5 Ways Submit Mileage

Introduction to Submitting Mileage

Submitting mileage is an essential task for individuals who use their personal vehicles for business purposes. It helps in keeping track of the miles driven and claiming reimbursements or deductions on tax returns. In this article, we will explore the different ways to submit mileage, making it easier for you to choose the method that suits your needs.

There are several methods to submit mileage, and each has its own set of advantages and disadvantages. Accuracy and consistency are key when it comes to recording mileage, as it directly affects the reimbursement or deduction amount. Let's dive into the different ways to submit mileage and understand their unique features.

Method 1: Manual Logbook

The traditional method of submitting mileage involves maintaining a manual logbook. This method requires you to record each trip’s starting and ending odometer readings, date, destination, and purpose.

- Advantages:

- Low cost: Manual logbooks are inexpensive and easily available.

- Easy to use: Recording mileage in a logbook is a straightforward process.

- Disadvantages:

- Prone to errors: Manual logbooks can lead to mistakes, such as incorrect odometer readings or forgotten entries.

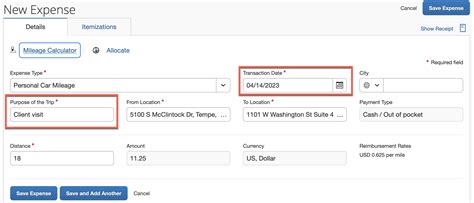

Method 2: Mobile Apps

With the advancement of technology, mobile apps have become a popular choice for submitting mileage. These apps use GPS to track trips and calculate mileage automatically.

Some popular mobile apps for tracking mileage include MileIQ, TripLog, and Hurdlr. These apps offer features such as:

- Automatic trip detection

- GPS tracking

- Customizable mileage rates

- Exportable reports

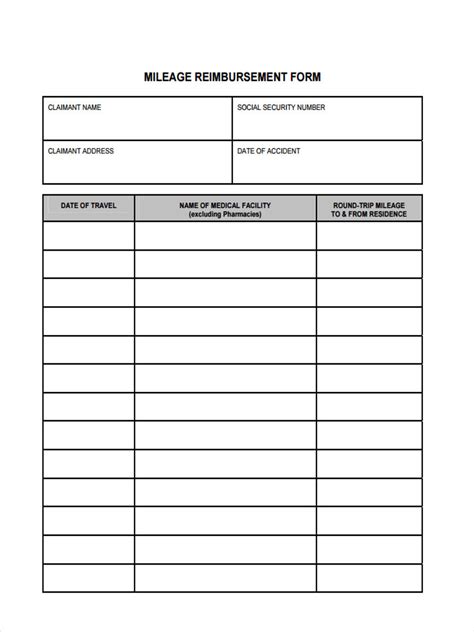

Method 3: Spreadsheet Templates

Using spreadsheet templates is another way to submit mileage. This method involves creating a table with columns for date, starting and ending odometer readings, destination, and purpose.

Spreadsheet templates offer flexibility and customization options, allowing you to create a template that suits your specific needs. You can also use formulas to calculate total mileage and reimbursement amounts.

| Date | Starting Odometer Reading | Ending Odometer Reading | Destination | Purpose |

|---|---|---|---|---|

| 2023-02-01 | 10000 | 10050 | Client Meeting | Business |

| 2023-02-02 | 10050 | 10100 | Office | Commute |

Method 4: Mileage Tracking Devices

Mileage tracking devices are small gadgets that plug into your vehicle’s ODB-II port and track mileage automatically. These devices are accurate and reliable, eliminating the need for manual logging.

Mileage tracking devices offer features such as:

- Automatic mileage tracking

- GPS tracking

- Customizable mileage rates

- Wireless syncing with mobile apps or computers

Method 5: Fleet Management Software

Fleet management software is designed for businesses with multiple vehicles. This software offers advanced features such as vehicle tracking, fuel management, and maintenance scheduling.

Fleet management software provides:

- Real-time vehicle tracking

- Automated mileage tracking

- Customizable reports

- Integration with accounting software

📝 Note: When choosing a method to submit mileage, consider factors such as accuracy, ease of use, and compatibility with your accounting software.

In summary, submitting mileage can be done in various ways, each with its own set of advantages and disadvantages. By understanding the different methods, you can choose the one that best suits your needs and ensures accuracy and compliance with tax regulations. Whether you prefer a manual logbook, mobile app, spreadsheet template, mileage tracking device, or fleet management software, the key is to find a method that works for you and helps you manage your mileage effectively.

What is the most accurate method for submitting mileage?

+

The most accurate method for submitting mileage is using a mileage tracking device or fleet management software, as they automatically track mileage and eliminate human error.

Can I use a mobile app to track mileage for multiple vehicles?

+

Yes, some mobile apps allow you to track mileage for multiple vehicles, making it a convenient option for businesses with a fleet of vehicles.

How often should I submit my mileage log?

+

You should submit your mileage log regularly, preferably at the end of each month or quarter, to ensure accurate reimbursement or deduction amounts.