5 IRA Rollover Tips

Understanding the IRA Rollover Process

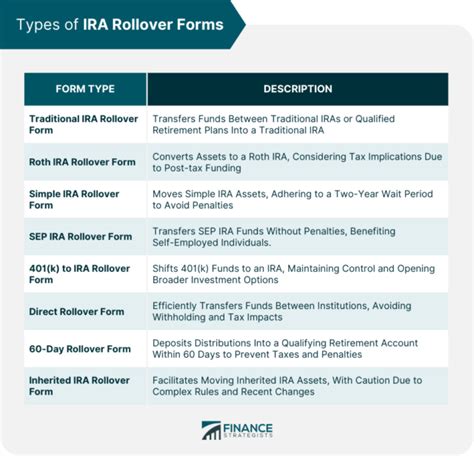

When it comes to managing your retirement savings, understanding the rules and regulations surrounding Individual Retirement Accounts (IRAs) is crucial. One of the key concepts to grasp is the IRA rollover, a process that allows you to transfer funds from one retirement account to another without incurring immediate tax liabilities. This can be a valuable strategy for consolidating accounts, changing investment options, or moving from an employer-sponsored plan to an IRA. However, navigating the IRA rollover process can be complex, and making informed decisions requires careful consideration of several factors.

Key Considerations for an IRA Rollover

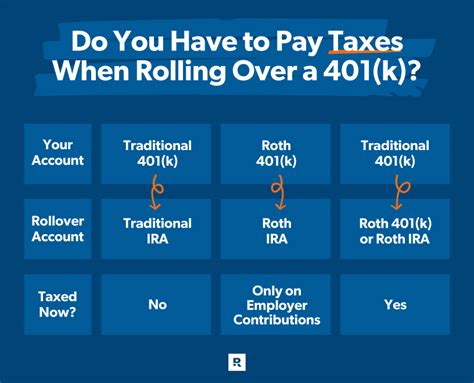

Before initiating an IRA rollover, it’s essential to understand the different types of IRAs (Traditional and Roth), the rules governing rollovers, and the potential implications for your tax situation and retirement goals. Traditional IRAs offer tax-deductible contributions and tax-deferred growth, but withdrawals are taxed as ordinary income. In contrast, Roth IRAs are funded with after-tax dollars, grow tax-free, and offer tax-free withdrawals in retirement, provided certain conditions are met. Understanding these differences is vital for making an informed decision about which type of IRA is best suited for your needs.

5 IRA Rollover Tips

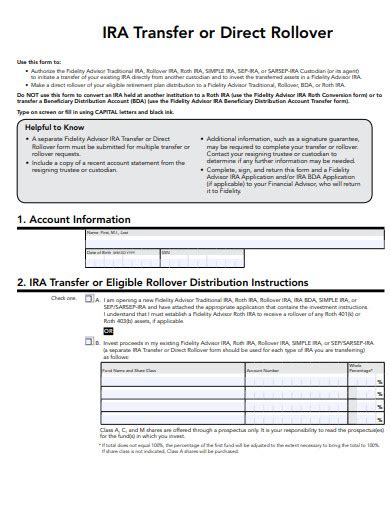

To ensure a smooth and beneficial IRA rollover process, consider the following tips: - Direct Rollover vs. Indirect Rollover: Opt for a direct rollover, where the funds are transferred directly from one custodian to another, to avoid the 20% mandatory withholding that applies to indirect rollovers. - Time Limits: Be aware of the 60-day window for completing an indirect rollover. If you receive a distribution from an IRA or employer-sponsored retirement plan, you have 60 days to roll those funds into another IRA or qualified plan to avoid taxes and potential penalties. - Once-Per-Year Rule: Understand the once-per-year rule for indirect IRA rollovers. This rule limits how often you can use the 60-day rollover option for IRAs. It’s crucial for avoiding unintended tax consequences and ensuring compliance with IRS regulations. - Consider Professional Advice: Given the complexity of IRA rollovers and the potential for significant tax implications, it may be beneficial to consult with a financial advisor or tax professional. They can provide personalized guidance based on your specific situation and goals. - Review Fees and Investment Options: When choosing a new IRA custodian, consider the fees associated with the account, as well as the range of investment options available. Ensuring that your IRA is aligned with your retirement goals and risk tolerance is essential for long-term success.

Benefits of an IRA Rollover

An IRA rollover can offer several benefits, including the ability to consolidate accounts for easier management, change investment options to better align with your financial goals, and move from an employer-sponsored plan to an IRA, potentially reducing fees or gaining more control over your investments. However, it’s essential to weigh these benefits against the potential risks and complexities involved in the rollover process.

Common Mistakes to Avoid

To maximize the benefits of an IRA rollover and minimize potential drawbacks, it’s crucial to avoid common mistakes, such as: - Failing to meet the 60-day deadline for indirect rollovers - Not understanding the once-per-year rule for IRA rollovers - Ignoring the potential tax implications of a rollover - Not reviewing the fees and investment options of the new IRA custodian - Proceeding without professional advice when needed

💡 Note: Always consult with a financial advisor or tax professional before making significant changes to your retirement accounts to ensure that your decisions align with your overall financial strategy and goals.

Given the complexities and potential benefits associated with IRA rollovers, it’s clear that careful planning and consideration are essential. By understanding the rules, benefits, and potential pitfalls, individuals can make informed decisions that support their long-term financial and retirement goals. In summary, navigating the IRA rollover process requires a thorough understanding of the options available, the rules governing these transactions, and the potential implications for one’s financial situation. With the right approach and perhaps the guidance of a financial professional, individuals can leverage IRA rollovers as a strategic tool in their retirement planning arsenal.

What is the main difference between a Traditional IRA and a Roth IRA?

+

The primary difference lies in how they are taxed. Traditional IRAs are tax-deductible and grow tax-deferred, but withdrawals are taxed as ordinary income. Roth IRAs are funded with after-tax dollars, grow tax-free, and offer tax-free withdrawals in retirement if certain conditions are met.

Can I roll over my 401(k) into an IRA?

+

Yes, you can roll over a 401(k) or other employer-sponsored retirement plan into an IRA. This can provide more control over your investments and potentially reduce fees. However, it’s essential to understand the rules and potential tax implications before proceeding.

What is the once-per-year rule for IRA rollovers?

+

The once-per-year rule limits how often you can use the 60-day rollover option for IRAs. Essentially, you can only make one rollover from one IRA to another IRA in a 12-month period. This rule is designed to prevent frequent movements of funds that could be used for short-term loans or other non-retirement purposes.