Fill Out Beneficiary Paperwork

Introduction to Beneficiary Paperwork

When it comes to managing assets, whether it be through a will, trust, or insurance policy, designating a beneficiary is a crucial step. A beneficiary is an individual or entity that will receive the benefits of a particular asset after the owner’s passing. Filling out beneficiary paperwork is essential to ensure that one’s wishes are carried out, and the process can be straightforward if approached with the right guidance. In this article, we will delve into the world of beneficiary paperwork, exploring its importance, the types of beneficiaries, and a step-by-step guide on how to fill out the necessary forms.

Understanding the Importance of Beneficiary Designation

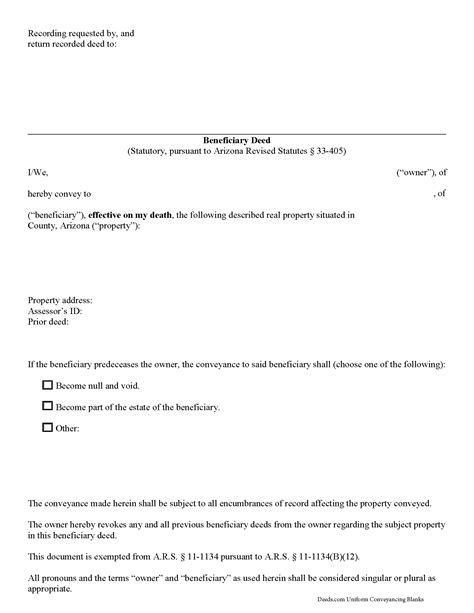

Designating a beneficiary is not just a formality; it is a critical aspect of estate planning. By naming a beneficiary, individuals can ensure that their assets are distributed according to their wishes, minimizing the risk of disputes among family members or the application of intestate laws, which dictate how assets are divided when there is no will. Moreover, beneficiary designations can help bypass probate, a lengthy and costly legal process that oversees the distribution of assets. This can provide peace of mind, knowing that loved ones will receive their inheritance more quickly and with less hassle.

Types of Beneficiaries

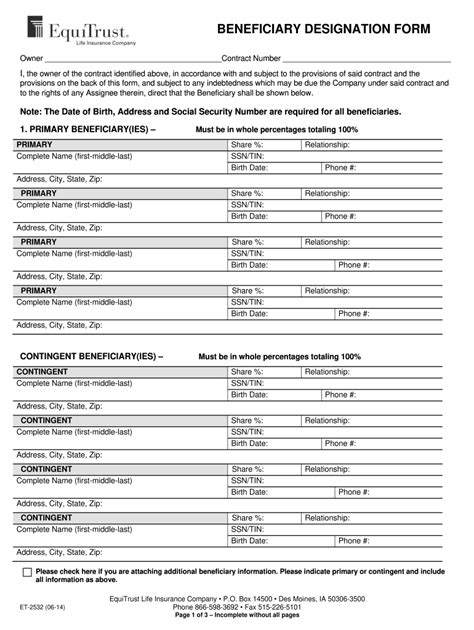

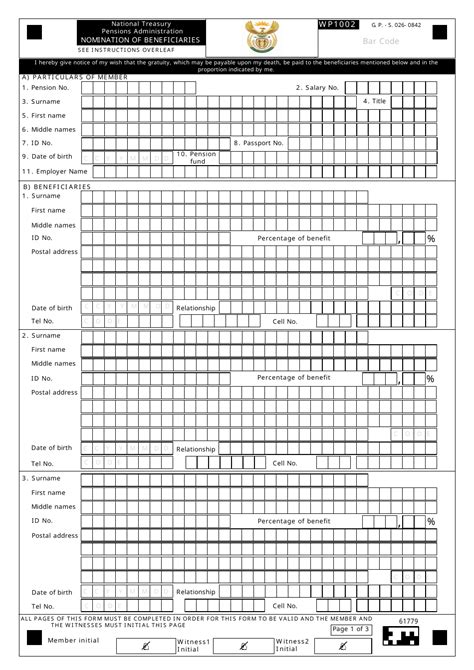

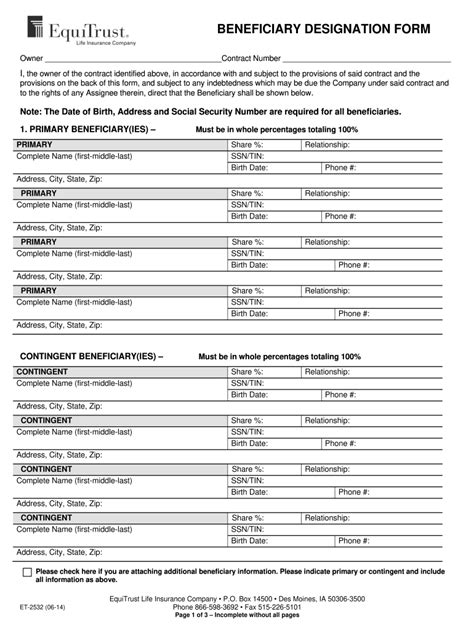

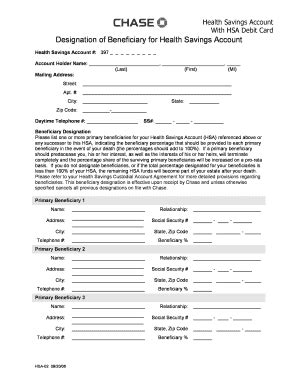

There are several types of beneficiaries that can be designated, depending on the asset and the individual’s preferences. These include: - Primary Beneficiaries: The first in line to receive the asset. If the primary beneficiary predeceases the owner, the asset will typically pass to the secondary beneficiary. - Secondary Beneficiaries: Also known as contingent beneficiaries, they receive the asset if the primary beneficiary is unable to do so. - Minor Beneficiaries: When assets are left to minors, it is often advisable to establish a trust to manage the assets until the minor reaches adulthood. - Charitable Beneficiaries: For those who wish to leave a legacy to a favorite charity or cause.

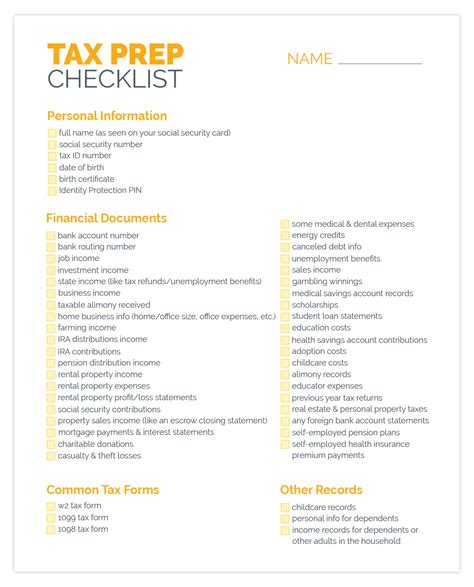

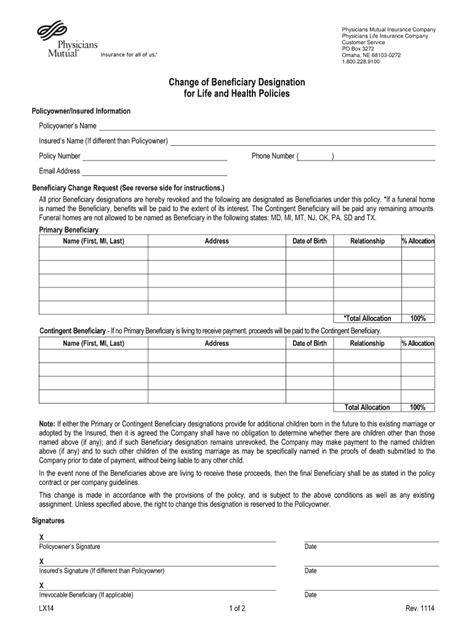

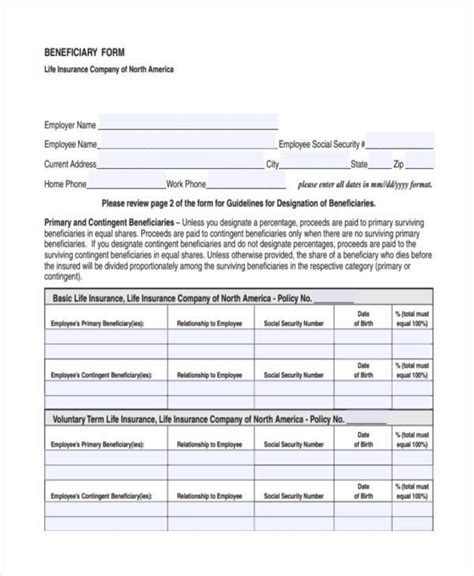

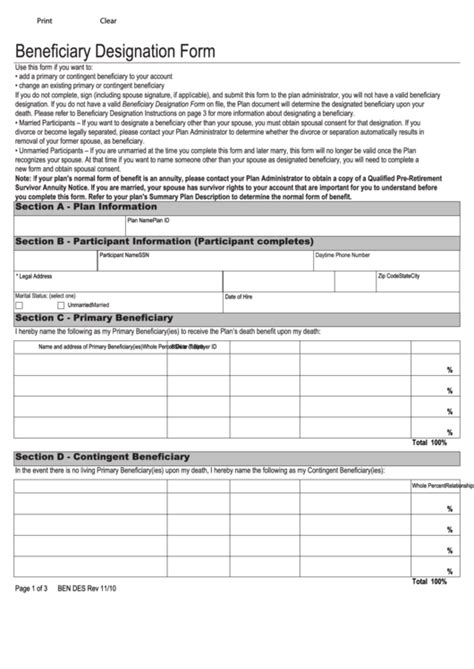

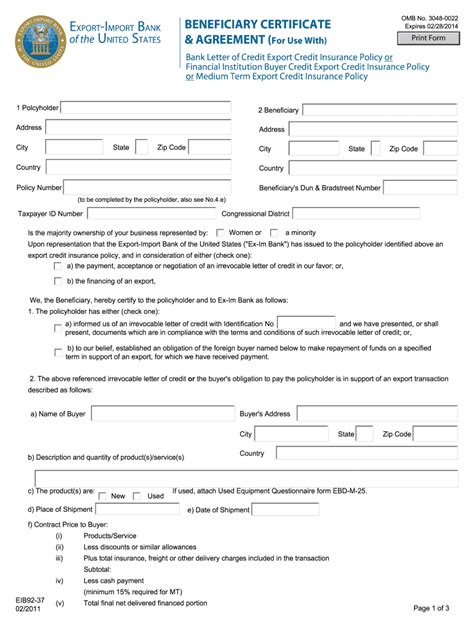

A Step-by-Step Guide to Filling Out Beneficiary Paperwork

Filling out beneficiary paperwork involves several key steps: 1. Gather Necessary Information: Before starting, ensure you have all the necessary details, including the full legal names of beneficiaries, their relationships to you, dates of birth, and social security numbers. 2. Identify the Asset: Clearly identify the asset for which you are designating a beneficiary. This could be a life insurance policy, retirement account, or another type of asset that allows beneficiary designation. 3. Choose Your Beneficiaries: Decide on your primary and secondary beneficiaries. Consider factors such as the beneficiary’s financial situation, their ability to manage the asset, and your overall estate plan. 4. Complete the Beneficiary Form: Obtain the beneficiary designation form from the asset holder (e.g., insurance company, financial institution). Fill out the form carefully, ensuring all information is accurate and complete. 5. Sign and Date the Form: Once completed, sign and date the form. Some forms may require a witness signature or notarization, so be sure to follow the instructions provided. 6. Submit the Form: Return the completed form to the asset holder. Keep a copy for your records and consider informing your beneficiaries of their designation.

Considerations and Potential Issues

While designating beneficiaries can seem straightforward, there are considerations and potential issues to be aware of: - Review and Update: Beneficiary designations should be reviewed periodically, especially after significant life events such as marriage, divorce, or the birth of a child. - Consistency with Overall Estate Plan: Ensure that beneficiary designations align with your overall estate plan to avoid unintended consequences. - Tax Implications: Certain assets, like retirement accounts, have tax implications for beneficiaries. Understanding these implications can help in making informed decisions.

| Asset Type | Beneficiary Designation Requirements |

|---|---|

| Life Insurance Policies | Typically require the name, date of birth, and relationship of the beneficiary |

| Retirement Accounts | |

| Trusts | Often involve more complex beneficiary designations, including the establishment of sub-trusts for minor beneficiaries |

💡 Note: It is essential to understand the specific requirements for each asset type to ensure that beneficiary designations are properly executed.

Final Thoughts on Beneficiary Paperwork

In conclusion, filling out beneficiary paperwork is a vital component of any comprehensive estate plan. By understanding the importance of beneficiary designation, the types of beneficiaries, and how to fill out the necessary forms, individuals can ensure their assets are distributed according to their wishes. It is crucial to approach this task with care, considering all aspects of beneficiary designation to avoid potential issues. With the right guidance and attention to detail, the process can be navigated efficiently, providing peace of mind for both the individual and their loved ones.

What is the purpose of designating a beneficiary?

+

The purpose of designating a beneficiary is to ensure that assets are distributed according to one’s wishes after their passing, bypassing the lengthy and costly probate process.

Can beneficiary designations be changed?

+

Yes, beneficiary designations can typically be changed by completing a new beneficiary designation form and submitting it to the asset holder. It is advisable to review and update beneficiary designations periodically, especially after significant life events.

What happens if no beneficiary is designated?

+

If no beneficiary is designated for an asset, it will typically be distributed according to the intestate laws of the state, which can lead to unintended consequences and potential disputes among family members.