1099 Paperwork Deadline

Understanding the 1099 Paperwork Deadline

The 1099 paperwork deadline is a crucial date for businesses and individuals who need to file information returns with the Internal Revenue Service (IRS). The 1099 form is used to report various types of income, such as freelance work, rental income, and dividends. It’s essential to understand the deadline for filing 1099 forms to avoid penalties and ensure compliance with tax laws.

Who Needs to File 1099 Forms?

Businesses and individuals who make payments to others, such as independent contractors, freelancers, and rental property owners, need to file 1099 forms. The following are some examples of who needs to file 1099 forms: * Businesses that pay independent contractors $600 or more in a calendar year * Rental property owners who receive rental income * Financial institutions that pay interest or dividends * Government agencies that make payments to individuals or businesses

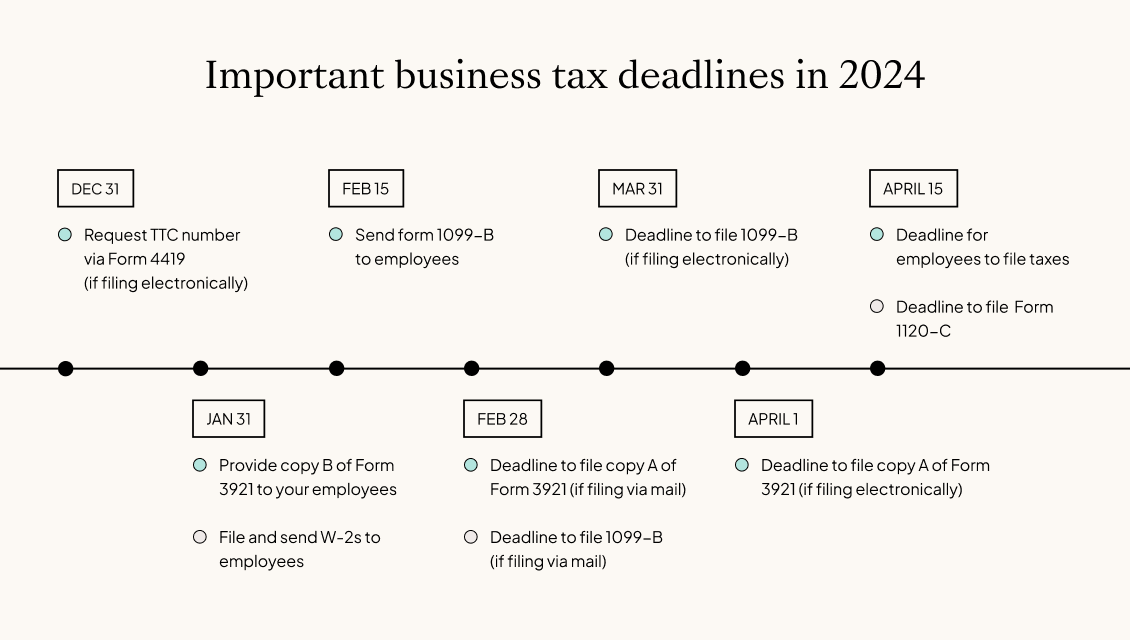

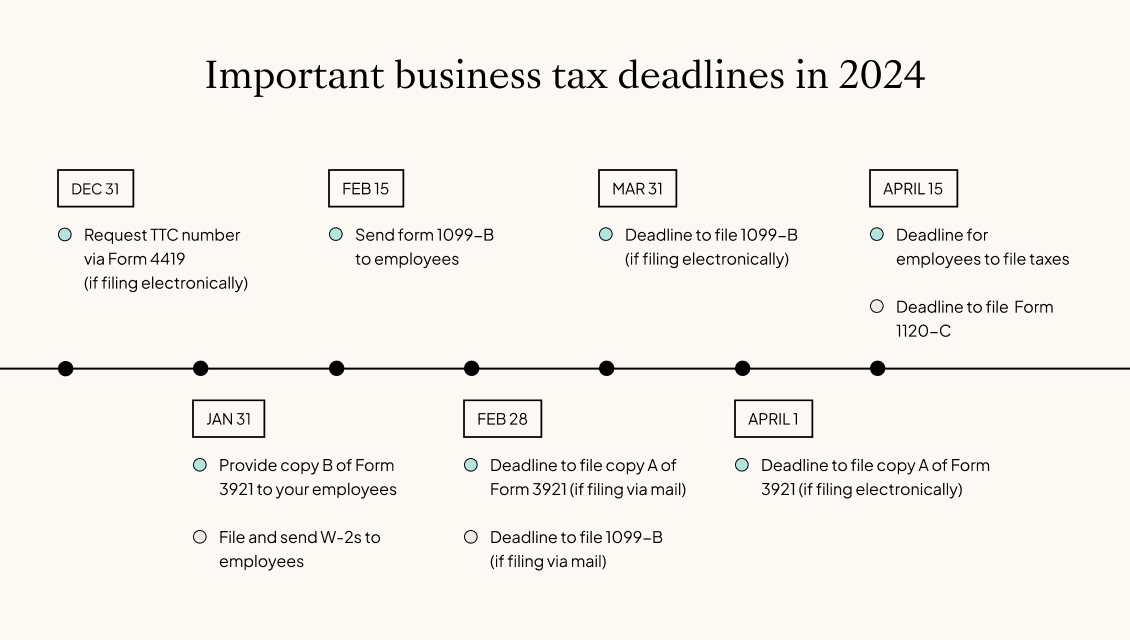

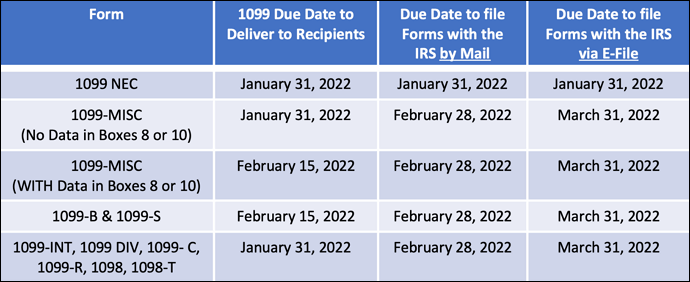

1099 Paperwork Deadline

The deadline for filing 1099 forms is January 31st of each year. This means that businesses and individuals must file their 1099 forms with the IRS and provide copies to the recipients by January 31st. It’s essential to note that the deadline may be extended if the due date falls on a weekend or federal holiday.

Consequences of Missing the Deadline

Missing the 1099 paperwork deadline can result in penalties and interest on the unpaid amount. The IRS may impose penalties of up to $250 per form for failure to file or late filing. Additionally, the IRS may also impose penalties for failure to provide accurate information or for not providing the required forms to recipients.

How to File 1099 Forms

To file 1099 forms, businesses and individuals can use the following methods: * E-file: The IRS offers an electronic filing system for 1099 forms. This method is faster and more convenient than paper filing. * Paper filing: Businesses and individuals can file 1099 forms by mail using the IRS’s paper filing system. * Third-party providers: Many third-party providers offer 1099 filing services, including e-filing and paper filing.

Important Notes

📝 Note: It’s essential to keep accurate records of all payments made to individuals and businesses, as this information will be needed to complete the 1099 forms.

📝 Note: Businesses and individuals can use IRS Form 1096 to summarize the information reported on the 1099 forms.

Summary of 1099 Forms

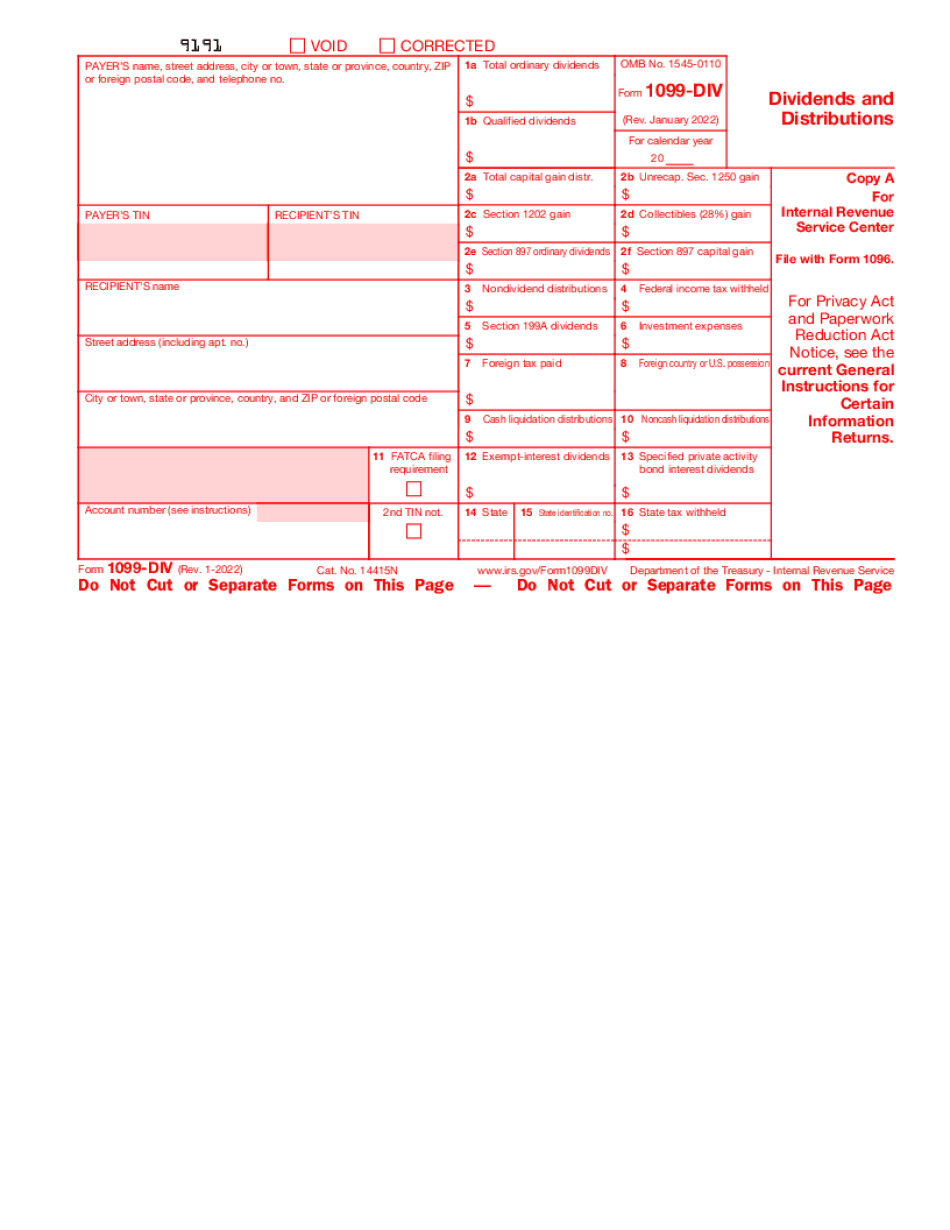

The following table summarizes the different types of 1099 forms:

| Form Number | Form Description |

|---|---|

| 1099-MISC | Miscellaneous income, such as freelance work and rental income |

| 1099-INT | Interest income, such as interest earned on savings accounts |

| 1099-DIV | Dividend income, such as dividends earned on stock investments |

In summary, understanding the 1099 paperwork deadline is crucial for businesses and individuals who need to file information returns with the IRS. By knowing who needs to file 1099 forms, the deadline, and the consequences of missing the deadline, individuals and businesses can ensure compliance with tax laws and avoid penalties.

The key points to remember are to file 1099 forms by January 31st, to use accurate and complete information, and to keep records of all payments made to individuals and businesses. By following these guidelines, businesses and individuals can ensure a smooth and efficient filing process.

What is the deadline for filing 1099 forms?

+

The deadline for filing 1099 forms is January 31st of each year.

Who needs to file 1099 forms?

+

Businesses and individuals who make payments to others, such as independent contractors, freelancers, and rental property owners, need to file 1099 forms.

What are the consequences of missing the 1099 paperwork deadline?

+

Missing the 1099 paperwork deadline can result in penalties and interest on the unpaid amount. The IRS may impose penalties of up to $250 per form for failure to file or late filing.