5 IRS Paperwork Tips

Understanding IRS Paperwork: A Comprehensive Guide

Dealing with IRS paperwork can be overwhelming, especially for individuals and businesses that are not familiar with the process. The IRS requires various forms and documents to be filed throughout the year, and failing to comply can result in penalties and fines. In this article, we will provide you with 5 IRS paperwork tips to help you navigate the process with ease.

Tip 1: Stay Organized and Keep Accurate Records

Staying organized and keeping accurate records is crucial when it comes to IRS paperwork. This includes keeping track of all your income, expenses, and deductions throughout the year. You can use a spreadsheet or accounting software to help you stay organized. It’s also essential to keep all your receipts, invoices, and bank statements in a safe place, as you may need to refer to them when filing your taxes. Remember, accurate records can help you avoid audits and ensure you receive the maximum refund you’re entitled to.

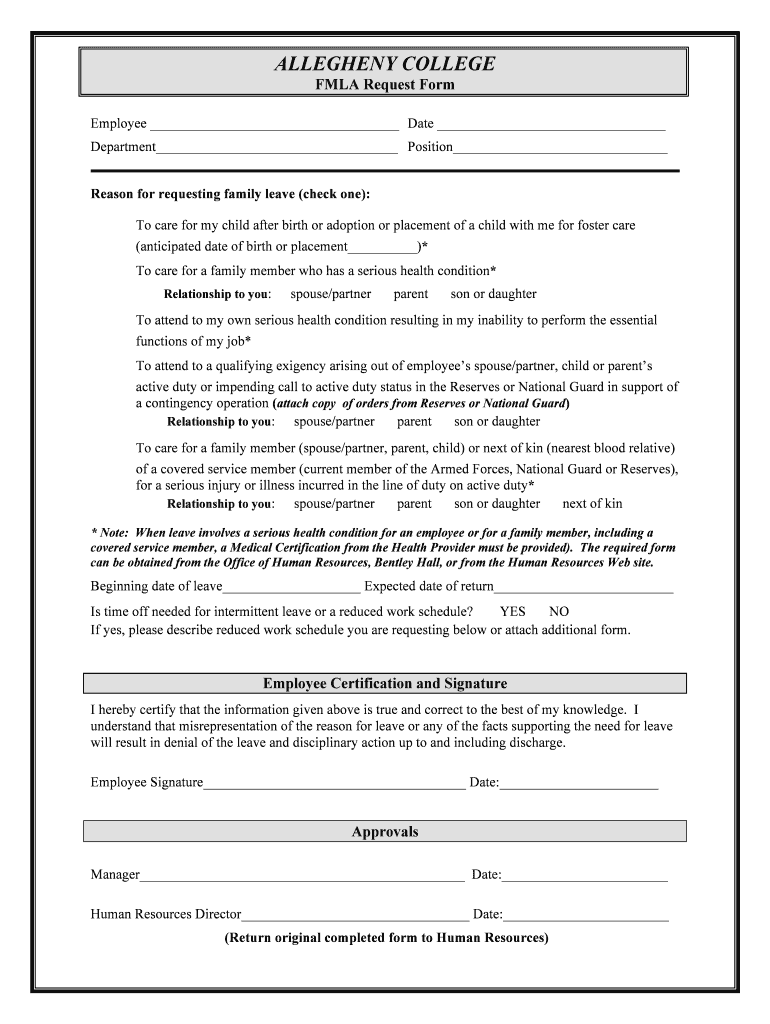

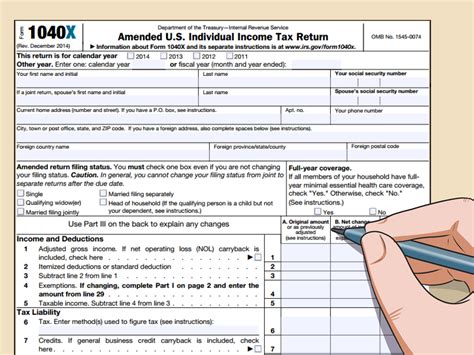

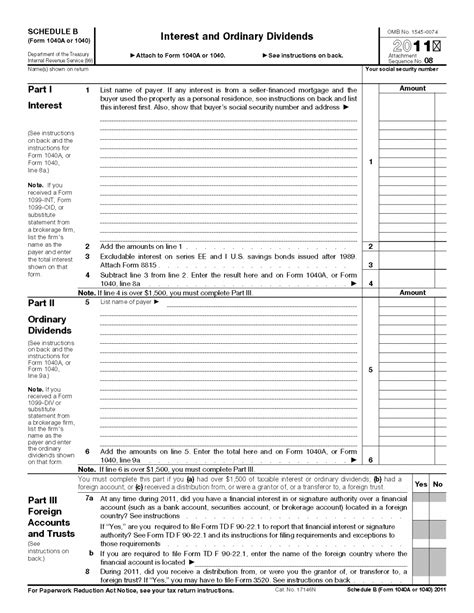

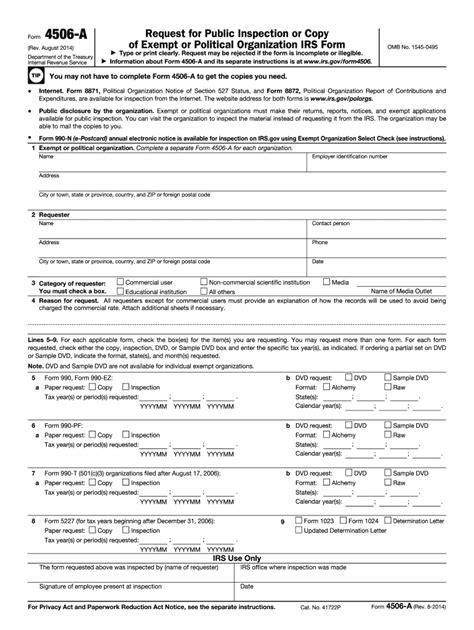

Tip 2: Understand the Different Types of IRS Forms

The IRS requires various forms to be filed, and understanding the different types of forms can help you stay compliant. Some of the most common forms include: * Form 1040: The standard form for personal income tax returns * Form 1099: Used to report income from self-employment, freelance work, or contract labor * Form W-2: Used to report income from employment * Form 941: Used to report employment taxes It’s essential to understand which forms you need to file and when they are due.

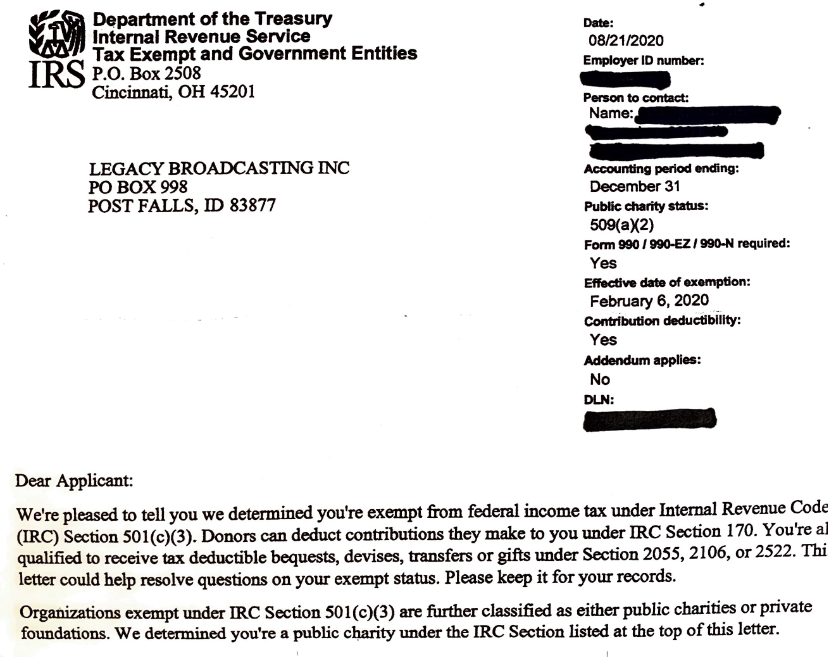

Tip 3: Take Advantage of IRS Resources

The IRS provides various resources to help individuals and businesses with their paperwork. These resources include: * The IRS website: irs.gov * IRS publications: Such as Publication 17, which provides guidance on individual income tax returns * IRS forms and instructions: Available on the IRS website or by calling the IRS * IRS customer service: Available by phone or in-person at local IRS offices Taking advantage of these resources can help you stay informed and ensure you’re in compliance with all IRS requirements.

Tip 4: Consider Hiring a Tax Professional

If you’re not familiar with IRS paperwork or feel overwhelmed, consider hiring a tax professional. Tax professionals can help you: * Prepare and file your taxes * Ensure you’re taking advantage of all the deductions and credits you’re eligible for * Represent you in case of an audit * Provide guidance on IRS paperwork and compliance When hiring a tax professional, make sure to research their credentials and experience.

Tip 5: Stay Up-to-Date with IRS Changes and Updates

The IRS is constantly updating its forms, regulations, and requirements. Staying up-to-date with these changes can help you avoid penalties and fines. You can stay informed by: * Visiting the IRS website regularly * Signing up for IRS newsletters and updates * Following IRS social media accounts * Attending IRS workshops and seminars By staying informed, you can ensure you’re in compliance with all IRS requirements and avoid any potential issues.

📝 Note: It's essential to keep accurate records and stay organized to avoid any potential issues with the IRS.

To help you better understand the different types of IRS forms, here is a table summarizing some of the most common forms:

| Form Number | Form Name | Purpose |

|---|---|---|

| 1040 | Personal Income Tax Return | Reports personal income and calculates tax liability |

| 1099 | Miscellaneous Income | Reports income from self-employment, freelance work, or contract labor |

| W-2 | Wage and Tax Statement | Reports income from employment |

| 941 | Employer’s Quarterly Federal Tax Return | Reports employment taxes |

In summary, dealing with IRS paperwork requires organization, attention to detail, and a basic understanding of IRS forms and regulations. By following these 5 tips, you can ensure you’re in compliance with all IRS requirements and avoid any potential issues. Remember to stay informed, take advantage of IRS resources, and consider hiring a tax professional if needed.

What is the deadline for filing personal income tax returns?

+

The deadline for filing personal income tax returns is typically April 15th of each year.

What is the difference between a Form 1099 and a Form W-2?

+

A Form 1099 is used to report income from self-employment, freelance work, or contract labor, while a Form W-2 is used to report income from employment.

Can I file my taxes online?

+

Yes, you can file your taxes online through the IRS website or through a tax preparation software.