7 Tips Keep Tax Papers

Organizing Your Tax Papers: A Guide to Stress-Free Filing

When it comes to tax season, one of the most daunting tasks can be organizing and keeping track of all the necessary documents and papers. From W-2 forms to receipts for deductions, it’s easy to get overwhelmed by the sheer amount of paperwork involved. However, with a few simple tips and strategies, you can keep your tax papers in order and make the filing process much smoother.

Tip 1: Designate a Specific Area for Tax Papers

One of the first steps in keeping your tax papers organized is to designate a specific area where you will keep all your documents. This could be a file folder, a drawer, or even a digital folder on your computer. The key is to have one central location where you can easily access and store all your tax-related papers. Consider using a color-coded system to categorize different types of documents, such as income statements, deductions, and receipts.

Tip 2: Use a Filing System

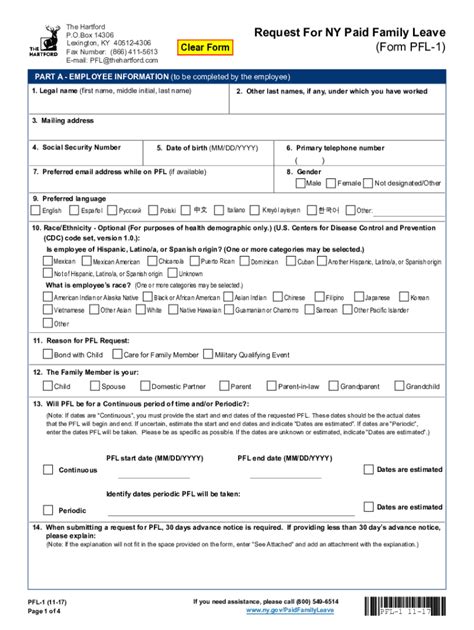

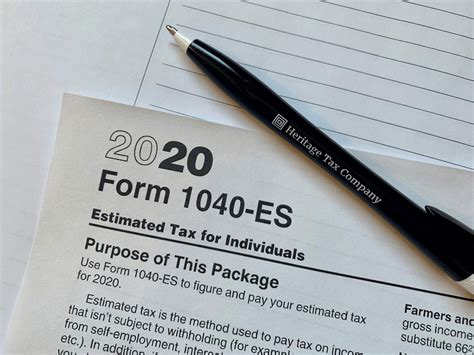

A filing system is essential for keeping your tax papers organized. You can use a physical file cabinet or a digital tool like a spreadsheet or a tax software program. Create separate files for different categories of documents, such as: * Income statements (W-2, 1099, etc.) * Deductions (charitable donations, medical expenses, etc.) * Receipts (business expenses, home office deductions, etc.) * Tax returns (previous years’ returns, current year’s return, etc.)

Tip 3: Keep Digital Copies

In addition to physical copies, it’s a good idea to keep digital copies of your tax papers. This can be done by scanning documents and saving them to a cloud storage service like Google Drive or Dropbox. Digital copies can be easily accessed and shared with your tax preparer or accountant, and they can also be used as a backup in case the physical copies are lost or damaged.

Tip 4: Keep Receipts Organized

Receipts can be one of the most challenging types of documents to keep track of, especially if you have a lot of business expenses or deductions. Consider using a receipt organizer or a digital receipt tracking tool to keep all your receipts in one place. You can also use categories or tags to categorize receipts by type, such as “business meals” or “home office expenses”.

Tip 5: Review and Update Your Papers Regularly

It’s essential to review and update your tax papers regularly to ensure that everything is accurate and up-to-date. Set aside time each month to go through your papers and make sure that all documents are accounted for and that all information is correct. This can help you catch any errors or discrepancies early on and avoid last-minute stress during tax season.

Tip 6: Consider Hiring a Tax Professional

If you’re feeling overwhelmed by the task of keeping your tax papers organized, consider hiring a tax professional to help you. A tax professional can provide guidance on what documents you need to keep and how to organize them, and they can also help you with the filing process. Additionally, a tax professional can help you identify potential deductions and credits that you may be eligible for.

Tip 7: Stay Up-to-Date with Tax Law Changes

Finally, it’s essential to stay up-to-date with changes in tax law and regulations. The tax code is constantly evolving, and new laws and regulations can affect what documents you need to keep and how you need to organize them. Consider following tax professionals or financial advisors on social media or signing up for newsletters to stay informed about any changes that may affect your tax situation.

📝 Note: It's essential to keep your tax papers organized and up-to-date to avoid any potential penalties or fines. By following these tips, you can ensure that your tax papers are in order and that you're taking advantage of all the deductions and credits you're eligible for.

In summary, keeping your tax papers organized is crucial for a stress-free filing process. By designating a specific area for tax papers, using a filing system, keeping digital copies, organizing receipts, reviewing and updating papers regularly, considering hiring a tax professional, and staying up-to-date with tax law changes, you can ensure that your tax papers are in order and that you’re taking advantage of all the deductions and credits you’re eligible for.

What is the best way to organize my tax papers?

+

The best way to organize your tax papers is to designate a specific area for them, use a filing system, and keep digital copies. You can also use categories or tags to categorize documents by type.

How long should I keep my tax papers?

+

It’s generally recommended to keep your tax papers for at least three years in case of an audit. However, you may need to keep them for longer if you have a business or if you’re self-employed.

Can I deduct business expenses on my tax return?

+

Yes, you can deduct business expenses on your tax return. However, you’ll need to keep accurate records of your expenses, including receipts and invoices. You can also use a mileage log to track business miles driven.