Spouse Dies Paperwork Needs

Dealing with the Loss of a Spouse: A Guide to Necessary Paperwork

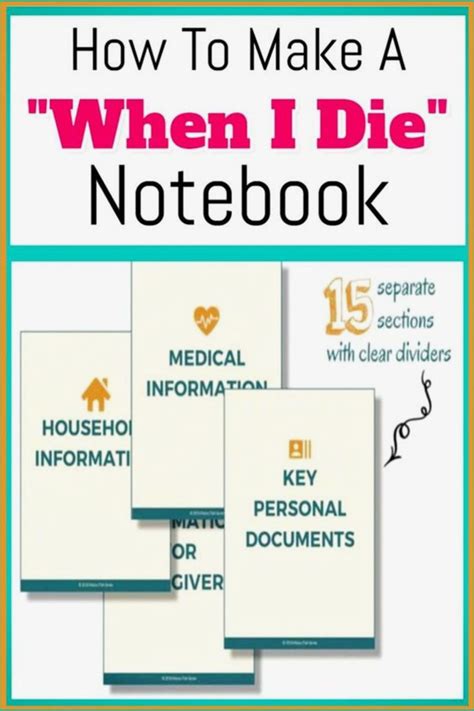

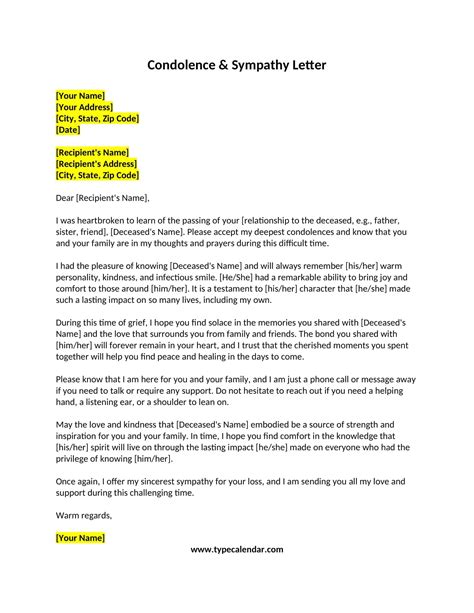

When a spouse passes away, it can be a difficult and emotional time for the surviving partner. In addition to coping with grief, there are numerous practical tasks that need to be attended to, including handling various paperwork and administrative duties. This guide aims to provide a comprehensive overview of the necessary steps to take when a spouse dies, focusing on the paperwork and legal requirements involved.

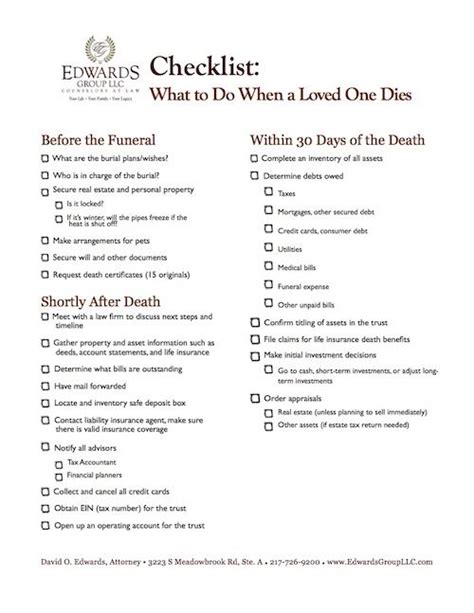

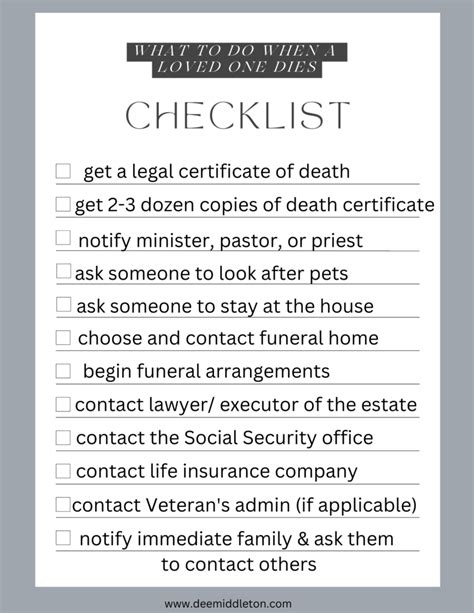

Immediate Actions

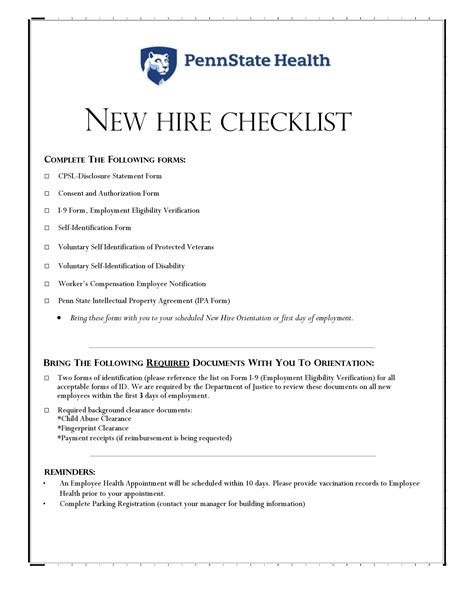

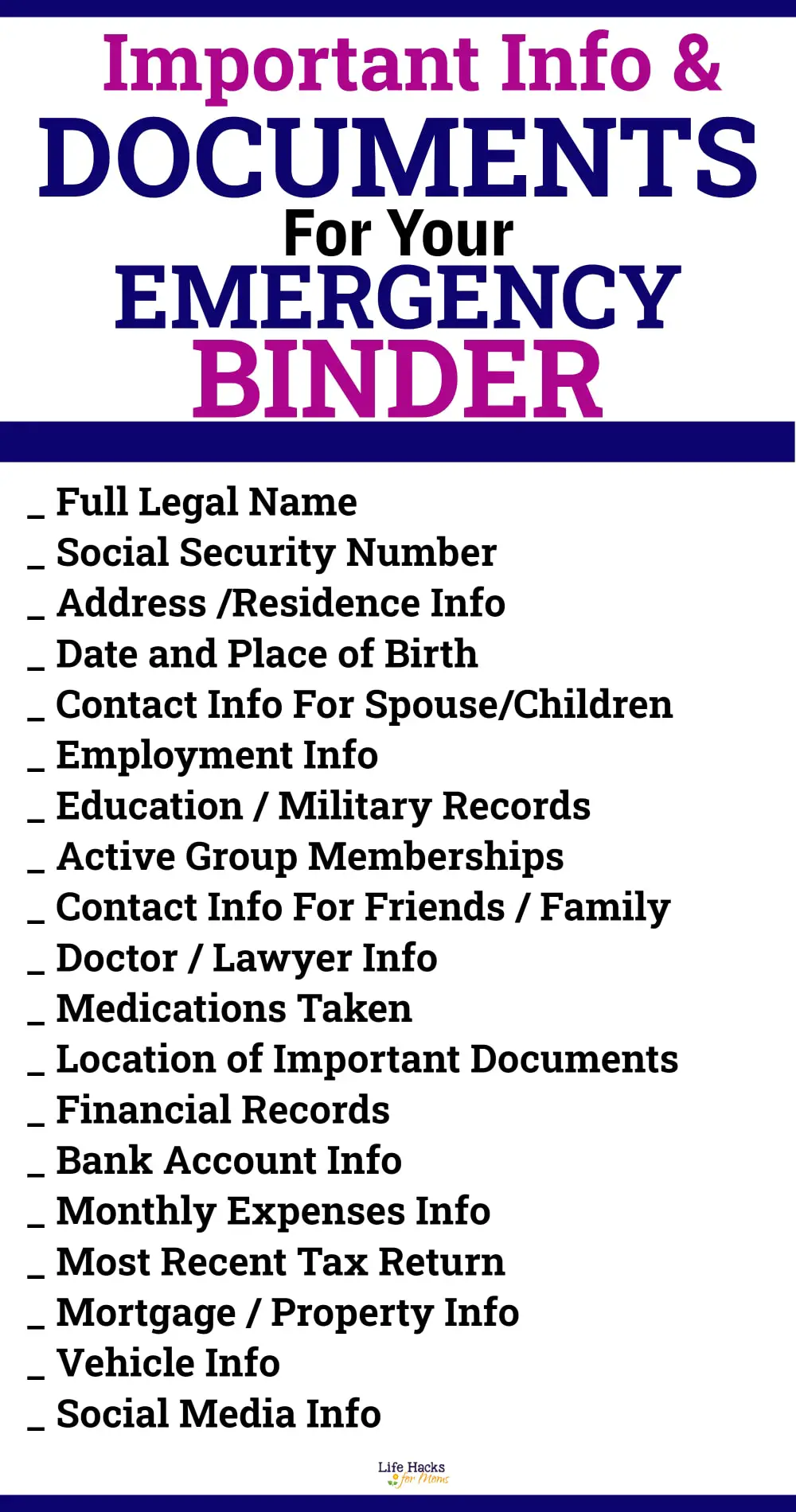

In the days and weeks following the death of a spouse, it’s essential to take care of several immediate tasks. These include: * Obtaining a death certificate, which is usually issued by the hospital or the funeral home * Notifying the relevant authorities, such as the social security administration and the pension provider * Informing the spouse’s employer, if applicable * Contacting the life insurance company, if a policy is in place These initial steps will help set the stage for the more detailed paperwork and administrative tasks that follow.

Notifying Relevant Parties

A crucial aspect of handling the death of a spouse is notifying the relevant parties. This includes: * Social Security Administration: to report the death and potentially apply for survivor benefits * Life Insurance Company: to file a claim and receive the policy payout * Banks and Credit Card Companies: to notify them of the death and potentially freeze or close accounts * Loan and Mortgage Providers: to inform them of the death and discuss potential repayment options * Employer or Pension Provider: to report the death and potentially apply for survivor benefits It’s essential to keep a record of all notifications, including dates, times, and the names of the people spoken to.

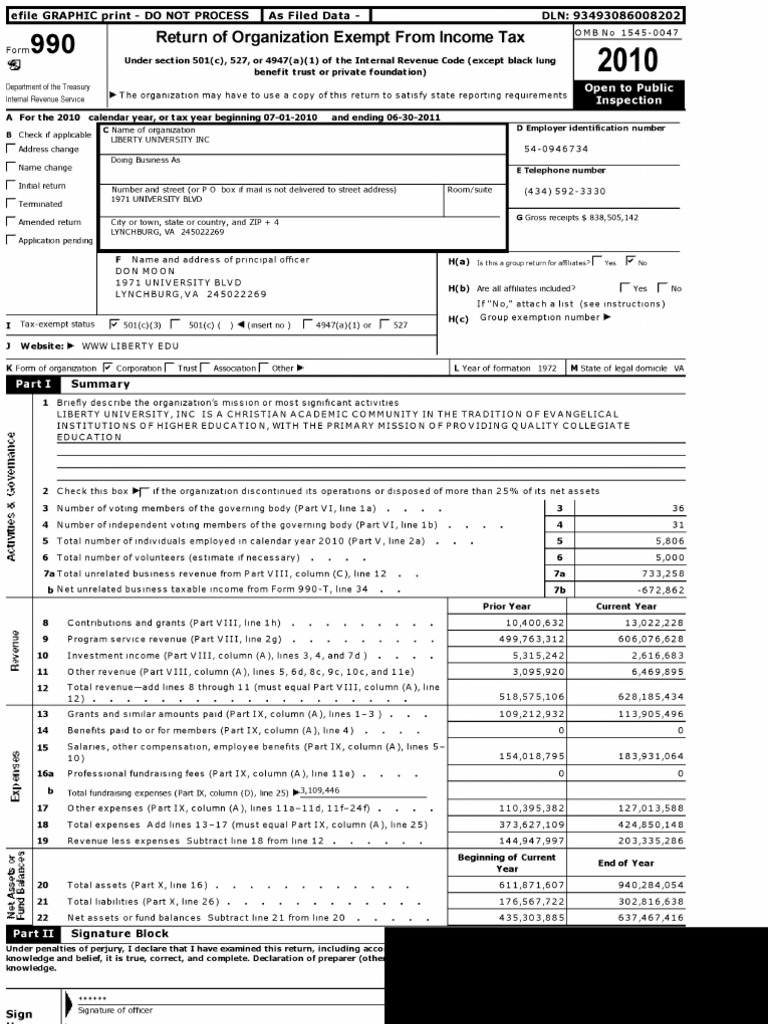

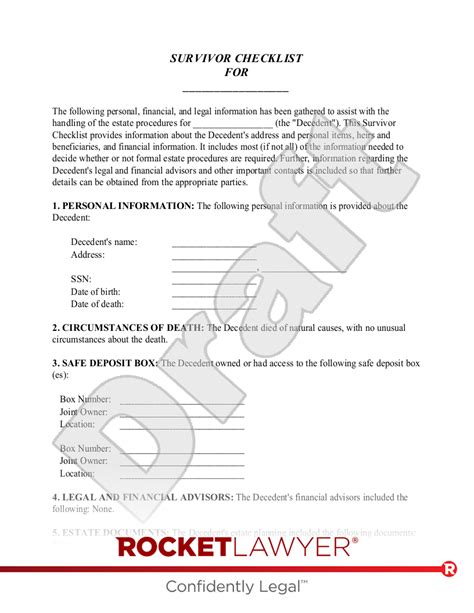

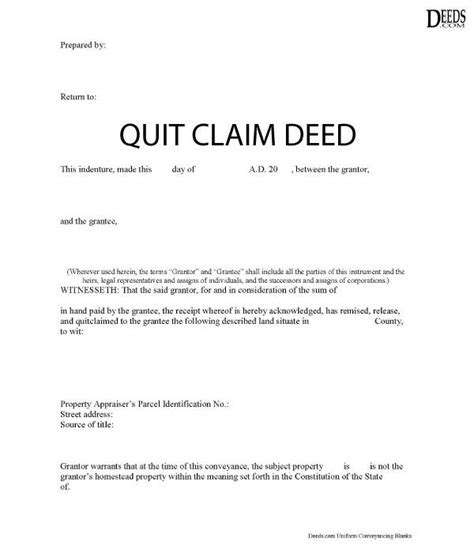

Probate and Estate Administration

If the deceased spouse had assets, such as property, investments, or savings, it may be necessary to go through the probate process. This involves: * Obtaining a grant of probate, which gives the executor or administrator the authority to manage the estate * Identifying and valuing the assets of the estate * Paying any outstanding debts or taxes * Distributing the remaining assets according to the will or the laws of intestacy The probate process can be complex and time-consuming, so it’s recommended to seek the advice of a solicitor or estate administrator.

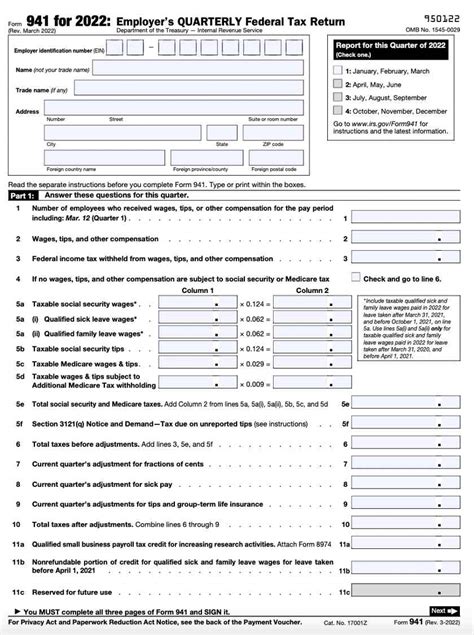

Tax Implications

The death of a spouse can have significant tax implications, including: * Inheritance Tax: potentially payable on the estate of the deceased spouse * Income Tax: the surviving spouse may need to complete a tax return for the year of death * Capital Gains Tax: potentially payable on the sale of assets from the estate It’s essential to consult with a tax professional to ensure that all tax obligations are met and that the surviving spouse is aware of any potential tax liabilities.

Benefits and Allowances

The surviving spouse may be eligible for various benefits and allowances, including: * Widowed Parent’s Allowance: a weekly payment for parents who have lost a spouse * Bereavement Support Payment: a one-off payment or series of payments to help with funeral costs and other expenses * State Pension: the surviving spouse may be eligible for a state pension based on their late spouse’s national insurance contributions It’s crucial to research and apply for these benefits as soon as possible to ensure that the surviving spouse receives the support they are entitled to.

| Benefit | Description | Eligibility |

|---|---|---|

| Widowed Parent's Allowance | A weekly payment for parents who have lost a spouse | Parents with dependent children |

| Bereavement Support Payment | A one-off payment or series of payments to help with funeral costs and other expenses | Spouses or civil partners of the deceased |

| State Pension | A weekly payment based on the late spouse's national insurance contributions | Spouses or civil partners of the deceased who have reached state pension age |

📝 Note: The benefits and allowances available may vary depending on the country or region, so it's essential to research and consult with relevant authorities to determine eligibility.

In the aftermath of a spouse’s death, it’s vital to take care of the necessary paperwork and administrative tasks to ensure that the surviving spouse receives the support they are entitled to. By understanding the immediate actions, notifying relevant parties, handling probate and estate administration, and being aware of tax implications and benefits, the surviving spouse can navigate this challenging time with greater ease.

To summarize, the key points to consider when dealing with the loss of a spouse include taking immediate action, notifying relevant parties, handling probate and estate administration, understanding tax implications, and applying for benefits and allowances. By following these steps and seeking professional advice when needed, the surviving spouse can ensure that they are well-supported during this difficult time.

What is the first step to take when a spouse dies?

+

The first step to take when a spouse dies is to obtain a death certificate, which is usually issued by the hospital or the funeral home. This document is essential for notifying relevant parties and handling administrative tasks.

How do I notify the social security administration of my spouse’s death?

+

To notify the social security administration of your spouse’s death, you can call their customer service number or visit their website. You will need to provide the death certificate and other relevant documentation to report the death and potentially apply for survivor benefits.

What benefits am I eligible for as a surviving spouse?

+

As a surviving spouse, you may be eligible for various benefits, including Widowed Parent’s Allowance, Bereavement Support Payment, and State Pension. The specific benefits you are eligible for will depend on your individual circumstances, so it’s essential to research and consult with relevant authorities to determine your eligibility.