5 Executor Paperworks

Introduction to Executor Paperworks

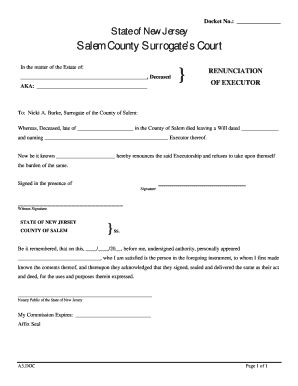

When it comes to managing the estate of a deceased person, the role of an executor is crucial. The executor is responsible for ensuring that the wishes of the deceased are carried out as stated in their will, and that all legal and financial matters are taken care of. One of the key aspects of being an executor is dealing with executor paperwork, which can be complex and time-consuming. In this article, we will explore the different types of executor paperwork, the importance of keeping accurate records, and provide tips on how to manage the process efficiently.

Types of Executor Paperworks

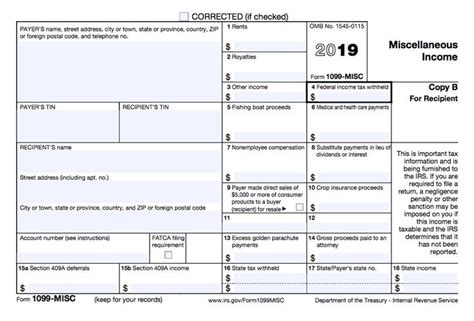

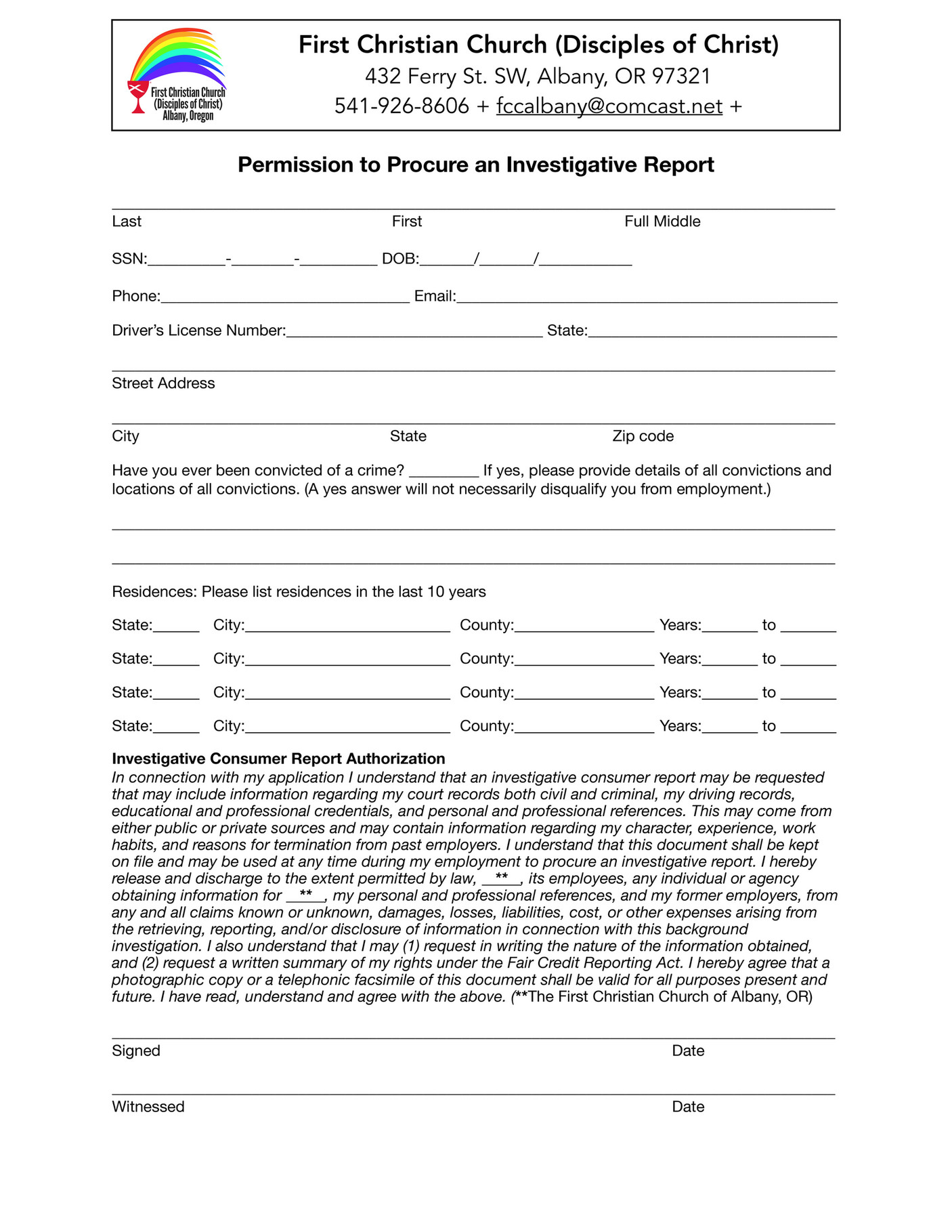

There are several types of executor paperwork that need to be completed, including: * Probate documents: These are the legal documents that need to be filed with the court to confirm the executor’s authority to manage the estate. * Tax returns: The executor is responsible for filing tax returns on behalf of the deceased and the estate. * Inventory of assets: The executor needs to create a detailed inventory of the deceased’s assets, including property, investments, and personal belongings. * Beneficiary designations: The executor needs to ensure that the beneficiaries named in the will receive their inheritances. * Estate accounts: The executor needs to open and manage estate accounts to pay bills, taxes, and other expenses.

Importance of Keeping Accurate Records

Keeping accurate records is essential for executors to ensure that they are carrying out their duties correctly and efficiently. This includes: * Maintaining a record of all financial transactions: This includes receipts, invoices, and bank statements. * Tracking correspondence: The executor should keep a record of all correspondence with beneficiaries, lawyers, and other parties involved in the estate. * Creating a timeline: The executor should create a timeline of key events and deadlines to ensure that everything is completed on time.

📝 Note: It's essential to keep all records organized and easily accessible, as they may be required for audit or other purposes.

Tips for Managing Executor Paperwork

Managing executor paperwork can be overwhelming, but there are several tips that can help make the process more efficient: * Seek professional help: If the executor is not familiar with the process, it’s recommended to seek the help of a lawyer or accountant. * Use estate management software: There are several software programs available that can help the executor manage the estate and keep track of paperwork. * Keep beneficiaries informed: The executor should keep beneficiaries informed of the progress of the estate and provide them with regular updates. * Stay organized: The executor should keep all paperwork and records organized and easily accessible.

| Document | Purpose |

|---|---|

| Probate documents | To confirm the executor's authority to manage the estate |

| Tax returns | To file taxes on behalf of the deceased and the estate |

| Inventory of assets | To create a detailed inventory of the deceased's assets |

In summary, managing executor paperwork is a critical aspect of being an executor. By understanding the different types of paperwork, keeping accurate records, and seeking professional help when needed, executors can ensure that they are carrying out their duties efficiently and effectively. It’s also essential to stay organized and keep beneficiaries informed throughout the process. By following these tips, executors can reduce the stress and complexity of managing an estate and ensure that the wishes of the deceased are carried out as stated in their will.

What is the role of an executor in managing an estate?

+

The role of an executor is to manage the estate of a deceased person, including paying bills, filing taxes, and distributing assets to beneficiaries.

What types of paperwork do executors need to complete?

+

Executors need to complete probate documents, tax returns, inventory of assets, beneficiary designations, and estate accounts.

Why is it essential to keep accurate records as an executor?

+

Keeping accurate records is essential to ensure that the executor is carrying out their duties correctly and efficiently, and to provide transparency to beneficiaries and other parties involved in the estate.