5 Mortgage Paperwork Musts

Introduction to Mortgage Paperwork

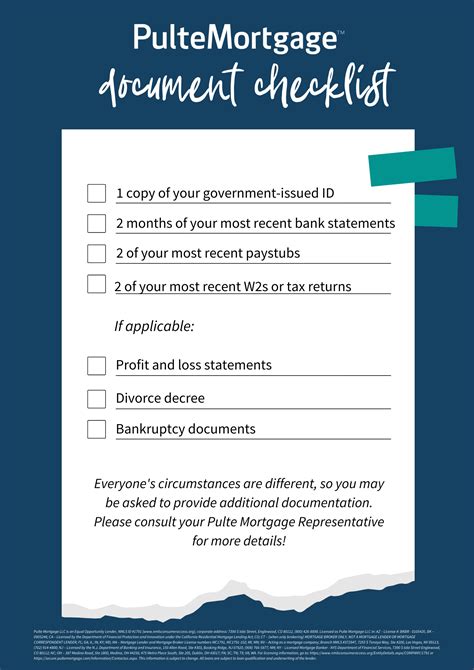

When navigating the process of purchasing a home, one of the most critical and often overwhelming steps is dealing with the mortgage paperwork. This complex and detailed process requires careful attention to ensure that all necessary documents are properly filled out and submitted on time. Understanding the key components of mortgage paperwork is essential for a smooth and successful transaction. In this article, we will explore the 5 mortgage paperwork musts that every homeowner should be aware of.

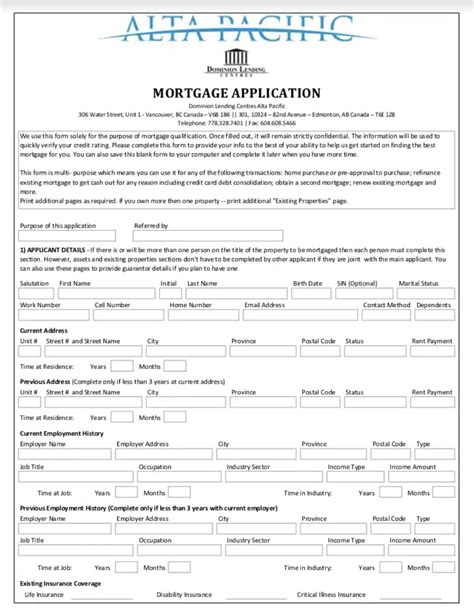

1. Loan Application

The loan application is the foundation of the mortgage process. It is here that you will provide personal and financial information to your lender, which will be used to determine your eligibility for a mortgage. This includes details such as your income, employment history, credit score, and the amount you are requesting to borrow. It is crucial to ensure that all information provided is accurate and complete, as any discrepancies can lead to delays or even the rejection of your application.

2. Pre-Approval Letter

A pre-approval letter is a document provided by your lender that states the amount they are willing to lend you, based on your financial situation. This letter is typically valid for a certain period, usually 30 to 60 days, and is used to demonstrate to sellers that you are a serious and qualified buyer. Having a pre-approval letter can give you an advantage when making an offer on a home, as it shows that you have already begun the process of securing financing.

3. Good Faith Estimate (GFE)

The Good Faith Estimate is a document that outlines the terms of your loan, including the interest rate, monthly payments, and all associated costs. This estimate is usually provided to you within three days of applying for a mortgage and is designed to give you a clear understanding of what to expect. It is essential to carefully review the GFE, as it can help you avoid any unexpected expenses or surprises down the line.

4. Appraisal Report

An appraisal report is an independent assessment of the value of the property you are purchasing. This report is typically required by lenders to ensure that the amount they are lending is not more than the actual value of the property. The appraisal process involves a professional appraiser visiting the property to assess its condition, size, and comparable sales in the area. Understanding the appraisal report is crucial, as a low appraisal can impact your ability to secure the desired loan amount.

5. Closing Disclosure

The Closing Disclosure is a document that outlines the final terms of your loan, including all costs and fees associated with the transaction. This document is provided to you at least three business days before closing and is designed to give you a clear understanding of what to expect at the closing table. It is vital to review the Closing Disclosure carefully, as it is your last opportunity to identify any errors or discrepancies before finalizing the loan.

📝 Note: It is essential to keep all mortgage paperwork organized and easily accessible, as you may need to refer to these documents throughout the process and even after the transaction is complete.

To further illustrate the importance of these documents, consider the following table:

| Document | Description | Importance |

|---|---|---|

| Loan Application | Initial application for a mortgage | Foundation of the mortgage process |

| Pre-Approval Letter | States the amount the lender is willing to lend | Demonstrates to sellers that you are a serious buyer |

| Good Faith Estimate (GFE) | Outlines the terms of the loan | Helps avoid unexpected expenses |

| Appraisal Report | Independent assessment of the property's value | Ensures the loan amount is not more than the property's value |

| Closing Disclosure | Final terms of the loan, including all costs and fees | Last opportunity to identify any errors or discrepancies |

In summary, navigating the world of mortgage paperwork requires attention to detail and a thorough understanding of the key documents involved. By being aware of these 5 mortgage paperwork musts, you can ensure a smoother and more successful transaction, ultimately leading to the realization of your dream of homeownership. The process, while complex, is manageable when approached with the right knowledge and preparation. As you move forward, remember that each document plays a critical role in the mortgage process, and understanding their importance is key to a successful outcome.

What is the purpose of the Good Faith Estimate?

+

The Good Faith Estimate is designed to provide borrowers with a clear understanding of the terms of their loan, including the interest rate, monthly payments, and all associated costs, helping them avoid unexpected expenses.

Why is the appraisal report necessary?

+

The appraisal report is necessary to ensure that the lender is not lending more than the actual value of the property, protecting both the lender and the borrower from potential financial risks.

What should I look for when reviewing the Closing Disclosure?

+

When reviewing the Closing Disclosure, you should carefully check for any errors or discrepancies in the loan terms, including the interest rate, monthly payments, and all associated costs and fees, to ensure everything is as expected before finalizing the loan.