Home Ownership Tax Paperwork Essentials

Introduction to Home Ownership Tax Paperwork

As a homeowner, understanding the various tax paperwork essentials is crucial for maximizing your tax benefits and avoiding potential penalties. The process of navigating through tax-related documents can be overwhelming, especially for first-time homeowners. However, with the right guidance, you can ensure that you are taking advantage of all the tax deductions and credits available to you. In this article, we will delve into the world of home ownership tax paperwork, exploring the key documents and forms you need to be familiar with, and providing tips on how to stay organized and compliant with tax laws.

Understanding Tax-Related Documents

When it comes to home ownership, there are several tax-related documents that you need to be aware of. These include: * Form 1098: Mortgage Interest Statement: This form is provided by your lender and shows the amount of mortgage interest you paid during the year. * Form 1099-INT: Interest Income: If you have a home equity loan or line of credit, you may receive this form showing the interest income you earned. * Form 1040: U.S. Individual Income Tax Return: This is the standard form used for personal income tax returns, where you will report your income, deductions, and credits. * Schedule A: Itemized Deductions: This schedule is used to itemize your deductions, including mortgage interest, property taxes, and other expenses related to your home.

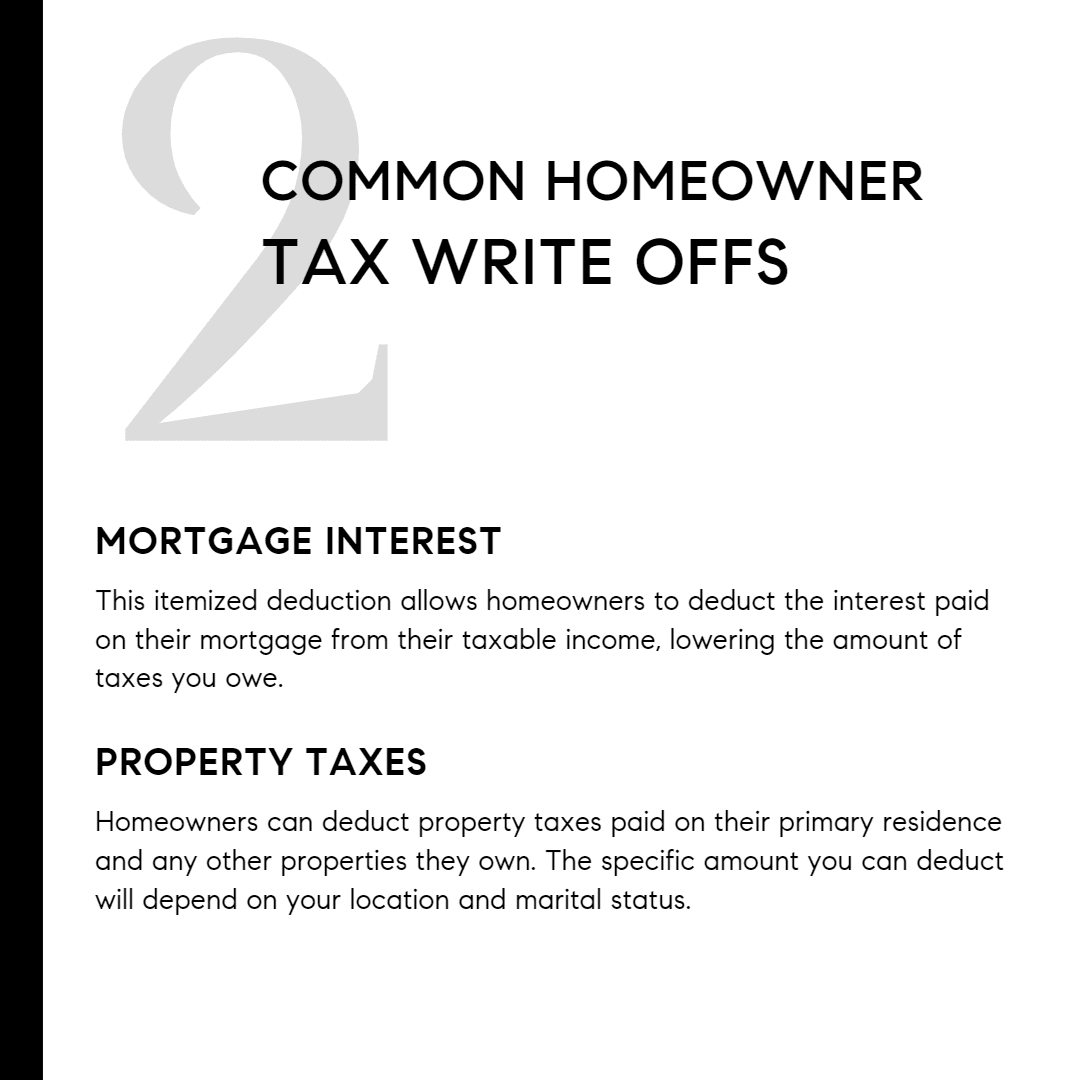

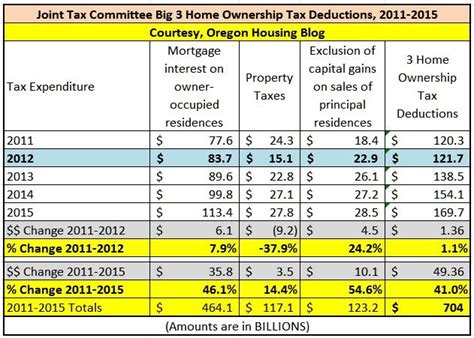

Key Tax Deductions and Credits

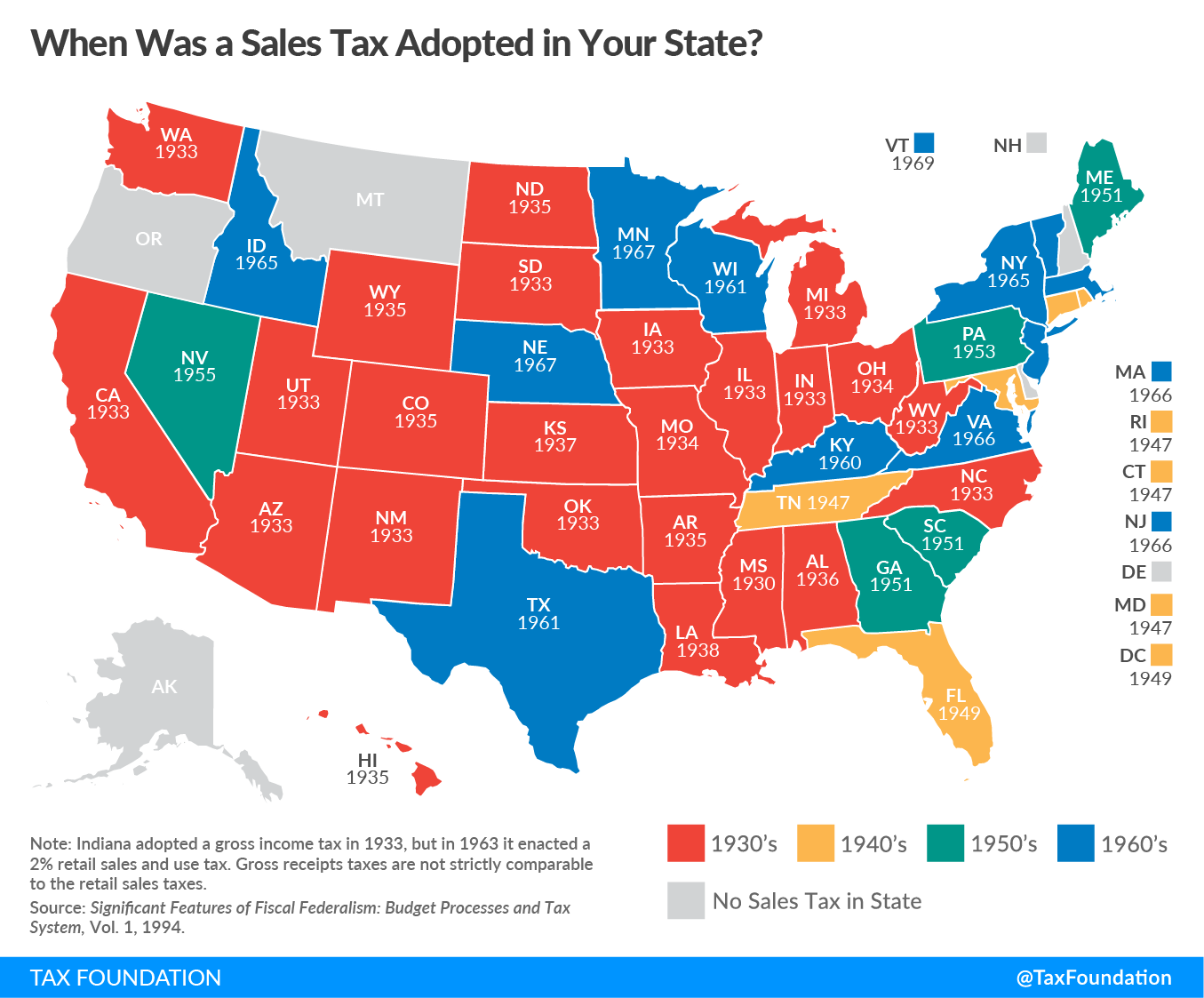

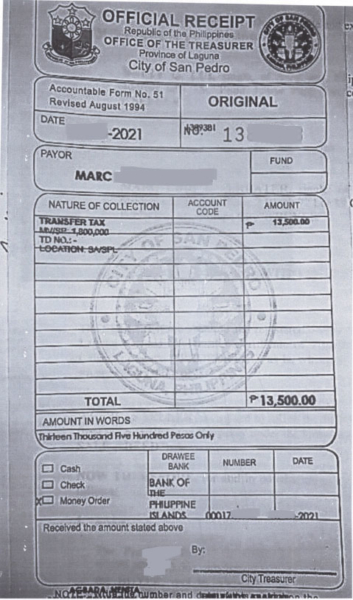

As a homeowner, you are eligible for several tax deductions and credits that can help reduce your taxable income. Some of the most significant include: * Mortgage Interest Deduction: You can deduct the interest you pay on your mortgage, which can be a significant amount, especially in the early years of your loan. * Property Tax Deduction: You can also deduct the property taxes you pay on your home, which can include state and local taxes. * Mortgage Insurance Premiums Deduction: If you have private mortgage insurance (PMI), you may be able to deduct the premiums you pay. * Home Office Deduction: If you use a portion of your home for business purposes, you may be eligible for a home office deduction.

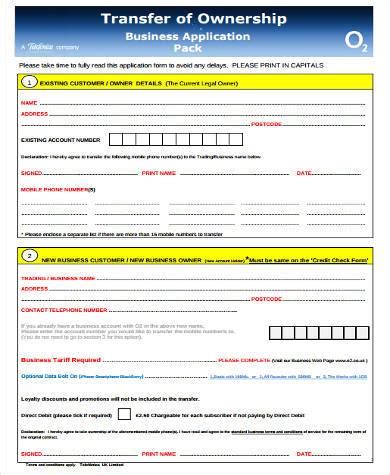

Organizing Your Tax Paperwork

To ensure that you are taking advantage of all the tax deductions and credits available to you, it’s essential to stay organized and keep accurate records. Here are some tips to help you get started: * Create a designated folder or file for your tax-related documents, including receipts, invoices, and bank statements. * Set up a system for tracking your expenses, such as a spreadsheet or budgeting app. * Keep records of your home improvements, including receipts and invoices, as these can be used to calculate your basis in the property. * Consider consulting with a tax professional or accountant to ensure you are taking advantage of all the tax benefits available to you.

📝 Note: It's essential to keep accurate records and receipts for all your tax-related expenses, as these can be used to support your deductions and credits in case of an audit.

Common Mistakes to Avoid

When it comes to home ownership tax paperwork, there are several common mistakes to avoid. These include: * Failing to keep accurate records and receipts for your tax-related expenses. * Missing deadlines for filing your tax return or paying your taxes. * Not taking advantage of all the tax deductions and credits available to you. * Not consulting with a tax professional or accountant to ensure you are in compliance with tax laws.

Staying Up-to-Date with Tax Laws and Regulations

Tax laws and regulations are constantly changing, and it’s essential to stay up-to-date to ensure you are in compliance and taking advantage of all the tax benefits available to you. Here are some tips to help you stay informed: * Check the IRS website regularly for updates and changes to tax laws and regulations. * Consult with a tax professional or accountant to ensure you are in compliance with tax laws. * Attend seminars or workshops on tax-related topics to stay informed and up-to-date.

| Document | Description |

|---|---|

| Form 1098 | Mortgage Interest Statement |

| Form 1099-INT | Interest Income |

| Form 1040 | U.S. Individual Income Tax Return |

| Schedule A | Itemized Deductions |

In summary, understanding the essentials of home ownership tax paperwork is crucial for maximizing your tax benefits and avoiding potential penalties. By staying organized, keeping accurate records, and consulting with a tax professional or accountant, you can ensure that you are taking advantage of all the tax deductions and credits available to you. Remember to stay up-to-date with tax laws and regulations, and avoid common mistakes to ensure you are in compliance and maximizing your tax benefits.

What is the deadline for filing my tax return?

+

The deadline for filing your tax return is typically April 15th of each year, but it’s essential to check the IRS website for any updates or changes to the deadline.

Can I deduct my home office expenses on my tax return?

+

Yes, you can deduct your home office expenses on your tax return, but you must meet certain requirements and follow specific guidelines set by the IRS.

How do I keep track of my tax-related expenses and receipts?

+

You can keep track of your tax-related expenses and receipts by creating a designated folder or file, setting up a system for tracking your expenses, and keeping accurate records and receipts for all your tax-related expenses.