5 Forms for 203k

Introduction to 203k Forms

The Federal Housing Administration (FHA) provides mortgage insurance on loans made by FHA-approved lenders. One of the most popular FHA loan programs is the 203k loan, which allows homeowners to finance the purchase and rehabilitation of a home with a single loan. To facilitate the 203k loan process, several forms are required. In this article, we will discuss the five main forms used in the 203k loan process.

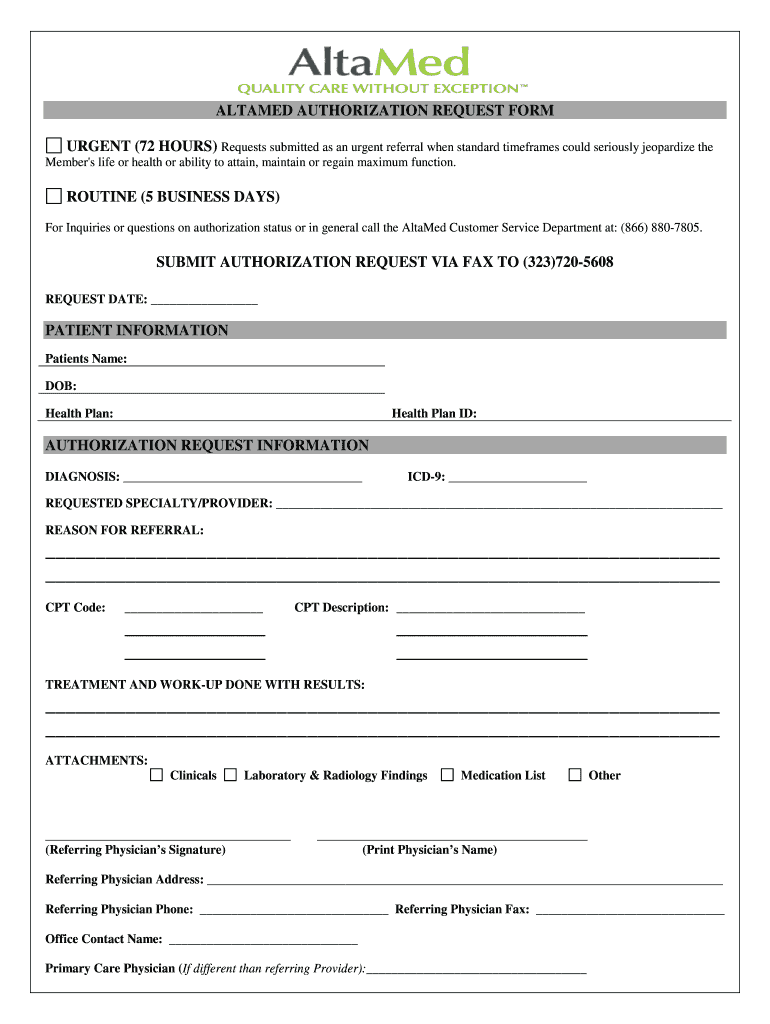

Form 1: HUD-92900-A, Request for Endorsement of Credit Report

The HUD-92900-A form is used to request an endorsement of the borrower’s credit report. This form is typically completed by the lender and submitted to the FHA. The form requires information about the borrower’s credit history, including their credit score, credit accounts, and any derogatory credit marks.

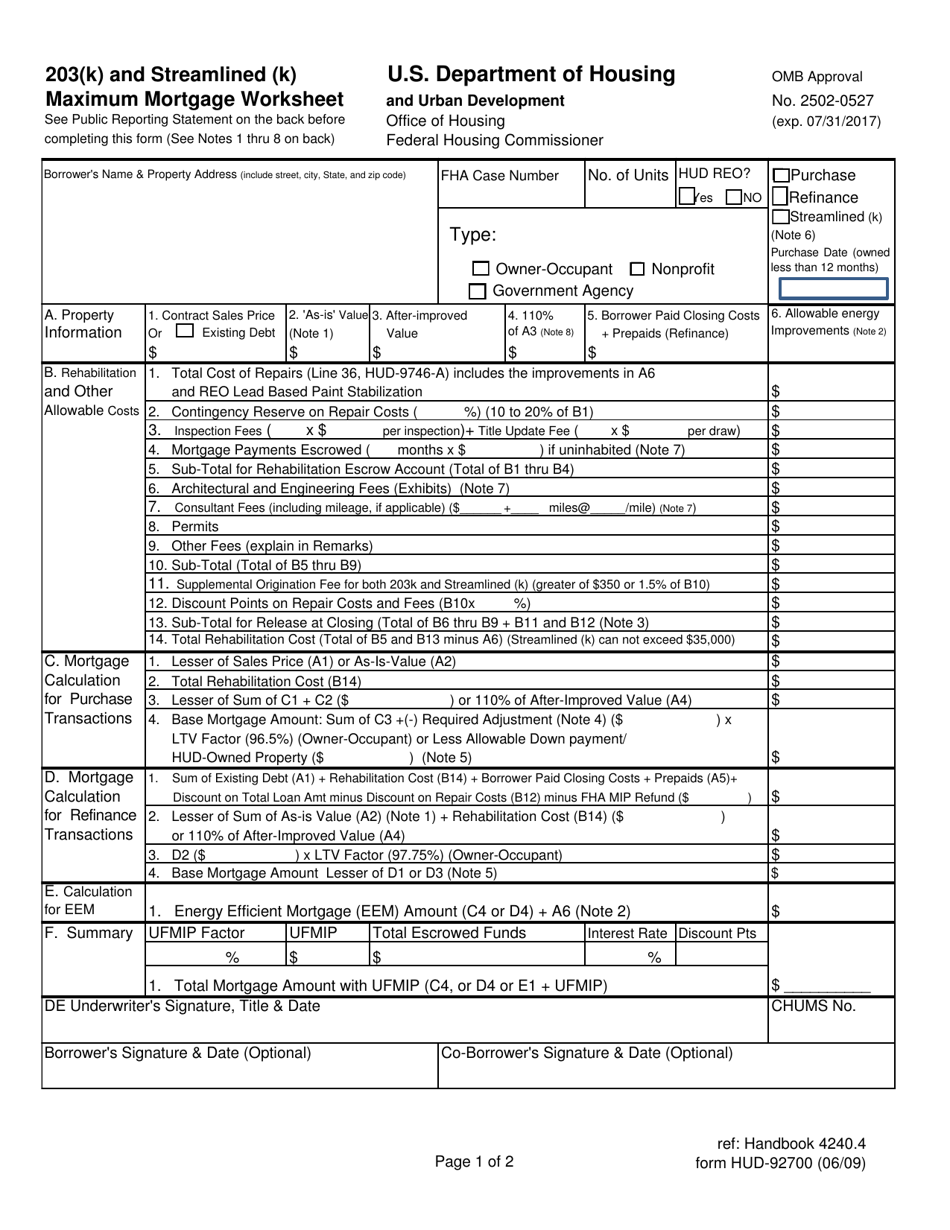

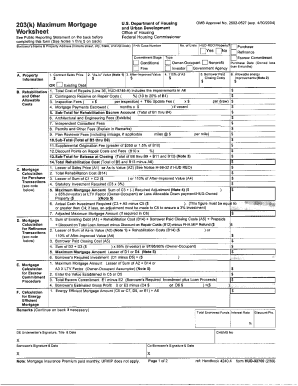

Form 2: HUD-92900-B, Summary of Rehabilitation Cost Estimate

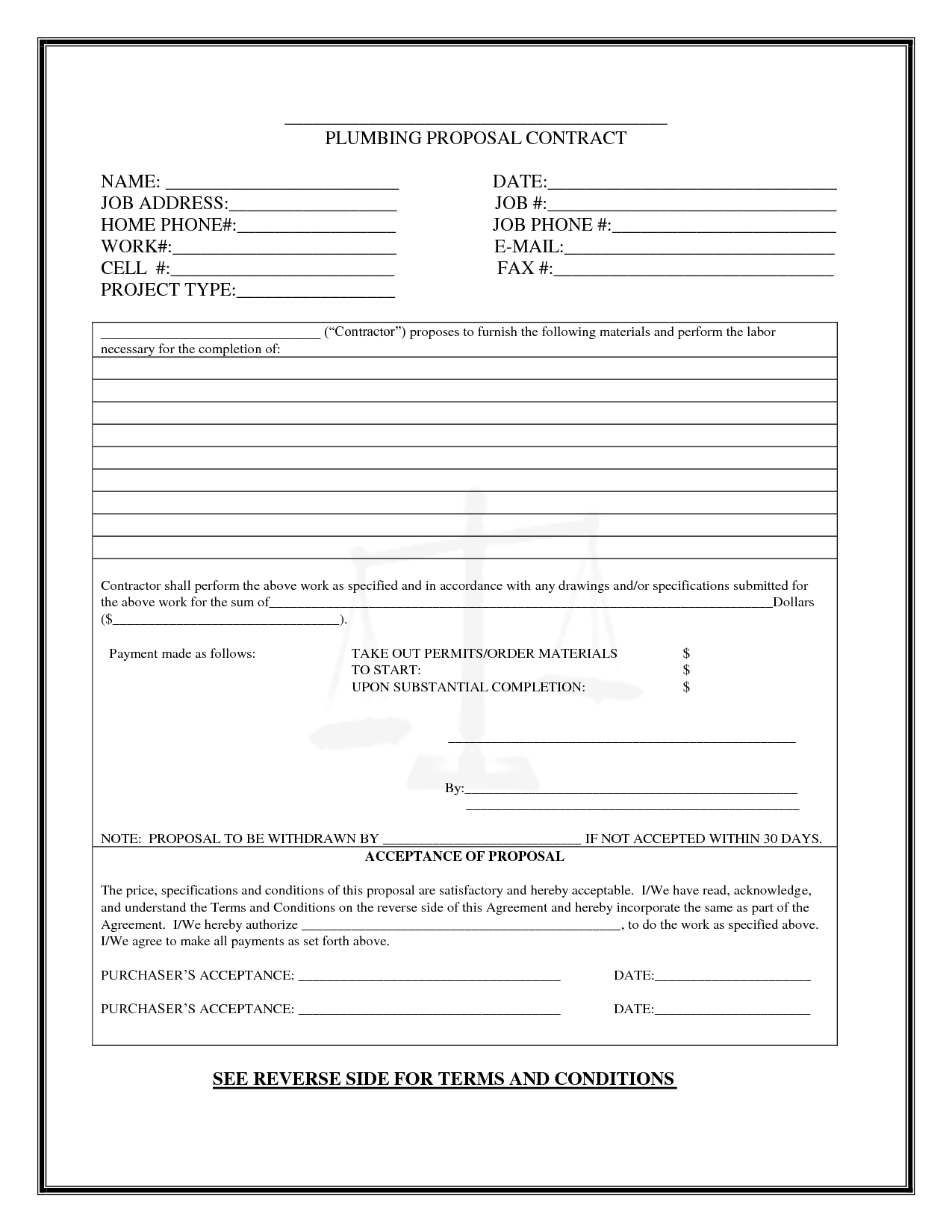

The HUD-92900-B form is used to estimate the cost of rehabilitation for the property. This form is completed by the borrower and/or the contractor and provides a detailed breakdown of the costs associated with the rehabilitation project, including labor, materials, and permits.

Form 3: HUD-9746-A, Certificate of Completion

The HUD-9746-A form is used to certify that the rehabilitation work has been completed in accordance with the approved plans and specifications. This form is typically completed by the contractor and submitted to the lender.

Form 4: HUD-4000.1, Federal Housing Administration Single Family Housing Policy Handbook

The HUD-4000.1 form is not a form in the classical sense, but rather a comprehensive handbook that outlines the policies and procedures for the 203k loan program. This handbook provides detailed guidance on the eligibility requirements, loan limits, and underwriting procedures for the 203k loan program.

Form 5: HUD-92541, Architectural Exhibits

The HUD-92541 form is used to provide detailed architectural exhibits, including plans, specifications, and drawings, to support the rehabilitation project. This form is typically completed by the architect or designer and submitted to the lender.

📝 Note: These forms are subject to change, and lenders may have additional requirements. It's essential to consult with an FHA-approved lender to ensure that all necessary forms are completed accurately and submitted on time.

To illustrate the importance of these forms, consider the following table:

| Form | Purpose |

|---|---|

| HUD-92900-A | Request for endorsement of credit report |

| HUD-92900-B | Estimate of rehabilitation cost |

| HUD-9746-A | Certification of completion |

| HUD-4000.1 | FHA single family housing policy handbook |

| HUD-92541 | Architectural exhibits |

Some key points to keep in mind when working with these forms include: * Ensuring accuracy and completeness of all forms * Submitting forms in a timely manner to avoid delays in the loan process * Consulting with an FHA-approved lender to ensure compliance with all requirements * Carefully reviewing and understanding the terms and conditions of the 203k loan program

In summary, the 203k loan process involves several key forms that must be completed accurately and submitted on time. By understanding the purpose and requirements of each form, borrowers can navigate the process more efficiently and increase their chances of a successful loan application.

What is the purpose of the HUD-92900-A form?

+

The HUD-92900-A form is used to request an endorsement of the borrower’s credit report.

What is the difference between the HUD-92900-A and HUD-92900-B forms?

+

The HUD-92900-A form is used for credit reporting, while the HUD-92900-B form is used to estimate the cost of rehabilitation.

Can I submit the forms electronically?

+

Yes, many lenders accept electronic submissions of the forms. However, it’s essential to check with the lender to confirm their specific requirements.