Paperwork

File Taxes Paperwork Needed

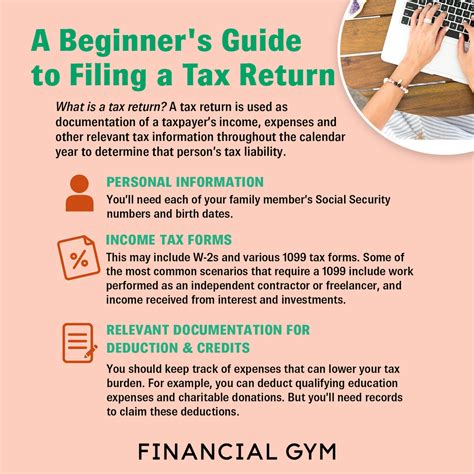

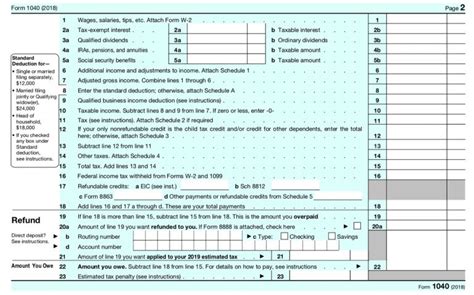

Introduction to Filing Taxes

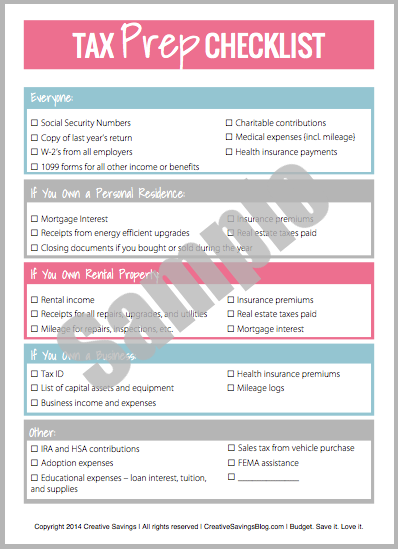

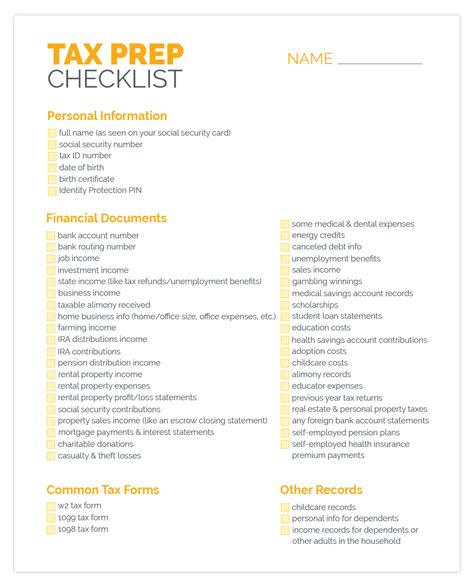

Filing taxes can be a daunting task, especially when it comes to gathering all the necessary paperwork. The process involves collecting various documents that prove your income, deductions, and credits. In this article, we will guide you through the essential paperwork needed to file your taxes efficiently. Understanding what documents are required can help you avoid last-minute rushes and ensure you take advantage of all the deductions and credits you are eligible for.

Personal Identification Documents

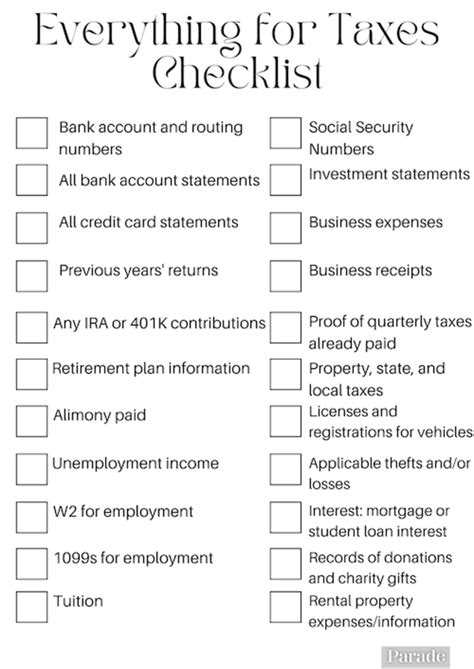

To start the tax filing process, you will need to provide personal identification documents. These include:

- Social Security number or Individual Taxpayer Identification Number (ITIN) for yourself, your spouse, and dependents.

- Driver’s license or state ID for identity verification.

- Birth dates for yourself, your spouse, and dependents.

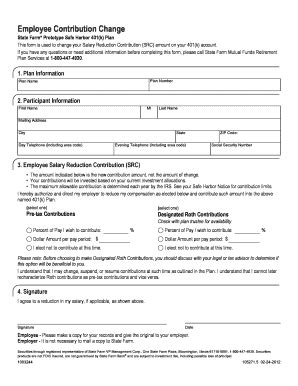

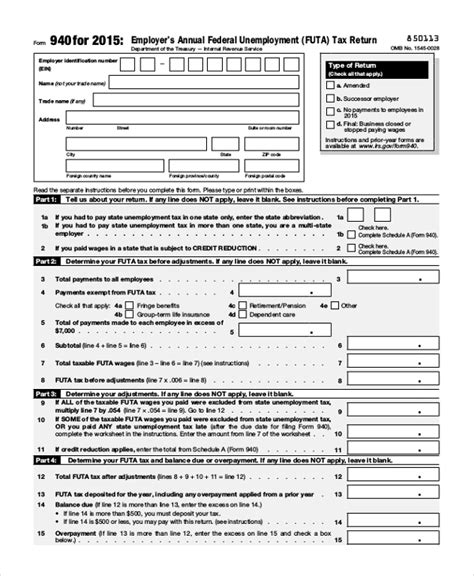

Income-Related Documents

Next, you will need to gather documents that prove your income. These may include:

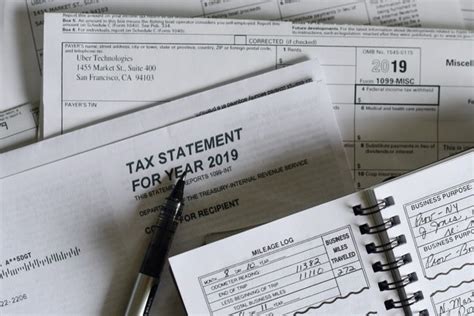

- W-2 forms from your employer(s), showing your income and taxes withheld.

- 1099 forms for freelance work, contract labor, or self-employment income.

- Interest statements from banks and investments (1099-INT).

- Dividend statements from investments (1099-DIV).

- Capital gains statements from the sale of assets (1099-B).

Deductions and Credits

Deductions and credits can significantly reduce your tax liability. Common documents needed for deductions and credits include:

- Receipts for charitable donations.

- Medical expense receipts, including prescriptions, doctor visits, and hospital stays.

- Mortgage interest statements (1098) for homeowners.

- Property tax statements for homeowners.

- Child care expense receipts for the Child and Dependent Care Credit.

- Education expense receipts for the Education Credits.

Dependents and Household Information

If you have dependents or specific household situations, you may need additional documents:

- Birth certificates for dependents.

- Adoption papers if you adopted a child during the tax year.

- Divorce or separation agreements if they impact your filing status or dependents.

- Alimony payment records if you pay or receive alimony.

Tax Filing Status

Your filing status affects your tax rates and the credits you are eligible for. Common filing statuses include:

- Single

- Married Filing Jointly

- Married Filing Separately

- Head of Household

- Qualifying Widow(er)

Previous Year’s Tax Return

Having a copy of your previous year’s tax return can be helpful for several reasons:

- Reference for carryover deductions or credits.

- Audit purposes, in case you are audited.

- Tracking changes in income or deductions from year to year.

📝 Note: Keeping all tax-related documents organized and easily accessible can simplify the tax filing process and reduce stress.

Conclusion and Final Thoughts

In conclusion, gathering all the necessary paperwork is a critical step in filing your taxes. By understanding what documents are required and keeping them well-organized, you can navigate the tax filing process more efficiently. Remember, accuracy and completeness are key to avoiding delays or potential audits. Take your time, and if necessary, consult with a tax professional to ensure you are taking full advantage of all deductions and credits available to you.

What is the deadline for filing taxes?

+

The deadline for filing taxes typically falls on April 15th of each year, but it can vary if this date falls on a weekend or a federal holiday.

Can I file my taxes electronically?

+

Yes, you can file your taxes electronically through the IRS website or through tax preparation software. Electronic filing is faster, more accurate, and provides quicker refunds.

What if I need an extension on my tax filing?

+

If you need more time to file your taxes, you can request an automatic six-month extension by filing Form 4868. This gives you until October 15th to file your return, but you must still pay any estimated tax due by the original deadline to avoid penalties.