COBRA Paperwork Deadline

Understanding COBRA Paperwork Deadline

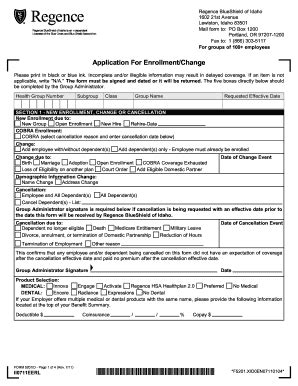

The Consolidated Omnibus Budget Reconciliation Act (COBRA) is a federal law that requires employers to offer continued health coverage to employees and their families after a qualifying event, such as job loss or divorce. One of the critical aspects of COBRA is meeting the paperwork deadline, which can be complex and time-sensitive. In this article, we will delve into the details of COBRA paperwork deadlines, the consequences of missing them, and provide guidance on how to navigate this process efficiently.

Qualifying Events and Notification

To initiate the COBRA process, a qualifying event must occur. Examples of qualifying events include:

- Voluntary or involuntary termination of employment

- Divorce or legal separation

- Death of the covered employee

- Dependent child ceasing to be a dependent under the plan

- Employee becoming entitled to Medicare

COBRA Paperwork Deadline

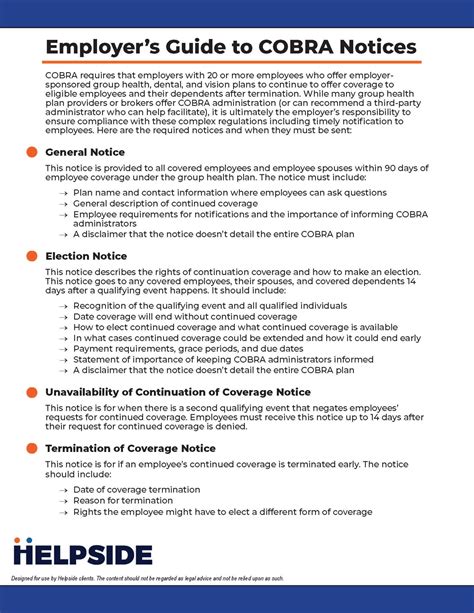

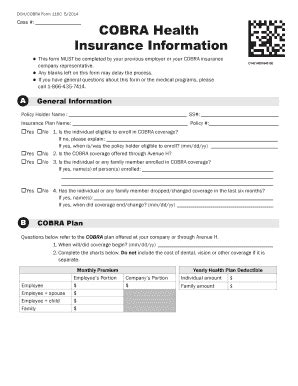

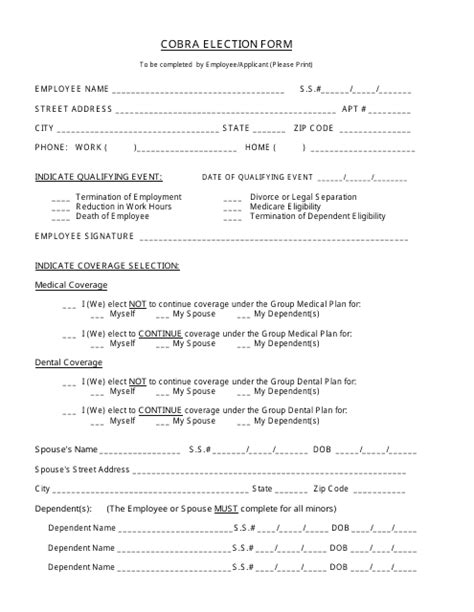

The COBRA paperwork deadline refers to the timeframe within which various parties must complete and submit necessary documents. Here are the key deadlines:

- Employer’s Notification Deadline: The employer must notify the plan administrator of a qualifying event within 30 days of the event.

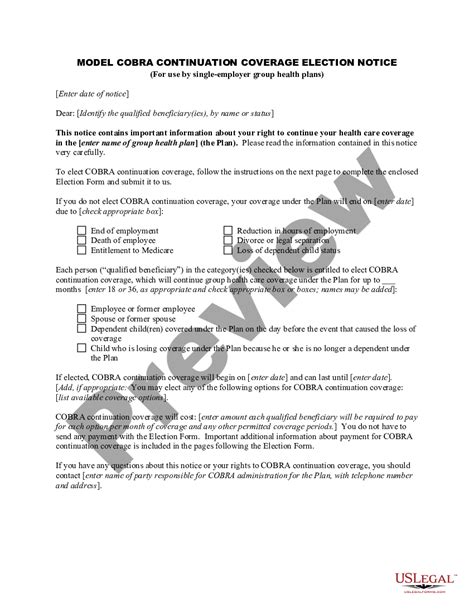

- Plan Administrator’s Notification Deadline: The plan administrator must then notify the qualified beneficiaries of their COBRA rights within 14 days of receiving the employer’s notification.

- Election Deadline: Qualified beneficiaries have 60 days from the date they receive the COBRA election notice to decide whether to elect COBRA coverage. This 60-day period starts from the date of the notice, not from the date of the qualifying event.

- Premium Payment Deadline: Once COBRA coverage is elected, the first premium payment is due within 45 days after the election. Subsequent premium payments are due on the first day of each month, with a 30-day grace period for late payments.

Consequences of Missing Deadlines

Missing COBRA deadlines can have significant consequences for both employers and qualified beneficiaries. For employers, failure to notify the plan administrator or the qualified beneficiaries within the required timeframe can lead to:

- Fines and penalties, including excise taxes under the Internal Revenue Code

- Lawsuits from qualified beneficiaries who were not properly notified

- Damage to the employer’s reputation and potential loss of business

Best Practices for Managing COBRA Paperwork

To avoid the consequences of missing deadlines, employers and plan administrators should adopt best practices for managing COBRA paperwork:

- Automate Notification Processes: Use software or outsourced services to automate the notification process, ensuring timely and accurate notifications.

- Maintain Accurate Records: Keep detailed records of qualifying events, notifications, and elections to demonstrate compliance with COBRA requirements.

- Communicate Clearly: Ensure that all communications with qualified beneficiaries are clear, concise, and provide all necessary information for them to make informed decisions about COBRA coverage.

- Train HR Personnel: Provide ongoing training to HR personnel on COBRA regulations, including deadlines and notification requirements, to ensure they are equipped to handle the process correctly.

Table of COBRA Deadlines

The following table summarizes the key COBRA deadlines:

| Event | Deadline |

|---|---|

| Employer’s notification to plan administrator | 30 days after qualifying event |

| Plan administrator’s notification to qualified beneficiaries | 14 days after receiving employer’s notification |

| Qualified beneficiaries’ election of COBRA coverage | 60 days after receiving COBRA election notice |

| First premium payment | 45 days after electing COBRA coverage |

📝 Note: It is essential to understand that these deadlines are strict and missing them can have significant consequences. Employers and qualified beneficiaries should prioritize meeting these deadlines to ensure compliance with COBRA regulations and to avoid potential penalties.

In the context of navigating the complexities of COBRA paperwork deadlines, it’s crucial to maintain a keen awareness of the regulatory landscape and the specific requirements that apply to each situation. By doing so, employers can ensure compliance, and qualified beneficiaries can make informed decisions about their health coverage. The process, while intricate, is designed to protect the rights of individuals to continued health coverage during significant life changes.

As we reflect on the importance of adhering to COBRA paperwork deadlines, it becomes clear that understanding and complying with these regulations is not merely a legal necessity but also a critical component of ensuring that individuals and families have access to the health coverage they need. By streamlining the notification and election process, and by prioritizing clear communication and accurate record-keeping, employers and plan administrators can play a pivotal role in facilitating a smooth transition for those affected by qualifying events.

What is the primary purpose of COBRA?

+

The primary purpose of COBRA is to provide continued health coverage to employees and their families after a qualifying event, such as job loss or divorce, ensuring that they have access to health insurance during significant life changes.

How long do qualified beneficiaries have to elect COBRA coverage?

+

Qualified beneficiaries have 60 days from the date they receive the COBRA election notice to decide whether to elect COBRA coverage. This period starts from the date of the notice, not from the date of the qualifying event.

What are the consequences for employers who fail to meet COBRA deadlines?

+

Employers who fail to meet COBRA deadlines can face fines and penalties, including excise taxes under the Internal Revenue Code, lawsuits from qualified beneficiaries, and damage to their reputation, potentially leading to loss of business.