Mortgage Application Paperwork Needed

Introduction to Mortgage Application Process

The mortgage application process can be a daunting task, especially for first-time homebuyers. One of the most critical aspects of this process is gathering the necessary paperwork. Mortgage lenders require a significant amount of documentation to verify an applicant’s creditworthiness and ability to repay the loan. In this article, we will outline the typical paperwork needed for a mortgage application, providing readers with a comprehensive guide to navigate this complex process.

Understanding the Mortgage Application Paperwork

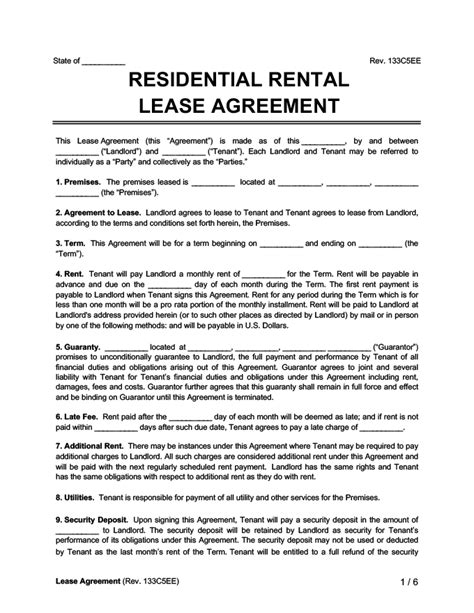

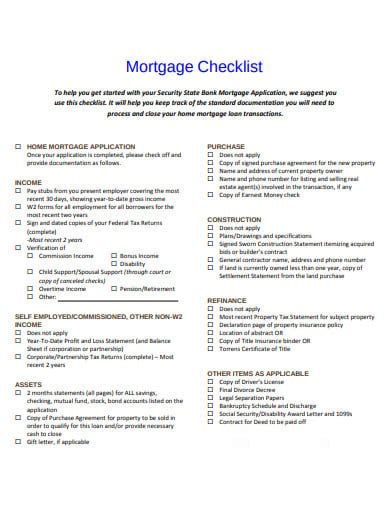

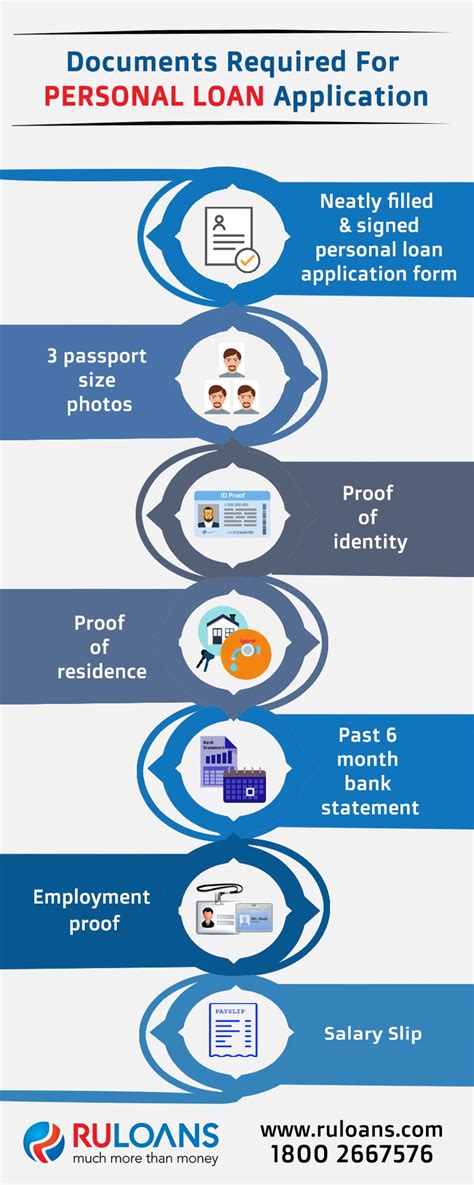

When applying for a mortgage, lenders will typically request a variety of documents to assess an applicant’s financial situation. These documents can be broadly categorized into several groups, including: * Identification documents: These include government-issued IDs, such as a driver’s license or passport, and social security cards. * Income documents: Pay stubs, W-2 forms, and tax returns are used to verify an applicant’s income and employment history. * Credit documents: Credit reports and scores are used to evaluate an applicant’s creditworthiness. * Asset documents: Bank statements, investment accounts, and retirement accounts are used to verify an applicant’s assets and savings. * Property documents: The property’s address, value, and any outstanding liens or mortgages must be disclosed.

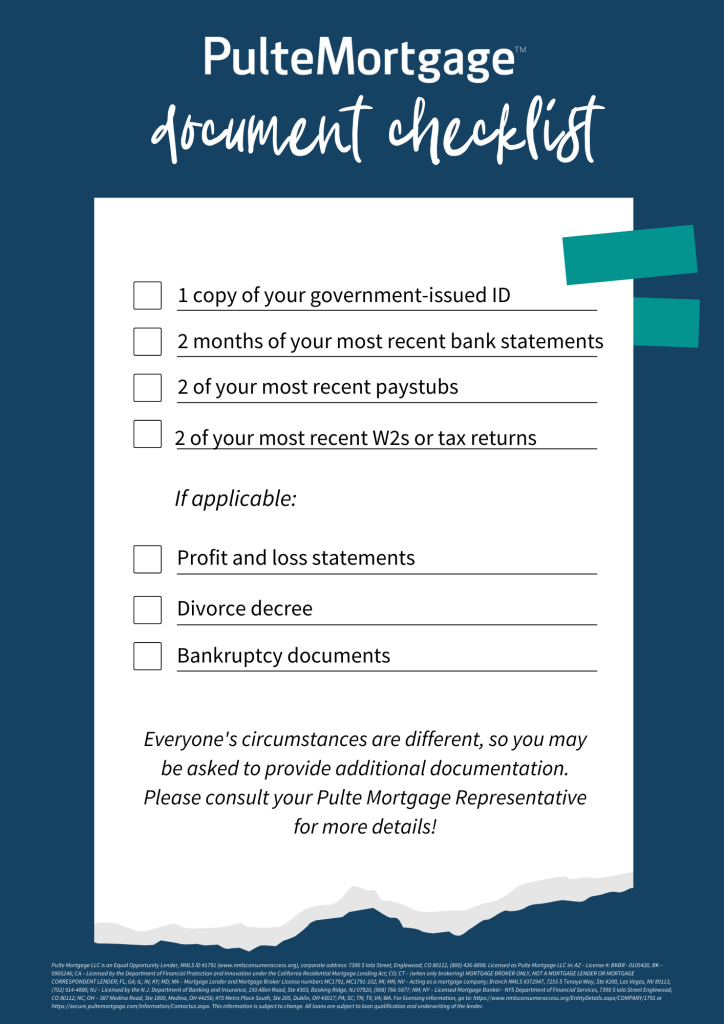

Breakdown of Required Documents

Here is a more detailed list of the paperwork typically required for a mortgage application: * Identification documents: + Driver’s license or state ID + Passport + Social security card * Income documents: + Pay stubs (most recent 30 days) + W-2 forms (previous 2 years) + Tax returns (previous 2 years) + Letter from employer confirming employment and income * Credit documents: + Credit report + Credit score * Asset documents: + Bank statements (most recent 60 days) + Investment account statements + Retirement account statements * Property documents: + Property address + Property value (appraisal or assessment) + Outstanding liens or mortgages

Additional Requirements for Self-Employed Individuals

Self-employed individuals may need to provide additional documentation, such as: * Business tax returns (previous 2 years) * Business financial statements (balance sheet and income statement) * Letter from accountant or CPA confirming business income and expenses

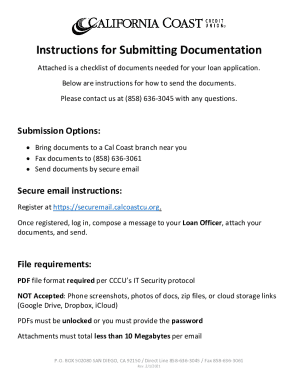

Importance of Organizing Paperwork

It is essential to organize the required paperwork in a logical and accessible manner. This will help the lender to efficiently review the application and reduce the risk of delays or errors. Applicants should consider creating a folder or digital file with the following structure:

| Category | Documents |

|---|---|

| Identification | Driver’s license, passport, social security card |

| Income | Pay stubs, W-2 forms, tax returns |

| Credit | Credit report, credit score |

| Assets | Bank statements, investment account statements, retirement account statements |

| Property | Property address, property value, outstanding liens or mortgages |

📝 Note: It is crucial to ensure that all documents are up-to-date and accurate, as any discrepancies may lead to delays or even rejection of the mortgage application.

Finalizing the Mortgage Application

Once all the required paperwork has been gathered and organized, the applicant can submit the mortgage application. The lender will review the application and may request additional documentation or clarification on certain aspects. After the application has been approved, the applicant will receive a loan estimate and a closing disclosure, which outline the terms of the loan and the closing costs.

To summarize the key points, the mortgage application process requires a significant amount of paperwork, including identification, income, credit, asset, and property documents. It is essential to organize these documents in a logical and accessible manner to ensure a smooth and efficient application process. By understanding the required paperwork and being prepared, applicants can increase their chances of a successful mortgage application. The importance of accuracy and attention to detail cannot be overstated, as any errors or discrepancies may lead to delays or even rejection of the application. By following these guidelines and being diligent in the application process, individuals can navigate the complex world of mortgage applications with confidence.

What is the typical timeframe for a mortgage application process?

+

The typical timeframe for a mortgage application process can vary depending on several factors, including the complexity of the application and the efficiency of the lender. However, on average, it can take anywhere from 30 to 60 days to complete the process.

What are the most common reasons for mortgage application rejection?

+

The most common reasons for mortgage application rejection include poor credit history, high debt-to-income ratio, insufficient income or assets, and incomplete or inaccurate documentation.

Can I apply for a mortgage online?

+

Yes, many lenders offer online mortgage applications, which can be a convenient and efficient way to apply for a mortgage. However, it is essential to ensure that the lender is reputable and that the application process is secure.