5 FSA Tax Tips

Introduction to FSA Tax Tips

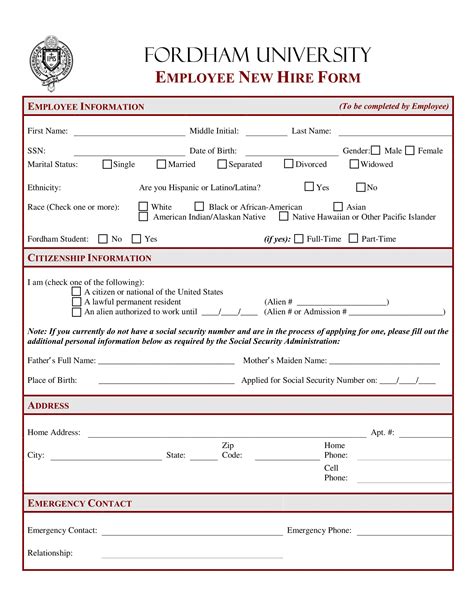

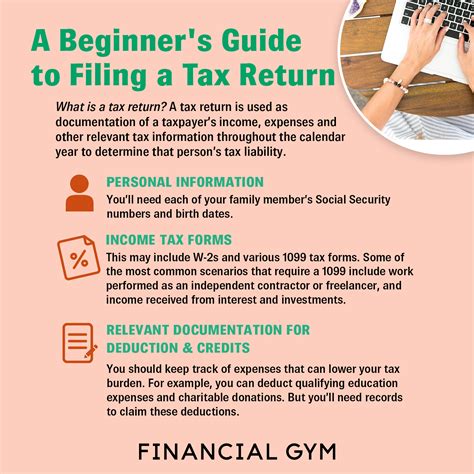

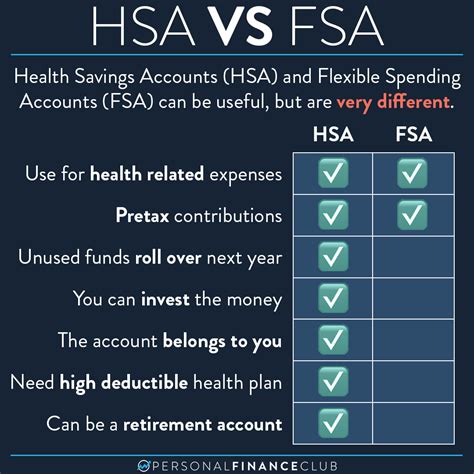

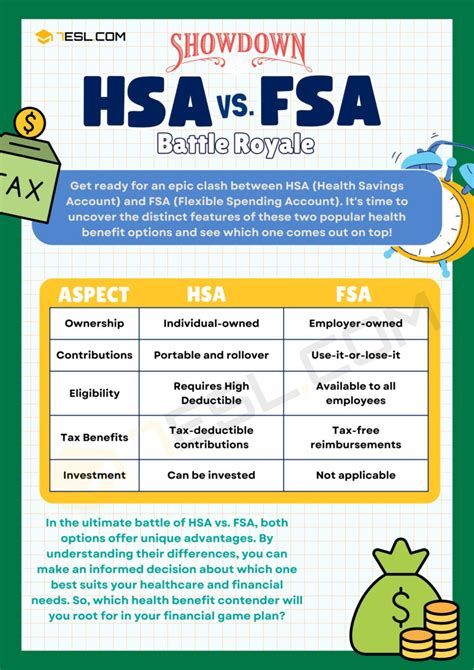

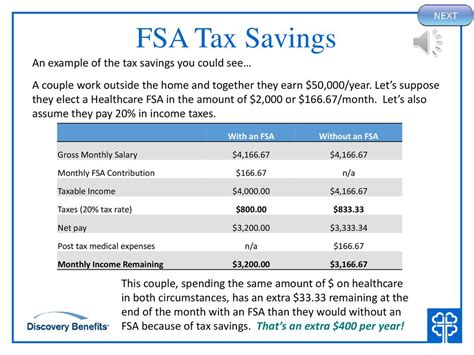

Flexible Spending Accounts (FSAs) are a great way to save money on healthcare and dependent care expenses. By setting aside pre-tax dollars, you can reduce your taxable income and lower your tax bill. However, FSAs can be complex, and it’s essential to understand the rules and regulations to maximize your benefits. In this article, we’ll provide you with 5 FSA tax tips to help you make the most of your FSA.

Understanding FSA Basics

Before we dive into the tax tips, let’s cover some FSA basics. There are two types of FSAs: Healthcare FSAs and Dependent Care FSAs. Healthcare FSAs can be used to pay for medical expenses, such as doctor visits, prescriptions, and hospital stays. Dependent Care FSAs, on the other hand, can be used to pay for childcare or adult care expenses. Both types of FSAs have contribution limits and require you to submit claims to receive reimbursement.

FSA Tax Tip 1: Contribute to an FSA to Reduce Taxable Income

Contributing to an FSA can help reduce your taxable income, which can lead to a lower tax bill. For example, if you contribute 1,000 to a Healthcare FSA, you can reduce your taxable income by 1,000. This can result in significant tax savings, especially if you’re in a higher tax bracket. Here are some benefits of contributing to an FSA: * Reduce taxable income * Lower tax bill * Increase take-home pay

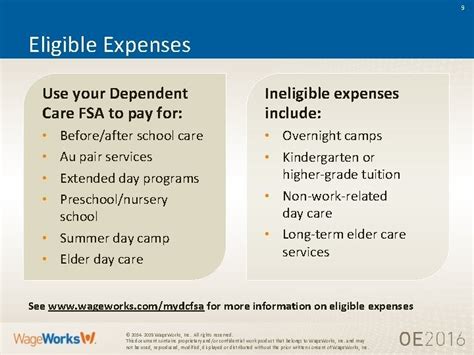

FSA Tax Tip 2: Use FSA Funds for Eligible Expenses

It’s essential to use your FSA funds for eligible expenses to avoid forfeiting unused balances. Here are some examples of eligible expenses for Healthcare FSAs and Dependent Care FSAs: * Healthcare FSA: + Doctor visits + Prescriptions + Hospital stays + Medical equipment * Dependent Care FSA: + Childcare + Adult care + Summer camp + Before- and after-school programs

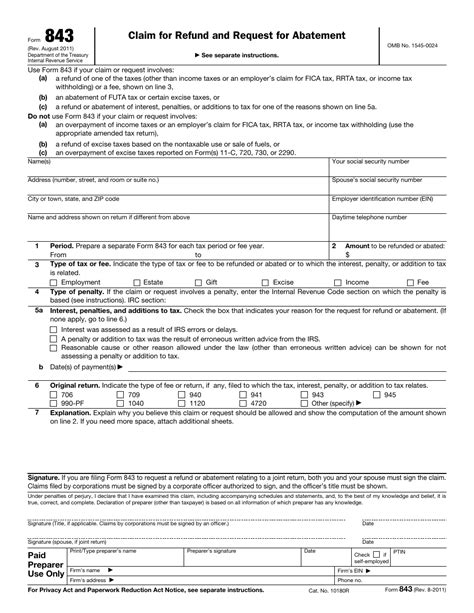

FSA Tax Tip 3: Keep Receipts and Records

To receive reimbursement from your FSA, you’ll need to submit claims with receipts and records. It’s essential to keep accurate records of your expenses, including: * Receipts * Invoices * Statements * Explanation of Benefits (EOB) statements

📝 Note: Keep your receipts and records organized and easily accessible to avoid delays in reimbursement.

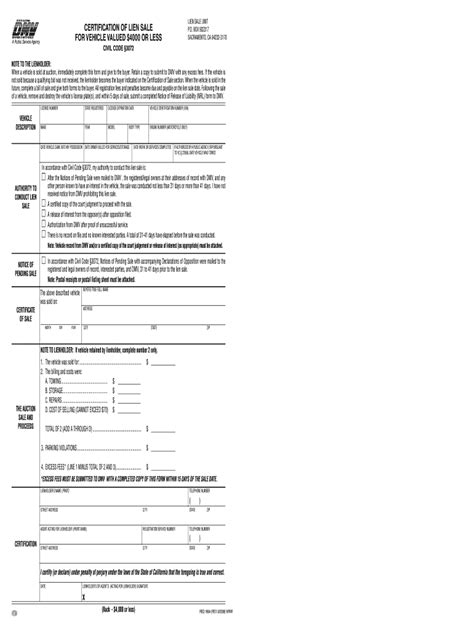

FSA Tax Tip 4: Avoid Forfeiting Unused Balances

One of the most significant pitfalls of FSAs is forfeiting unused balances. To avoid this, make sure to: * Use your FSA funds before the plan year ends * Submit claims promptly * Keep track of your account balance * Consider using the grace period or carryover feature, if available

FSA Tax Tip 5: Consider the FSA Carryover Feature

The FSA carryover feature allows you to carry over up to 500 of unused funds to the next plan year. This can help you avoid forfeiting unused balances and make the most of your FSA. Here's an example of how the carryover feature works: <table> <tr> <th>Plan Year</th> <th>Contribution</th> <th>Unused Balance</th> <th>Carryover</th> </tr> <tr> <td>2022</td> <td>1,000 200</td> <td>200 (carried over to 2023) 2023 1,000</td> <td>0 $0 (no carryover)

In summary, FSAs can be a great way to save money on healthcare and dependent care expenses. By following these 5 FSA tax tips, you can maximize your benefits and avoid common pitfalls. Remember to contribute to an FSA, use funds for eligible expenses, keep receipts and records, avoid forfeiting unused balances, and consider the FSA carryover feature.

What is the contribution limit for a Healthcare FSA?

+

The contribution limit for a Healthcare FSA is $2,850 in 2022.

Can I use my FSA funds for non-eligible expenses?

+

No, you can only use your FSA funds for eligible expenses. Using funds for non-eligible expenses can result in penalties and taxes.

How do I submit claims for reimbursement?

+

You can submit claims for reimbursement by filling out a claim form and attaching receipts and records. You can also submit claims online or through a mobile app, depending on your FSA provider.