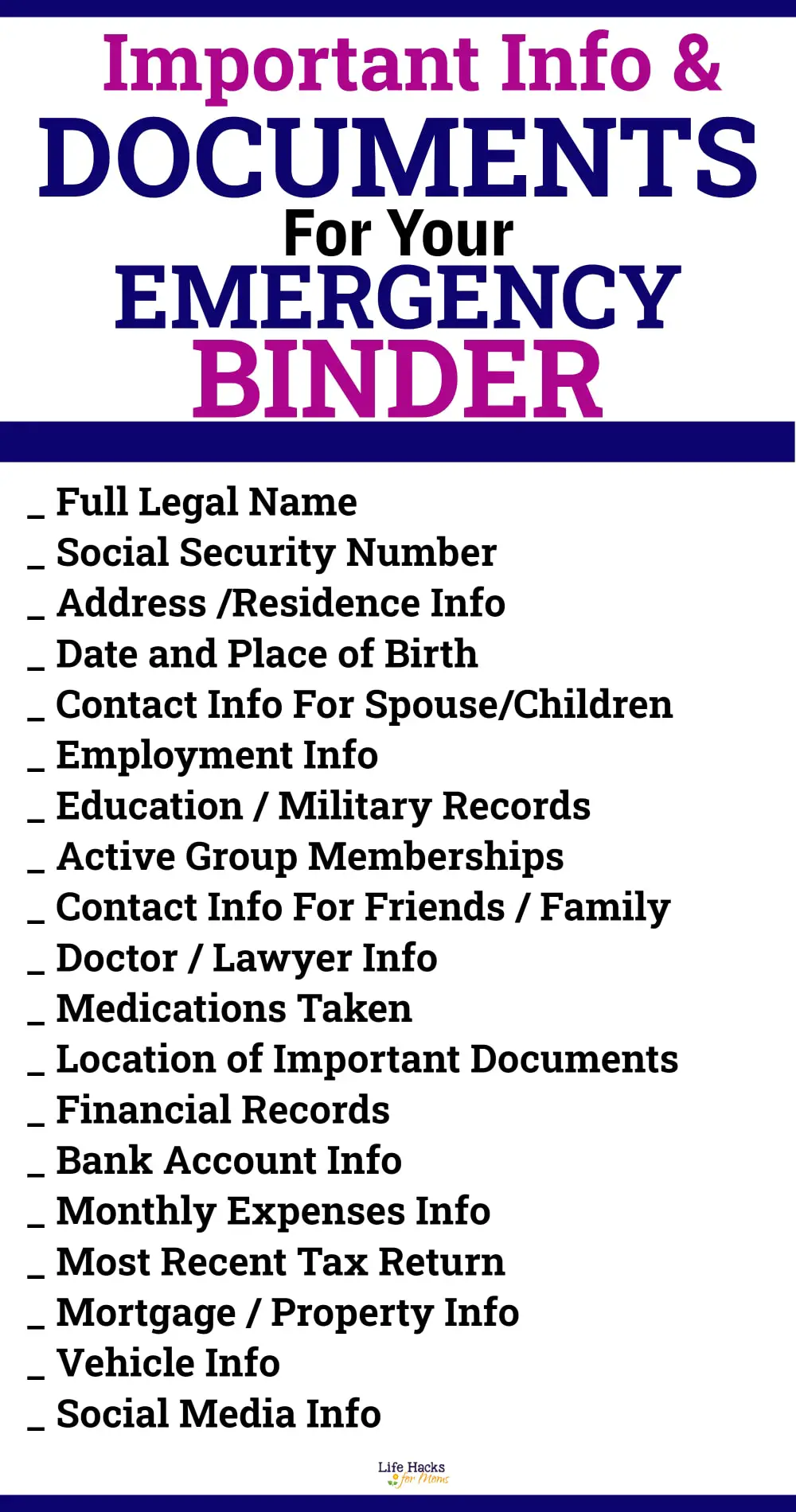

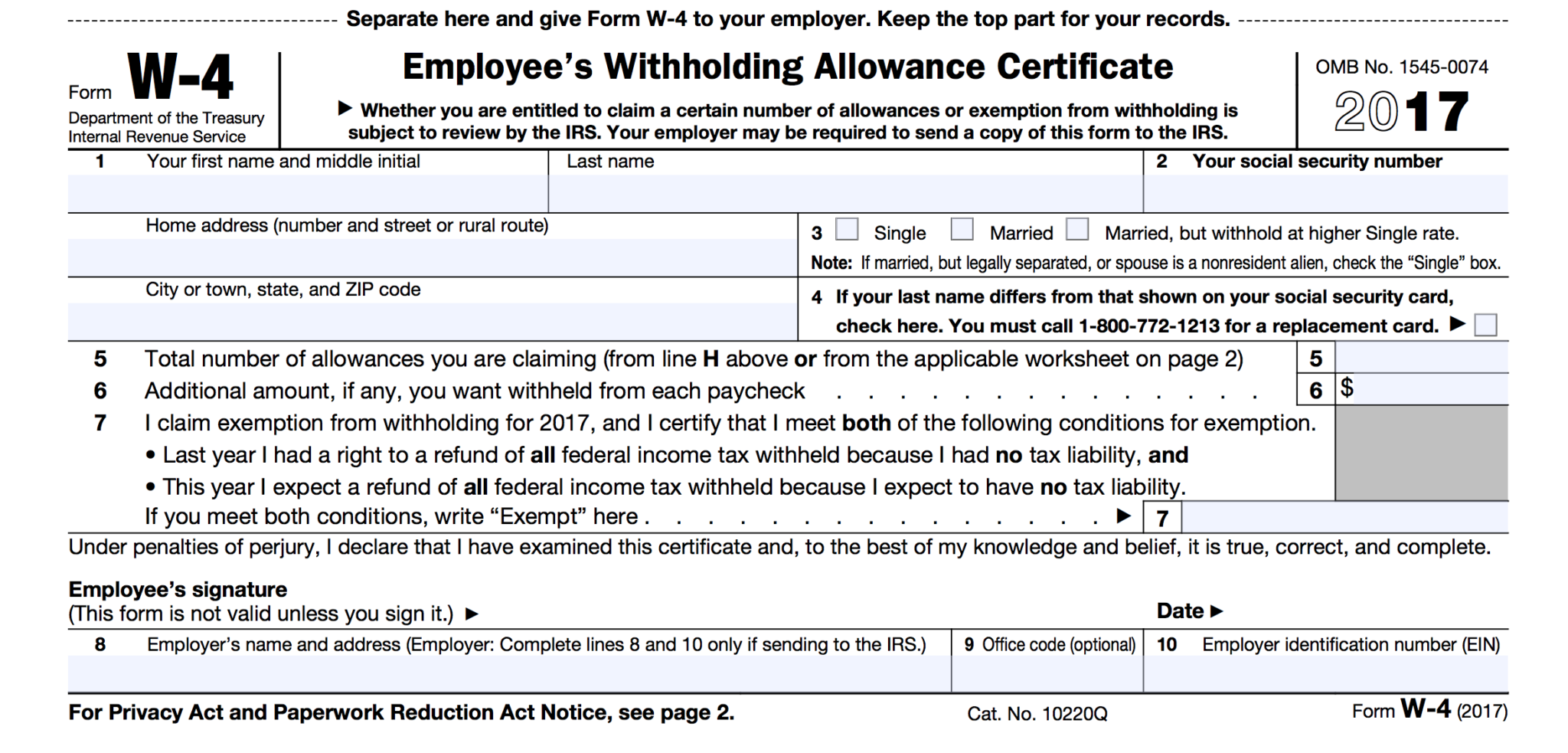

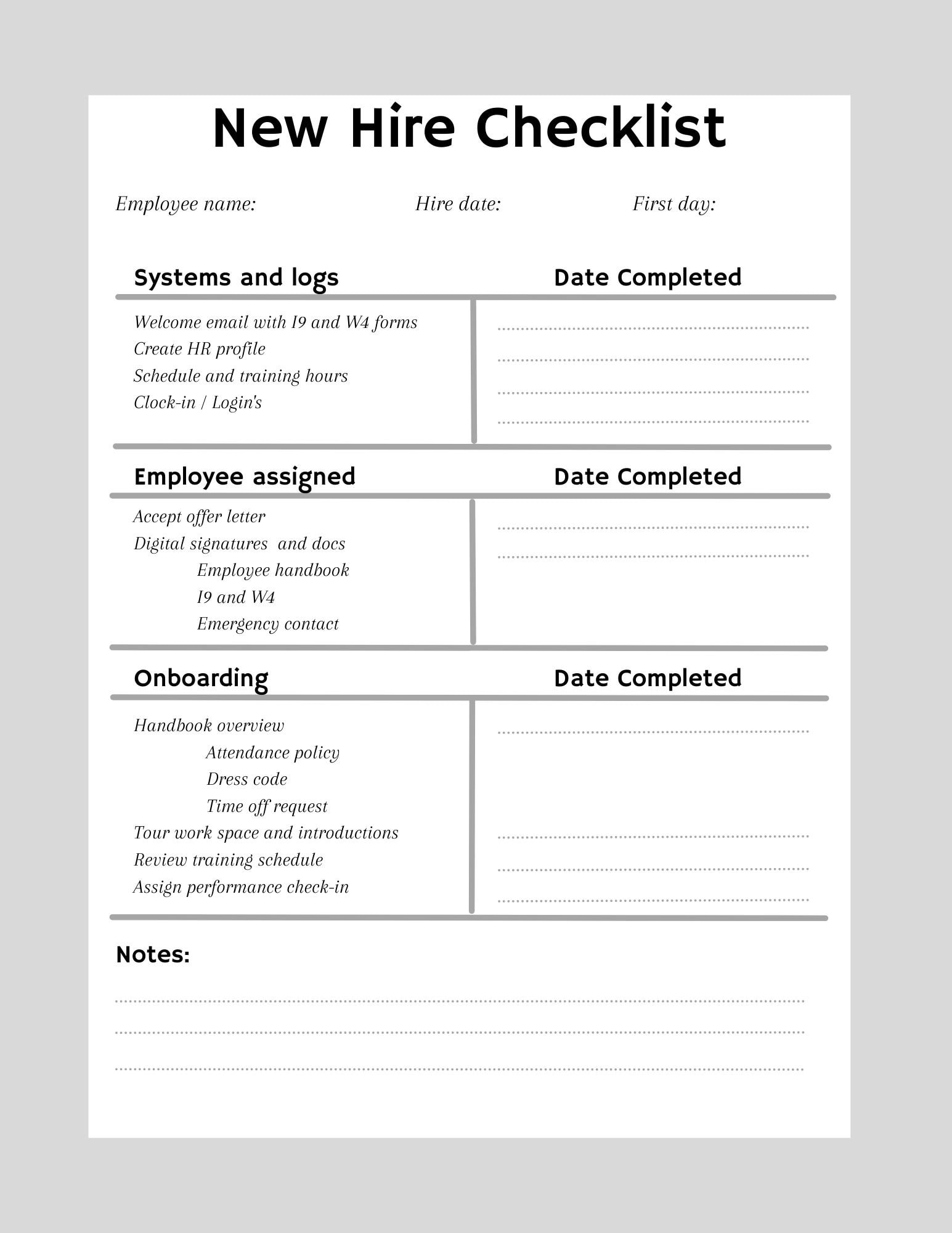

So, what types of documents should you be saving? Here are some examples: * Identification documents: Passport, driver’s license, birth certificate, etc. * Financial documents: Bank statements, investment records, tax returns, etc. * Insurance policies: Health, life, auto, home, etc. * Employment records: Pay stubs, W-2 forms, employment contracts, etc. * Estate planning documents: Will, trust, power of attorney, etc.

Organizing and Storing Essential Paperwork

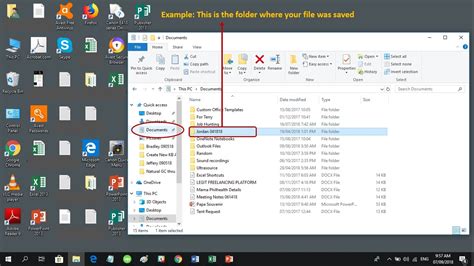

Now that we’ve discussed the importance of saving essential paperwork, let’s talk about how to organize and store it effectively. Here are some tips: * Use a filing system: Create a filing system that works for you, using categories and labels to help you quickly find what you need. * Store documents in a safe place: Consider using a fireproof safe or a secure online storage service to protect your documents from damage or loss. * Scan and digitize documents: Scanning and digitizing your documents can help you save space and make it easier to access them from anywhere. * Keep backups: Make sure to keep backups of your important documents, either physically or digitally, in case the originals are lost or damaged.

| Document Type | Retention Period |

|---|---|

| Tax returns | At least 3 years |

| Bank statements | At least 1 year |

| Insurance policies | As long as the policy is in effect |

💡 Note: The retention period for different types of documents may vary depending on your location and individual circumstances. It's always a good idea to consult with a professional to determine the best retention period for your specific needs.

Maintaining Your Essential Paperwork

Maintaining your essential paperwork is an ongoing process. Here are some tips to help you stay on track: * Review and update regularly: Regularly review your documents to ensure they are up-to-date and accurate. * Shred unnecessary documents: Shred any documents that are no longer needed to reduce clutter and protect your identity. * Keep your filing system organized: Make sure to keep your filing system organized and easy to use, so you can quickly find what you need.

As we’ve discussed, saving essential paperwork is crucial for protecting your identity, finances, and overall well-being. By understanding the benefits of saving essential paperwork, knowing what types of documents to save, and using effective organization and storage methods, you can reduce stress, avoid financial losses, and ensure compliance with regulations. In the end, it’s all about being prepared and taking control of your important documents.