Paperwork

5 Filing Requirements

Introduction to Tax Filing Requirements

When it comes to managing personal or business finances, understanding tax filing requirements is crucial. Taxes are an essential part of any economy, serving as a primary source of income for governments to fund public expenditures. The process of filing taxes can seem daunting, especially for those who are new to it. However, breaking down the process into manageable steps and understanding the key concepts can make it more approachable. In this context, we will delve into the world of tax filing, exploring the essential requirements and providing guidance on how to navigate this sometimes complex landscape.

Understanding Tax Obligations

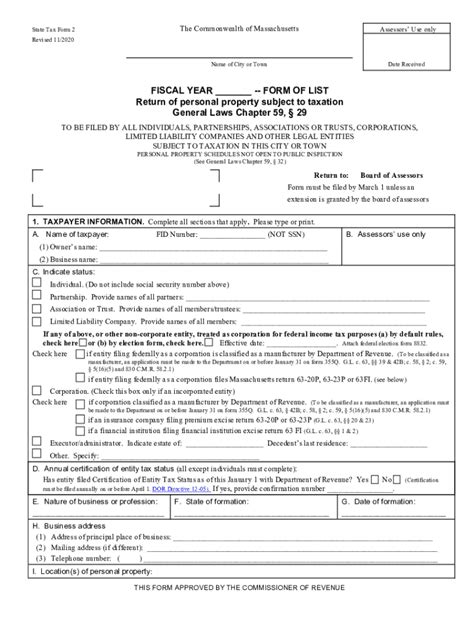

Tax obligations vary widely depending on an individual’s or business’s specific circumstances. These circumstances include income level, sources of income, marital status, number of dependents, and the type of tax (income tax, sales tax, property tax, etc.). For individuals, tax obligations often involve reporting all income earned within a tax year, claiming deductions and credits where applicable, and paying any tax due by the designated deadline. Businesses, on the other hand, must navigate more complex tax laws, including corporate income taxes, payroll taxes, and potentially international tax laws if they operate globally.

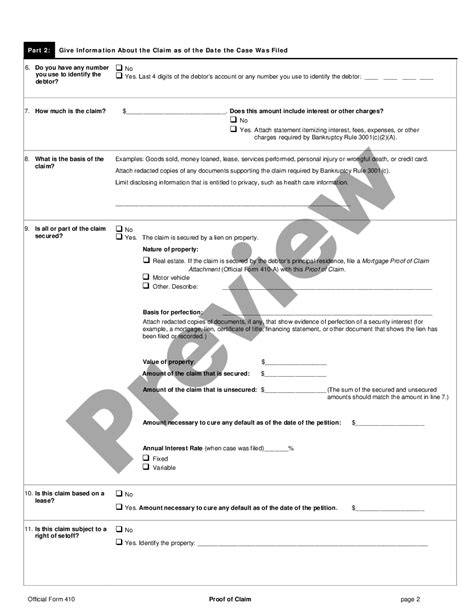

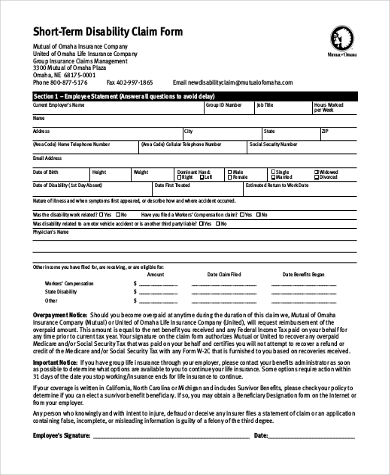

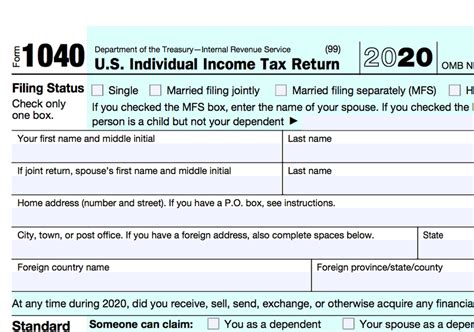

Key Filing Requirements

To comply with tax laws, individuals and businesses must meet specific filing requirements. These include: - Income Reporting: Accurately reporting all sources of income. - Tax Forms: Using the correct tax forms for the type of tax being filed (e.g., Form 1040 for personal income tax in the United States). - Deadlines: Meeting the specified filing deadline to avoid penalties and interest. - Supporting Documentation: Keeping detailed records and documentation to support income, deductions, and credits claimed. - Payment of Tax Due: Paying any tax due by the deadline or arranging for payment plans if necessary.

Steps to File Taxes

The process of filing taxes can be broken down into several steps: 1. Gather Necessary Documents: Collect all relevant financial documents, including W-2s, 1099s, interest statements, and receipts for deductions. 2. Choose a Filing Status: Determine the appropriate filing status (single, married filing jointly, married filing separately, head of household, qualifying widow(er)). 3. Select a Filing Method: Decide whether to file manually, use tax software, or hire a tax professional. 4. Report Income and Claim Deductions: Accurately report all income and claim eligible deductions and credits. 5. Review and Submit: Carefully review the tax return for errors or omissions and submit it by the deadline.

Important Considerations

- Audits: Understand that tax returns may be subject to audit, and maintaining detailed records can facilitate this process. - Tax Planning: Consider tax implications in financial planning to minimize tax liabilities legally. - Tax Law Changes: Stay informed about changes in tax laws that could impact filing requirements and tax obligations.

📝 Note: It's essential to stay organized and keep detailed financial records throughout the year to ensure a smooth tax filing process.

Tax Filing Tools and Resources

Numerous tools and resources are available to assist with tax filing, including:

| Resource | Description |

|---|---|

| Tax Software | Programs like TurboTax and H&R Block that guide users through the filing process. |

| Tax Professionals | Accountants and tax preparers who can handle the filing process on behalf of individuals and businesses. |

| Government Websites | Official government sites, such as the IRS website in the United States, which provide tax information, forms, and filing guidance. |

As we move forward in understanding and managing our tax obligations, it’s clear that knowledge is power. By grasping the fundamentals of tax filing requirements and staying informed about tax laws and regulations, individuals and businesses can better navigate the tax landscape, ensuring compliance and potentially reducing their tax liability. This understanding not only facilitates the tax filing process but also contributes to overall financial health and stability. In essence, being proactive and informed about tax obligations is a critical component of personal and business financial management.