5 Papers to Keep

Introduction to Essential Papers

In today’s digital age, it’s easy to assume that all documents can be stored electronically and that physical papers are a thing of the past. However, there are certain papers that you should always keep, either for legal reasons, financial purposes, or for future reference. These papers can be crucial in various aspects of life, including taxes, insurance, and personal identification. In this article, we will discuss the top 5 papers to keep and why they are so important.

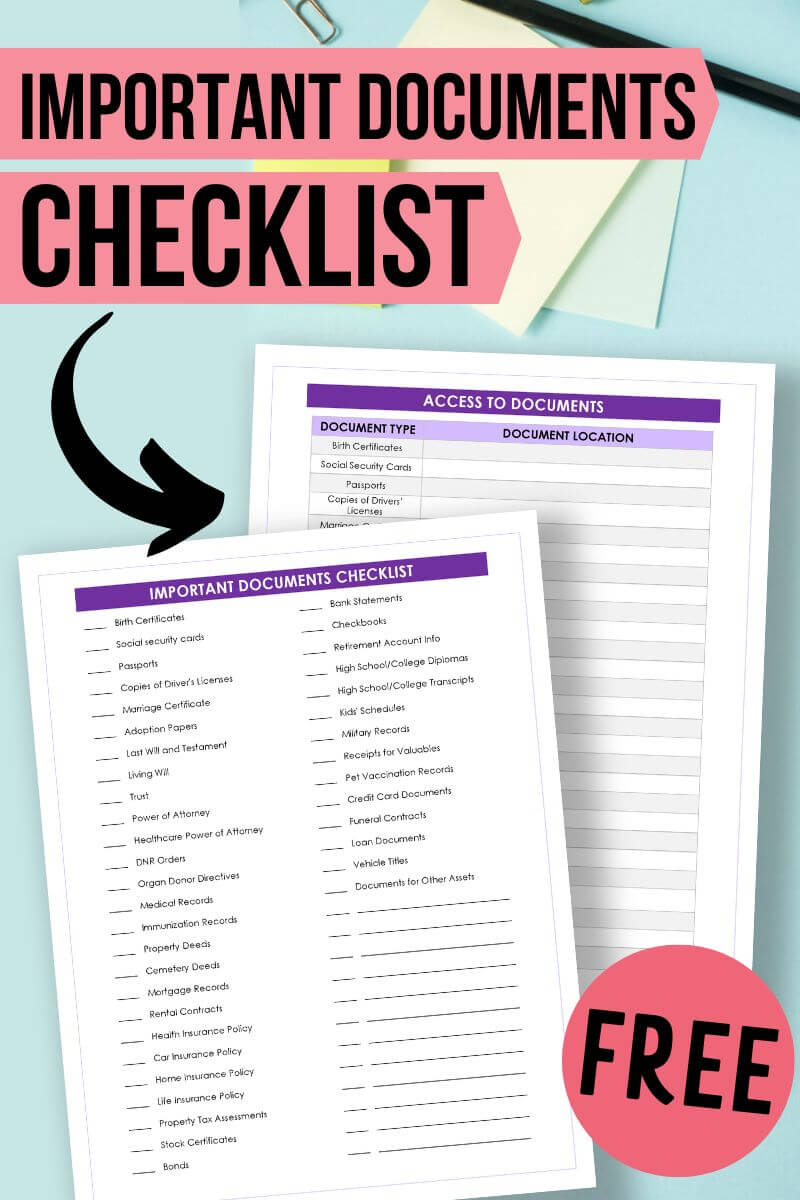

1. Identification Documents

Identification documents are crucial for proving who you are and where you live. These documents can include: * Passport * Driver’s license * Social Security card * Birth certificate * Marriage certificate (if applicable) It’s essential to keep these documents in a safe and secure place, such as a fireproof safe or a safe deposit box at a bank. You should also make sure to keep digital copies of these documents, but the physical papers are still necessary for various official purposes.

2. Tax-Related Documents

Tax-related documents are necessary for filing your taxes and for potential audits. You should keep: * Tax returns for at least three years * W-2 forms and 1099 forms for at least three years * Receipts for deductions, such as charitable donations and medical expenses * Records of business expenses (if self-employed) These documents will help you prove your income and expenses, which can be beneficial during tax season. You can also scan these documents and store them digitally, but it’s recommended to keep the physical papers as well.

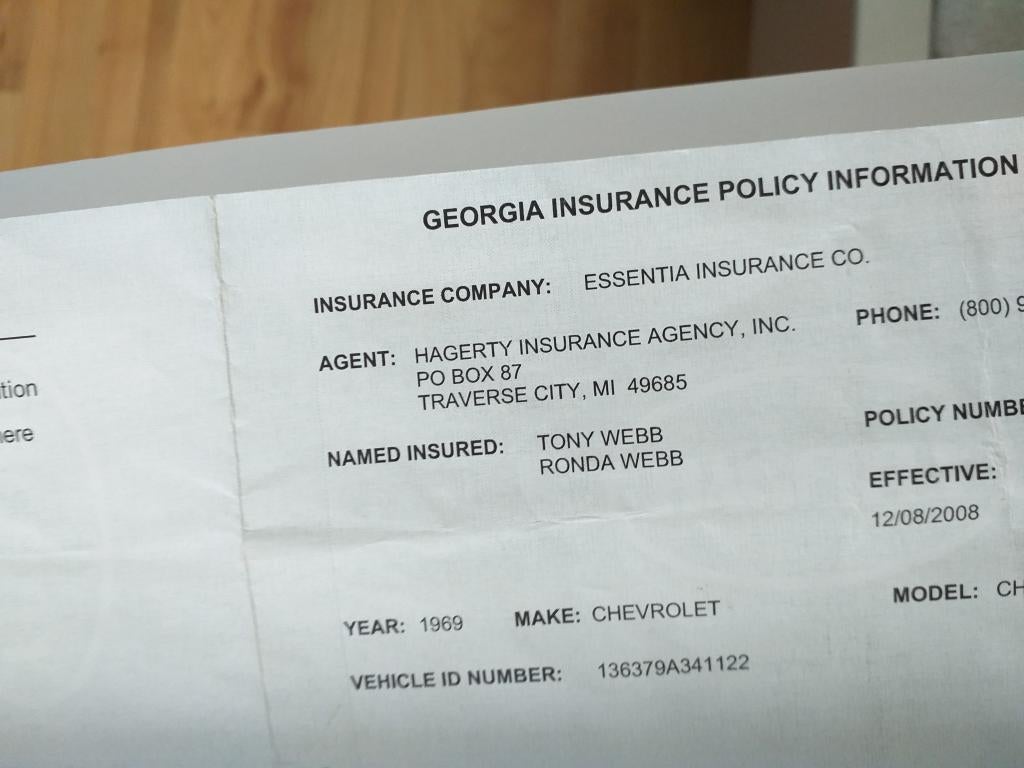

3. Insurance Policies

Insurance policies are essential for protecting yourself and your loved ones from unexpected events. You should keep: * Life insurance policies * Health insurance policies * Auto insurance policies * Homeowners insurance policies These policies can provide financial protection in case of accidents, illnesses, or natural disasters. Make sure to review your policies regularly and update them as needed.

4. Financial Documents

Financial documents are necessary for managing your finances and making informed decisions. You should keep: * Bank statements for at least a year * Investment statements (such as 401(k) or IRA statements) * Credit card statements for at least a year * Loan documents (such as mortgage or car loan documents) These documents can help you track your spending, income, and debt. You can also use them to detect any errors or suspicious activity in your accounts.

5. Estate Planning Documents

Estate planning documents are essential for ensuring that your wishes are carried out after you pass away. You should keep: * Will * Trust documents * Power of attorney documents * Advance directives (such as a living will or healthcare proxy) These documents can help you distribute your assets, appoint guardians for your children, and make medical decisions on your behalf. Make sure to review these documents regularly and update them as needed.

📝 Note: It's essential to keep these documents in a safe and secure place, such as a fireproof safe or a safe deposit box at a bank. You should also consider scanning these documents and storing them digitally, but the physical papers are still necessary for various official purposes.

In summary, keeping essential papers can help you stay organized, protect your finances, and ensure that your wishes are carried out. By keeping identification documents, tax-related documents, insurance policies, financial documents, and estate planning documents, you can have peace of mind knowing that you’re prepared for any situation.

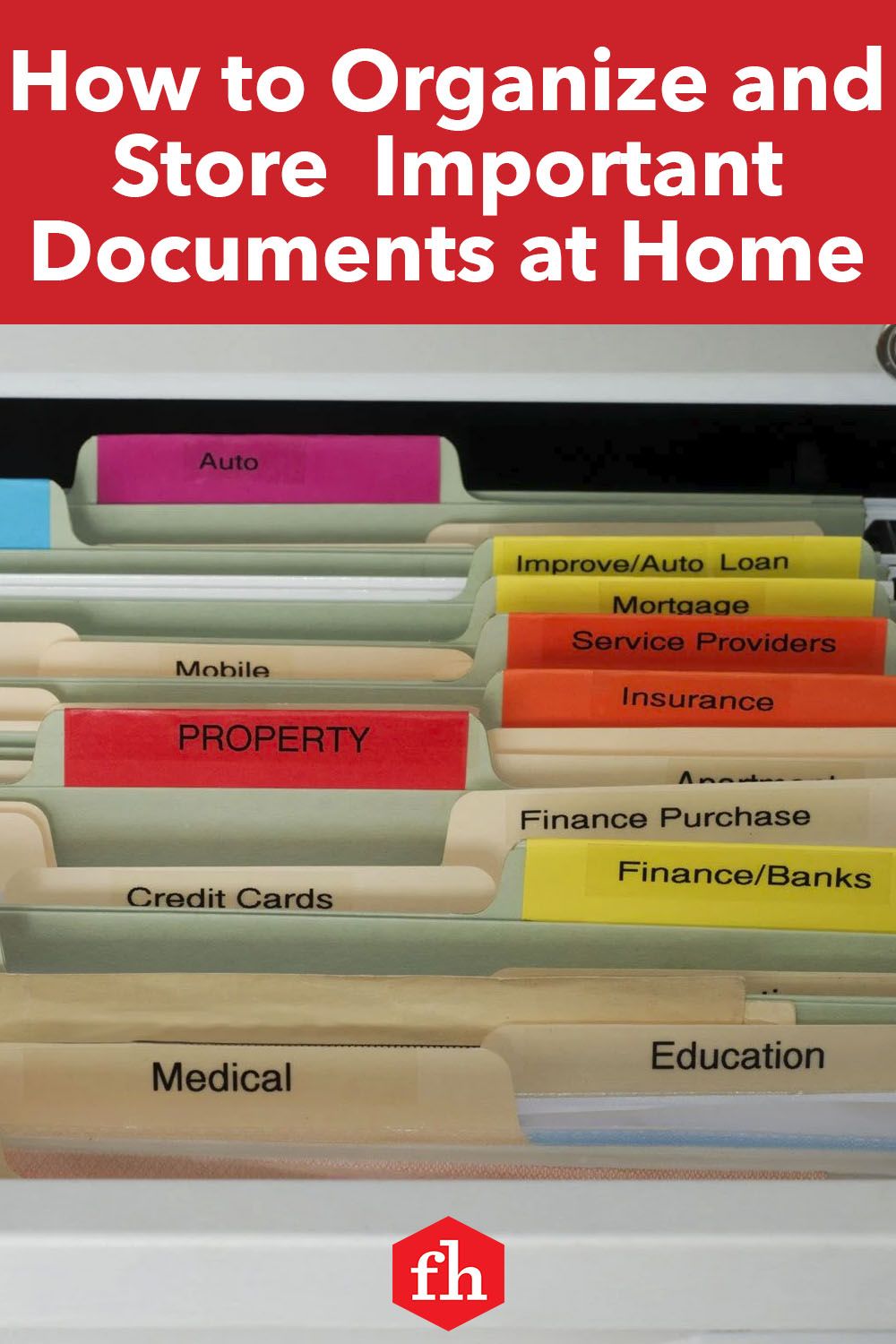

What is the best way to store important papers?

+

The best way to store important papers is in a fireproof safe or a safe deposit box at a bank. You should also consider scanning these documents and storing them digitally.

How long should I keep tax-related documents?

+

You should keep tax-related documents for at least three years. This includes tax returns, W-2 forms, 1099 forms, and receipts for deductions.

What is the importance of estate planning documents?

+

Estate planning documents are essential for ensuring that your wishes are carried out after you pass away. These documents can help you distribute your assets, appoint guardians for your children, and make medical decisions on your behalf.