W4 Allowances Explained

Understanding W4 Allowances

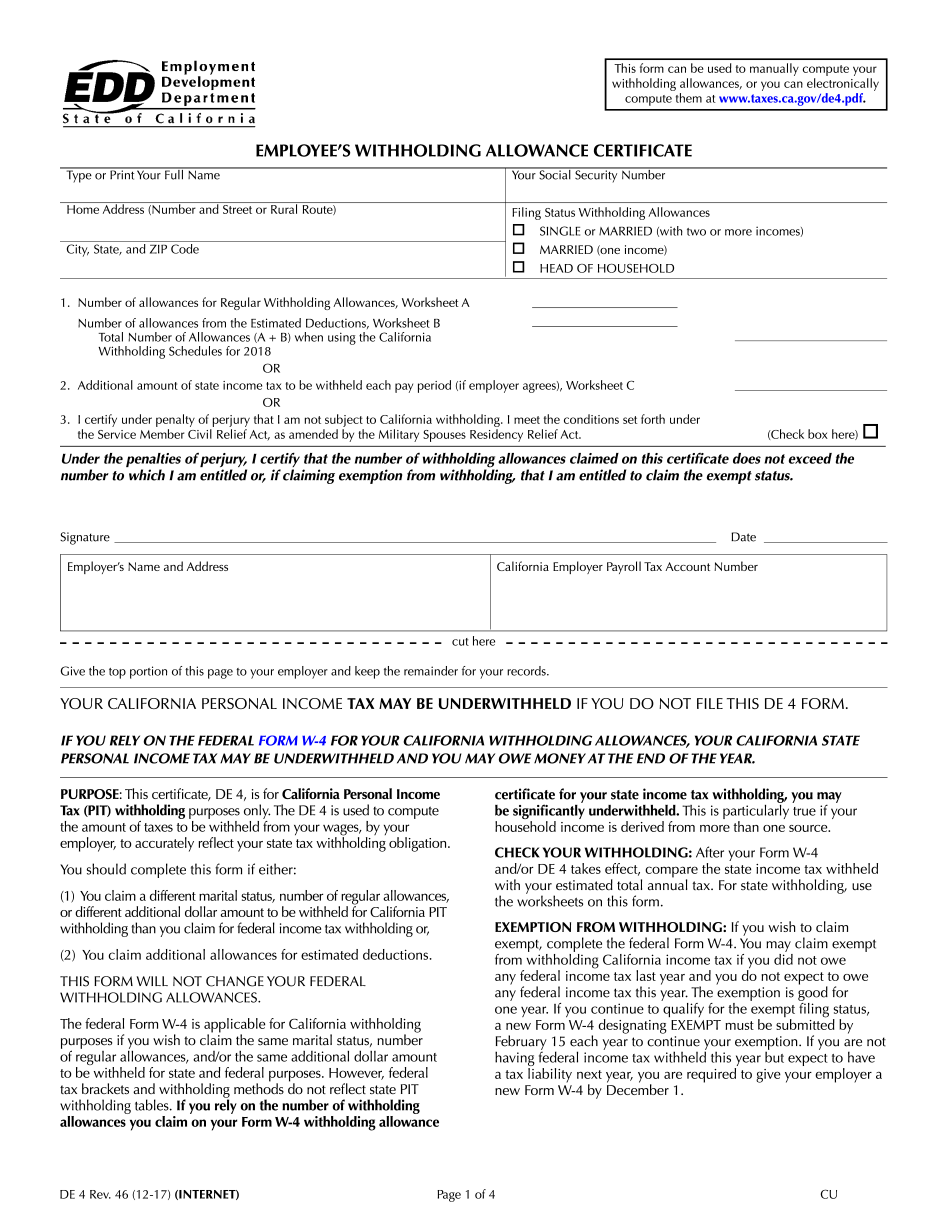

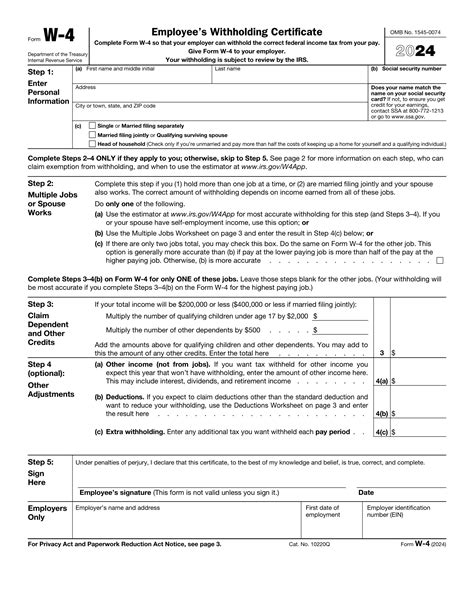

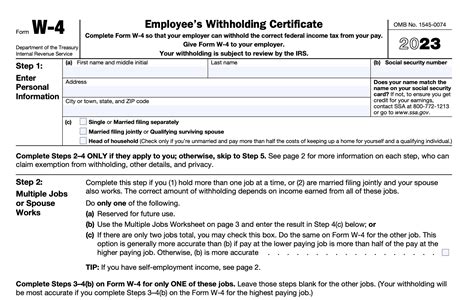

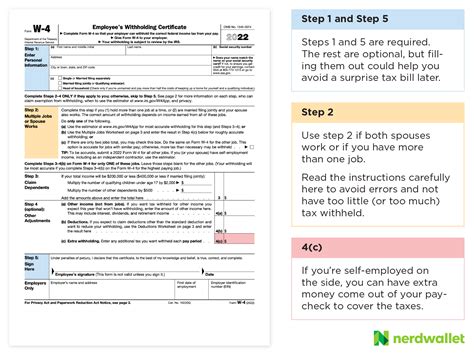

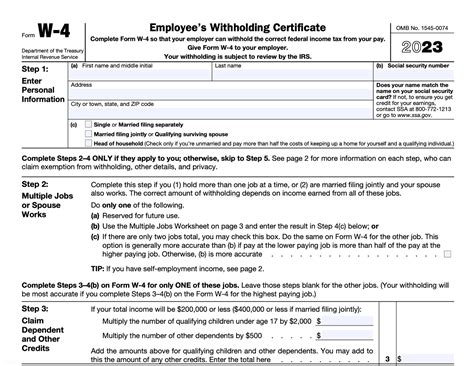

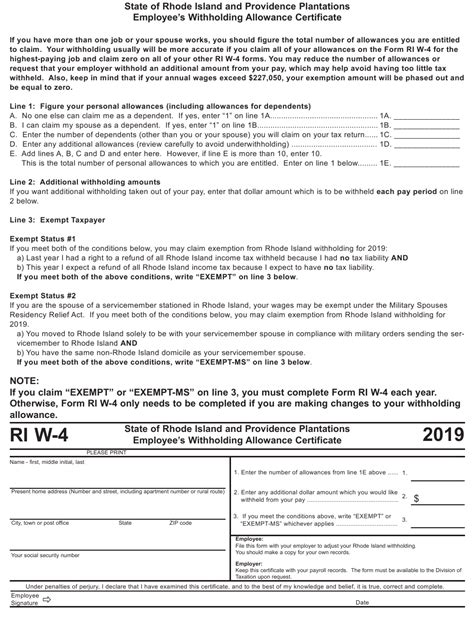

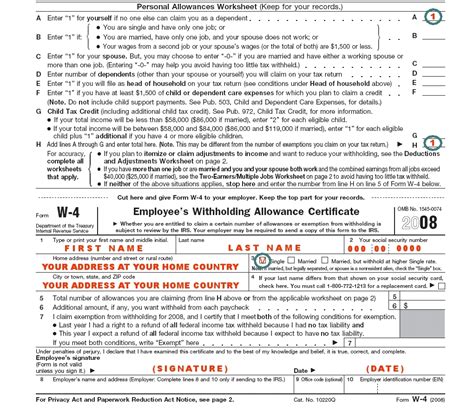

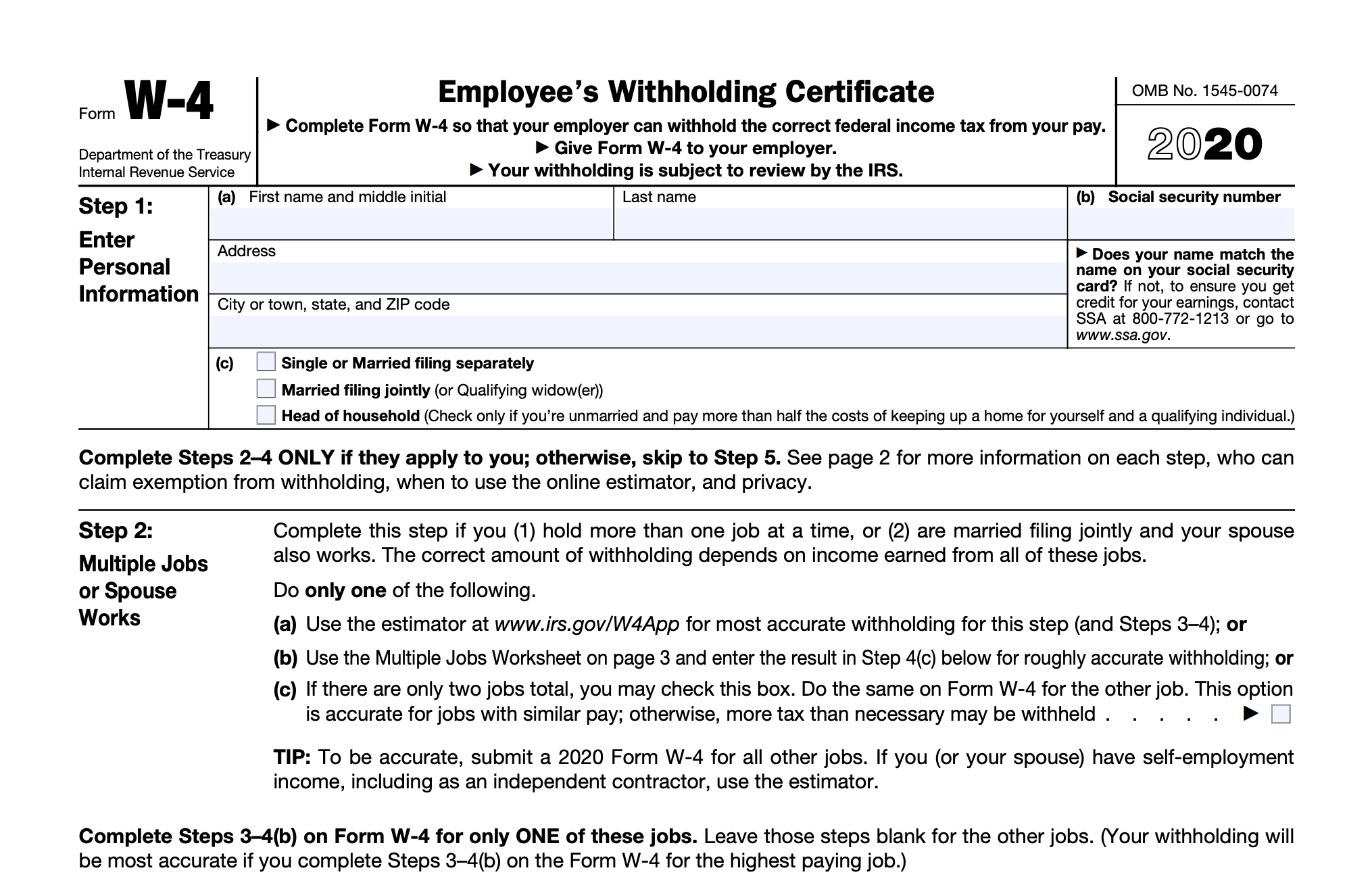

When it comes to taxes, one of the most important forms you’ll encounter is the W-4 form. The W-4 form, also known as the Employee’s Withholding Certificate, is used by employers to determine the amount of federal income tax to withhold from an employee’s paycheck. One of the key components of the W-4 form is the concept of allowances. In this article, we’ll delve into the world of W4 allowances, exploring what they are, how they work, and why they’re essential for ensuring you’re not overpaying or underpaying your taxes.

What are W4 Allowances?

W4 allowances are exemptions that reduce the amount of income subject to federal income tax. The more allowances you claim, the less tax will be withheld from your paycheck. Conversely, the fewer allowances you claim, the more tax will be withheld. Allowances are based on the number of dependents you have, your filing status, and other factors that affect your tax liability. Claiming the correct number of allowances is crucial to avoid overpaying or underpaying your taxes.

How do W4 Allowances Work?

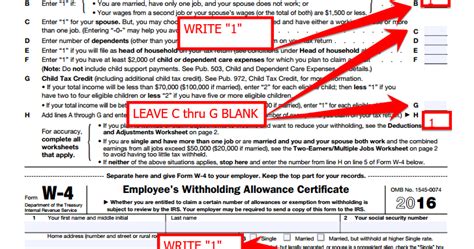

When you start a new job, you’ll typically be asked to complete a W-4 form. On this form, you’ll be asked to claim a certain number of allowances. The number of allowances you claim will depend on your individual circumstances. For example: * If you’re single and have no dependents, you may claim one allowance. * If you’re married and have two dependents, you may claim three allowances. * If you’re single and have one dependent, you may claim two allowances. The number of allowances you claim will affect the amount of tax withheld from your paycheck. The more allowances you claim, the less tax will be withheld.

Factors that Affect W4 Allowances

Several factors can affect the number of allowances you’re eligible to claim. These include: * Filing status: Your filing status (single, married, head of household, etc.) can impact the number of allowances you’re eligible to claim. * Number of dependents: The number of dependents you have can increase the number of allowances you’re eligible to claim. * Other income: If you have other sources of income, such as a side job or investments, you may need to adjust your allowances accordingly. * Tax credits: If you’re eligible for tax credits, such as the Earned Income Tax Credit (EITC), you may need to adjust your allowances.

Calculating W4 Allowances

Calculating W4 allowances can be complex, but there are several tools and resources available to help. The IRS provides a Withholding Calculator that can help you determine the correct number of allowances to claim. You can also use the W-4 worksheet provided with the W-4 form to estimate your allowances. It’s essential to carefully review your individual circumstances and adjust your allowances accordingly.

Consequences of Incorrect W4 Allowances

Claiming the incorrect number of allowances can have significant consequences. If you claim too few allowances, you may end up owing taxes when you file your tax return. On the other hand, if you claim too many allowances, you may end up with a large refund, but you’ll also have missed out on the opportunity to receive that money throughout the year. It’s essential to carefully review your allowances and adjust them as needed to avoid any unexpected tax bills or missed opportunities.

Updating W4 Allowances

Your allowances may change throughout the year due to changes in your individual circumstances. For example, if you get married or have a child, you may need to update your allowances. You can update your allowances by submitting a new W-4 form to your employer. It’s essential to review your allowances regularly to ensure you’re not overpaying or underpaying your taxes.

📝 Note: It's essential to keep your W-4 form up to date to avoid any unexpected tax bills or missed opportunities.

W4 Allowances and Tax Planning

W4 allowances play a critical role in tax planning. By claiming the correct number of allowances, you can minimize your tax liability and maximize your refund. It’s essential to consider your overall tax strategy when determining your allowances. You may want to consult with a tax professional to ensure you’re taking advantage of all the allowances and credits available to you.

| Filing Status | Number of Dependents | Allowances |

|---|---|---|

| Single | 0 | 1 |

| Married | 2 | 3 |

| Head of Household | 1 | 2 |

In summary, W4 allowances are a critical component of the tax withholding process. By understanding how allowances work and claiming the correct number, you can minimize your tax liability and maximize your refund. It’s essential to review your allowances regularly and update them as needed to ensure you’re not overpaying or underpaying your taxes.

As we wrap up our discussion on W4 allowances, it’s clear that this topic is complex and multifaceted. By taking the time to understand how allowances work and claiming the correct number, you can take control of your tax strategy and ensure you’re not leaving any money on the table.

What is a W4 allowance?

+

A W4 allowance is an exemption that reduces the amount of income subject to federal income tax.

How do I calculate my W4 allowances?

+

You can use the IRS Withholding Calculator or the W-4 worksheet to estimate your allowances.

What happens if I claim too few allowances?

+

If you claim too few allowances, you may end up owing taxes when you file your tax return.