House Buying Paperwork

Introduction to House Buying Paperwork

When it comes to buying a house, the process can be overwhelming, especially when it comes to the paperwork involved. Understanding the different documents and their purposes is crucial to ensure a smooth transaction. In this article, we will guide you through the various types of paperwork you can expect to encounter when buying a house.

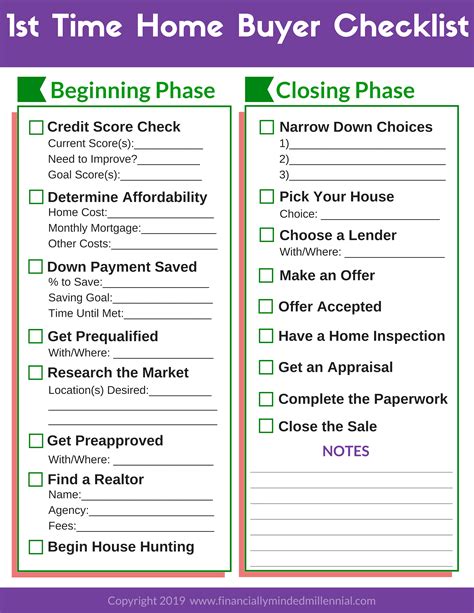

Pre-Approval and Pre-Qualification

The first step in the home buying process is to get pre-qualified and pre-approved for a mortgage. This involves providing financial information to a lender, who will then provide a pre-qualification letter stating the amount they are willing to lend. The pre-approval process is more detailed and involves a credit check and verification of income and assets. The resulting pre-approval letter is usually valid for a certain period and indicates the approved loan amount.

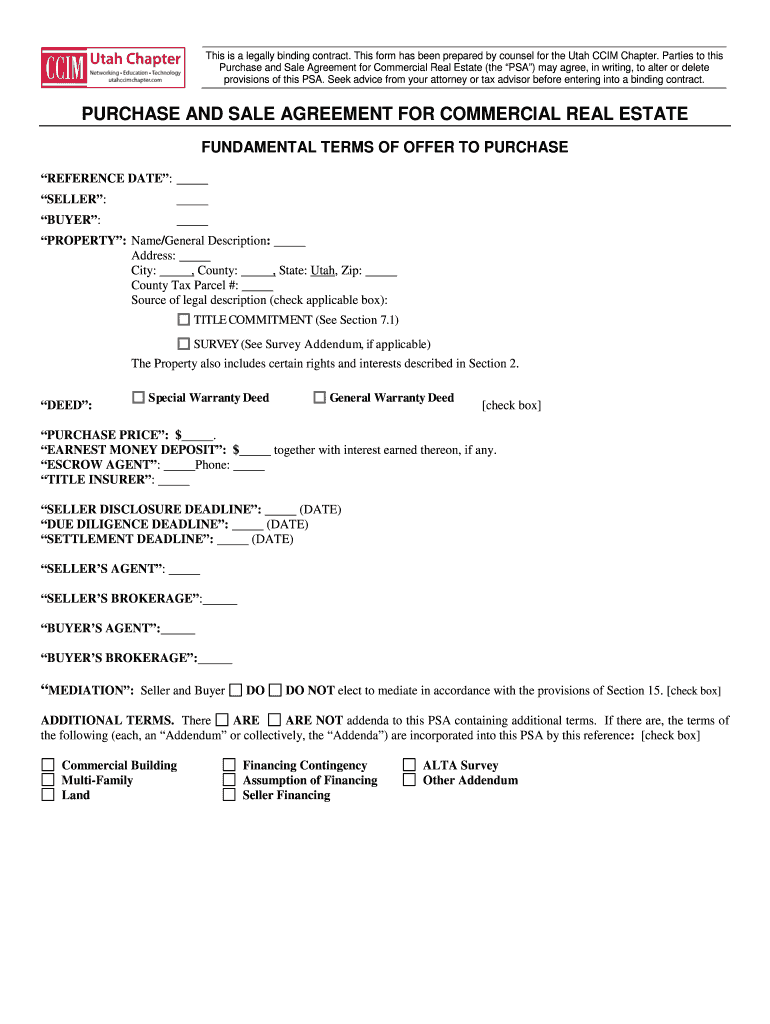

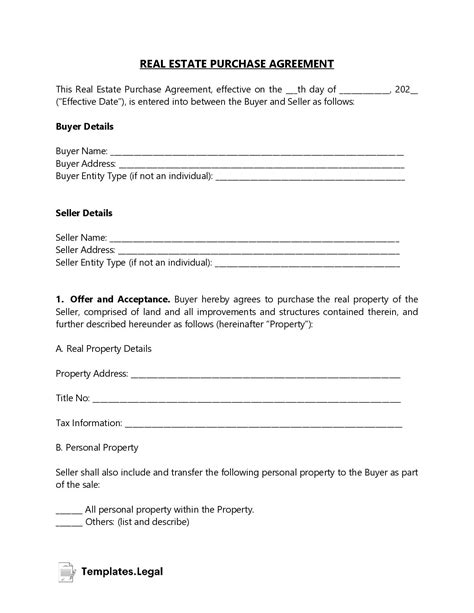

Offer and Acceptance

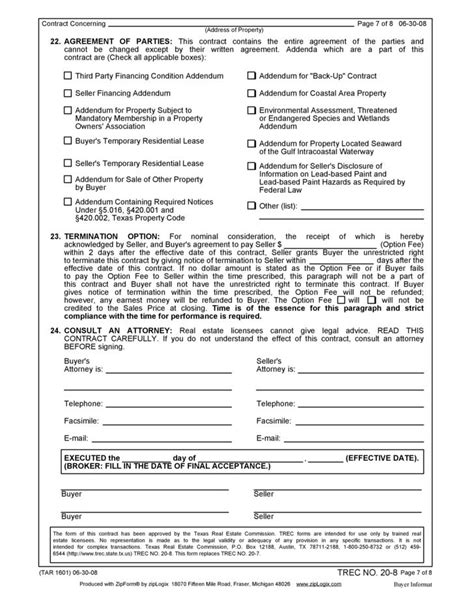

Once you have found a house you want to buy, you will need to make an offer. This typically involves submitting a purchase agreement or offer to purchase document, which includes the price you are willing to pay, any contingencies, and your proposed closing date. If the seller accepts your offer, they will sign the document, and it will become a binding contract.

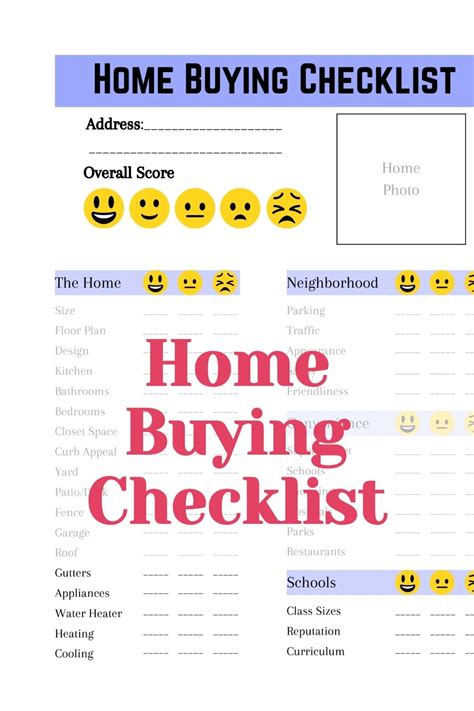

Inspections and Due Diligence

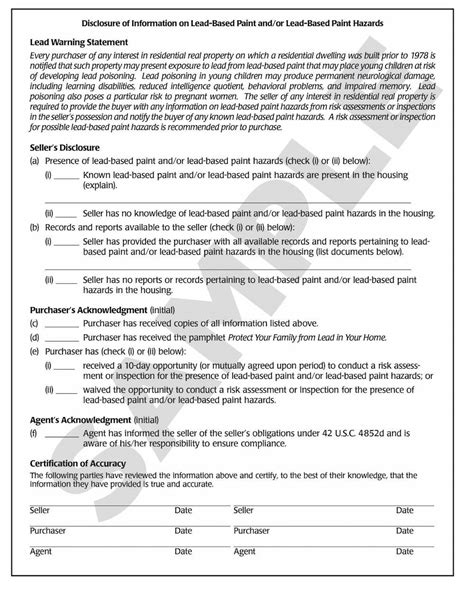

After the offer has been accepted, you will typically hire inspectors to examine the property for any potential issues. These inspections may include: * Home inspection: to identify any structural or mechanical problems * Pest inspection: to check for termites or other pest damage * Environmental inspection: to test for hazards such as lead or asbestos The results of these inspections may be used to negotiate repairs or credits with the seller.

Loan Application and Processing

With the offer accepted and inspections complete, you will need to finalize your loan application. This involves providing additional financial documentation and waiting for the lender to process and approve the loan. The lender will also order an appraisal to ensure the property’s value matches the sale price.

Closing and Settlement

The final step in the home buying process is the closing, also known as settlement. This is where you sign the final loan documents, transfer the ownership of the property, and pay the closing costs. The closing costs typically include fees for the lender, title company, and other services. The title company will also ensure the property title is clear and free of any liens.

Key Documents

Some of the key documents you will encounter during the home buying process include: * Deed: the document that transfers ownership of the property * Mortgage note: the document that outlines the terms of the loan * Mortgage deed: the document that secures the loan with the property * Title report: the document that shows the property’s ownership history and any liens

| Document | Purpose |

|---|---|

| Pre-qualification letter | States the amount the lender is willing to lend |

| Pre-approval letter | Indicates the approved loan amount and is usually valid for a certain period |

| Purchase agreement | Outlines the terms of the sale, including price and closing date |

| Deed | Transfers ownership of the property |

📝 Note: It's essential to carefully review all documents before signing to ensure you understand the terms and conditions of the sale and loan.

Conclusion and Final Thoughts

In conclusion, buying a house involves a significant amount of paperwork, from the initial pre-qualification and pre-approval to the final closing and settlement. Understanding the different documents and their purposes is crucial to ensuring a smooth transaction. By being prepared and knowing what to expect, you can navigate the home buying process with confidence.

What is the difference between pre-qualification and pre-approval?

+

Pre-qualification is an estimate of the amount a lender is willing to lend, while pre-approval is a more detailed process that involves a credit check and verification of income and assets, resulting in a more accurate approved loan amount.

What is the purpose of a home inspection?

+

A home inspection is used to identify any potential issues with the property, such as structural or mechanical problems, and can be used to negotiate repairs or credits with the seller.

What are closing costs, and who pays them?

+

Closing costs are fees associated with the home buying process, such as lender fees, title company fees, and appraisal fees. These costs are typically paid by the buyer, but can be negotiated with the seller.