Subcontractor Paperwork Requirements

Introduction to Subcontractor Paperwork Requirements

As a contractor, managing subcontractors is a critical aspect of any construction project. Subcontractors play a vital role in the successful completion of a project, and their paperwork requirements are essential to ensure compliance with laws, regulations, and contractual obligations. In this article, we will delve into the world of subcontractor paperwork requirements, exploring the necessary documents, forms, and certifications that subcontractors must provide to work on a project.

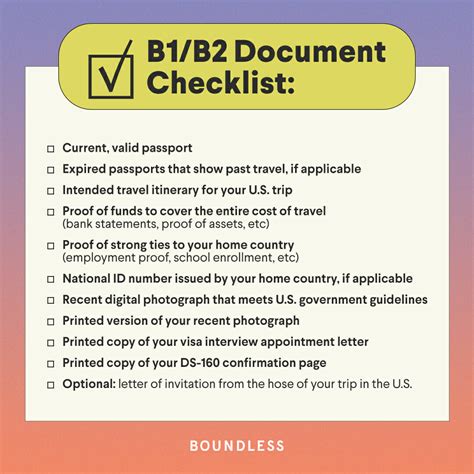

Pre-Qualification Documents

Before a subcontractor can start working on a project, they must provide pre-qualification documents to the contractor. These documents include: * Business License: A copy of the subcontractor’s business license, which proves they are authorized to operate a business in the state. * Insurance Certificates: Certificates of insurance, including liability insurance, workers’ compensation insurance, and umbrella insurance. * W-9 Form: A completed W-9 form, which provides the subcontractor’s tax identification number and other relevant information. * References: A list of references from previous clients or contractors, which can be used to verify the subcontractor’s work quality and reliability.

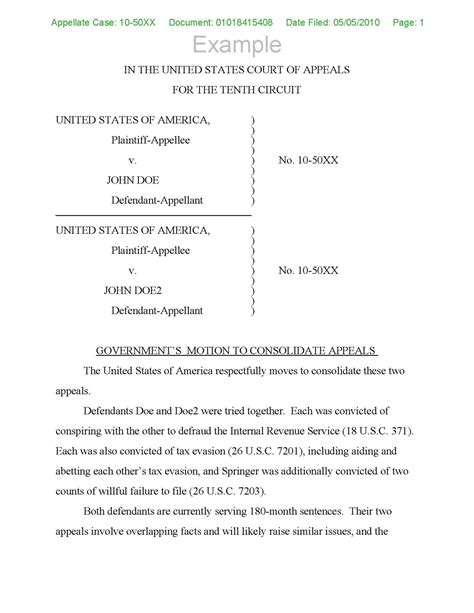

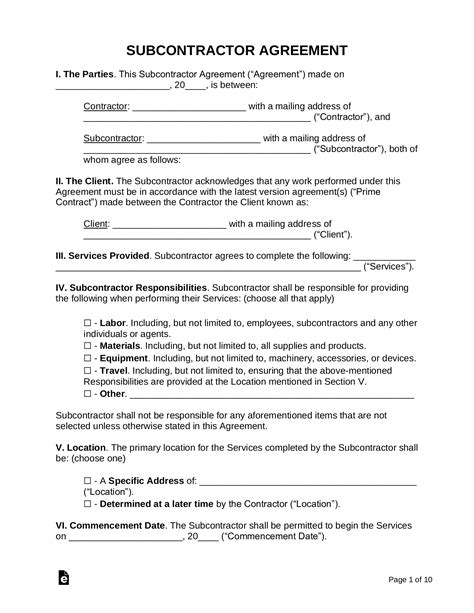

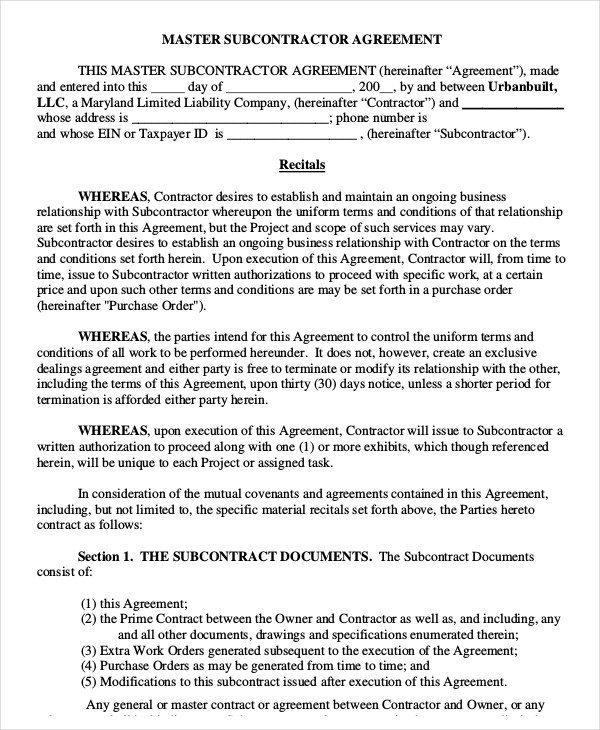

Contractual Documents

Once a subcontractor has been pre-qualified, they must sign a contract with the contractor. The contract should include: * Scope of Work: A detailed description of the work to be performed by the subcontractor. * Payment Terms: The payment terms, including the amount, method, and schedule of payments. * Completion Date: The date by which the subcontractor must complete their work. * Warranty: A warranty provision, which outlines the subcontractor’s responsibility for defects or deficiencies in their work.

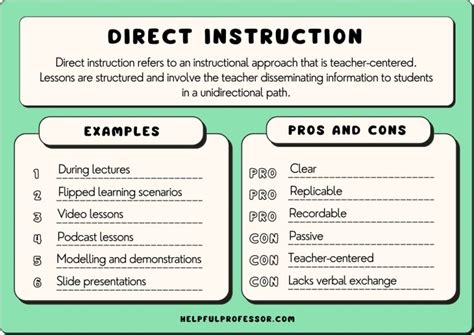

Compliance Documents

Subcontractors must also comply with various laws and regulations, including: * OSHA Regulations: Compliance with Occupational Safety and Health Administration (OSHA) regulations, including safety training and hazard reporting. * Environmental Regulations: Compliance with environmental regulations, including hazardous waste disposal and pollution prevention. * Labor Laws: Compliance with labor laws, including minimum wage, overtime, and workers’ compensation requirements.

Invoice and Payment Documents

Subcontractors must submit invoices to the contractor for payment, which should include: * Invoice Form: A standard invoice form, which includes the subcontractor’s name, address, and tax identification number. * Work Completed: A description of the work completed, including the dates and hours worked. * Payment Amount: The amount due for payment, including any deductions or withholdings.

| Document | Description |

|---|---|

| Business License | A copy of the subcontractor's business license |

| Insurance Certificates | Certificates of insurance, including liability insurance and workers' compensation insurance |

| W-9 Form | A completed W-9 form, which provides the subcontractor's tax identification number |

| Contract | A contract between the subcontractor and contractor, outlining the scope of work, payment terms, and completion date |

📝 Note: Subcontractors should ensure they have all necessary documents and certifications before starting work on a project, as failure to comply with paperwork requirements can result in delays, fines, or even termination of the contract.

To summarize, subcontractor paperwork requirements are essential to ensure compliance with laws, regulations, and contractual obligations. Contractors and subcontractors must work together to ensure all necessary documents are provided and completed accurately and on time. By doing so, they can avoid delays, disputes, and potential legal issues, and ensure a successful project completion.

What is the purpose of a W-9 form?

+

The purpose of a W-9 form is to provide the subcontractor’s tax identification number and other relevant information to the contractor, which is used for tax reporting purposes.

What are the consequences of not complying with subcontractor paperwork requirements?

+

The consequences of not complying with subcontractor paperwork requirements can include delays, fines, or even termination of the contract. It is essential for subcontractors to ensure they have all necessary documents and certifications before starting work on a project.

How often should subcontractors update their paperwork and certifications?

+

Subcontractors should update their paperwork and certifications regularly, or as required by laws and regulations. This can include annual updates to insurance certificates, business licenses, and other documents.