5 Mortgage Tips

Introduction to Mortgage Tips

When it comes to purchasing a home, one of the most significant financial decisions you will make is choosing the right mortgage. With so many options available, it can be overwhelming to navigate the process. However, by understanding some key mortgage tips, you can make an informed decision that suits your financial situation and goals. In this article, we will explore five essential mortgage tips to consider when applying for a mortgage.

Understanding Your Financial Situation

Before applying for a mortgage, it is crucial to understand your financial situation. This includes assessing your income, expenses, debts, and credit score. Your credit score plays a significant role in determining the interest rate you will qualify for and whether you will be approved for a mortgage. A good credit score can help you qualify for better interest rates, which can save you thousands of dollars over the life of the loan. To improve your credit score, make sure to pay your bills on time, keep credit card balances low, and avoid applying for multiple credit cards.

Shopping Around for Mortgage Rates

Another critical mortgage tip is to shop around for mortgage rates. Different lenders offer varying interest rates, so it is essential to compare rates from multiple lenders to find the best deal. You can use online mortgage comparison tools or consult with a mortgage broker to help you find the most competitive rates. Additionally, consider working with a reputable lender that offers flexible repayment terms and low fees.

Considering Mortgage Options

There are various mortgage options available, each with its pros and cons. Some popular options include: * Fixed-rate mortgages: Offer a fixed interest rate for the life of the loan, providing predictable monthly payments. * Adjustable-rate mortgages: Offer a lower initial interest rate that may adjust over time, potentially reducing monthly payments. * Government-backed mortgages: Offer more lenient credit score requirements and lower down payments, such as FHA loans or VA loans. Consider your financial situation, goals, and risk tolerance when choosing a mortgage option.

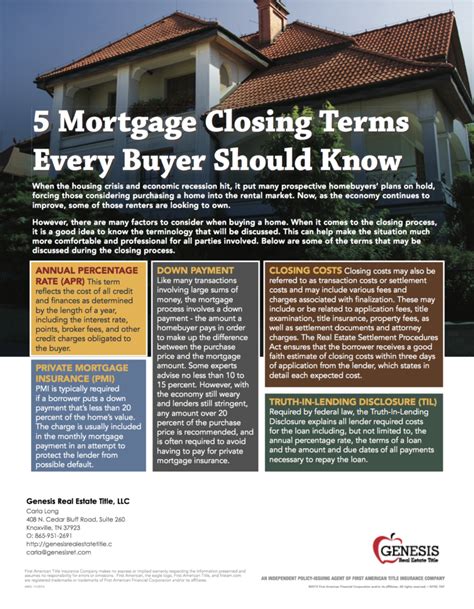

Preparing for Closing Costs

In addition to your monthly mortgage payments, you will need to prepare for closing costs, which can range from 2% to 5% of the purchase price. These costs include: * Origination fees * Appraisal fees * Title insurance * Escrow fees Make sure to factor these costs into your budget and consider negotiating with the seller to cover some of the costs.

Reviewing and Understanding Mortgage Terms

Finally, it is essential to review and understand the mortgage terms before signing the loan agreement. This includes: * Interest rate * Loan term * Monthly payment amount * Prepayment penalties * Late payment fees Take the time to carefully review the terms and ask questions if you are unsure about any aspect of the loan.

📝 Note: Always read the fine print and ask questions before signing the loan agreement to avoid any potential issues or surprises down the line.

As you navigate the mortgage application process, remember to stay informed, and don’t hesitate to seek professional advice if needed. By following these five mortgage tips, you can make an informed decision that sets you up for long-term financial success.

In the end, finding the right mortgage is a critical step in achieving your dream of homeownership. By taking the time to understand your financial situation, shopping around for mortgage rates, considering mortgage options, preparing for closing costs, and reviewing mortgage terms, you can make a confident decision that suits your needs and goals. With the right mortgage, you can enjoy the benefits of homeownership while managing your finances effectively.

What is the difference between a fixed-rate and adjustable-rate mortgage?

+

A fixed-rate mortgage offers a fixed interest rate for the life of the loan, while an adjustable-rate mortgage offers a lower initial interest rate that may adjust over time.

How do I improve my credit score to qualify for better mortgage rates?

+

You can improve your credit score by paying your bills on time, keeping credit card balances low, and avoiding applying for multiple credit cards.

What are closing costs, and how much can I expect to pay?

+

Closing costs can range from 2% to 5% of the purchase price and include fees such as origination fees, appraisal fees, title insurance, and escrow fees.