QuickBooks S Corp Quarterly Filing

Understanding QuickBooks S Corp Quarterly Filing

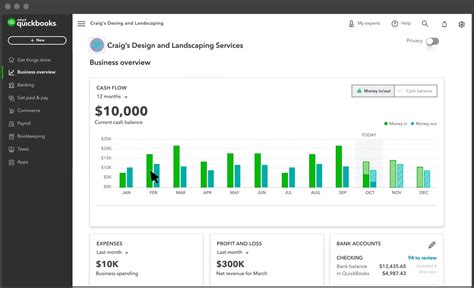

As a business owner, managing your company’s finances and ensuring compliance with tax regulations is crucial for its success and longevity. For S Corporations (S Corps), one of the key aspects of financial management is the quarterly filing of taxes. QuickBooks, a leading accounting software, can significantly simplify this process. In this article, we will delve into the world of QuickBooks S Corp quarterly filing, exploring what it entails, how to prepare for it, and the benefits of using QuickBooks for this purpose.

What is an S Corporation?

Before we dive into the specifics of quarterly filing, it’s essential to understand what an S Corporation is. An S Corporation is a type of corporation that elects to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. This means that S Corps are not subject to double taxation, which is a significant advantage. However, S Corps are subject to certain restrictions, such as the number of shareholders and the types of shareholders they can have.

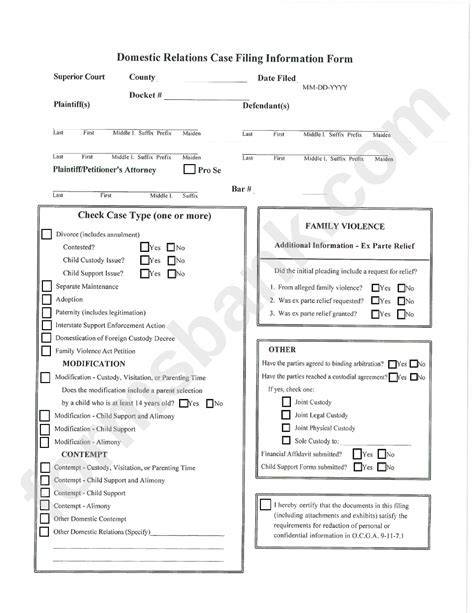

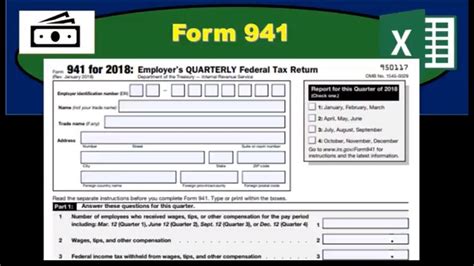

Quarterly Filing Requirements for S Corps

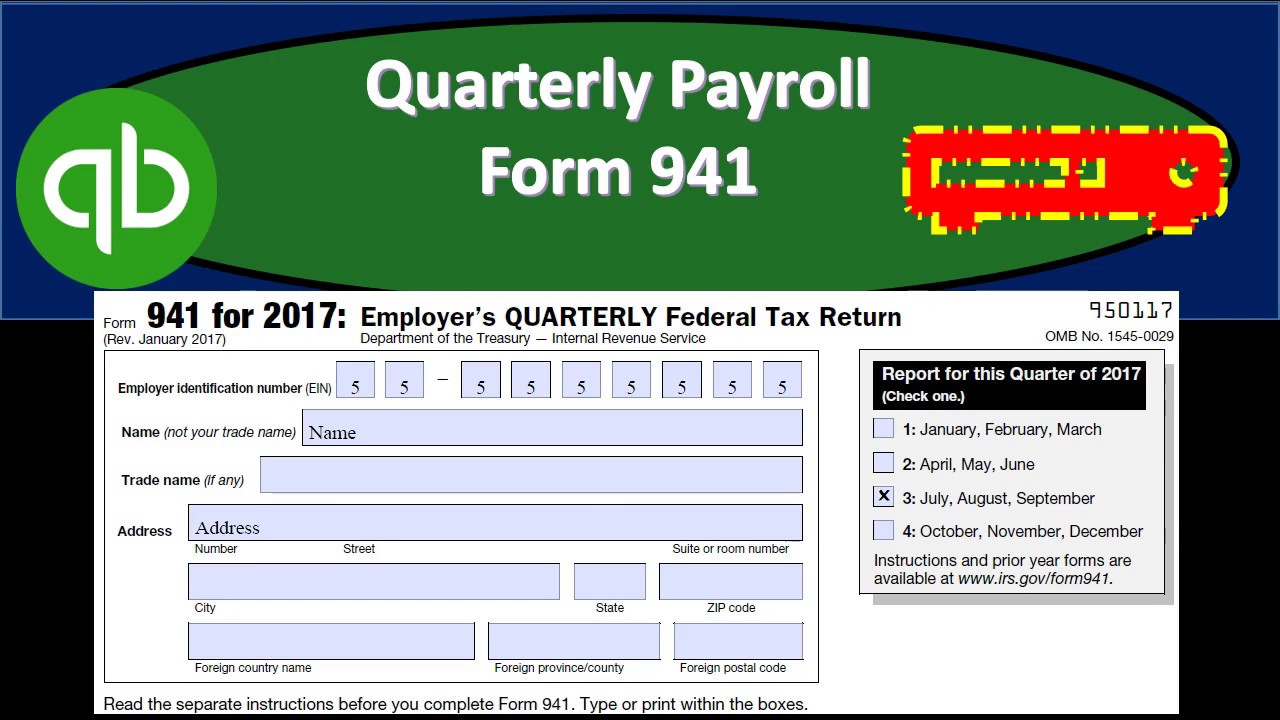

S Corporations are required to file Form 941, Employer’s Quarterly Federal Tax Return, with the IRS each quarter. This form is used to report employment taxes, including federal income tax withholding, social security tax, and Medicare tax. The due dates for Form 941 are: - April 30th for the first quarter (January 1 - March 31) - July 31st for the second quarter (April 1 - May 31) - October 31st for the third quarter (June 1 - August 31) - January 31st of the following year for the fourth quarter (September 1 - December 31)

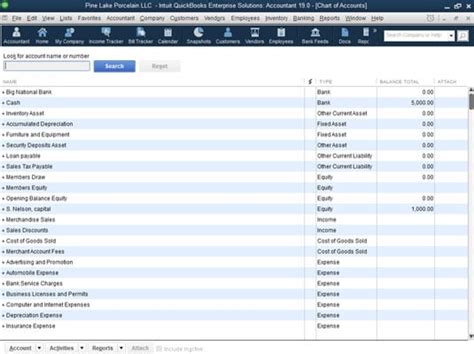

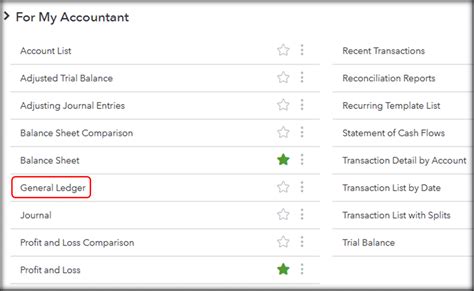

Using QuickBooks for Quarterly Filing

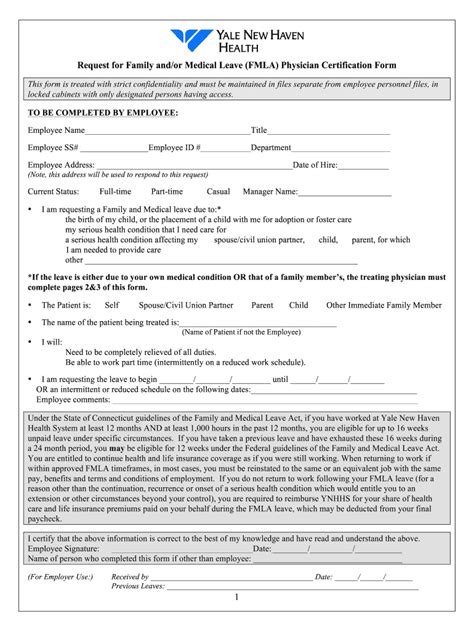

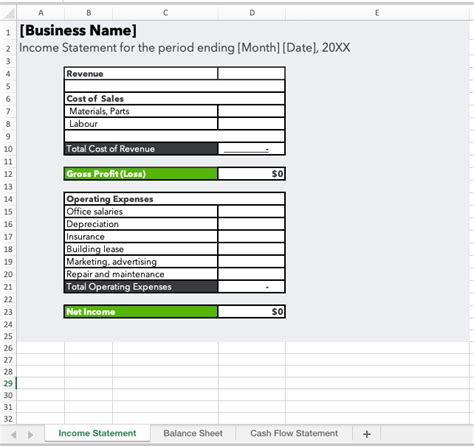

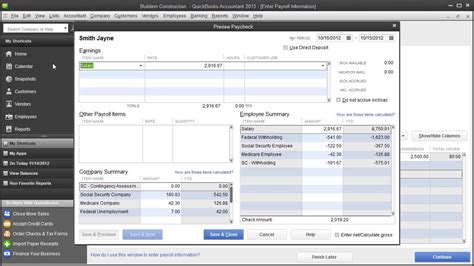

QuickBooks offers a comprehensive solution for managing your business’s finances, including payroll and tax filing. When it comes to quarterly filing for S Corps, QuickBooks can help in several ways: - Payroll Management: QuickBooks allows you to manage your payroll, including calculating and deducting employment taxes. - Tax Forms: QuickBooks can generate the necessary tax forms, including Form 941, based on your payroll data. - Electronic Filing: QuickBooks enables you to electronically file your tax forms, making the process faster and more accurate.

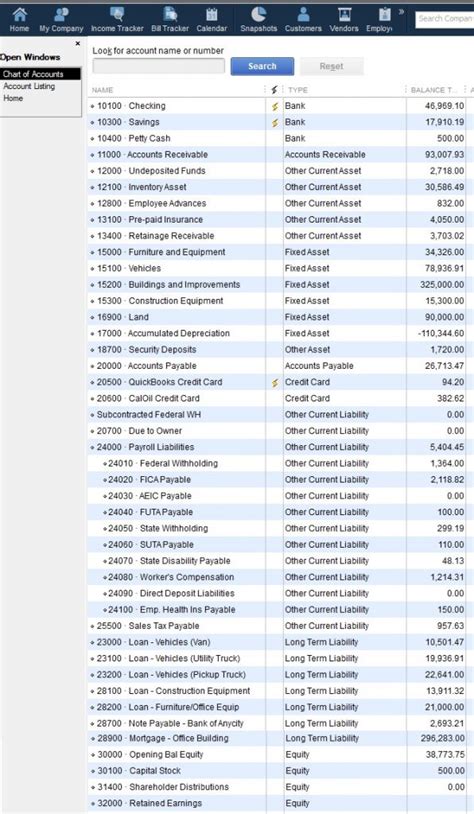

Preparing for Quarterly Filing with QuickBooks

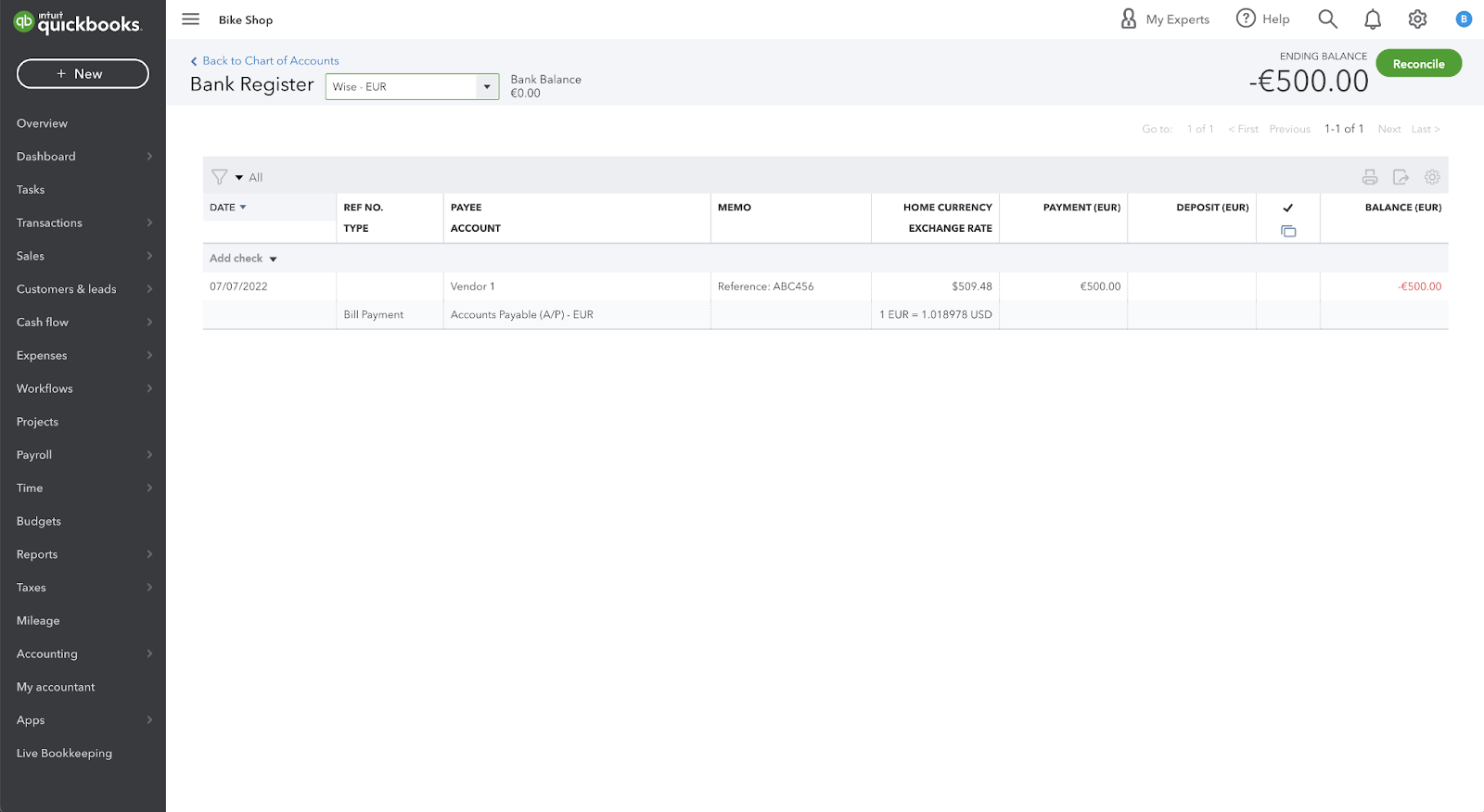

To ensure a smooth quarterly filing process with QuickBooks, follow these steps: - Set Up Your Payroll: Configure your payroll settings in QuickBooks, including adding employees, setting up pay schedules, and defining your tax obligations. - Run Payroll: Process your payroll each pay period, ensuring that all necessary taxes are withheld and recorded. - Review and Reconcile: Regularly review your payroll reports and reconcile any discrepancies to ensure accuracy. - Generate Tax Forms: Use QuickBooks to generate Form 941 and any other required tax forms. - Electronically File: Submit your tax forms electronically through QuickBooks.

Benefits of Using QuickBooks for Quarterly Filing

Utilizing QuickBooks for your S Corp’s quarterly filing offers several benefits: - Accuracy: QuickBooks reduces the likelihood of errors in your tax forms and calculations. - Efficiency: The automated process saves time and streamlines your financial management. - Compliance: QuickBooks helps ensure you meet all tax filing requirements and deadlines. - Organization: All your financial and tax data is organized in one place, making it easier to manage and access.

📝 Note: It's essential to regularly update your QuickBooks software to ensure you have the latest tax forms and regulations.

Additional Tips for S Corp Quarterly Filing

- Keep Accurate Records: Maintain detailed and accurate financial records to support your tax filings. - Consult a Professional: If you’re unsure about any aspect of the quarterly filing process, consider consulting with a tax professional or accountant. - Plan Ahead: Ensure you have sufficient funds to cover your tax liabilities and avoid late payment penalties.

What is the deadline for filing Form 941 for the first quarter?

+

The deadline for filing Form 941 for the first quarter is April 30th.

Can QuickBooks generate and electronically file Form 941?

+

Yes, QuickBooks can generate and electronically file Form 941, making the quarterly filing process more efficient.

What are the benefits of using QuickBooks for S Corp quarterly filing?

+

The benefits include increased accuracy, efficiency, compliance, and organization of financial and tax data.

In summary, managing your S Corp’s quarterly filing with QuickBooks is a streamlined and efficient process that ensures compliance with tax regulations and reduces the risk of errors. By understanding the requirements for quarterly filing, preparing your payroll and tax data, and utilizing the features of QuickBooks, you can simplify your financial management and focus on growing your business. Whether you’re a seasoned business owner or just starting out, leveraging QuickBooks for your S Corp’s quarterly filing needs can be a valuable decision for your company’s financial health and success.