Paperwork

Retirement Paperwork at 62

Introduction to Retirement at 62

When approaching the age of 62, many individuals begin to consider their options for retirement. This age is significant because it marks the earliest point at which one can start receiving Social Security retirement benefits. However, the decision to retire at 62 involves careful consideration of several factors, including financial readiness, health status, and personal goals. One crucial aspect of preparing for retirement at this age is understanding and navigating the necessary paperwork.

Understanding Social Security Benefits

At the heart of retirement planning for most Americans is Social Security. The Social Security Administration (SSA) provides benefits to eligible retirees, and the age at which one chooses to start receiving these benefits can significantly impact the amount of money received over a lifetime. For those considering retirement at 62, it’s essential to understand that taking benefits early results in a permanent reduction in monthly benefits compared to waiting until full retirement age or later.

Required Paperwork for Social Security Benefits

To apply for Social Security benefits, individuals will need to gather and submit specific documents. The primary paperwork includes: - Birth certificate: To verify age. - Social Security number: Typically, this is verified through a Social Security card. - Proof of citizenship: A passport or birth certificate can serve as proof. - W-2 forms or self-employment tax returns: To verify earnings. - Marriage or divorce documents: If applicable, to determine eligibility for spousal benefits.

Application Process

The application for Social Security benefits can be completed online, by phone, or in person at a local SSA office. It’s recommended to apply three months before the desired start date of benefits to ensure timely processing. The SSA website provides a detailed checklist of required documents and a step-by-step guide to the application process.

Medicare Considerations

Another critical component of retirement at 62 is Medicare, the federal health insurance program. While Medicare eligibility begins at 65, understanding how it interacts with retirement planning is vital. For those retiring before 65, alternative health insurance arrangements must be made until Medicare eligibility is reached.

Employer Retirement Plans

Many employers offer 401(k) or similar retirement plans. At 62, individuals may be eligible to withdraw from these plans without incurring the typical 10% penalty for early withdrawal, though taxes will still be owed on the withdrawal amount. Reviewing the specifics of one’s employer-sponsored plan is crucial for understanding the rules regarding withdrawals and required minimum distributions (RMDs).

Other Financial Considerations

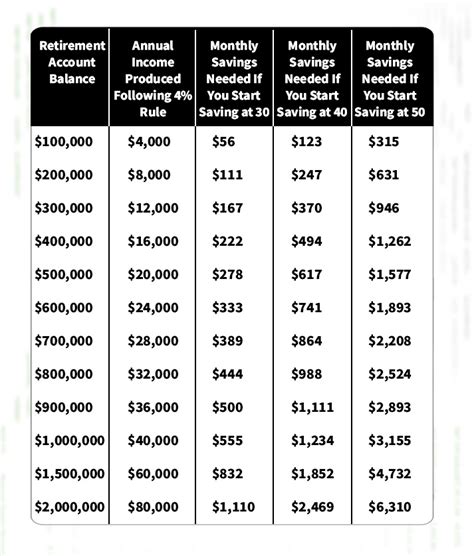

Retirement planning at 62 involves more than just navigating paperwork; it also requires a thorough review of one’s financial situation. Key considerations include: - Savings and investments: Assessing whether current savings are sufficient to support retirement goals. - Debt management: Ensuring that debt is manageable on a retirement income. - Income streams: Identifying all sources of retirement income, including pensions, part-time work, or rental properties.

Conclusion

Retiring at 62 can be a fulfilling decision for those who have carefully planned their finances and understood the implications of early retirement on their Social Security benefits and other income streams. By thoroughly reviewing the necessary paperwork, considering the impact on Social Security benefits, and assessing overall financial readiness, individuals can make informed decisions about their retirement timing. Ultimately, the key to a successful retirement at 62 or any age is preparation and a clear understanding of the financial and lifestyle implications of this significant life change.

What is the earliest age I can retire and receive Social Security benefits?

+

The earliest age you can start receiving Social Security retirement benefits is 62.

Will taking Social Security benefits at 62 reduce my monthly payments?

+

Yes, taking Social Security benefits at 62 will result in a permanent reduction in your monthly benefits compared to waiting until your full retirement age or later.

What documents do I need to apply for Social Security benefits?

+

You will need your birth certificate, Social Security number, proof of citizenship, W-2 forms or self-employment tax returns, and marriage or divorce documents if applicable.