Paperwork

Keep Insurance Claim Paperwork

Introduction to Insurance Claim Paperwork

When dealing with insurance claims, it’s essential to keep track of all the paperwork involved. This includes policy documents, claim forms, receipts, and communication records with the insurance company. Properly organizing these documents can help ensure a smooth claims process and prevent potential disputes. In this article, we’ll discuss the importance of keeping insurance claim paperwork, the types of documents you should keep, and provide tips on how to stay organized.

Why Keep Insurance Claim Paperwork?

Keeping insurance claim paperwork is crucial for several reasons:

- Proof of Claim: Documents serve as proof that you’ve filed a claim and provide details about the incident or event.

- Supporting Evidence: Paperwork helps support your claim by providing evidence of damages, losses, or expenses incurred.

- Communication Records: Keeping records of conversations and correspondence with the insurance company can help resolve disputes and ensure that agreements are met.

- Financial Records: Paperwork related to insurance claims can also serve as financial records, helping you track expenses and revenue related to the claim.

Types of Insurance Claim Paperwork

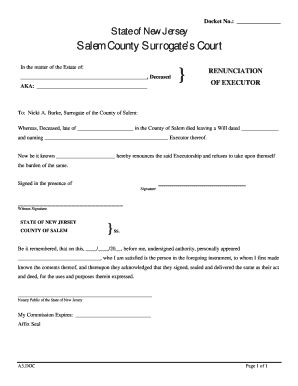

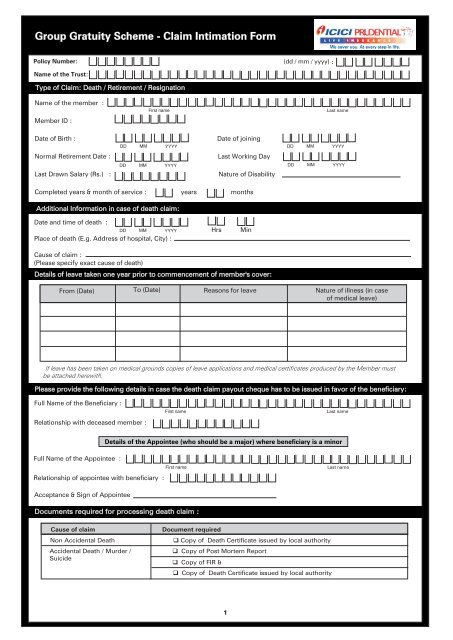

The types of paperwork you should keep vary depending on the type of insurance claim. However, some common documents include:

- Policy documents: Keep a copy of your insurance policy, including the policy number, coverage details, and any endorsements or riders.

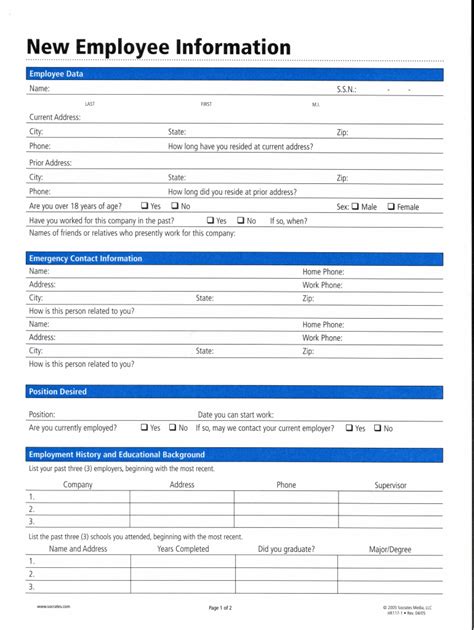

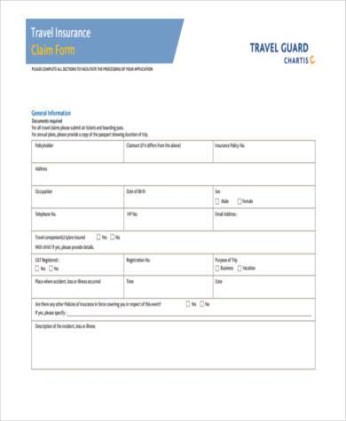

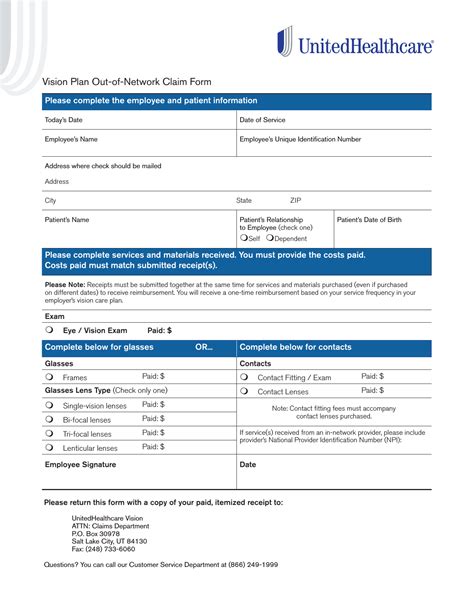

- Claim forms: Completed claim forms, including any supporting documentation, such as photos or witness statements.

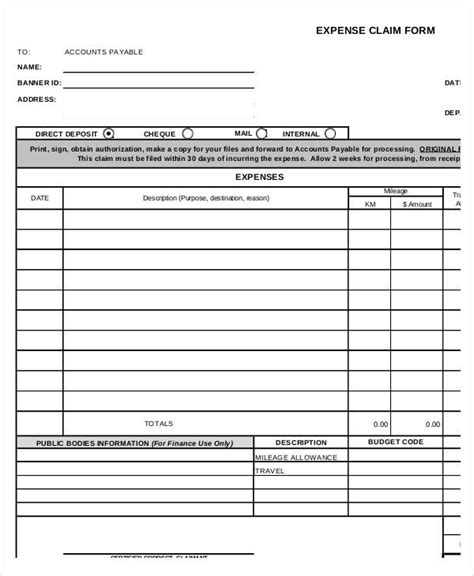

- Receipts: Keep receipts for any expenses related to the claim, such as repair estimates, medical bills, or temporary accommodation costs.

- Communication records: Record dates, times, and details of conversations with the insurance company, including claims adjusters and customer service representatives.

- Correspondence: Keep copies of any letters, emails, or faxes sent to or received from the insurance company.

Organizing Your Insurance Claim Paperwork

To stay organized, consider the following tips:

- Create a dedicated folder: Designate a specific folder or file to store all insurance claim paperwork.

- Use a spreadsheet: Create a spreadsheet to track expenses, correspondence, and claim progress.

- Make digital copies: Scan or take photos of important documents and store them digitally, such as in cloud storage or on an external hard drive.

- Set reminders: Set reminders for follow-up appointments, deadlines, or upcoming events related to the claim.

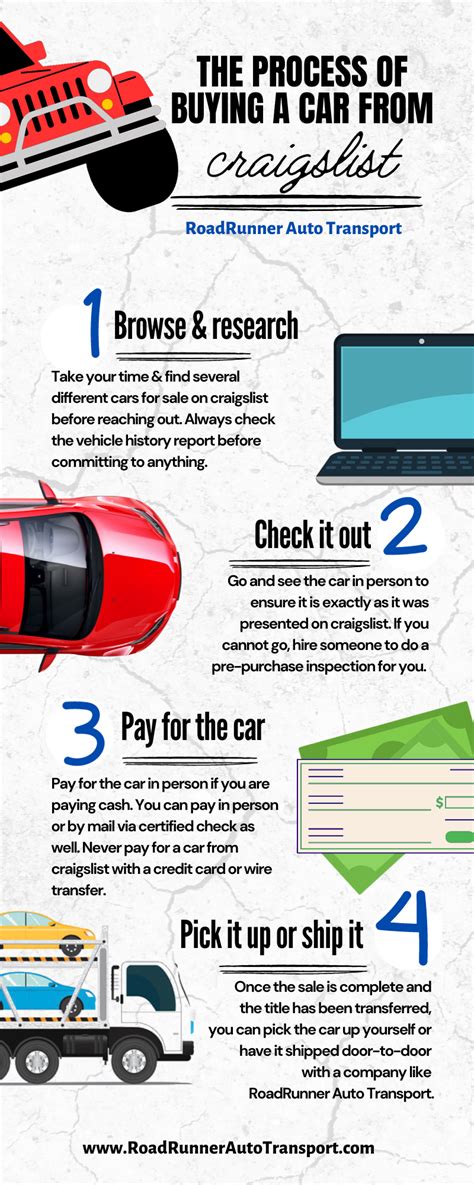

Example of Insurance Claim Paperwork

Here’s an example of what your insurance claim paperwork might look like:

| Document Type | Description |

|---|---|

| Policy Document | Copy of insurance policy, including policy number and coverage details |

| Claim Form | Completed claim form, including supporting documentation (e.g., photos, witness statements) |

| Receipts | Receipts for expenses related to the claim (e.g., repair estimates, medical bills) |

| Communication Records | Record of dates, times, and details of conversations with insurance company representatives |

📝 Note: It's essential to keep accurate and detailed records of all communication with the insurance company to avoid disputes and ensure a smooth claims process.

Best Practices for Keeping Insurance Claim Paperwork

To ensure you’re keeping your insurance claim paperwork organized and up-to-date, follow these best practices:

- Review and update regularly: Regularly review your paperwork to ensure it’s accurate and up-to-date.

- Keep it secure: Store your paperwork in a secure location, such as a locked cabinet or a password-protected digital storage system.

- Make backups: Create backups of your paperwork, such as scanning documents and storing them digitally.

- Seek professional help: If you’re unsure about any aspect of the claims process, consider seeking help from a professional, such as an insurance adjuster or attorney.

In the end, keeping insurance claim paperwork is crucial for a smooth and successful claims process. By understanding the importance of keeping paperwork, knowing what types of documents to keep, and following tips for organization, you can ensure that your insurance claim is handled efficiently and effectively. This will not only save you time and stress but also help you get the compensation you deserve.