5 Refinance Papers Needed

Introduction to Refinance Papers

When considering refinancing a mortgage, it’s essential to understand the various documents involved in the process. Refinancing a mortgage can be a complex and daunting task, but being prepared with the necessary paperwork can help streamline the process. In this article, we will discuss the 5 refinance papers needed to refinance a mortgage.

Understanding Refinance Papers

Refinance papers are documents that provide lenders with the necessary information to evaluate an applicant’s creditworthiness and determine the terms of the new loan. These papers typically include financial statements, identification documents, and property information. The 5 refinance papers needed are:

- Pay stubs and W-2 forms: These documents provide proof of income and employment history.

- Bank statements and investment accounts: These documents provide a snapshot of an applicant’s financial situation, including their assets and liabilities.

- Identification documents: These documents, such as a driver’s license or passport, verify an applicant’s identity.

- Property appraisal or valuation report: This document provides an estimate of the property’s value, which is used to determine the loan-to-value ratio.

- Loan application and credit report: This document provides a detailed overview of an applicant’s credit history and debt obligations.

Preparing Refinance Papers

To prepare for the refinance process, it’s essential to gather all the necessary documents and ensure they are accurate and up-to-date. Here are some tips to keep in mind:

- Organize documents in a logical order: This will make it easier to review and submit the documents to the lender.

- Review documents for errors: Ensure all documents are accurate and complete to avoid delays in the refinance process.

- Make copies of documents: Keep a copy of all documents for your records, in case the original documents are lost or misplaced.

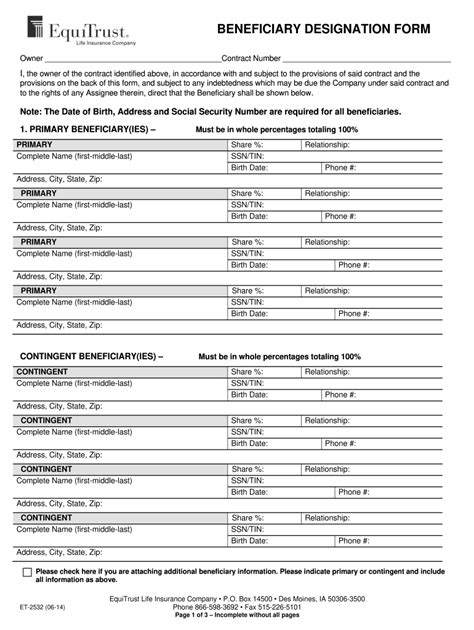

Refinance Paper Checklist

Here is a checklist of the 5 refinance papers needed:

| Document | Description |

|---|---|

| Pay stubs and W-2 forms | Proof of income and employment history |

| Bank statements and investment accounts | Financial statements and asset information |

| Identification documents | Verification of identity |

| Property appraisal or valuation report | Estimate of property value |

| Loan application and credit report | Credit history and debt obligations |

📝 Note: It's essential to review and understand the refinance papers needed to avoid delays in the refinance process.

Benefits of Refinancing

Refinancing a mortgage can provide several benefits, including:

- Lower interest rates: Refinancing can help reduce monthly mortgage payments and save money on interest over the life of the loan.

- Improved loan terms: Refinancing can provide more favorable loan terms, such as a longer or shorter loan term, or a switch from an adjustable-rate to a fixed-rate loan.

- Increased cash flow: Refinancing can provide access to cash for home improvements, debt consolidation, or other financial needs.

Conclusion and Final Thoughts

In conclusion, refinancing a mortgage requires careful planning and preparation. By understanding the 5 refinance papers needed, applicants can streamline the process and increase their chances of approval. Remember to review and organize documents carefully, and don’t hesitate to seek professional advice if needed. With the right documents and a clear understanding of the refinance process, applicants can make informed decisions and achieve their financial goals.

What is the purpose of refinancing a mortgage?

+

The purpose of refinancing a mortgage is to replace an existing loan with a new one, often to take advantage of lower interest rates, improve loan terms, or access cash for other financial needs.

What are the benefits of refinancing a mortgage?

+

The benefits of refinancing a mortgage include lower interest rates, improved loan terms, and increased cash flow. Refinancing can also provide access to cash for home improvements, debt consolidation, or other financial needs.

What documents are required for refinancing a mortgage?

+

The documents required for refinancing a mortgage include pay stubs and W-2 forms, bank statements and investment accounts, identification documents, property appraisal or valuation report, and loan application and credit report.