Kansas Bankruptcy Filing Paperwork

Understanding the Kansas Bankruptcy Filing Process

The process of filing for bankruptcy in Kansas can be complex and overwhelming, especially for those who are not familiar with the legal system. Bankruptcy is a legal procedure that allows individuals or businesses to reorganize or eliminate debts under the protection of the federal bankruptcy court. In Kansas, the bankruptcy filing process involves several steps, including determining which type of bankruptcy to file, gathering required documents, and completing the necessary paperwork.

Types of Bankruptcy in Kansas

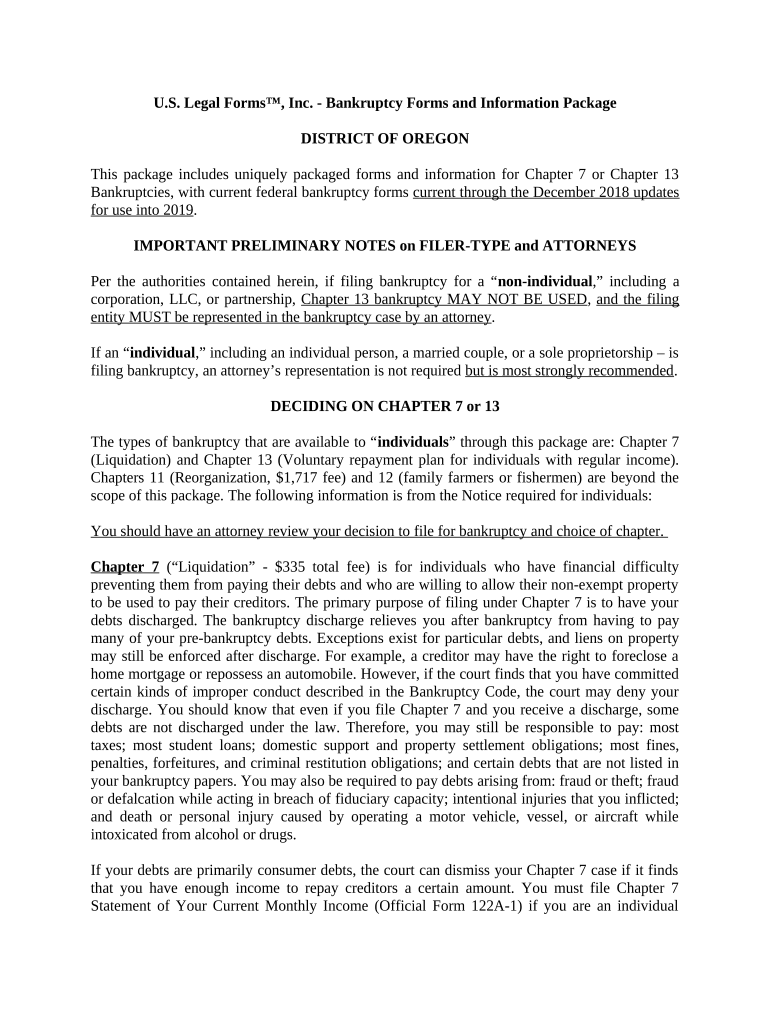

There are several types of bankruptcy that can be filed in Kansas, including: * Chapter 7 Bankruptcy: This type of bankruptcy involves the liquidation of non-exempt assets to pay off creditors. It is commonly referred to as “straight bankruptcy” or “liquidation bankruptcy.” * Chapter 13 Bankruptcy: This type of bankruptcy involves the creation of a repayment plan to pay off a portion of debts over a period of time, usually three to five years. * Chapter 11 Bankruptcy: This type of bankruptcy is typically used by businesses to reorganize and restructure debts.

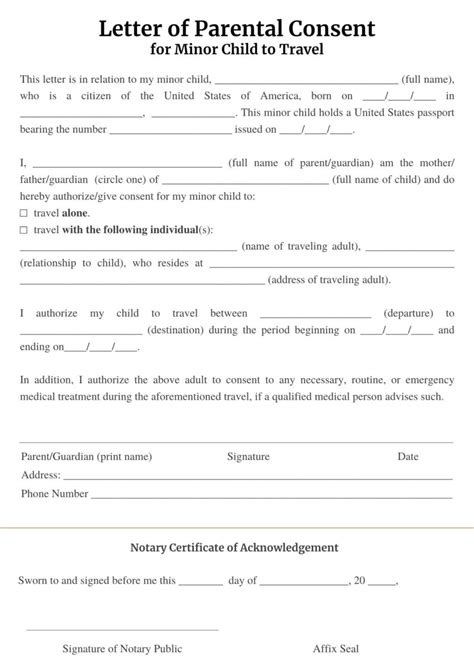

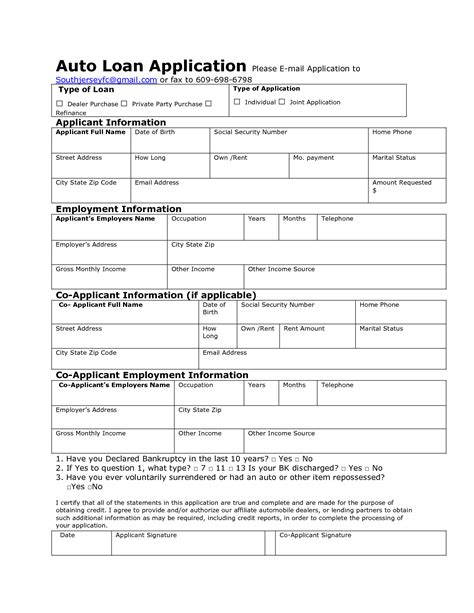

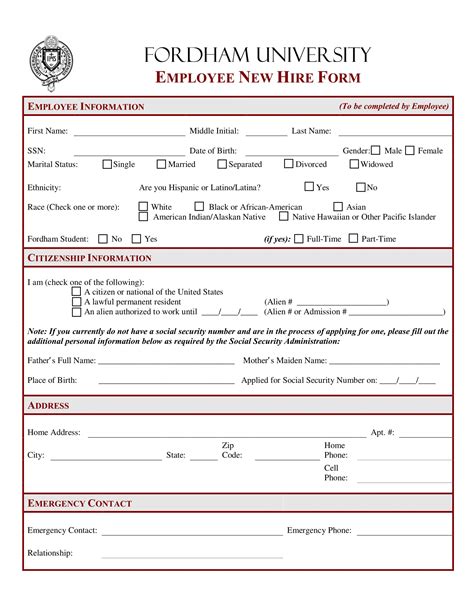

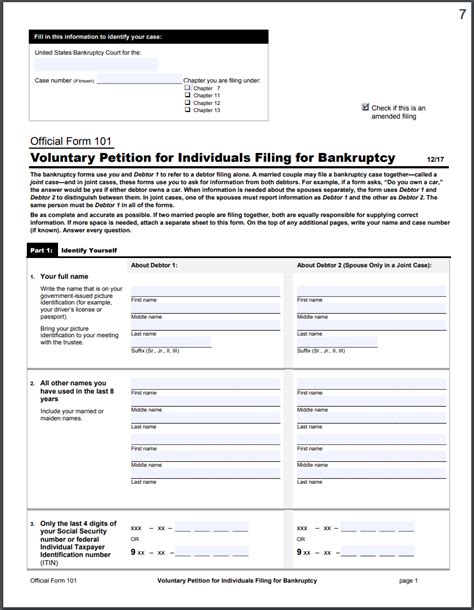

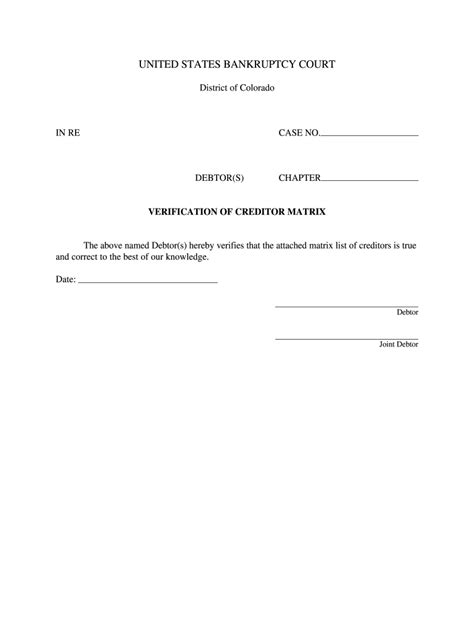

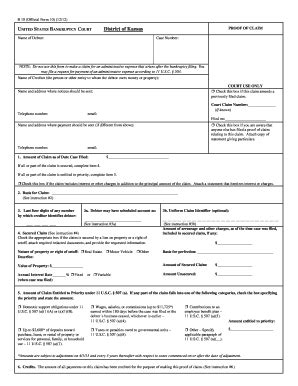

Required Documents for Kansas Bankruptcy Filing

To file for bankruptcy in Kansas, individuals and businesses must gather and submit several documents, including: * Petition: The petition is the initial document filed with the bankruptcy court to begin the bankruptcy process. * Schedules: Schedules are documents that provide detailed information about the individual’s or business’s assets, liabilities, income, and expenses. * Statement of Financial Affairs: This document provides a detailed overview of the individual’s or business’s financial transactions and activities. * Means Test: The means test is a document that determines whether an individual is eligible to file for Chapter 7 bankruptcy. * Credit Counseling Certificate: Individuals and businesses must complete a credit counseling course and obtain a certificate before filing for bankruptcy.

Bankruptcy Filing Fees in Kansas

The cost of filing for bankruptcy in Kansas varies depending on the type of bankruptcy and the individual’s or business’s financial situation. The filing fees for bankruptcy in Kansas are as follows:

| Type of Bankruptcy | Filing Fee |

|---|---|

| Chapter 7 Bankruptcy | 335</td> </tr> <tr> <td>Chapter 13 Bankruptcy</td> <td>310 |

| Chapter 11 Bankruptcy | $1,717 |

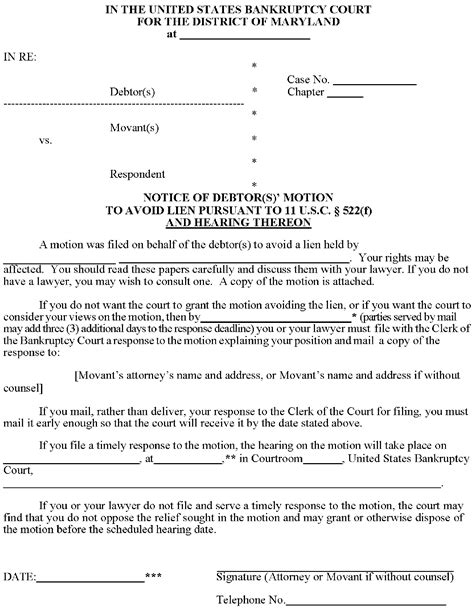

Step-by-Step Guide to Filing for Bankruptcy in Kansas

The following is a step-by-step guide to filing for bankruptcy in Kansas: * Step 1: Determine which type of bankruptcy to file: Individuals and businesses must determine which type of bankruptcy is best for their financial situation. * Step 2: Gather required documents: Individuals and businesses must gather all required documents, including the petition, schedules, statement of financial affairs, means test, and credit counseling certificate. * Step 3: Complete the bankruptcy paperwork: Individuals and businesses must complete the bankruptcy paperwork, including the petition and schedules. * Step 4: File the bankruptcy paperwork: Individuals and businesses must file the bankruptcy paperwork with the bankruptcy court. * Step 5: Attend the meeting of creditors: Individuals and businesses must attend the meeting of creditors, also known as the 341 meeting. * Step 6: Complete the bankruptcy process: Individuals and businesses must complete the bankruptcy process, including making payments and attending any required court hearings.

💡 Note: It is highly recommended that individuals and businesses seek the advice of a qualified bankruptcy attorney to ensure that the bankruptcy process is completed correctly and efficiently.

In summary, the process of filing for bankruptcy in Kansas involves determining which type of bankruptcy to file, gathering required documents, completing the bankruptcy paperwork, filing the bankruptcy paperwork, attending the meeting of creditors, and completing the bankruptcy process. It is essential to seek the advice of a qualified bankruptcy attorney to ensure that the bankruptcy process is completed correctly and efficiently.

What is the difference between Chapter 7 and Chapter 13 bankruptcy?

+

Chapter 7 bankruptcy involves the liquidation of non-exempt assets to pay off creditors, while Chapter 13 bankruptcy involves the creation of a repayment plan to pay off a portion of debts over a period of time.

How long does the bankruptcy process take in Kansas?

+

The length of the bankruptcy process in Kansas varies depending on the type of bankruptcy and the individual’s or business’s financial situation. Chapter 7 bankruptcy typically takes several months to complete, while Chapter 13 bankruptcy can take three to five years to complete.

Can I file for bankruptcy in Kansas without an attorney?

+

Yes, it is possible to file for bankruptcy in Kansas without an attorney. However, it is highly recommended that individuals and businesses seek the advice of a qualified bankruptcy attorney to ensure that the bankruptcy process is completed correctly and efficiently.