Make PPI Claim Without Paperwork

Making a PPI Claim Without Paperwork: A Step-by-Step Guide

If you’re one of the thousands of people who were mis-sold Payment Protection Insurance (PPI) in the UK, you may be eligible to make a claim for compensation. However, many people are put off from making a claim because they don’t have the necessary paperwork. But don’t worry, it’s still possible to make a PPI claim without paperwork. In this article, we’ll take you through the steps you need to take to make a successful claim.

What is PPI and How Was it Mis-sold?

Before we dive into the process of making a claim, it’s essential to understand what PPI is and how it was mis-sold. PPI is an insurance policy that was designed to cover loan or credit card payments if you were unable to work due to illness, injury, or redundancy. However, many lenders and financial institutions mis-sold PPI to customers by:

- Adding it to loans or credit cards without the customer’s knowledge or consent

- Not explaining the terms and conditions of the policy

- Not checking if the customer was eligible for the policy

- Using high-pressure sales tactics to sell the policy

Steps to Make a PPI Claim Without Paperwork

Making a PPI claim without paperwork can be a bit more challenging, but it’s still possible. Here are the steps you need to take:

- Check if you had PPI: The first step is to check if you had PPI on any of your loans or credit cards. You can do this by looking at your old bank statements or by contacting your lender directly.

- Gather information: If you don’t have any paperwork, try to gather as much information as possible about your loan or credit card, including the account number, the date you took out the loan or credit card, and the lender’s name.

- Use a claims management company: If you don’t have any paperwork, it may be helpful to use a claims management company. They can help you gather the necessary information and make a claim on your behalf.

- Contact the lender: If you prefer to make a claim directly with the lender, you can contact them and explain that you don’t have any paperwork. They may be able to help you locate the necessary documents or provide you with a claims form.

- Complete a claims form: Once you have gathered all the necessary information, you’ll need to complete a claims form. This will typically ask for details about your loan or credit card, as well as information about why you think you were mis-sold PPI.

- Submit your claim: Once you’ve completed the claims form, you can submit it to the lender or the Financial Ombudsman Service (FOS). The FOS is an independent body that can help resolve disputes between consumers and financial institutions.

What to Expect During the Claims Process

The claims process can take several weeks or even months to complete. Here’s what you can expect:

- Acknowledgement letter: Once you’ve submitted your claim, you should receive an acknowledgement letter from the lender or the FOS. This will confirm that they’ve received your claim and will investigate it further.

- Investigation: The lender or the FOS will then investigate your claim. This may involve requesting additional information from you or reviewing your loan or credit card documents.

- Decision: Once the investigation is complete, you’ll receive a decision on your claim. If your claim is successful, you’ll be awarded compensation, which will typically include a refund of the PPI premiums you paid, plus interest.

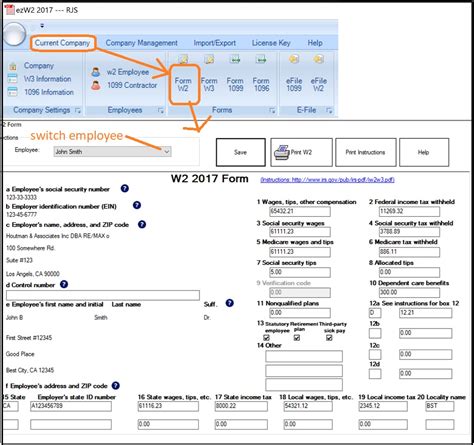

Table of PPI Claim Statistics

Here is a table showing some statistics about PPI claims:

| Year | Number of Claims | Amount of Compensation Paid |

|---|---|---|

| 2011 | 1.5 million | £1.9 billion |

| 2012 | 2.5 million | £3.5 billion |

| 2013 | 3.5 million | £5.5 billion |

💡 Note: These statistics are based on data from the Financial Conduct Authority (FCA) and show the number of PPI claims made and the amount of compensation paid out each year.

Tips for Making a Successful PPI Claim

Here are some tips for making a successful PPI claim:

- Act quickly: The sooner you make a claim, the better. The FCA has set a deadline for making PPI claims, so it’s essential to act quickly to avoid missing out.

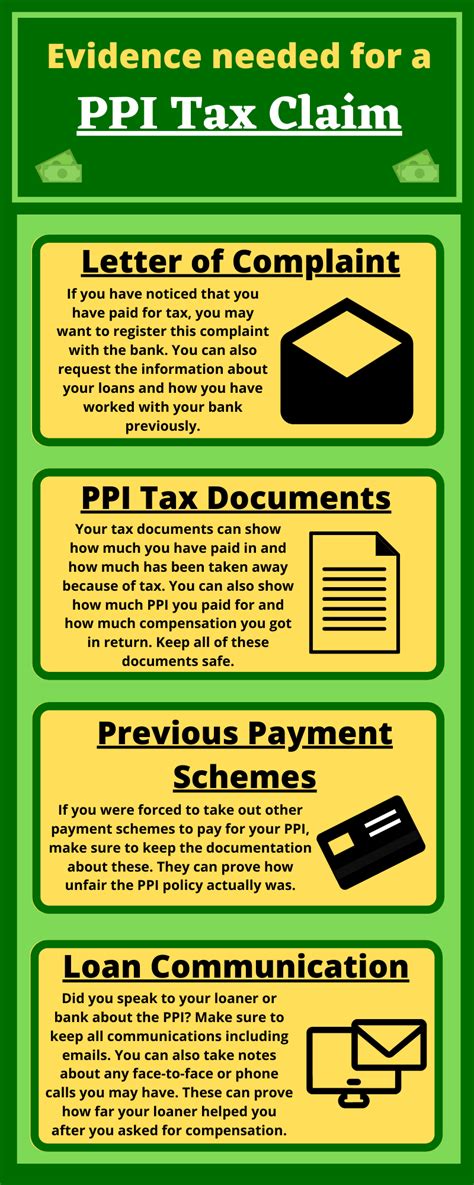

- Gather as much information as possible: The more information you have, the stronger your claim will be. Try to gather as much information as possible about your loan or credit card, including the account number, the date you took out the loan or credit card, and the lender’s name.

- Use a claims management company: If you’re not sure where to start or need help making a claim, consider using a claims management company. They can help you gather the necessary information and make a claim on your behalf.

In summary, making a PPI claim without paperwork can be a bit more challenging, but it’s still possible. By following the steps outlined in this article and gathering as much information as possible, you can make a successful claim and receive the compensation you’re entitled to. Remember to act quickly and consider using a claims management company if you need help making a claim.

What is the deadline for making a PPI claim?

+

The deadline for making a PPI claim is August 29, 2019. However, it’s essential to note that this deadline only applies to claims made directly to lenders. If you’re making a claim through the Financial Ombudsman Service (FOS), there is no deadline.

How long does it take to make a PPI claim?

+

The time it takes to make a PPI claim can vary depending on the complexity of the claim and the lender’s response. On average, it can take several weeks or even months to receive a decision on your claim.

Can I make a PPI claim if I’ve already paid off my loan or credit card?

+

Yes, you can still make a PPI claim even if you’ve already paid off your loan or credit card. The fact that you’ve paid off your debt doesn’t affect your eligibility to make a claim.

How much compensation can I expect to receive if my PPI claim is successful?

+

The amount of compensation you can expect to receive if your PPI claim is successful will depend on the amount of PPI premiums you paid and the interest you’re entitled to. On average, successful claimants can expect to receive several thousand pounds in compensation.