Tax Return Papers Show Proof

Understanding the Importance of Tax Return Papers

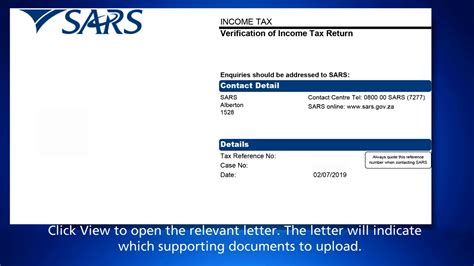

When it comes to managing personal or business finances, one of the most critical aspects is maintaining accurate and detailed records, especially regarding tax returns. Tax return papers serve as essential documents that provide proof of income, expenses, and tax payments made to the government. These papers are not just necessary for compliance with tax laws but also play a crucial role in various financial processes, including loan applications, audits, and even immigration procedures.

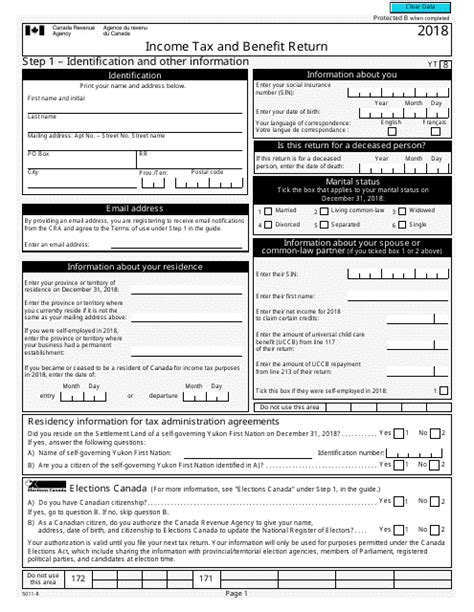

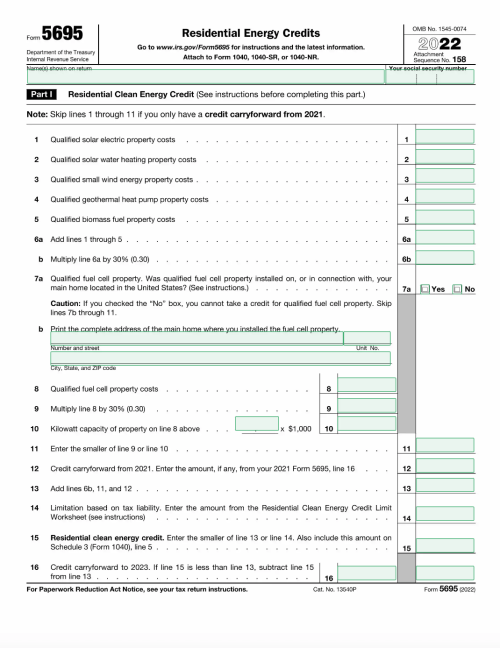

Components of Tax Return Papers

Tax return papers typically include several key components that are crucial for their validity and usefulness. These components may vary slightly depending on the jurisdiction and the type of tax return (individual, business, etc.), but generally, they include: - Identification Information: This includes the taxpayer’s name, address, and identification number (such as a Social Security number). - Income Details: A comprehensive breakdown of all income sources, including employment income, investments, and any other form of income. - Expense and Deduction Details: A list of all eligible expenses and deductions that can reduce the taxable income. - Tax Payments and Refunds: Information on any tax payments made during the year and details of any refunds due or received. - Signatures and Declarations: The taxpayer’s signature and a declaration that the information provided is true and accurate.

Why Are Tax Return Papers Important?

The importance of tax return papers cannot be overstated. They are vital documents that provide a clear picture of an individual’s or business’s financial situation at a particular point in time. Here are some reasons why they are crucial: - Proof of Income: For individuals, tax return papers can serve as proof of income when applying for loans, mortgages, or credit cards. - Business Financials: For businesses, these papers are essential for demonstrating financial health and stability, which can be important for investors, partners, or when applying for business loans. - Audit Purposes: In the event of a tax audit, having detailed and accurate tax return papers can significantly simplify the process and help in resolving any discrepancies quickly. - Immigration and Visa Applications: In some cases, tax return papers may be required as part of the documentation for immigration or visa applications to prove financial stability.

Managing and Storing Tax Return Papers

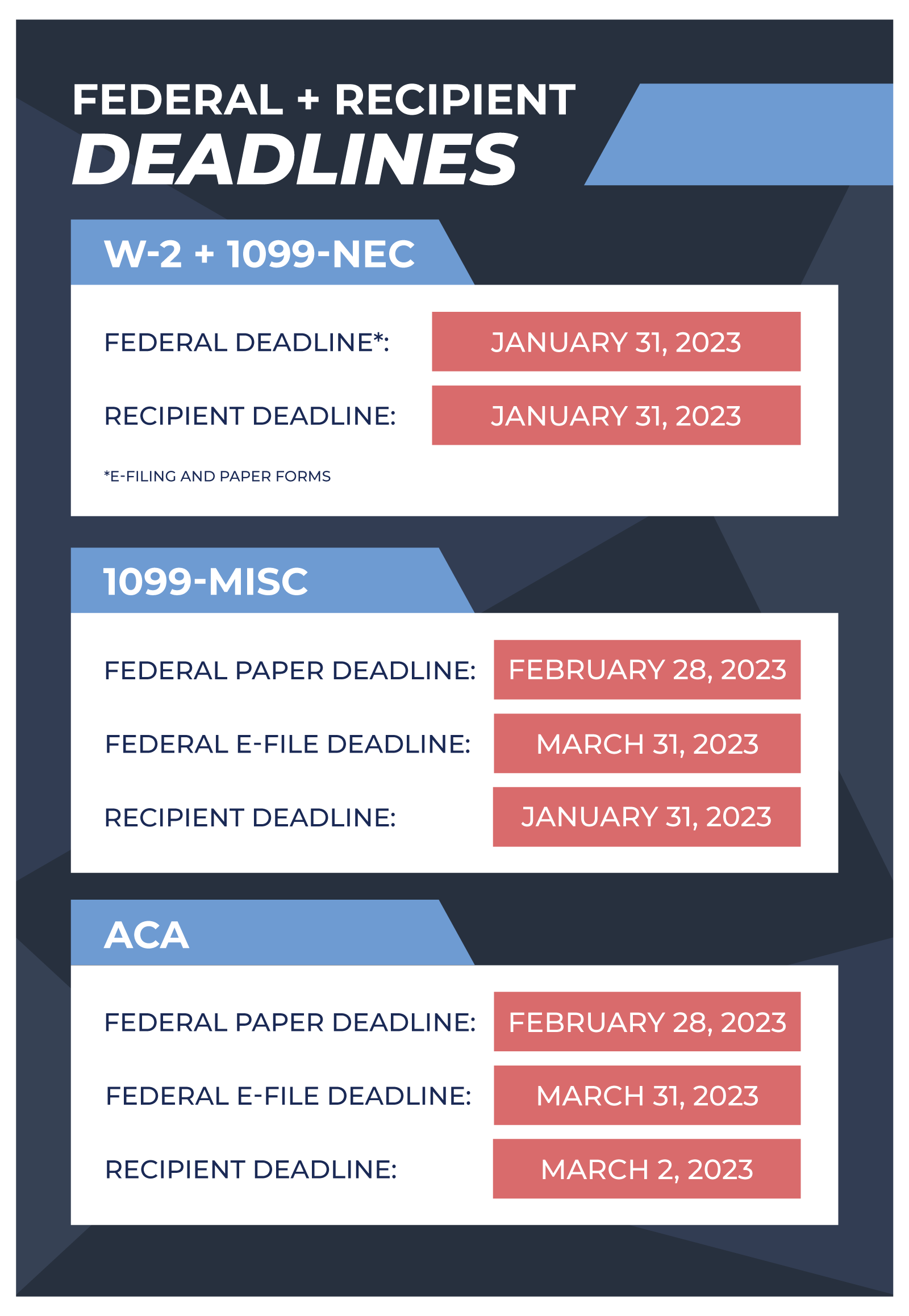

Given their importance, it’s essential to manage and store tax return papers effectively. Here are some tips: - Digital Storage: Consider scanning your tax return papers and storing them digitally in a secure location, such as an encrypted cloud storage service. - Physical Storage: If you prefer to keep physical copies, store them in a safe and secure location, such as a fireproof safe or a locked cabinet. - Organization: Keep your tax return papers organized by year and ensure they are easily accessible when needed.

📝 Note: It's recommended to keep tax return papers for at least three to seven years, depending on your jurisdiction's tax laws and regulations, as this can vary.

Best Practices for Maintaining Tax Return Papers

To ensure that your tax return papers are always in order and easily accessible, follow these best practices: - Regular Updates: Ensure that your tax return papers are updated annually to reflect any changes in your income, expenses, or tax obligations. - Professional Assistance: If you’re unsure about any aspect of your tax return, consider seeking the help of a tax professional. - Accuracy and Honesty: Always ensure that the information provided in your tax return papers is accurate and honest. Misrepresentation can lead to severe penalties and legal issues.

| Year | Gross Income | Taxable Income | Tax Paid |

|---|---|---|---|

| 2022 | $50,000 | $40,000 | $8,000 |

| 2021 | $45,000 | $35,000 | $7,000 |

In summary, tax return papers are more than just compliance documents; they are critical financial records that offer insight into an individual’s or business’s financial health. By understanding their importance, maintaining them accurately, and storing them securely, individuals and businesses can ensure they are well-prepared for any financial or legal requirement that may arise.

As we reflect on the significance of tax return papers, it becomes clear that their role extends beyond mere tax compliance. They are integral to financial planning, providing a foundation for future financial decisions and strategies. Whether for personal or business purposes, keeping these documents in order is not just a necessity but a strategic move towards financial stability and security.

What is the primary purpose of tax return papers?

+

The primary purpose of tax return papers is to provide proof of income, expenses, and tax payments made to the government, ensuring compliance with tax laws and regulations.

How long should I keep my tax return papers?

+

Can I store my tax return papers digitally?

+

Yes, you can store your tax return papers digitally in a secure location, such as an encrypted cloud storage service, to ensure they are safe and easily accessible.