Paperwork

Investment Tax Paperwork Deadline

Understanding Investment Tax Paperwork Deadline

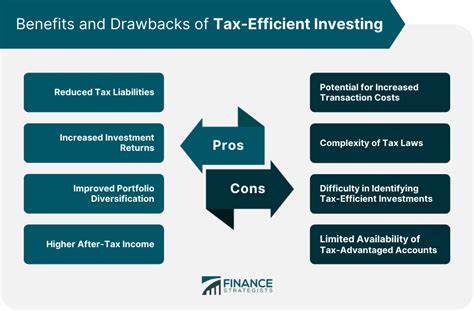

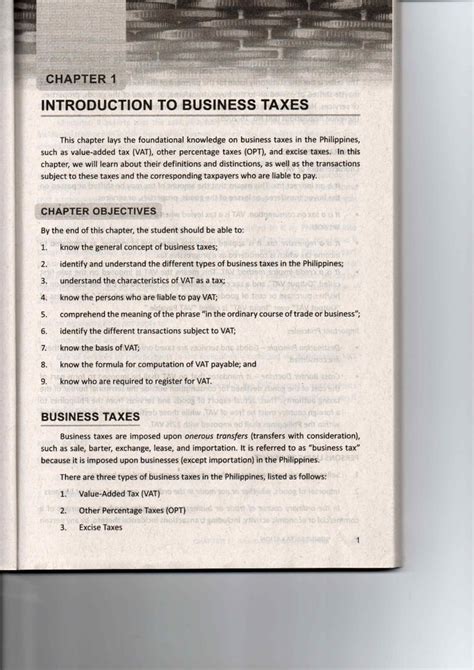

When it comes to managing investments, one of the most critical aspects that individuals and businesses must consider is the tax implications of their investment activities. Tax compliance is essential to avoid penalties and ensure that all investment gains are reported accurately. A crucial part of tax compliance is meeting the investment tax paperwork deadline. In this article, we will delve into the details of investment tax paperwork, the importance of meeting deadlines, and the steps to take to ensure compliance.

What is Investment Tax Paperwork?

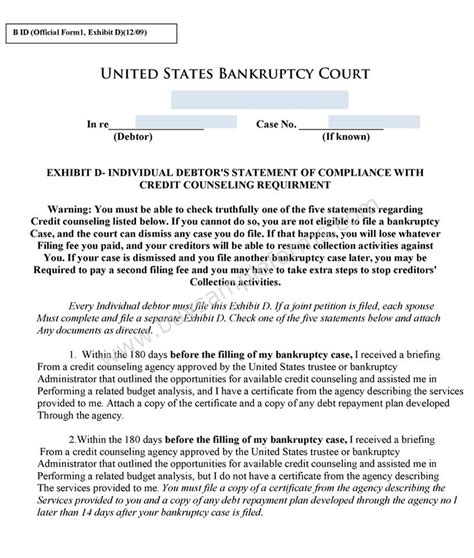

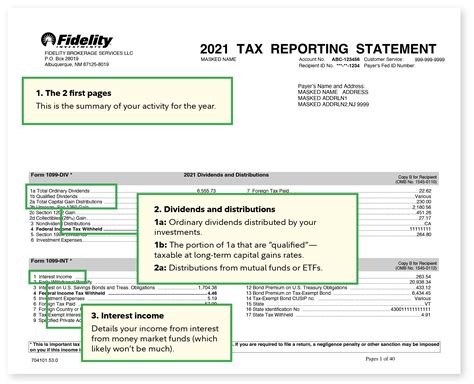

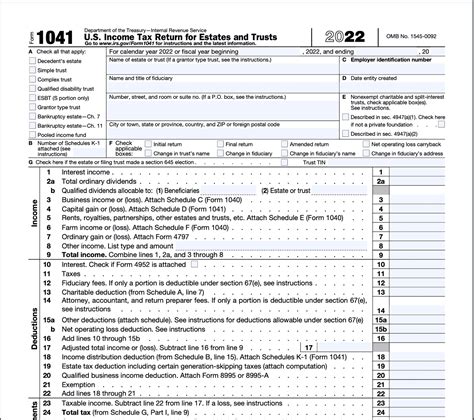

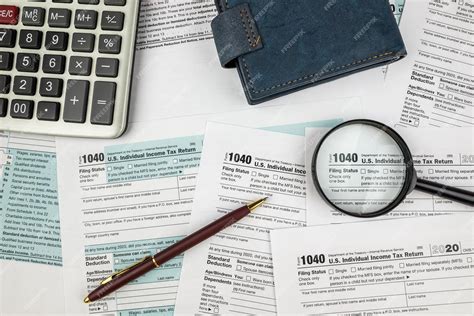

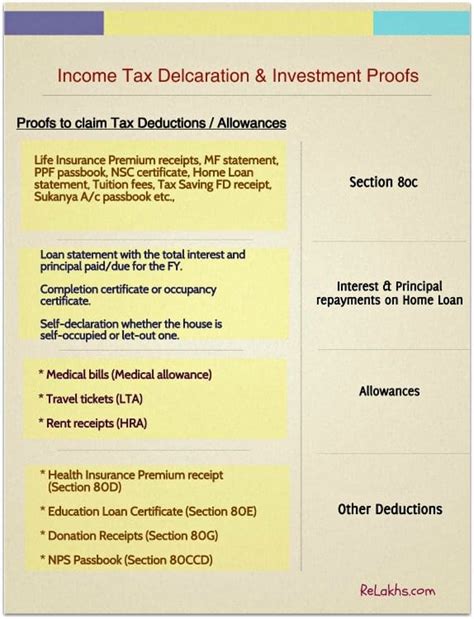

Investment tax paperwork refers to the documentation and forms required by tax authorities to report investment income, gains, and losses. This includes but is not limited to: - Capital Gains Statements: Documents that detail the sale of investments, such as stocks, bonds, or real estate, and the gains or losses incurred. - Dividend and Interest Statements: Forms that report income earned from dividends and interest on investments. - Tax Returns: The primary form (e.g., Form 1040 in the United States) used to report total income, including investment income, and claim deductions and credits.

Importance of Meeting the Deadline

Meeting the investment tax paperwork deadline is crucial for several reasons: - Avoid Penalties: Failing to file tax returns or missing deadlines can result in significant penalties and fines. - Accurate Reporting: Timely filing ensures that investment income and gains are reported accurately, reducing the risk of audits and further complications. - Refund Eligibility: For those eligible for a tax refund, filing on time ensures that the refund is received promptly.

Steps to Ensure Compliance

To ensure compliance with investment tax paperwork deadlines, follow these steps: - Keep Accurate Records: Maintain detailed and organized records of all investment activities throughout the year. - Consult a Tax Professional: If unsure about any aspect of investment tax paperwork, consult with a tax professional or accountant. - Use Tax Preparation Software: Utilize tax preparation software to streamline the filing process and reduce errors. - File Electronically: Electronic filing is generally faster and more accurate than paper filing.

Key Deadlines

The deadlines for investment tax paperwork can vary depending on the jurisdiction and the type of investment. However, some key deadlines to be aware of include: - January 31st: Typically the deadline for receiving investment income statements (e.g., Form 1099). - April 15th: The standard deadline for filing individual tax returns in the United States. - October 15th: The deadline for filing an extended tax return.

📝 Note: It's essential to check with local tax authorities for specific deadlines and requirements, as these can vary.

Conclusion and Next Steps

In conclusion, managing investment tax paperwork and meeting deadlines is a critical aspect of investment management. By understanding the requirements, maintaining accurate records, and seeking professional advice when needed, individuals and businesses can ensure compliance and avoid unnecessary penalties. It’s also important to stay informed about any changes in tax laws and deadlines to maintain seamless compliance. Whether you’re a seasoned investor or just starting out, prioritizing investment tax paperwork will help you navigate the complex world of investment taxation with confidence.

What happens if I miss the deadline for filing my investment tax return?

+

If you miss the deadline, you may face penalties and interest on the amount of tax owed. It’s advisable to file as soon as possible and pay any owed tax to minimize these penalties.

Can I file for an extension on my investment tax return?

+

Yes, you can file for an automatic extension, which typically gives you an additional six months to file your return. However, any tax owed is still due by the original deadline to avoid penalties and interest.

How do I ensure accuracy in my investment tax paperwork?

+

Ensure accuracy by keeping detailed records of all investment activities, using tax preparation software, and consulting with a tax professional if necessary. Double-check all figures and statements before filing.