Keep Tax Paperwork

Understanding the Importance of Keeping Tax Paperwork

Keeping tax paperwork is a crucial aspect of personal and business financial management. It not only helps in ensuring compliance with tax laws but also provides a clear picture of one’s financial situation. Tax records are essential for filing tax returns, claiming deductions, and dealing with any tax-related issues that may arise. In this blog post, we will delve into the world of tax paperwork, exploring its significance, the types of documents that should be kept, and how to maintain them efficiently.

Why Keep Tax Paperwork?

There are several reasons why keeping tax paperwork is important. Firstly, it helps in accurate tax filing. Having all the necessary documents at hand makes it easier to fill out tax returns correctly, reducing the risk of errors and potential penalties. Secondly, it facilitates the claiming of deductions and credits. Many taxpayers are eligible for various deductions and credits, but without the proper paperwork, these benefits might be missed. Lastly, keeping tax records is indispensable in case of an audit. The IRS or other tax authorities may request documentation to support the information provided in a tax return. Having these documents readily available can save time and stress.

Types of Tax Paperwork to Keep

Several types of documents should be kept for tax purposes. These include: - W-2 forms from employers, which show income and taxes withheld. - 1099 forms for freelance work or other income not subject to withholding. - Receipts for deductions, such as charitable donations, medical expenses, and business expenses. - Interest statements from banks and investments. - Dividend statements from investments. - Capital gains and losses statements from the sale of assets. - Mortgage interest statements. - Property tax statements.

How to Keep Tax Paperwork

Maintaining tax paperwork can be overwhelming, but with a systematic approach, it becomes manageable. Here are some steps to follow: - Create a filing system: Use folders or digital files labeled by year and category to store tax-related documents. - Scan documents: Consider scanning paper documents to create digital copies, which can be easier to store and access. - Use tax software: Many tax preparation software programs allow users to upload and store tax documents securely. - Keep documents for the right amount of time: The IRS generally has three years to initiate an audit. However, it’s recommended to keep tax records for at least seven years in case of any discrepancies.

📝 Note: Always check the specific requirements for document retention in your jurisdiction, as these can vary.

Benefits of Digital Storage

Storing tax paperwork digitally offers several benefits. It saves physical space, reduces the risk of document loss or damage, and makes it easier to access and share documents when needed. Additionally, digital storage can be secured with passwords and encryption, providing an extra layer of protection against identity theft.

Security Considerations

When storing tax paperwork, especially digitally, security is a top priority. Here are some tips to ensure your documents remain safe: - Use strong passwords and consider two-factor authentication. - Encrypt files, especially when storing them in the cloud. - Regularly back up files to prevent loss in case of a system failure. - Limit access to tax documents to authorized individuals only.

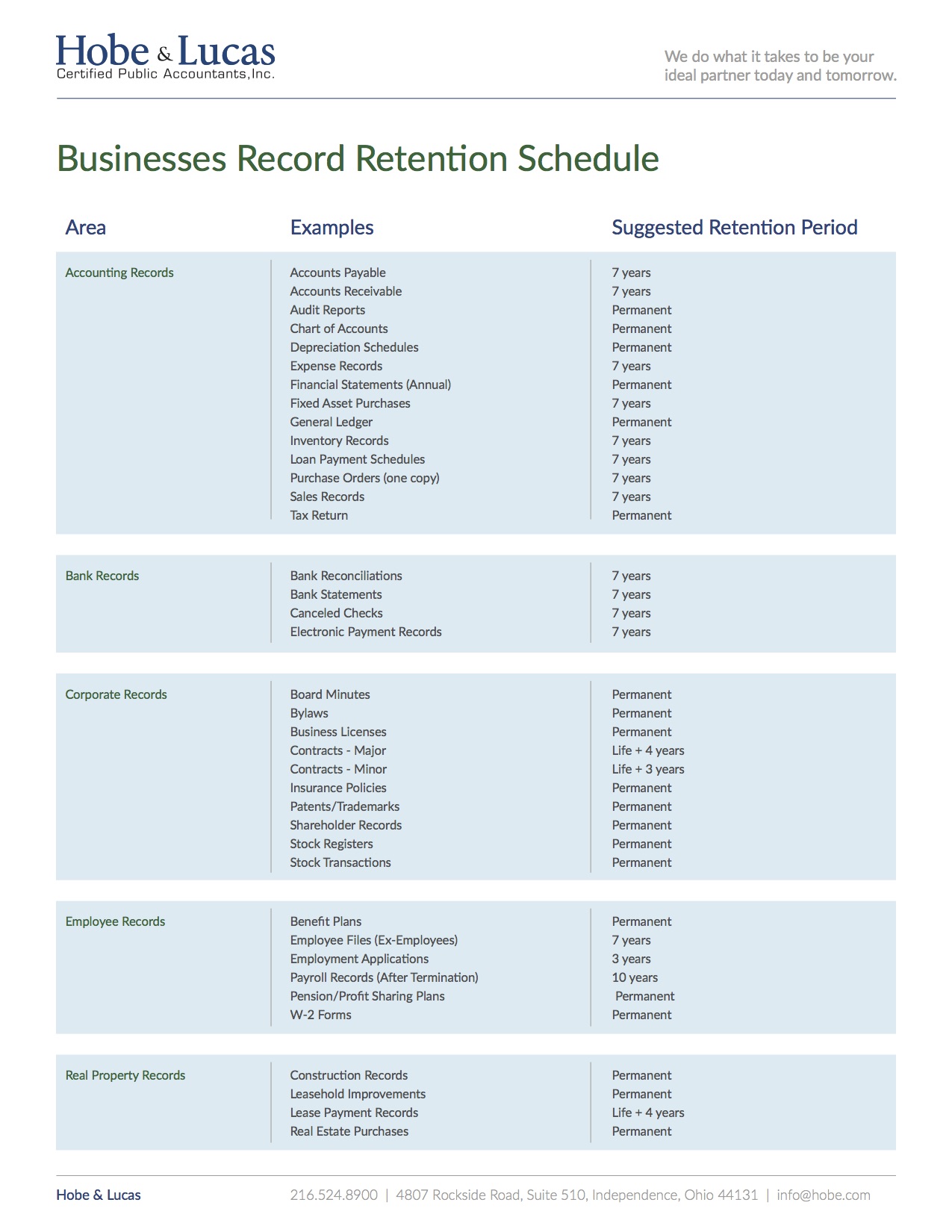

Organizing Tax Paperwork for Businesses

For businesses, organizing tax paperwork is even more critical due to the complexity and volume of documents involved. Businesses should: - Keep detailed financial records, including income statements, balance sheets, and cash flow statements. - Maintain employment records, such as payroll information and employee benefits. - Track business expenses meticulously, categorizing them for easier deduction claiming. - Consult with a tax professional to ensure compliance with all tax laws and regulations.

| Document Type | Purpose | Retention Period |

|---|---|---|

| W-2 Forms | Income and Tax Withholding | At least 7 years |

| 1099 Forms | Freelance Income | At least 7 years |

| Receipts for Deductions | Claiming Deductions | At least 7 years |

As we summarize the key points regarding the importance and management of tax paperwork, it’s clear that maintaining accurate and organized records is vital for both individuals and businesses. By understanding what documents to keep, how to store them securely, and for how long, taxpayers can ensure compliance with tax laws, make the most of deductions and credits, and be well-prepared in case of an audit. Effective tax paperwork management is a critical aspect of financial health, providing peace of mind and contributing to long-term financial stability.

What is the minimum period for keeping tax records?

+

It is generally recommended to keep tax records for at least seven years.

Can tax paperwork be stored digitally?

+

Yes, tax paperwork can be stored digitally. This method offers benefits such as space savings, easier access, and enhanced security with proper encryption and backup.

What types of documents should be kept for tax purposes?

+

Documents to keep include W-2 forms, 1099 forms, receipts for deductions, interest statements, dividend statements, capital gains and losses statements, mortgage interest statements, and property tax statements.