7 IRS Paperwork Tips

Introduction to IRS Paperwork

Dealing with IRS paperwork can be a daunting task, especially for those who are not familiar with the process. The Internal Revenue Service (IRS) requires individuals and businesses to submit various forms and documents to report their income, claim deductions, and pay taxes. Failure to comply with IRS regulations can result in penalties, fines, and even audits. In this article, we will provide 7 tips to help you navigate the complex world of IRS paperwork.

Tip 1: Understand Your Tax Obligations

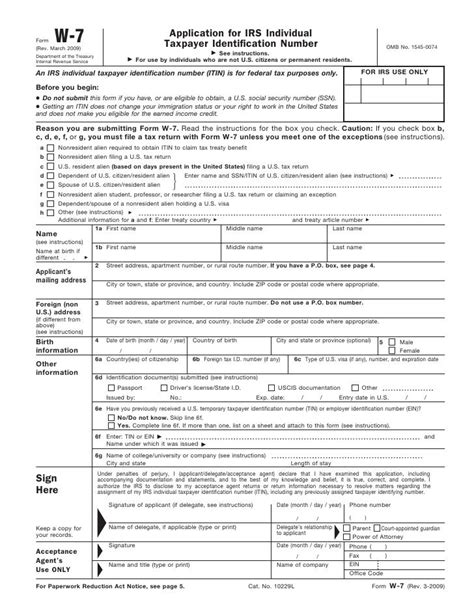

Before you start filling out IRS forms, it’s essential to understand your tax obligations. Know your filing status, income sources, and eligible deductions. This will help you determine which forms you need to file and what information you need to provide. You can find information on IRS forms and instructions on the official IRS website or by consulting with a tax professional.

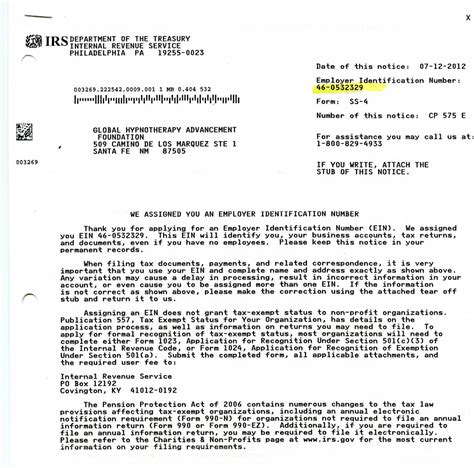

Tip 2: Gather Required Documents

To complete your IRS paperwork, you’ll need to gather various documents, including: * W-2 forms from your employer * 1099 forms for freelance or contract work * Interest statements from banks and investments * Charitable donation receipts * Medical expense records * Business expense records (if self-employed) Make sure you have all the necessary documents before starting your tax return.

Tip 3: Choose the Right Filing Status

Your filing status can affect your tax liability and eligibility for certain deductions. Choose the correct filing status, such as single, married filing jointly, or head of household. If you’re unsure about your filing status, consult with a tax professional or use the IRS’s online tool to determine your status.

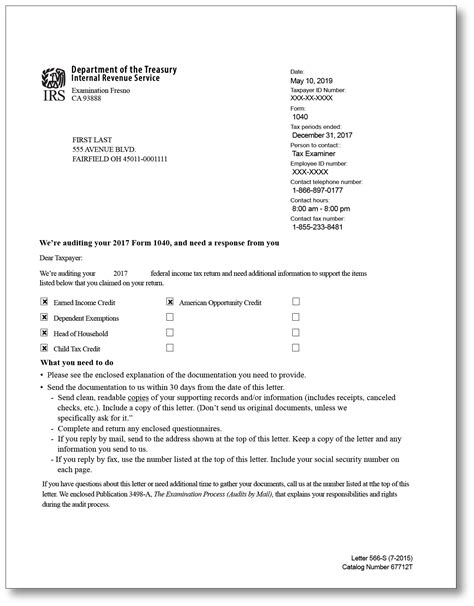

Tip 4: Take Advantage of Tax Credits and Deductions

Tax credits and deductions can significantly reduce your tax liability. Claim eligible credits, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit. You can also deduct expenses like mortgage interest, charitable donations, and medical expenses. Keep accurate records and consult with a tax professional to ensure you’re taking advantage of all eligible credits and deductions.

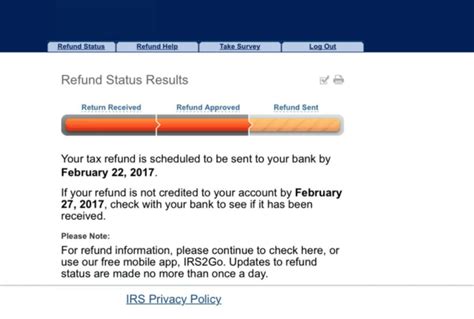

Tip 5: File Electronically

Filing your tax return electronically can save you time and reduce errors. The IRS’s e-file system is secure and convenient. You can e-file your return through the IRS website or use tax software like TurboTax or H&R Block. Electronic filing also allows for faster refunds and easier tracking of your return.

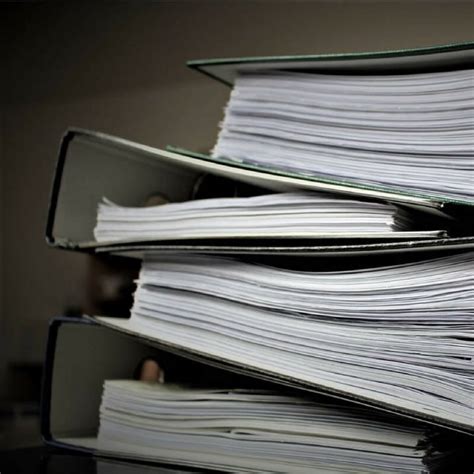

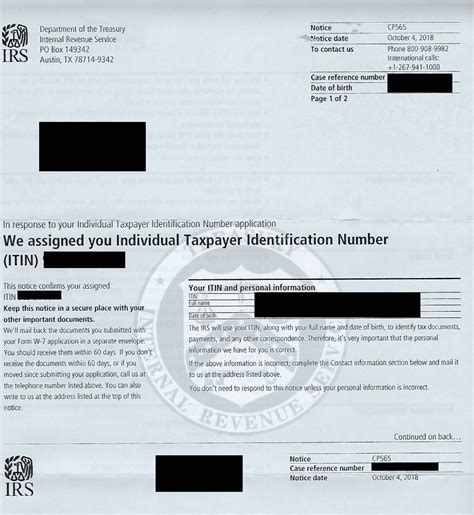

Tip 6: Keep Accurate Records

Maintaining accurate records is crucial for IRS paperwork. Keep all tax-related documents, including receipts, invoices, and bank statements. This will help you in case of an audit or if you need to amend your return. Consider using a cloud-based storage service or a physical file cabinet to keep your records organized.

Tip 7: Seek Professional Help

If you’re unsure about any aspect of your IRS paperwork, consider seeking professional help. Tax professionals can guide you through the process and ensure you’re taking advantage of all eligible credits and deductions. They can also help you navigate complex tax laws and regulations. Don’t hesitate to seek help if you’re unsure about any part of the process.

📝 Note: Always keep a copy of your tax return and supporting documents for at least three years in case of an audit or if you need to amend your return.

In summary, dealing with IRS paperwork requires attention to detail, organization, and a basic understanding of tax laws and regulations. By following these 7 tips, you can ensure a smooth and stress-free tax filing experience. Remember to stay informed, seek professional help when needed, and keep accurate records to avoid any potential issues with the IRS.

What is the deadline for filing my tax return?

+

The deadline for filing your tax return is typically April 15th of each year. However, if you need an extension, you can file Form 4868 to request an automatic six-month extension.

How do I know if I need to file a tax return?

+

You need to file a tax return if your income meets certain thresholds, which vary based on your filing status and age. You can check the IRS website or consult with a tax professional to determine if you need to file a return.

What happens if I miss the tax filing deadline?

+

If you miss the tax filing deadline, you may be subject to penalties and interest on any taxes owed. You can file for an extension or submit your return as soon as possible to minimize penalties. It’s essential to address any tax issues promptly to avoid further complications.