5 Docs to Refinance Car

Refinancing Your Car: A Comprehensive Guide

When it comes to refinancing your car, it’s essential to understand the process and the documents required to complete the transaction. Refinancing your car can help you save money on interest, lower your monthly payments, or remove a co-signer from the original loan. In this article, we will discuss the five primary documents you need to refinance your car and provide a step-by-step guide on how to refinance your vehicle.

Understanding the Refinancing Process

Before we dive into the required documents, let’s take a look at the refinancing process. Refinancing your car involves replacing your existing loan with a new one, usually with a lower interest rate or better terms. This can be done by applying for a new loan through a bank, credit union, or online lender. The lender will review your creditworthiness, income, and other factors to determine the interest rate and terms of the new loan.

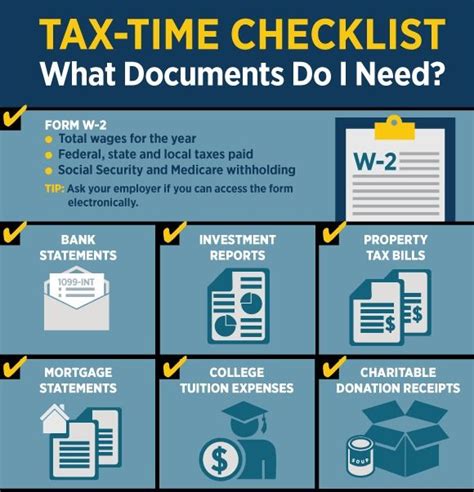

5 Essential Documents to Refinance Your Car

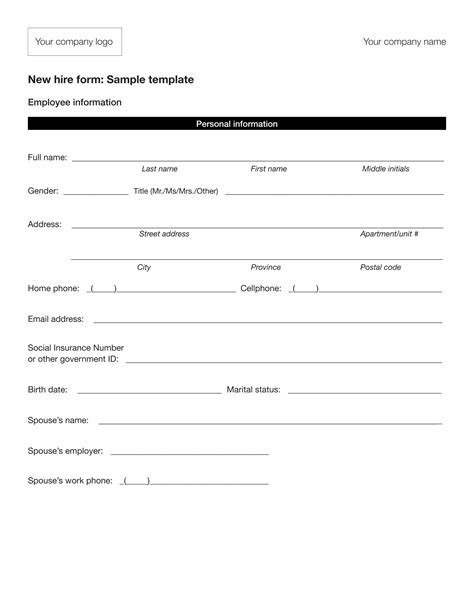

To refinance your car, you will need to provide the following documents: * Vehicle Title: The title of your vehicle, which proves ownership and is required to secure the new loan. * Current Loan Information: Details about your current loan, including the lender, loan balance, and interest rate. * Identification: A valid government-issued ID, such as a driver’s license or passport, to verify your identity. * Income Verification: Proof of income, such as pay stubs or tax returns, to demonstrate your ability to repay the loan. * Credit Report: A copy of your credit report, which will be used to determine your creditworthiness and interest rate.

Additional Requirements

In addition to the above documents, you may need to provide other information or paperwork, such as: * Insurance Information: Proof of insurance, which is required to protect the lender’s interest in the vehicle. * Vehicle Inspection: A vehicle inspection report, which may be required by the lender to assess the condition and value of the vehicle. * Co-Signer Information: If you have a co-signer on the original loan, you may need to provide their information and signature on the new loan documents.

💡 Note: The specific documents required may vary depending on the lender and your individual circumstances. Be sure to check with the lender for their specific requirements.

Step-by-Step Guide to Refinancing Your Car

Now that we’ve covered the required documents, let’s walk through the step-by-step process of refinancing your car: 1. Check your credit score and history to ensure you’re eligible for refinancing. 2. Gather the required documents and information. 3. Research and compare lenders to find the best interest rates and terms. 4. Apply for the new loan and provide the required documents. 5. Review and sign the loan agreement. 6. Pay off the existing loan with the new loan funds.

Tips and Considerations

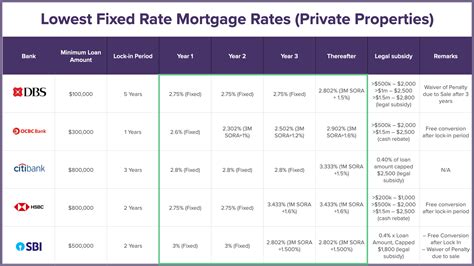

Before refinancing your car, consider the following tips and factors: * Interest Rates: Compare interest rates and terms from multiple lenders to ensure you’re getting the best deal. * Fees and Charges: Check for any fees or charges associated with the new loan, such as origination fees or prepayment penalties. * Loan Term: Consider the loan term and whether it aligns with your financial goals and budget. * Credit Score: Your credit score can significantly impact the interest rate and terms of the new loan. Work on improving your credit score before applying for refinancing.

| Document | Description |

|---|---|

| Vehicle Title | Proves ownership and secures the new loan |

| Current Loan Information | Details about the existing loan |

| Identification | Verifies identity |

| Income Verification | Demonstrates ability to repay the loan |

| Credit Report | Determines creditworthiness and interest rate |

In summary, refinancing your car can be a great way to save money or improve your financial situation. By understanding the required documents and following the step-by-step guide, you can navigate the refinancing process with confidence. Remember to carefully review the terms and conditions of the new loan and consider factors such as interest rates, fees, and loan term to ensure you’re making the best decision for your financial future.

What are the benefits of refinancing my car?

+

The benefits of refinancing your car include saving money on interest, lowering your monthly payments, or removing a co-signer from the original loan.

What is the difference between refinancing and trading in my car?

+

Refinancing your car involves replacing your existing loan with a new one, while trading in your car involves selling your current vehicle and purchasing a new one. Refinancing can be a more cost-effective option, but it depends on your individual circumstances.

How long does the refinancing process take?

+

The refinancing process typically takes a few days to a few weeks, depending on the lender and the complexity of the transaction. Be sure to check with the lender for their specific timeline and requirements.