Essential Paperwork to Keep

Introduction to Essential Paperwork

When it comes to managing your personal or business finances, organization and record-keeping are key. Having all the necessary paperwork in order can help you stay on top of your financial obligations, ensure compliance with regulatory requirements, and make informed decisions about your future. In this blog post, we will explore the essential paperwork you should keep, how to organize it, and provide tips for maintaining a system that works for you.

Personal Financial Paperwork

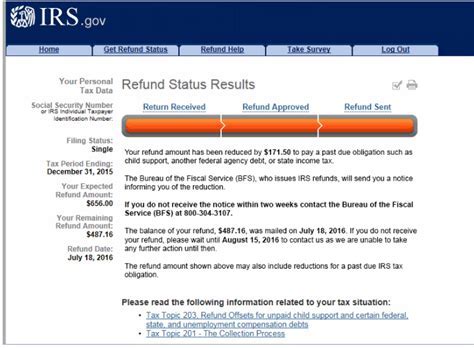

Keeping track of your personal financial paperwork is crucial for several reasons. It helps you monitor your income and expenses, manage your debt, and plan for long-term goals such as retirement or buying a home. Some of the essential personal financial paperwork includes: * Pay stubs: These documents show your income, deductions, and tax withholdings. * Bank statements: Regularly reviewing your bank statements can help you identify any discrepancies or fraudulent activities. * Tax returns: Keeping copies of your tax returns can be useful for future reference and in case of an audit. * Insurance policies: This includes health, life, auto, and home insurance policies. * Investment documents: If you have investments in stocks, bonds, or mutual funds, keep all related documents.

Business Financial Paperwork

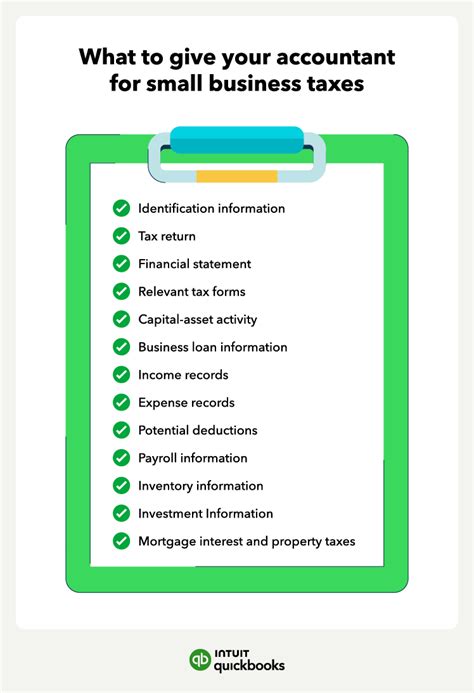

For business owners, maintaining accurate and comprehensive financial records is not only essential for financial management but also for compliance with tax laws and regulations. Some of the critical business financial paperwork includes: * Business registration documents: This includes your business license, articles of incorporation, and any other legal documents related to your business formation. * Tax returns and receipts: Keeping detailed records of your business income, expenses, and tax payments. * Employee records: If you have employees, you need to keep records of their employment, including contracts, pay stubs, and benefits information. * Contracts and agreements: This includes contracts with suppliers, clients, and partners. * Financial statements: Regularly prepare and keep financial statements such as balance sheets, income statements, and cash flow statements.

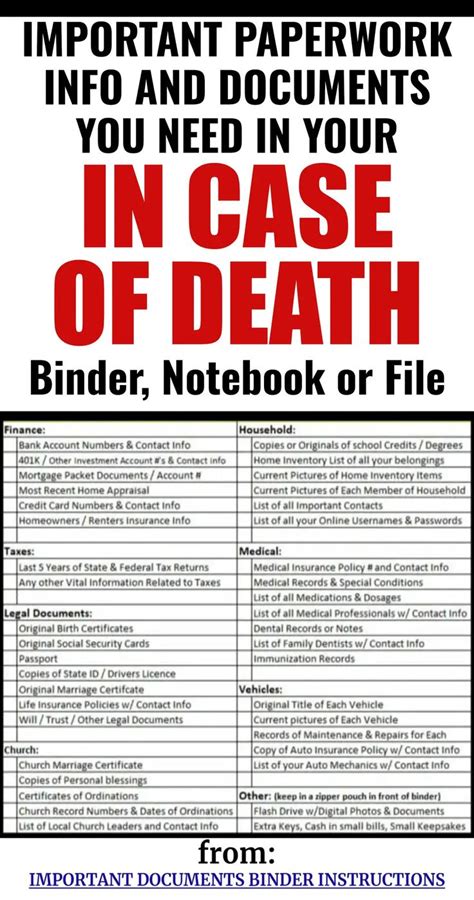

Organizing Your Paperwork

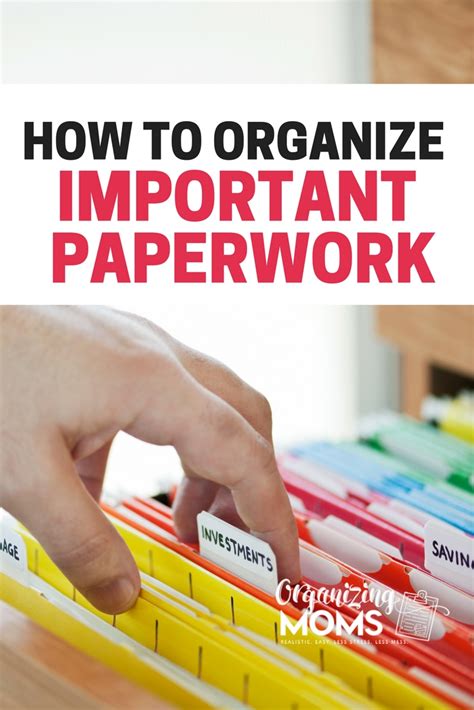

Organizing your paperwork effectively is crucial for easy access and to prevent loss of important documents. Here are some tips: * Use a filing system: Invest in a good filing cabinet and create separate folders for different categories of documents. * Digital storage: Consider scanning your documents and storing them digitally. This can help reduce physical storage needs and provide an additional layer of security. * Regularly update your records: Set aside time each month to update your records, file new documents, and discard any unnecessary paperwork. * Backup your digital files: If you choose to store your documents digitally, make sure to backup your files regularly to prevent data loss.

Security and Confidentiality

Ensuring the security and confidentiality of your paperwork is essential, especially for sensitive documents like tax returns, bank statements, and business contracts. Here are some measures you can take: * Lock away physical documents: Store your physical documents in a locked cabinet or safe. * Use secure digital storage: Choose digital storage solutions that offer strong encryption and secure access controls. * Limit access: Only allow authorized individuals to access your paperwork. * Shred unnecessary documents: Use a shredder to dispose of documents that are no longer needed, especially those containing sensitive information.

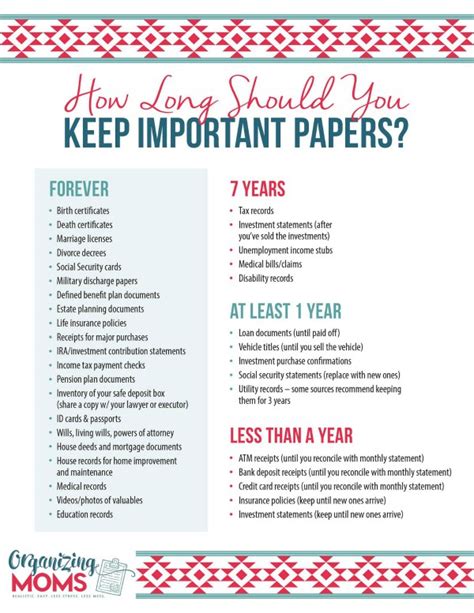

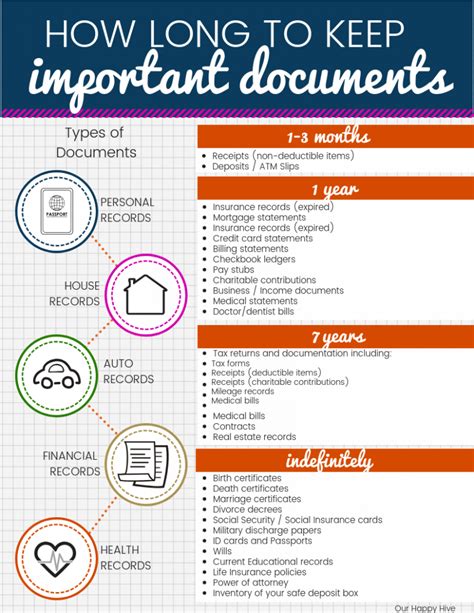

📝 Note: Always check the legal requirements for document retention in your jurisdiction to ensure you are keeping the necessary paperwork for the appropriate amount of time.

Conclusion and Final Thoughts

In conclusion, maintaining essential paperwork is a critical aspect of managing your personal and business finances effectively. By understanding what paperwork to keep, how to organize it, and taking measures to ensure its security and confidentiality, you can better navigate your financial obligations and make informed decisions about your future. Remember, a well-organized system of paperwork can save you time, reduce stress, and provide peace of mind.

What are the most important financial documents to keep?

+

The most important financial documents to keep include tax returns, bank statements, investment documents, insurance policies, and any legal documents related to your business or personal assets.

How long should I keep my financial paperwork?

+

The length of time you should keep your financial paperwork varies depending on the type of document and your jurisdiction’s legal requirements. Generally, it’s recommended to keep tax returns and supporting documents for at least three years, while other documents like bank statements and investment records can be kept for a year or more, depending on their relevance to your current financial situation.

What are the benefits of digitizing my paperwork?

+

Digitizing your paperwork can help reduce physical storage needs, provide an additional layer of security through backups, and make it easier to access and share documents when needed. However, it’s crucial to choose a secure digital storage solution to protect your sensitive information.