Paperwork

7 Bankruptcy Discharge Tips

Introduction to Bankruptcy Discharge

Receiving a bankruptcy discharge is a significant step towards achieving financial freedom. It marks the end of a long and often challenging process, providing individuals with a fresh start. Understanding the intricacies of bankruptcy discharge is crucial for those navigating this complex legal landscape. In this article, we will delve into the world of bankruptcy discharge, exploring seven essential tips that can guide individuals through this process.

Understanding Bankruptcy Discharge

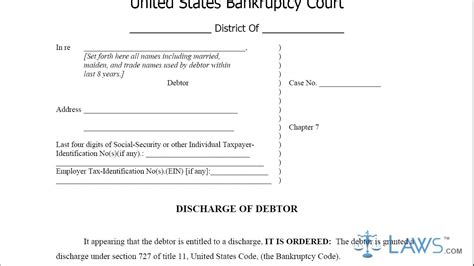

Before diving into the tips, it’s essential to understand what bankruptcy discharge means. Bankruptcy discharge refers to the legal elimination of debt, freeing the debtor from their obligation to repay certain debts. This concept is central to the bankruptcy process, offering debtors a way to manage their financial obligations and start anew. There are different types of bankruptcy, with Chapter 7 and Chapter 13 being the most common for individuals. Each has its own rules regarding discharge.

Tip 1: Choose the Right Type of Bankruptcy

Choosing between Chapter 7 and Chapter 13 bankruptcy is a critical decision. Chapter 7 bankruptcy involves the liquidation of assets to pay off creditors, with many debts being discharged. On the other hand, Chapter 13 bankruptcy involves creating a repayment plan to pay off a portion of debts over time, with the remaining balance discharged upon completion of the plan. The choice between these two should be based on the individual’s financial situation, the types of debt they have, and their long-term financial goals.

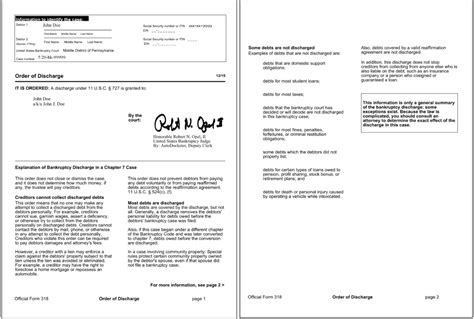

Tip 2: Understand Which Debts Are Dischargeable

Not all debts can be discharged in bankruptcy. Non-dischargeable debts include certain taxes, student loans, child support, and alimony. Dischargeable debts, on the other hand, typically include credit card debt, medical bills, and personal loans. Understanding which of your debts can be discharged is vital for managing expectations and making informed decisions throughout the bankruptcy process.

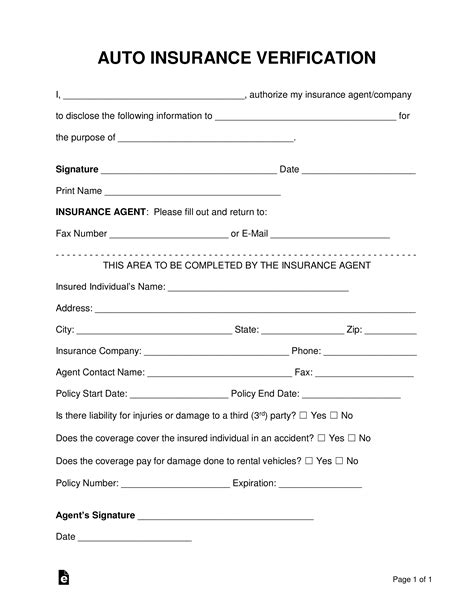

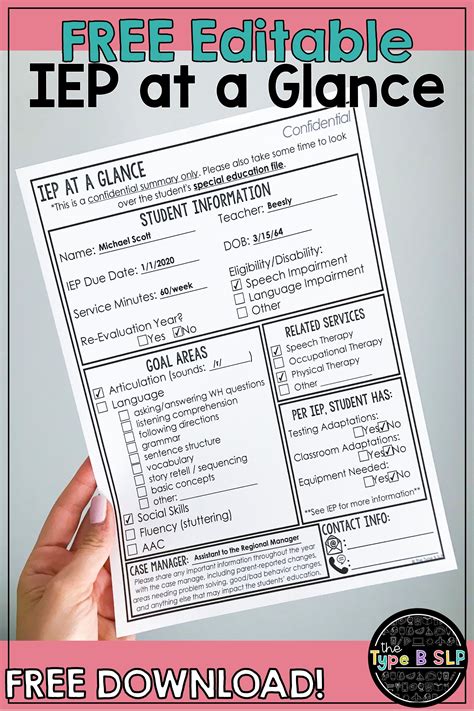

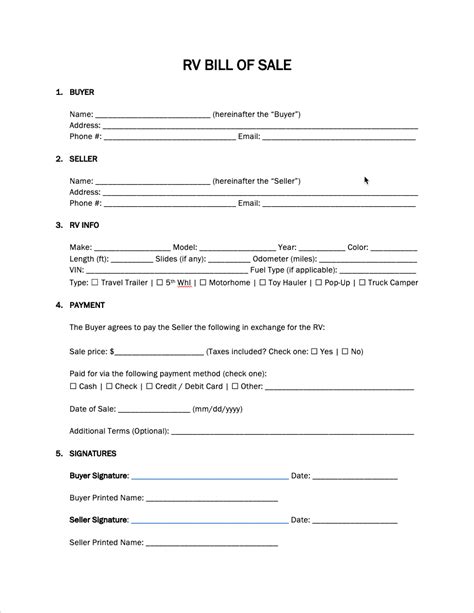

Tip 3: Keep Accurate Financial Records

Maintaining accurate and detailed financial records is essential. This includes income statements, expense reports, debt lists, and any communication with creditors. These records will be crucial when filing for bankruptcy, as they provide a clear picture of your financial situation. They can also help in identifying which debts are dischargeable and in creating a realistic repayment plan if opting for Chapter 13.

Tip 4: Avoid Pre-Bankruptcy Credit Spree

Some individuals might be tempted to go on a spending spree before filing for bankruptcy, thinking they can discharge these new debts. However, this can lead to serious legal consequences. Bankruptcy fraud, including incurring debt with no intention of repaying it, is a federal crime. It’s crucial to act in good faith and avoid accumulating new debt in the months leading up to a bankruptcy filing.

Tip 5: Be Aware of the Automatic Stay

Upon filing for bankruptcy, an automatic stay goes into effect. This provision of the bankruptcy code immediately stops most collection activities, including lawsuits, wage garnishments, and even foreclosure proceedings. While the automatic stay provides temporary relief, it’s essential to understand its limitations and the fact that it’s not a permanent solution to debt problems.

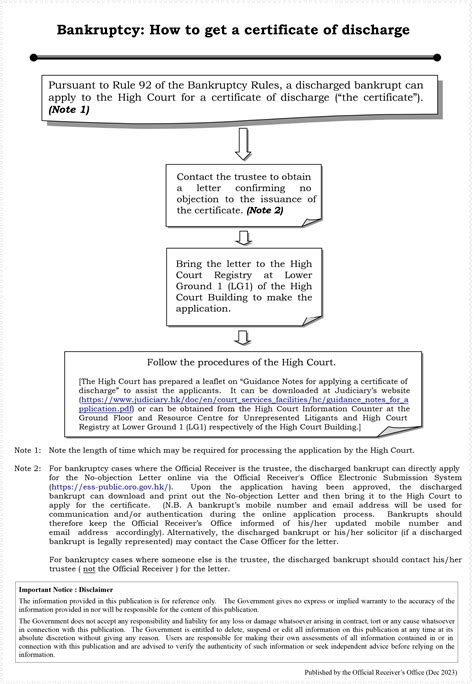

Tip 6: Complete the Mandatory Credit Counseling

As part of the bankruptcy process, individuals are required to complete credit counseling before filing and a debtor education course after filing. These programs are designed to help individuals understand their financial situation, manage their finances more effectively, and make informed decisions about their debt. Completing these courses is mandatory for receiving a discharge.

Tip 7: Seek Professional Advice

Navigating the bankruptcy process can be overwhelming. Bankruptcy attorneys and financial advisors can provide invaluable guidance, helping individuals make the best decisions for their unique financial situation. From choosing the right type of bankruptcy to ensuring all legal requirements are met, professional advice can make a significant difference in the outcome of the bankruptcy process.

💡 Note: The bankruptcy process and laws can vary significantly by jurisdiction, so it's crucial to consult with professionals who are familiar with the laws in your area.

Conclusion and Final Thoughts

Receiving a bankruptcy discharge is a significant milestone for individuals seeking to regain control of their finances. By understanding the different types of bankruptcy, knowing which debts can be discharged, keeping accurate financial records, avoiding pre-bankruptcy credit sprees, being aware of the automatic stay, completing mandatory credit counseling, and seeking professional advice, individuals can navigate the bankruptcy process more effectively. Each situation is unique, and the path to financial recovery will vary from person to person. However, with the right approach and support, achieving a bankruptcy discharge can be the first step towards a brighter financial future.

What is the main difference between Chapter 7 and Chapter 13 bankruptcy?

+

The main difference between Chapter 7 and Chapter 13 bankruptcy is that Chapter 7 involves the liquidation of assets to pay off debts, while Chapter 13 involves creating a repayment plan to pay off a portion of debts over time.

Which debts are typically not dischargeable in bankruptcy?

+

Debts that are typically not dischargeable in bankruptcy include certain taxes, student loans, child support, and alimony.

Why is it important to keep accurate financial records during the bankruptcy process?

+

Keeping accurate financial records is crucial for providing a clear picture of your financial situation, identifying dischargeable debts, and creating a realistic repayment plan if necessary.