Paperwork

Hire Independent Contractor Paperwork Needed

Introduction to Hiring Independent Contractors

When a business decides to hire an independent contractor, it’s essential to understand the legal and financial implications of this decision. Independent contractors are not employees, and as such, they are not entitled to the same benefits and rights as employees. However, this also means that businesses have different obligations towards independent contractors. In this article, we will explore the necessary paperwork and steps involved in hiring an independent contractor.

Understanding Independent Contractors

Before we dive into the paperwork, let’s define what an independent contractor is. An independent contractor is an individual or business that provides services to another business or individual on a contract basis. They are not employees and are responsible for their own taxes, benefits, and work schedule. Independent contractors can include freelancers, consultants, and independent businesses.

Necessary Paperwork for Hiring Independent Contractors

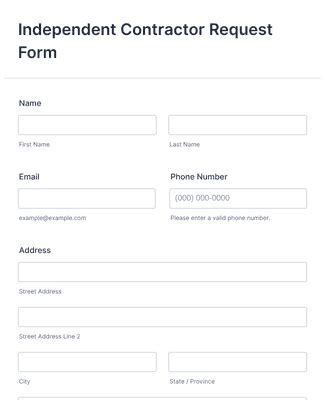

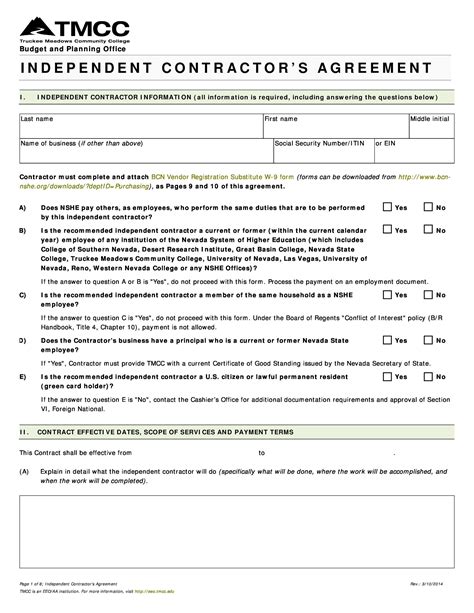

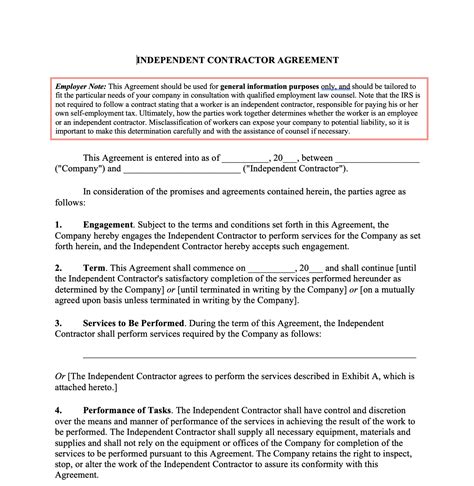

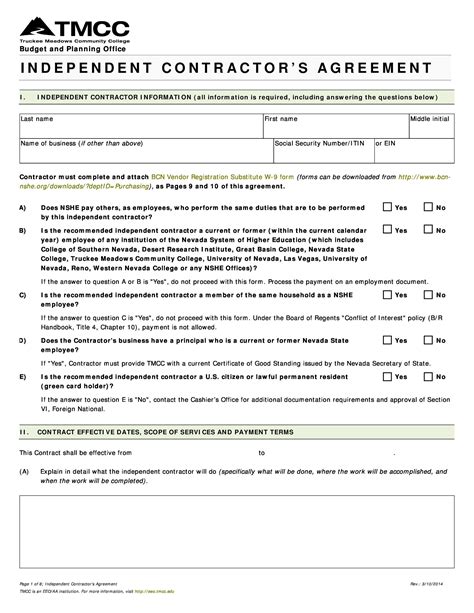

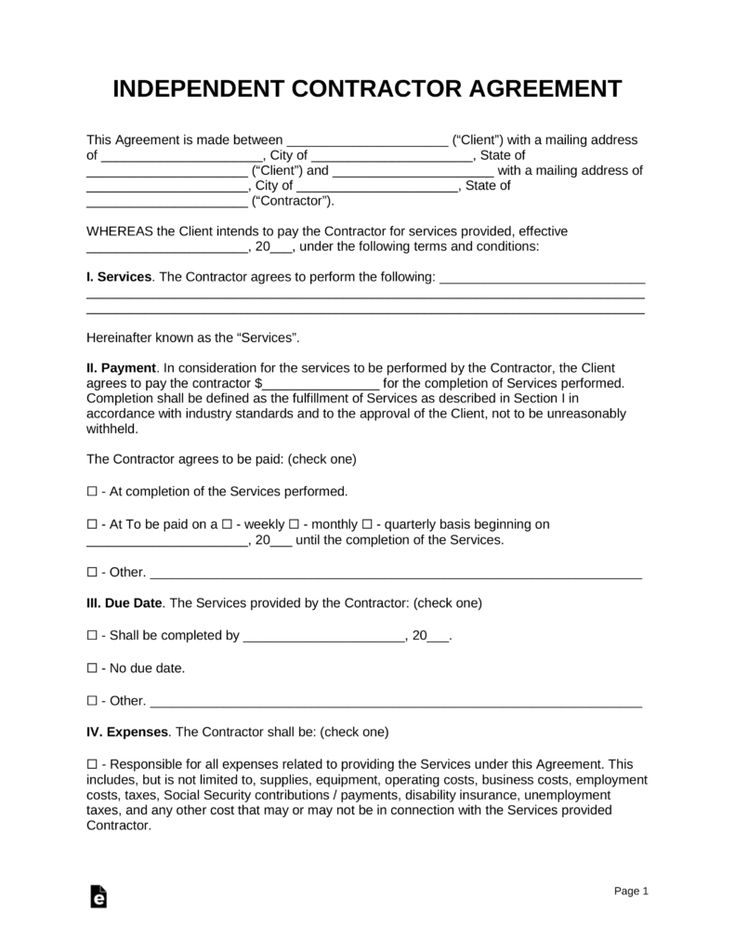

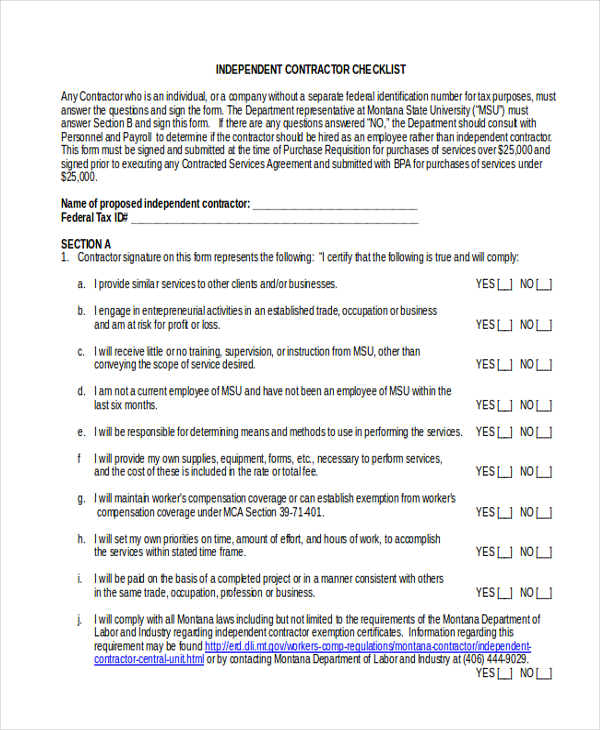

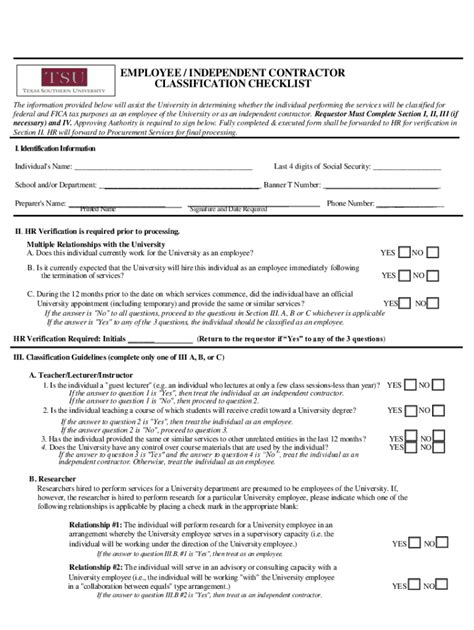

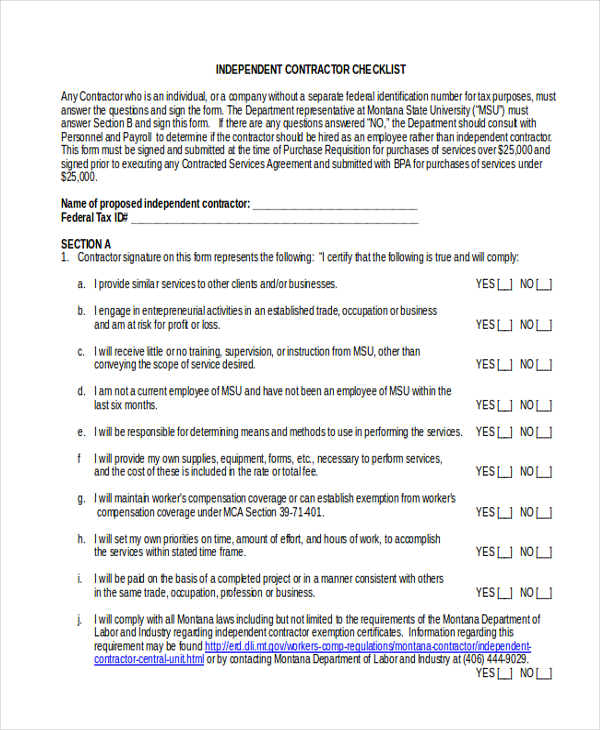

When hiring an independent contractor, there are several documents that need to be completed and signed. These documents help to establish the terms of the contract, the scope of work, and the payment terms. The necessary paperwork includes: * Independent Contractor Agreement: This is a contract between the business and the independent contractor that outlines the terms of the agreement, including the scope of work, payment terms, and duration of the contract. * W-9 Form: This form is used to verify the independent contractor’s identity and tax identification number. * Invoice Template: This is a template that the independent contractor will use to submit invoices for payment. * Contractor Questionnaire: This is a questionnaire that helps to gather information about the independent contractor, including their business structure, tax identification number, and payment terms.

Benefits of Hiring Independent Contractors

There are several benefits to hiring independent contractors, including: * Cost savings: Independent contractors are responsible for their own benefits, taxes, and work equipment, which can save businesses money. * Flexibility: Independent contractors can be hired on a project-by-project basis, which allows businesses to scale up or down as needed. * Access to specialized skills: Independent contractors can bring specialized skills and expertise to a project, which can be beneficial for businesses that don’t have the resources or expertise in-house.

Challenges of Hiring Independent Contractors

While there are benefits to hiring independent contractors, there are also challenges to consider. These include: * Liability concerns: Businesses may be liable for the actions of independent contractors, which can be a concern. * Tax implications: Businesses need to understand the tax implications of hiring independent contractors, including the need to issue 1099 forms. * Communication challenges: Independent contractors may work remotely, which can make communication and collaboration challenging.

Best Practices for Hiring Independent Contractors

To ensure a successful working relationship with independent contractors, businesses should follow these best practices: * Clearly define the scope of work: Make sure the independent contractor understands what is expected of them and what the deliverables are. * Establish a communication plan: Regular communication is essential for ensuring that the independent contractor is on track and that any issues are addressed quickly. * Set clear payment terms: Make sure the independent contractor understands when and how they will be paid.

📝 Note: Businesses should also ensure that they are complying with all relevant laws and regulations when hiring independent contractors, including tax laws and labor laws.

Conclusion and Next Steps

In conclusion, hiring independent contractors can be a great way for businesses to access specialized skills and expertise while saving money. However, it’s essential to understand the necessary paperwork and steps involved in hiring independent contractors. By following the best practices outlined in this article, businesses can ensure a successful working relationship with independent contractors. To summarize, the key points to consider when hiring independent contractors include understanding the necessary paperwork, benefits, and challenges, as well as following best practices for communication and payment.

What is the difference between an independent contractor and an employee?

+

An independent contractor is an individual or business that provides services to another business or individual on a contract basis, whereas an employee is an individual who works for a business or organization and is entitled to benefits and rights.

What paperwork is required when hiring an independent contractor?

+

The necessary paperwork includes an independent contractor agreement, W-9 form, invoice template, and contractor questionnaire.

What are the benefits of hiring independent contractors?

+

The benefits of hiring independent contractors include cost savings, flexibility, and access to specialized skills.