Paperwork

Tax Deduction Paperwork Expiration Dates

Understanding Tax Deduction Paperwork Expiration Dates

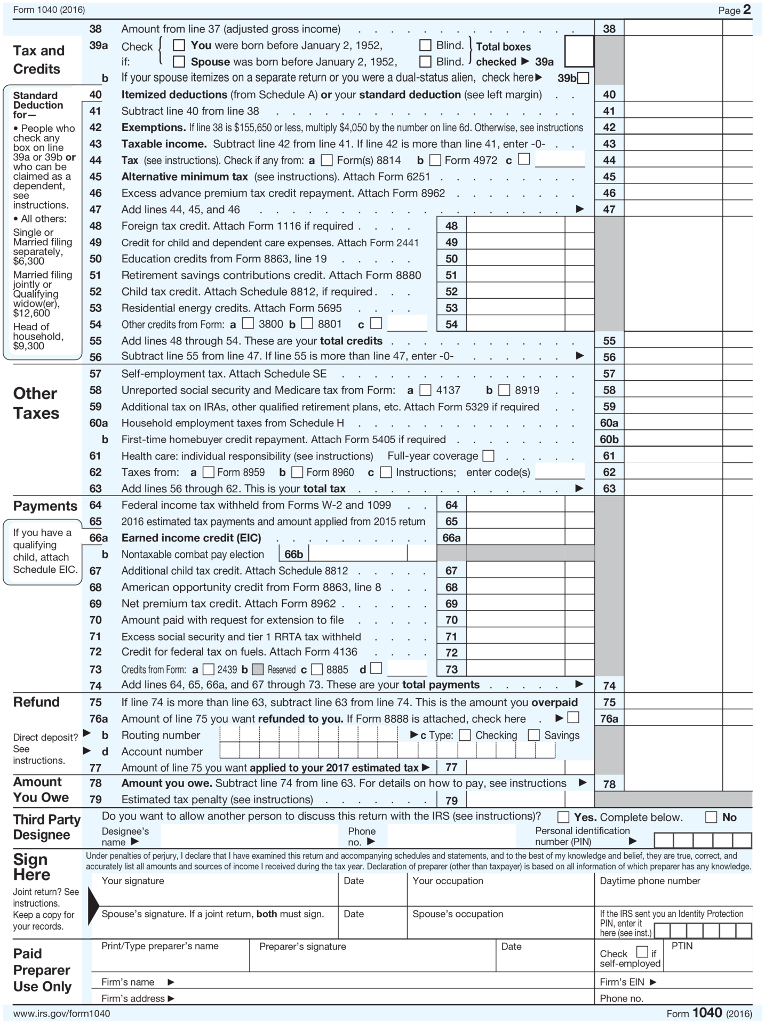

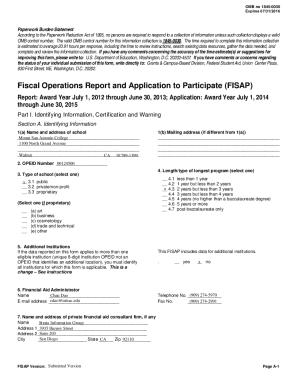

Tax deduction paperwork is a crucial aspect of managing finances, especially for individuals and businesses looking to minimize their tax liabilities. One important aspect of tax deduction paperwork is understanding the expiration dates associated with various documents and forms. Failing to keep track of these dates can result in missed opportunities for tax savings, leading to unnecessary financial burdens. In this article, we will delve into the world of tax deduction paperwork expiration dates, exploring their significance, how to keep track of them, and the potential consequences of not adhering to these timelines.

Significance of Tax Deduction Paperwork Expiration Dates

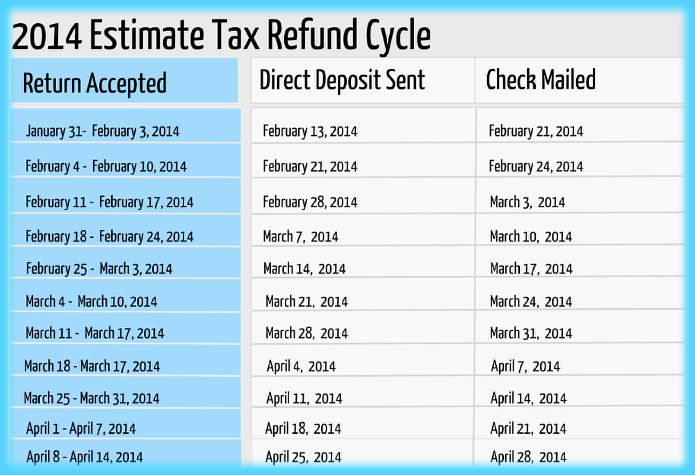

Tax deduction paperwork expiration dates are set by tax authorities to ensure that claims are processed in a timely manner and to prevent fraudulent activities. These dates vary depending on the type of tax deduction, the jurisdiction, and the specific requirements of the tax authority. It is essential to understand these dates to avoid delays in processing tax returns and to ensure that all eligible deductions are claimed. Furthermore, being aware of these expiration dates can help in planning financial activities, such as charitable donations or business investments, to maximize tax benefits.

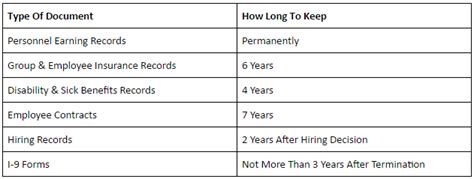

Types of Tax Deductions and Their Expiration Dates

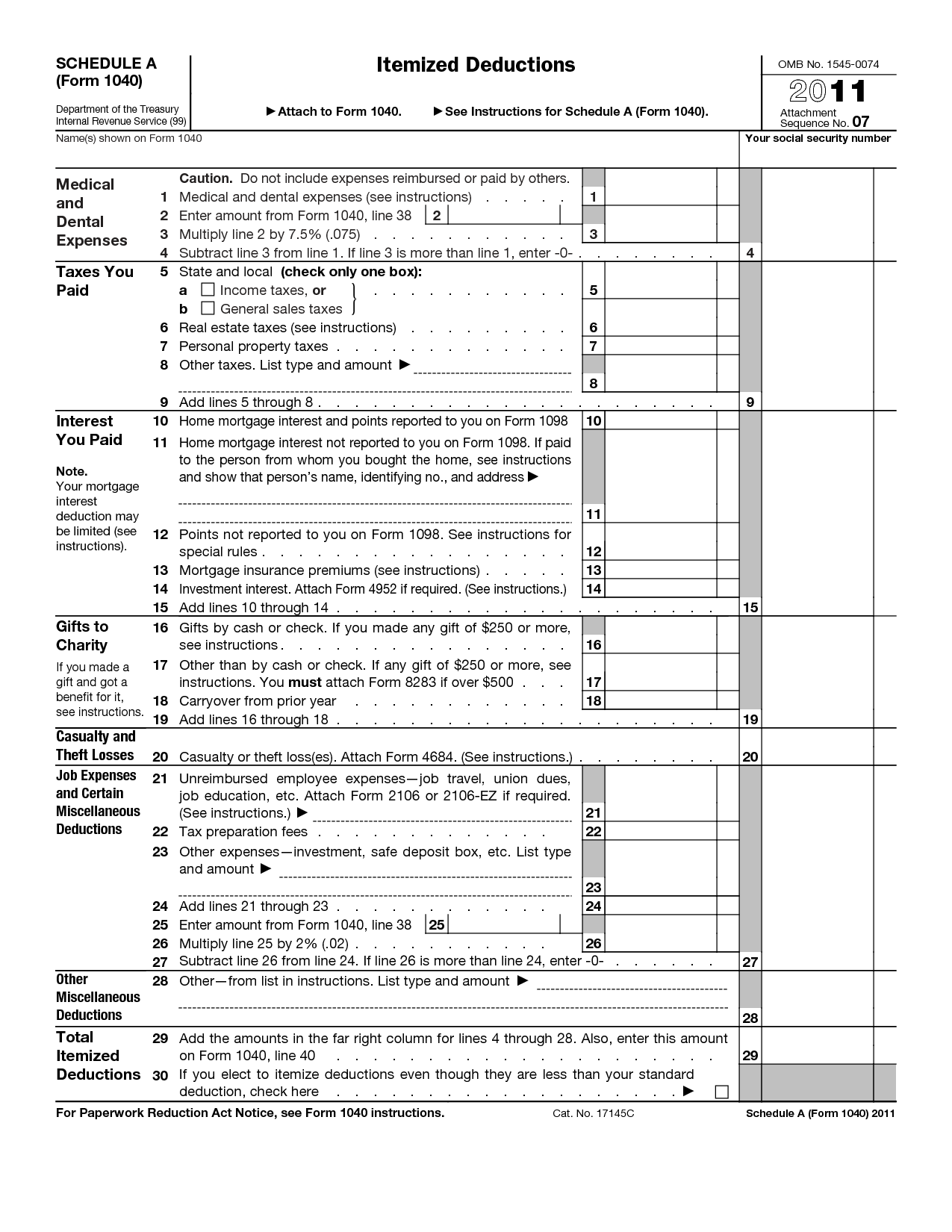

There are numerous types of tax deductions, each with its own set of rules and expiration dates. Some of the most common types include: - Charitable Donations: Receipts for charitable donations must be kept for a certain period, usually several years, in case of an audit. - Business Expenses: Records of business expenses, such as receipts and invoices, must be maintained for a specified duration. - Medical Expenses: Documents supporting medical expense claims have specific retention requirements. - Home Office Deductions: For individuals claiming home office deductions, records of utility bills, rent, and other related expenses must be kept.

Keeping Track of Expiration Dates

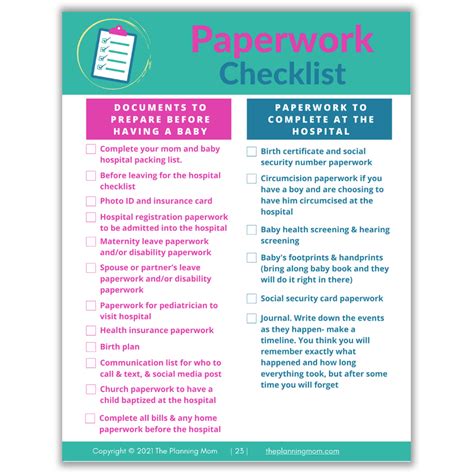

Given the variety of tax deductions and their respective expiration dates, it can be challenging to keep track of them all. Utilizing a tax calendar or a financial planning tool can be highly beneficial. These tools provide reminders of upcoming deadlines and help in organizing necessary documents. Additionally, consulting with a tax professional can offer personalized advice on managing tax deduction paperwork and ensuring compliance with all relevant expiration dates.

Potential Consequences of Missing Expiration Dates

Missing the expiration dates for tax deduction paperwork can have significant consequences, including: - Loss of Eligible Deductions: Failing to submit paperwork on time can result in forfeiting eligible tax deductions, leading to a higher tax liability. - Audits and Penalties: Incomplete or late paperwork can trigger audits, potentially resulting in penalties and fines. - Delayed Refunds: Inaccurate or missing paperwork can cause delays in processing tax returns, leading to delayed refunds.

📝 Note: It is crucial to regularly review and update tax deduction paperwork to avoid any potential issues with tax authorities.

Best Practices for Managing Tax Deduction Paperwork

To effectively manage tax deduction paperwork and keep track of expiration dates, consider the following best practices: - Digitize Documents: Scanning and saving documents digitally can help in organizing and accessing them easily. - Set Reminders: Use calendars or apps to set reminders for upcoming deadlines. - Seek Professional Advice: Consult with tax professionals for guidance on specific tax deductions and their requirements.

Conclusion and Future Planning

In conclusion, understanding and managing tax deduction paperwork expiration dates is vital for maximizing tax savings and avoiding potential penalties. By staying informed, utilizing organizational tools, and seeking professional advice when necessary, individuals and businesses can navigate the complex world of tax deductions with confidence. As financial situations and tax laws evolve, it is essential to regularly review and adjust strategies for managing tax deduction paperwork to ensure ongoing compliance and optimization of tax benefits.

What happens if I miss the expiration date for a tax deduction?

+

Missing the expiration date for a tax deduction can result in losing the eligibility for that deduction, leading to a higher tax liability. It may also trigger audits and potentially result in penalties and fines.

How can I keep track of tax deduction paperwork expiration dates?

+

Utilizing a tax calendar, financial planning tools, and consulting with a tax professional can help in keeping track of tax deduction paperwork expiration dates and ensuring compliance with all relevant deadlines.

What are the best practices for managing tax deduction paperwork?

+

Best practices include digitizing documents, setting reminders for deadlines, and seeking professional advice for guidance on specific tax deductions and their requirements.