Paperwork

Canada Paperwork Retention Period

Introduction to Canada Paperwork Retention Period

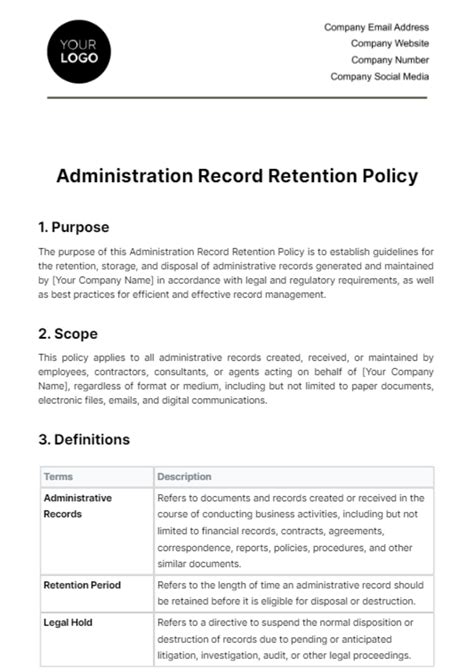

When it comes to managing paperwork, whether for personal or business purposes, understanding the retention period is crucial. In Canada, various types of documents have specific retention periods, which are the lengths of time you are required to keep them. These periods are set by different regulatory bodies and are essential for compliance, auditing, and historical record-keeping purposes. Understanding these requirements can help individuals and businesses avoid fines and ensure they are meeting their legal obligations.

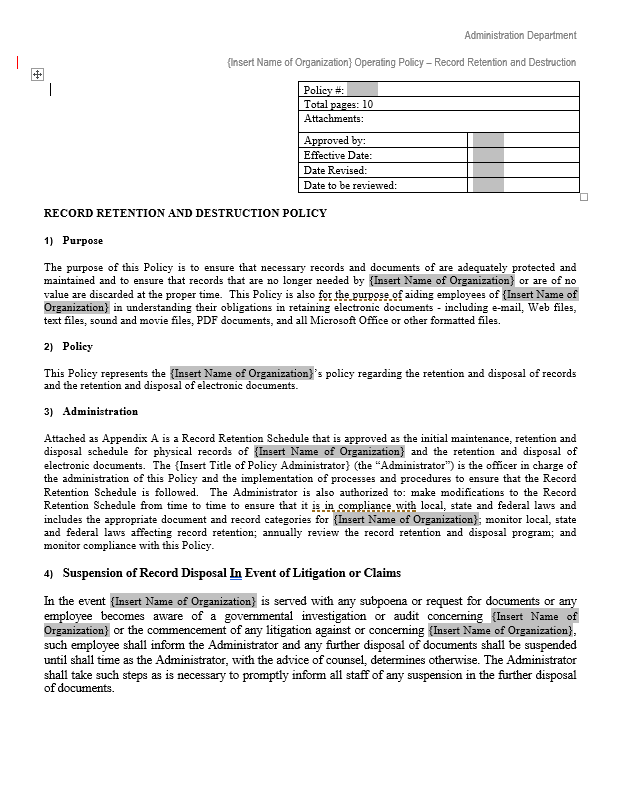

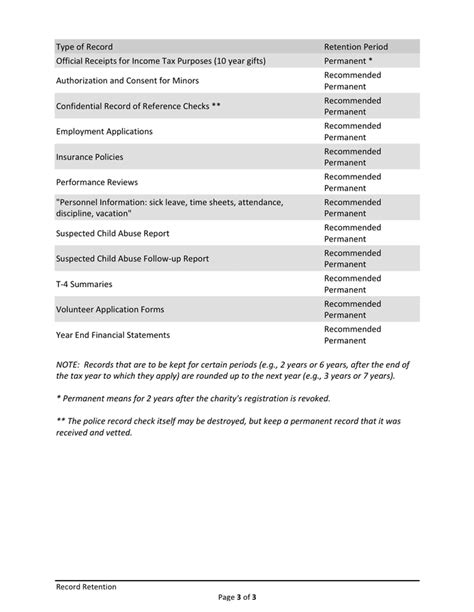

Types of Documents and Their Retention Periods

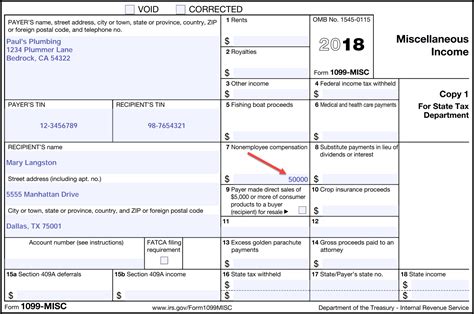

Different types of documents have varying retention periods. Here are some key categories: - Financial Documents: These include income tax returns, receipts, invoices, and bank statements. The Canada Revenue Agency (CRA) typically requires that these documents be kept for six years from the end of the tax year to which they relate. - Employment Records: For businesses, employment records, including payroll records, must be kept for three years after the date an employee leaves the company. - Health and Safety Records: Records related to health and safety in the workplace must be retained for three years after the date they were created. - Corporate Documents: Companies must keep minutes of meetings, shareholder lists, and other corporate documents for the life of the company plus a certain number of years after dissolution, depending on the jurisdiction.

Importance of Compliance

Compliance with retention requirements is critical for several reasons: - Legal Compliance: Keeping documents for the required amount of time ensures that you are meeting legal obligations and can avoid fines and penalties. - Auditing: In the event of an audit, having the necessary documents readily available can facilitate the process and help prove compliance with laws and regulations. - Historical Record: For personal and business purposes, maintaining a historical record of activities can be invaluable for future reference and planning.

Best Practices for Document Retention

To manage document retention effectively, consider the following best practices: - Digital Storage: Utilize secure digital storage solutions to keep documents organized and easily accessible. - Physical Storage: For physical documents, use a secure, fireproof safe or offsite storage facility. - Purge Schedules: Establish a regular schedule to review and purge documents that are no longer required to be kept. - Access Control: Limit access to sensitive documents to authorized personnel only.

📝 Note: Always consult with a legal or financial advisor to ensure you are meeting the specific retention requirements for your situation, as these can vary based on jurisdiction, type of document, and other factors.

Technological Solutions for Document Management

In today’s digital age, technology plays a significant role in document management. Solutions such as cloud storage services (e.g., Google Drive, Dropbox) and document management software can help in organizing, securing, and retaining documents. These solutions often offer features like: - Automated Backup: Regularly backs up your documents to prevent loss. - Access Controls: Allows you to set permissions for who can view or edit documents. - Version History: Keeps a record of changes made to documents over time.

Conclusion and Final Thoughts

In summary, understanding and complying with Canada’s paperwork retention periods is essential for both individuals and businesses. By knowing what documents to keep and for how long, and by implementing effective document management practices, you can ensure compliance with regulatory requirements, facilitate auditing processes, and maintain valuable historical records. Staying informed and adapting to changes in retention requirements is also crucial in this ever-evolving regulatory landscape.

What is the general retention period for financial documents in Canada?

+

The general retention period for financial documents, such as income tax returns and receipts, is six years from the end of the tax year to which they relate, as required by the Canada Revenue Agency (CRA).

How long must employment records be kept in Canada?

+

Employment records, including payroll records, must be kept for three years after the date an employee leaves the company.

What are the consequences of not complying with document retention requirements in Canada?

+

Not complying with document retention requirements can result in fines and penalties. It can also complicate auditing processes and lead to legal issues.