Paperwork

Colorado Unemployment Paperwork Retention Period

Understanding the Importance of Record Keeping for Colorado Unemployment

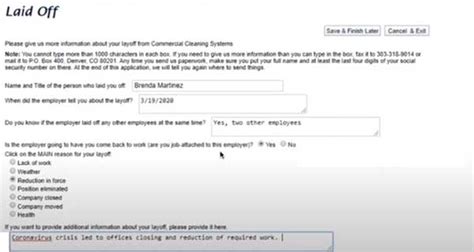

In the state of Colorado, unemployment insurance is designed to provide financial assistance to individuals who have lost their jobs through no fault of their own. The process of claiming these benefits involves a significant amount of paperwork and documentation. One crucial aspect of managing unemployment claims is understanding the retention period for related paperwork. This not only ensures compliance with state and federal regulations but also helps in maintaining a smooth and efficient claims process.

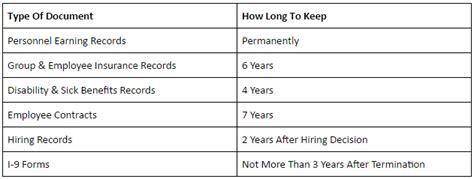

Colorado Unemployment Paperwork Retention Period Explained

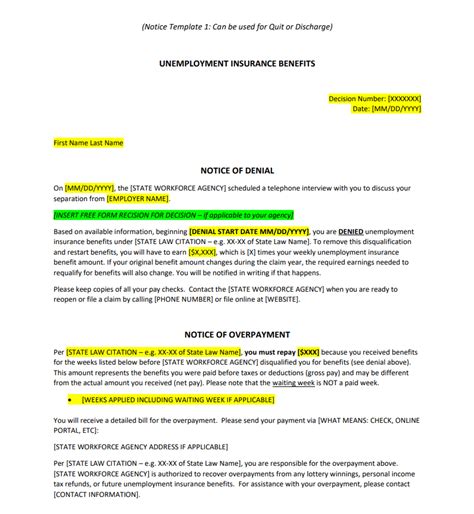

The retention period for unemployment paperwork in Colorado refers to the length of time that employers and claimants must keep records related to unemployment claims. This period is crucial because it allows for the proper audit and verification of claims, should any disputes or investigations arise. Generally, the retention period for most employment records, including those related to unemployment claims, is a minimum of 5 years. However, it’s essential to note that specific types of records may have different retention requirements, and it’s always best to consult with the Colorado Department of Labor and Employment for the most accurate and up-to-date information.

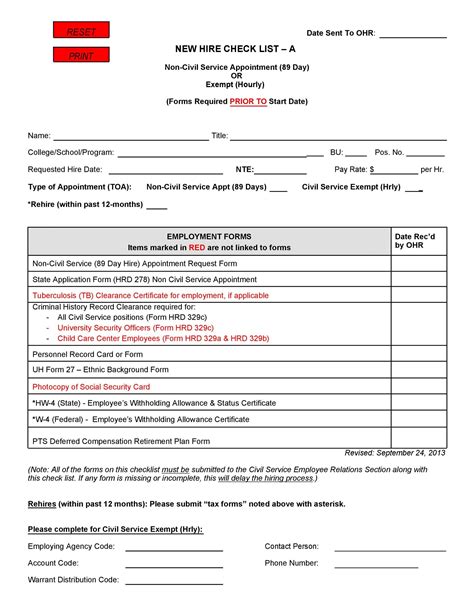

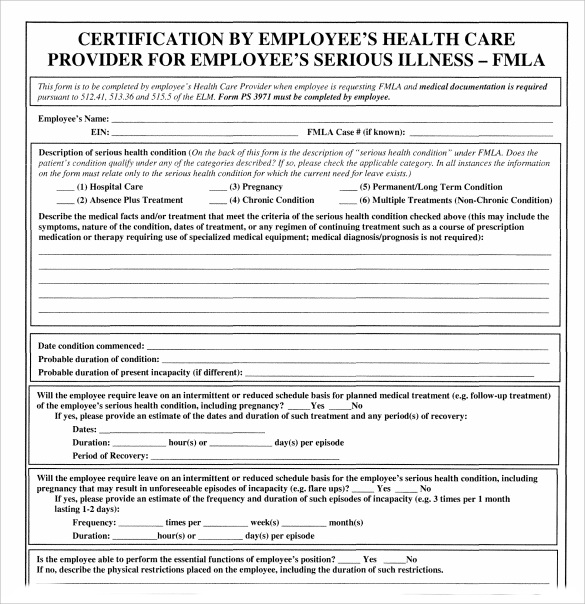

Types of Records to Retain

Employers in Colorado should retain a variety of records related to their employees and former employees, especially those related to unemployment claims. These may include: - Employment applications and resumes - Job descriptions and postings - Employee personnel files, including performance reviews and disciplinary actions - Payroll records, including wages, hours worked, and deductions - Termination notices and related documentation, such as reasons for termination and any severance agreements - Records of any disputes or hearings related to unemployment claims - Correspondence with the Colorado Department of Labor and Employment

Importance of Compliance

Compliance with record retention requirements is not just a good practice; it is also legally mandated. Failure to maintain the required records for the specified period can result in penalties, fines, and difficulties in resolving disputes related to unemployment claims. Employers must ensure that all records are accurate, complete, and easily accessible in case of an audit or investigation.

Best Practices for Record Keeping

To ensure compliance and efficiency, employers should adopt best practices for record keeping. These include: - Implementing a centralized and secure record-keeping system, whether physical or digital - Establishing clear policies and procedures for record retention and destruction - Training personnel on the importance and procedures of record keeping - Regularly reviewing and updating records to ensure they are current and compliant

📝 Note: Employers should consult with legal and HR professionals to ensure their record-keeping practices meet all state and federal requirements.

Technological Solutions for Record Keeping

In today’s digital age, technological solutions can greatly simplify the process of record keeping. Employers can utilize digital document management systems that offer secure storage, easy access, and automated compliance features. These systems can help in reducing physical storage needs, enhancing data security, and streamlining the process of retrieving documents when needed.

Conclusion and Future Considerations

In conclusion, understanding and complying with the Colorado unemployment paperwork retention period is crucial for employers. It not only helps in maintaining legal compliance but also ensures that the process of managing unemployment claims is efficient and less prone to errors. As regulations and requirements evolve, employers must stay informed and adapt their record-keeping practices accordingly. By prioritizing compliance and adopting best practices, employers can mitigate risks and focus on their core business operations.

What is the minimum retention period for unemployment-related records in Colorado?

+

The minimum retention period for most employment records, including those related to unemployment claims, is 5 years.

What types of records should employers retain for unemployment claims?

+

Employers should retain a variety of records, including employment applications, personnel files, payroll records, termination notices, and records of disputes or hearings related to unemployment claims.

Why is compliance with record retention requirements important?

+

Compliance is crucial because it ensures legal mandates are met, helps in resolving disputes efficiently, and prevents penalties and fines associated with non-compliance.