1099 Paperwork Requirements

Introduction to 1099 Paperwork Requirements

The 1099 paperwork requirements are a crucial aspect of tax compliance for businesses and individuals who make payments to independent contractors, freelancers, and other non-employees. The Internal Revenue Service (IRS) requires that these payments be reported on a 1099 form, which helps to ensure that the recipient reports the income on their tax return and pays the appropriate amount of taxes. In this article, we will explore the 1099 paperwork requirements, including who needs to file, what types of payments need to be reported, and the deadlines for filing.

Who Needs to File 1099 Forms?

Any business or individual who makes payments to non-employees, such as independent contractors, freelancers, and vendors, may need to file 1099 forms. This includes: * Businesses: Corporations, partnerships, limited liability companies (LLCs), and sole proprietorships * Individuals: Those who make payments to non-employees for services performed, such as rental property owners and self-employed individuals * Government agencies: Federal, state, and local government agencies that make payments to non-employees

Types of Payments That Need to Be Reported

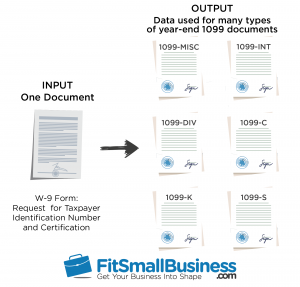

The following types of payments need to be reported on a 1099 form: * Non-employee compensation: Payments made to independent contractors, freelancers, and other non-employees for services performed * Rent: Payments made to rental property owners * Royalties: Payments made to individuals or businesses for the use of their intellectual property, such as patents, copyrights, and trademarks * Prizes and awards: Payments made to individuals for prizes and awards won * Other income: Payments made to individuals or businesses for other types of income, such as dividends and interest

Deadlines for Filing 1099 Forms

The deadlines for filing 1099 forms are as follows: * January 31: The deadline for filing 1099 forms with the IRS and providing copies to recipients * February 28: The deadline for filing 1099 forms with the IRS if filing by paper * March 31: The deadline for filing 1099 forms with the IRS if filing electronically

Penalties for Not Filing 1099 Forms

Failure to file 1099 forms or filing them late can result in penalties, including: * Fines: Up to $100 per form for failing to file or filing late * Interest: On the unpaid tax liability * Loss of deductions: For the payments made to non-employees

How to File 1099 Forms

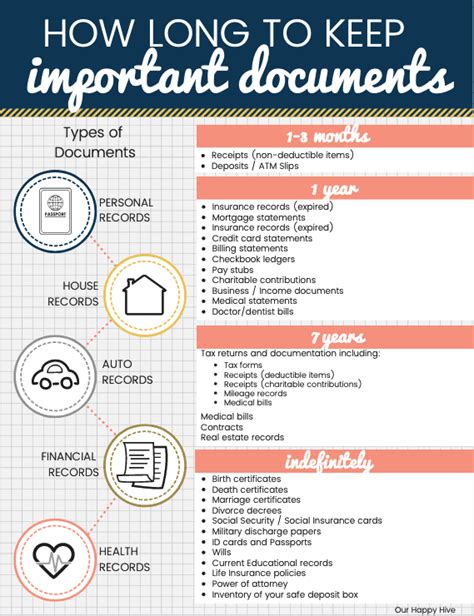

To file 1099 forms, follow these steps: * Obtain the necessary forms: From the IRS website or by calling the IRS * Complete the forms: With the required information, including the recipient’s name, address, and tax identification number * File the forms: With the IRS and provide copies to recipients * Keep records: Of the forms filed and the payments made

💡 Note: It is essential to keep accurate records of the payments made and the forms filed, in case of an audit or other IRS inquiry.

Electronic Filing of 1099 Forms

The IRS encourages electronic filing of 1099 forms, which can be done through the Filing Information Returns Electronically (FIRE) system. Electronic filing offers several benefits, including: * Faster processing: Of the forms filed * Reduced errors: Due to automated checks and balances * Increased security: Of the forms filed and the data transmitted

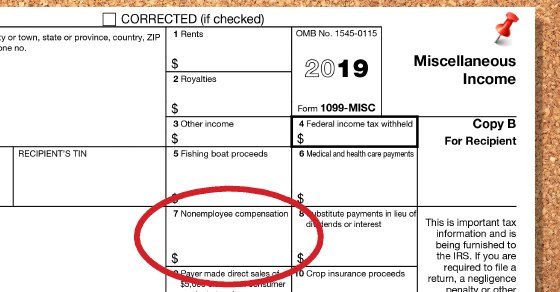

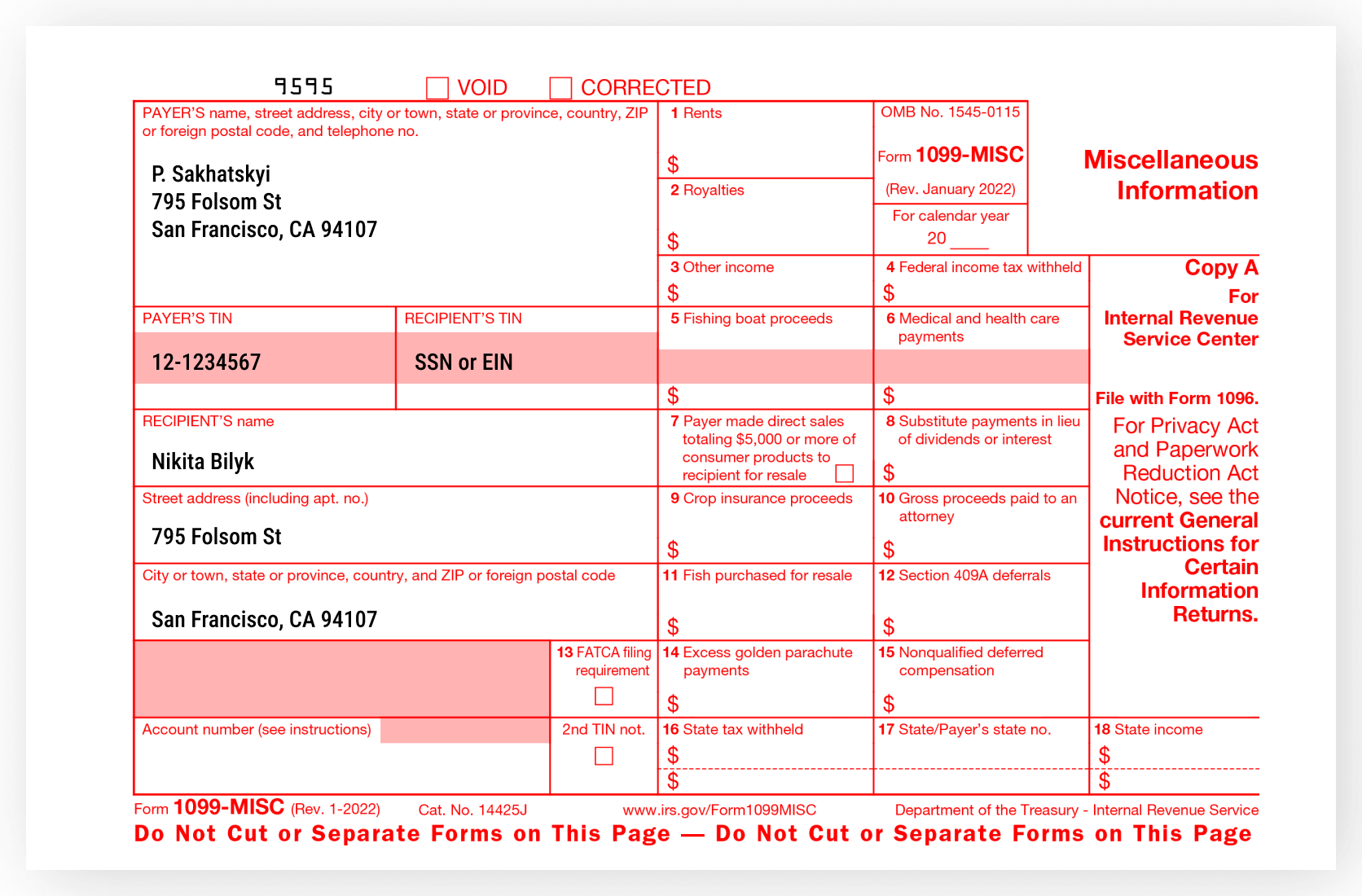

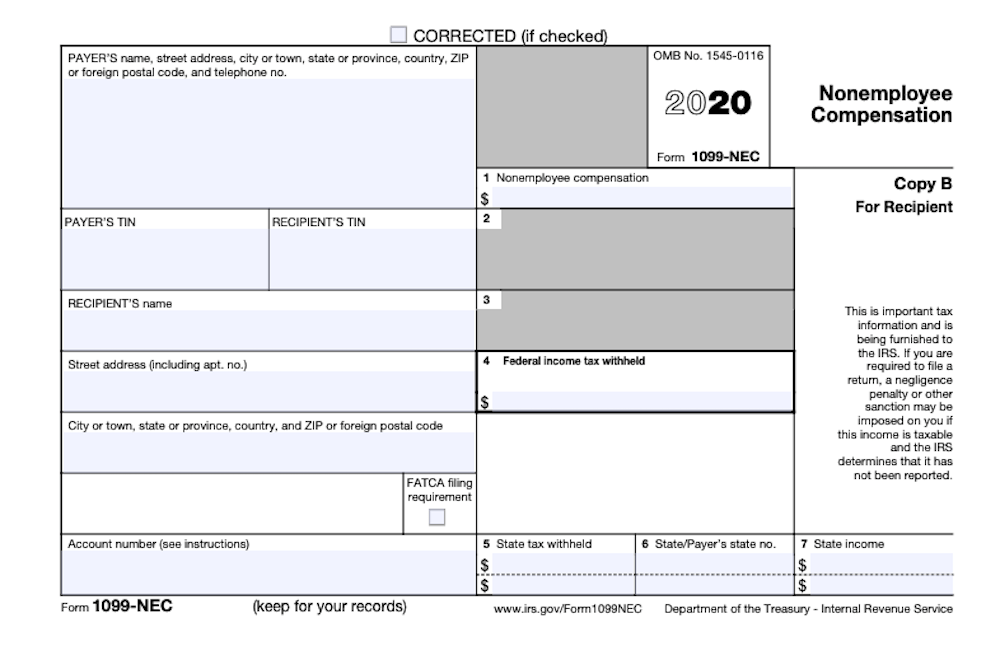

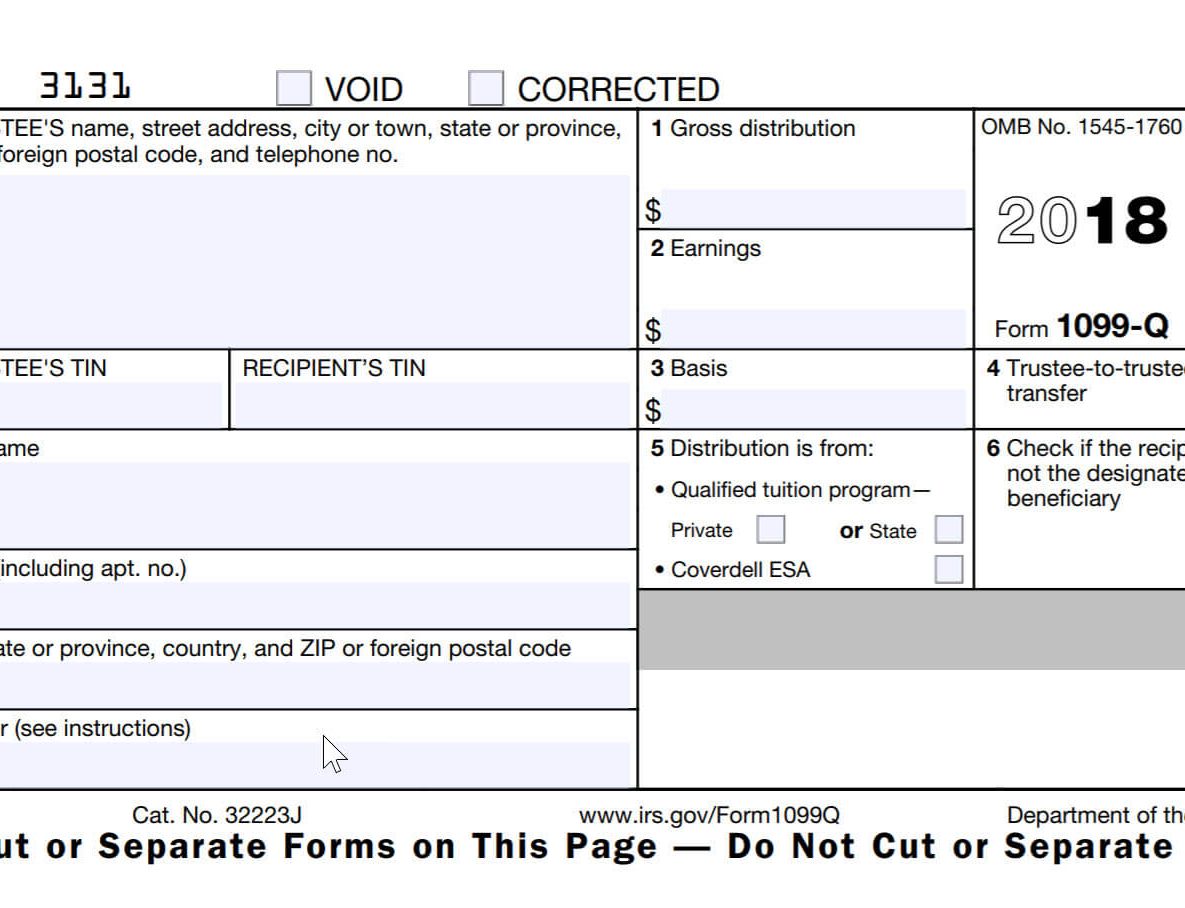

1099 Form Types

There are several types of 1099 forms, including: * 1099-MISC: For reporting miscellaneous income, such as non-employee compensation and rent * 1099-INT: For reporting interest income * 1099-DIV: For reporting dividend income * 1099-B: For reporting proceeds from broker and barter exchange transactions

| Form Type | Description |

|---|---|

| 1099-MISC | Miscellaneous income, such as non-employee compensation and rent |

| 1099-INT | Interest income |

| 1099-DIV | Dividend income |

| 1099-B | Proceeds from broker and barter exchange transactions |

In summary, the 1099 paperwork requirements are a critical aspect of tax compliance for businesses and individuals who make payments to non-employees. It is essential to understand who needs to file, what types of payments need to be reported, and the deadlines for filing. Failure to comply with the 1099 paperwork requirements can result in penalties, fines, and loss of deductions. By following the steps outlined in this article and seeking professional advice when needed, businesses and individuals can ensure compliance with the 1099 paperwork requirements and avoid any potential issues with the IRS.

What is the deadline for filing 1099 forms?

+

The deadline for filing 1099 forms is January 31 for both electronic and paper filing.

Who needs to file 1099 forms?

+

Businesses and individuals who make payments to non-employees, such as independent contractors, freelancers, and vendors, need to file 1099 forms.

What types of payments need to be reported on a 1099 form?

+

The following types of payments need to be reported on a 1099 form: non-employee compensation, rent, royalties, prizes and awards, and other income.