5 Mortgage Point Facts

Introduction to Mortgage Points

Mortgage points are a fundamental concept in the mortgage industry, and understanding them can help borrowers make informed decisions when applying for a mortgage. In this article, we will delve into the world of mortgage points, exploring what they are, how they work, and their benefits and drawbacks. Whether you are a first-time homebuyer or an experienced borrower, this information will provide valuable insights to help you navigate the mortgage landscape.

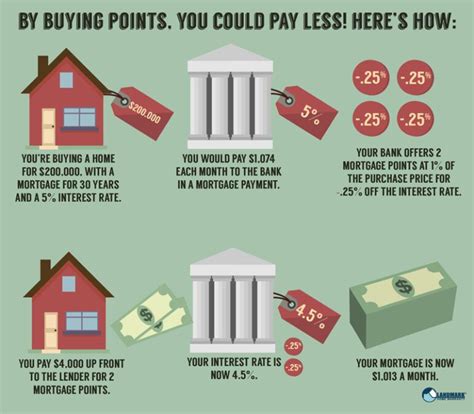

What are Mortgage Points?

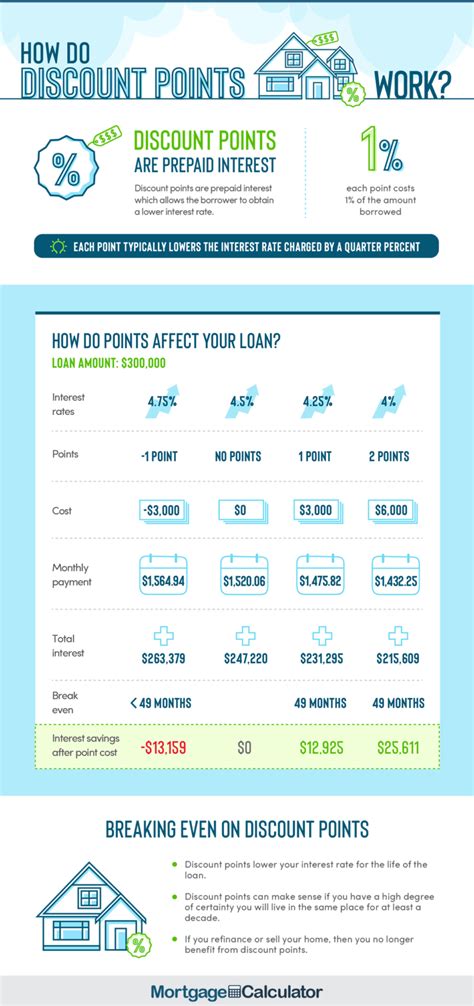

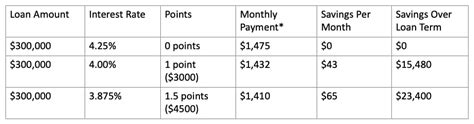

Mortgage points, also known as discount points, are fees paid to a lender at the time of closing in exchange for a reduced interest rate on a mortgage. These points are typically expressed as a percentage of the total loan amount and can be used to lower the borrower’s monthly mortgage payments. For example, if a borrower takes out a 200,000 mortgage and pays 2 points, they would pay 4,000 (2% of $200,000) in exchange for a lower interest rate.

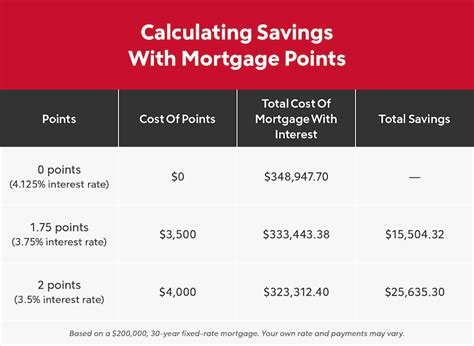

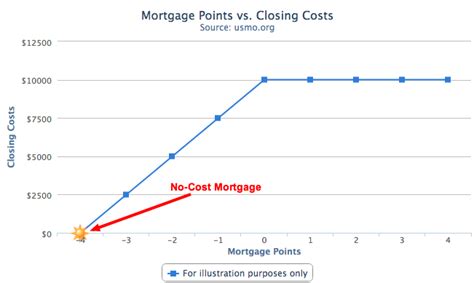

How do Mortgage Points Work?

When a borrower pays mortgage points, they are essentially paying a portion of their interest upfront. In return, the lender reduces the interest rate on the loan, which can result in lower monthly mortgage payments. The cost of mortgage points can vary depending on the lender and the loan terms, but they are usually calculated as a percentage of the loan amount. For instance, one point is equal to 1% of the loan amount, so if a borrower takes out a 150,000 mortgage and pays 1 point, they would pay 1,500 (1% of $150,000).

Benefits of Mortgage Points

Paying mortgage points can have several benefits for borrowers: * Lower monthly payments: By reducing the interest rate on the loan, borrowers can lower their monthly mortgage payments, making homeownership more affordable. * Long-term savings: Over the life of the loan, borrowers can save thousands of dollars in interest payments by paying mortgage points upfront. * Tax deductions: Mortgage points can be tax-deductible, which can help reduce the borrower’s taxable income.

Drawbacks of Mortgage Points

While paying mortgage points can have benefits, there are also some drawbacks to consider: * Upfront costs: Mortgage points require an upfront payment, which can be a significant expense for borrowers. * Break-even analysis: Borrowers need to perform a break-even analysis to determine if paying mortgage points makes sense for their situation. If they plan to sell the property or refinance the loan before breaking even, paying points may not be the best option. * Alternative uses for funds: The money used to pay mortgage points could be used for other purposes, such as making a larger down payment or covering closing costs.

Mortgage Point Facts

Here are some key facts to keep in mind when considering mortgage points: * Mortgage points are not always a good idea: Borrowers should carefully evaluate their financial situation and loan terms before deciding to pay mortgage points. * Mortgage points can be negotiated: Borrowers may be able to negotiate the cost of mortgage points with their lender, especially if they are taking out a large loan. * Mortgage points may not be refundable: If a borrower decides to refinance their loan or sell the property, they may not be able to recoup the cost of mortgage points.

💡 Note: Borrowers should carefully review their loan terms and consider their financial situation before deciding to pay mortgage points.

Conclusion and Final Thoughts

In conclusion, mortgage points can be a valuable tool for borrowers looking to reduce their monthly mortgage payments and save on interest over the life of the loan. However, it’s essential to carefully evaluate the costs and benefits of paying mortgage points and consider alternative options before making a decision. By understanding how mortgage points work and their potential benefits and drawbacks, borrowers can make informed decisions and navigate the mortgage landscape with confidence.

What are mortgage points, and how do they work?

+

Mortgage points, also known as discount points, are fees paid to a lender at the time of closing in exchange for a reduced interest rate on a mortgage. They are typically expressed as a percentage of the total loan amount and can be used to lower the borrower’s monthly mortgage payments.

Are mortgage points always a good idea?

+

No, mortgage points are not always a good idea. Borrowers should carefully evaluate their financial situation and loan terms before deciding to pay mortgage points. It’s essential to consider the break-even analysis and alternative uses for the funds before making a decision.

Can mortgage points be negotiated?

+

Yes, mortgage points can be negotiated with the lender, especially if the borrower is taking out a large loan. It’s essential to review the loan terms and discuss options with the lender to determine the best course of action.