Get Power of Attorney Paperwork

Understanding the Importance of Power of Attorney

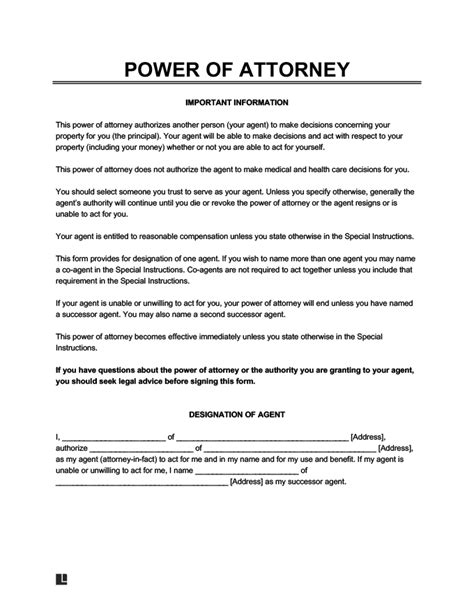

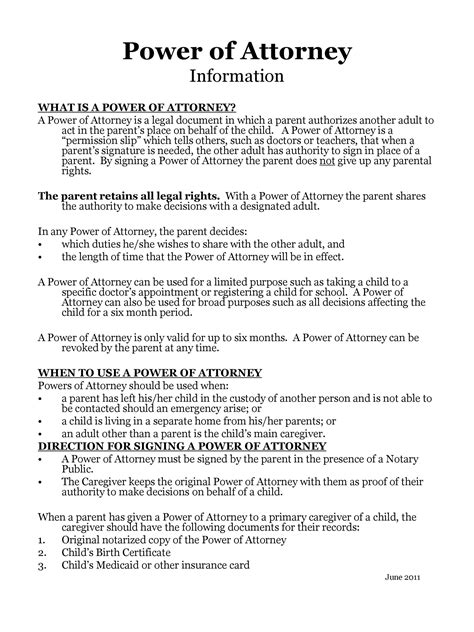

When it comes to managing personal and financial affairs, having a power of attorney (POA) in place can provide peace of mind and ensure that one’s wishes are respected. A power of attorney is a legal document that grants an individual, known as the agent or attorney-in-fact, the authority to act on behalf of another person, known as the principal, in matters related to their financial, health, and personal affairs. In this article, we will delve into the world of power of attorney paperwork, exploring its types, benefits, and steps to obtain it.

Types of Power of Attorney

There are several types of power of attorney, each serving a specific purpose:

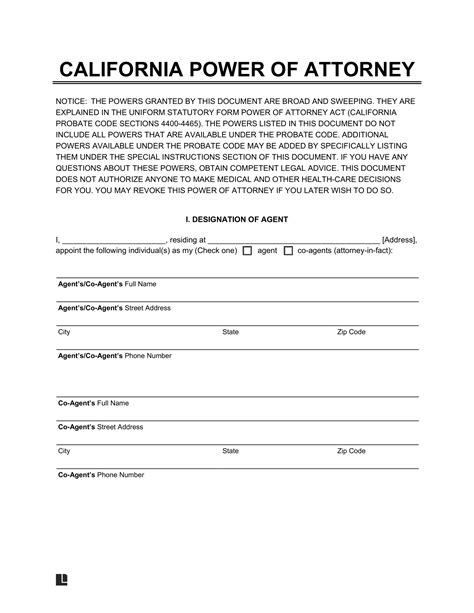

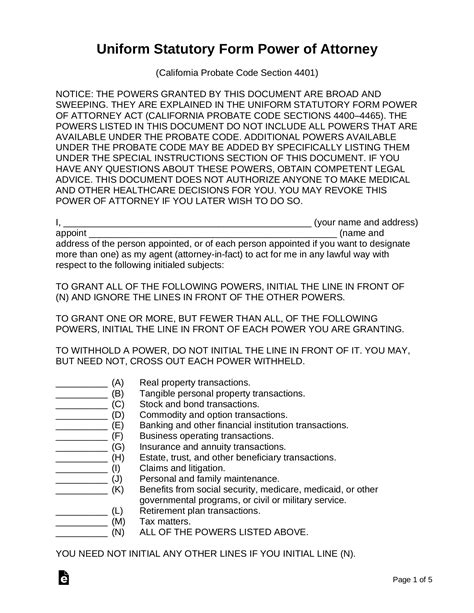

- General Power of Attorney: Grants the agent broad powers to manage the principal’s financial and personal affairs.

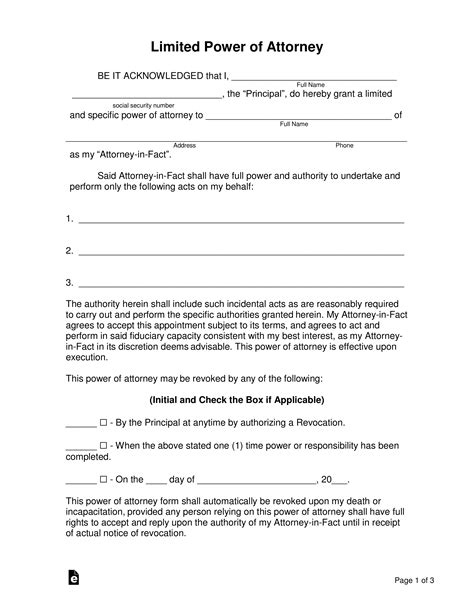

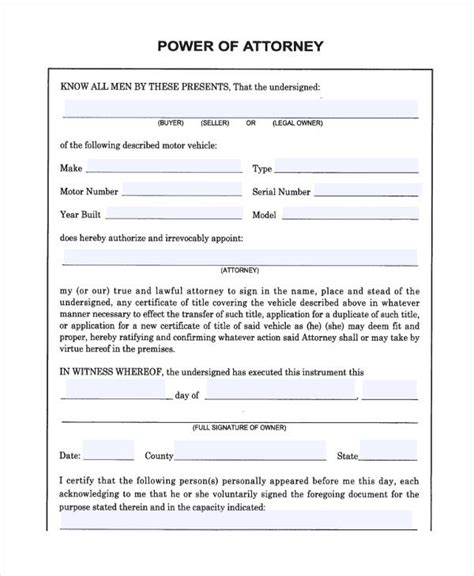

- Special Power of Attorney: Limits the agent’s powers to specific areas, such as managing a particular asset or handling a specific transaction.

- Healthcare Power of Attorney: Authorizes the agent to make medical decisions on behalf of the principal.

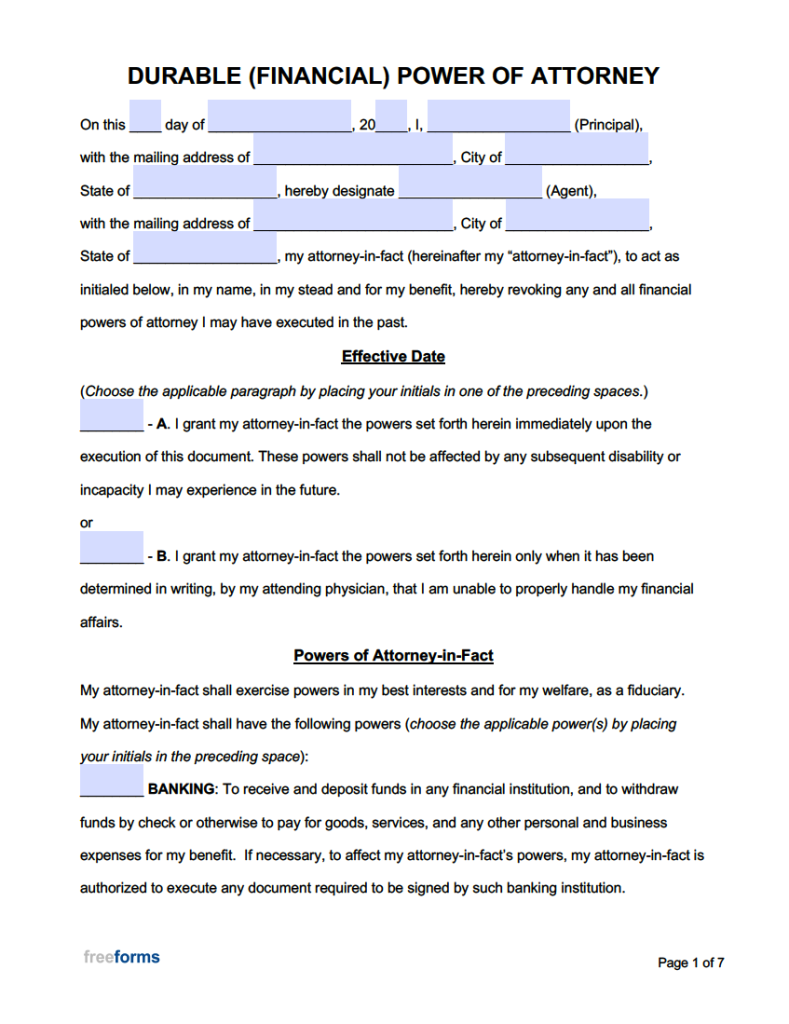

- Durable Power of Attorney: Remains in effect even if the principal becomes incapacitated or unable to make decisions.

Benefits of Power of Attorney

Having a power of attorney in place offers numerous benefits, including:

- Convenience: Allows the agent to manage the principal’s affairs, reducing the need for court intervention.

- Flexibility: Enables the principal to specify the scope of the agent’s powers and the duration of the agreement.

- Peace of mind: Provides assurance that the principal’s wishes will be respected and their affairs will be managed according to their desires.

- Cost savings: Can help avoid costly court proceedings and legal fees associated with guardianship or conservatorship.

Steps to Obtain Power of Attorney

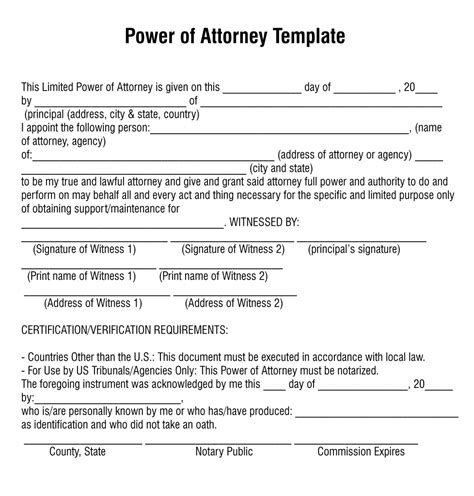

To obtain power of attorney paperwork, follow these steps:

- Choose an agent: Select a trusted individual to act as your agent, ensuring they are willing and able to fulfill their responsibilities.

- Determine the type of power of attorney: Decide which type of power of attorney best suits your needs, considering the scope of powers and duration of the agreement.

- Consult with an attorney: Seek the advice of an attorney specializing in elder law or estate planning to ensure the power of attorney document is properly drafted and executed.

- Execute the document: Sign the power of attorney document in the presence of a notary public, and have it witnessed by the required number of individuals, if applicable.

- Store the document safely: Keep the original power of attorney document in a secure location, such as a safe deposit box or a fireproof safe, and provide copies to the agent and other relevant parties.

Important Considerations

When creating a power of attorney, it is essential to consider the following:

- Capacity: Ensure the principal has the mental capacity to understand the nature and implications of the power of attorney.

- Voluntariness: Verify that the principal is entering into the agreement voluntarily, without coercion or undue influence.

- Agent’s responsibilities: Clearly outline the agent’s duties and responsibilities, including their obligations to act in the best interests of the principal.

| Type of Power of Attorney | Description |

|---|---|

| General Power of Attorney | Grants broad powers to manage financial and personal affairs |

| Special Power of Attorney | Limits powers to specific areas or transactions |

| Healthcare Power of Attorney | Authorizes agent to make medical decisions |

| Durable Power of Attorney | Remains in effect even if principal becomes incapacitated |

📝 Note: It is crucial to review and understand the power of attorney document before signing, as it can have significant implications for your financial and personal affairs.

In summary, having a power of attorney in place can provide peace of mind and ensure that your wishes are respected. By understanding the different types of power of attorney, their benefits, and the steps to obtain them, you can make informed decisions about your financial and personal affairs. It is essential to consult with an attorney and carefully consider the implications of creating a power of attorney to ensure that your wishes are respected and your affairs are managed according to your desires.

What is the purpose of a power of attorney?

+

A power of attorney grants an individual the authority to act on behalf of another person in matters related to their financial, health, and personal affairs.

What are the different types of power of attorney?

+

There are several types of power of attorney, including general, special, healthcare, and durable power of attorney, each serving a specific purpose.

How do I obtain power of attorney paperwork?

+

To obtain power of attorney paperwork, follow the steps outlined in this article, including choosing an agent, determining the type of power of attorney, consulting with an attorney, executing the document, and storing it safely.