File Taxes Paperwork Needed

Introduction to Filing Taxes

Filing taxes can be a daunting task, especially when it comes to gathering all the necessary paperwork. The process involves collecting various documents that prove your income, deductions, and credits. To make this process smoother, it’s essential to understand what paperwork is required and how to organize it efficiently. In this article, we will guide you through the necessary steps and documents needed to file your taxes successfully.

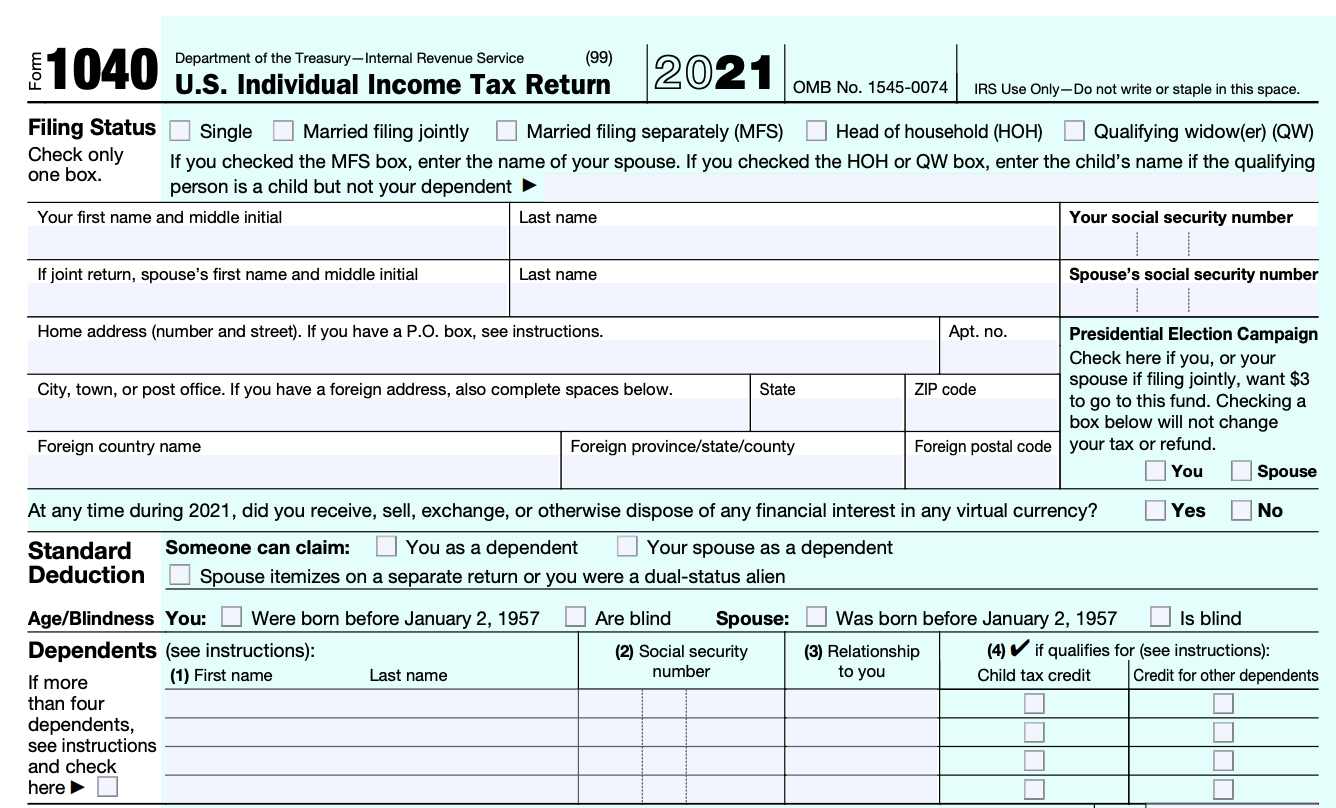

Understanding Tax Forms and Categories

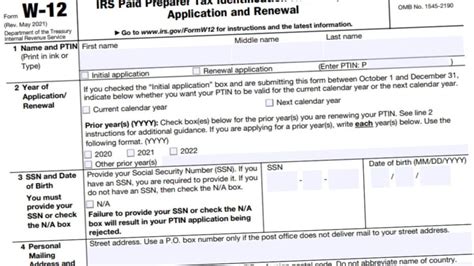

Before diving into the paperwork, it’s crucial to understand the different tax forms and categories. The most common tax form for individuals is the Form 1040, which is used to report income, deductions, and credits. Other forms, such as Form W-2 and Form 1099, are used to report specific types of income. Taxpayers may also need to file additional forms for items like itemized deductions, self-employment income, or education credits.

Gathering Necessary Paperwork

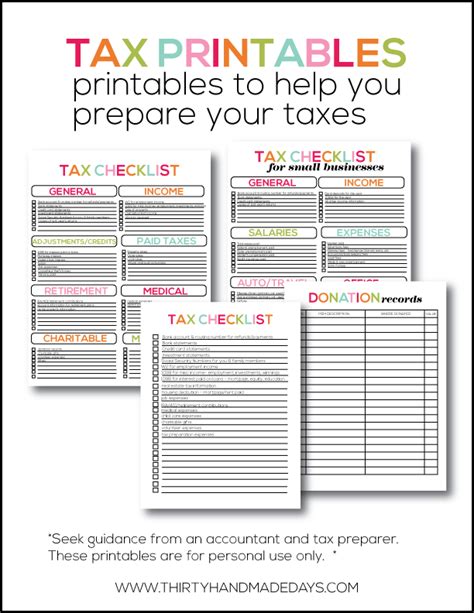

To file your taxes, you will need to gather the following paperwork:

- Identification documents: Social Security number or Individual Taxpayer Identification Number (ITIN) for yourself, your spouse, and dependents

- Income documents:

- Form W-2 from your employer(s)

- Form 1099 for freelance work, interest, dividends, or capital gains

- Any other income-related documents, such as Form K-1 for partnership or S corporation income

- Deduction and credit documents:

- Receipts for charitable donations

- Records of medical expenses

- Information about mortgage interest and property taxes

- Records of education expenses or child care costs

- Business expense documents (if self-employed):

- Records of business income and expenses

- Information about business use of your home

- Records of business-related travel expenses

Organizing Your Paperwork

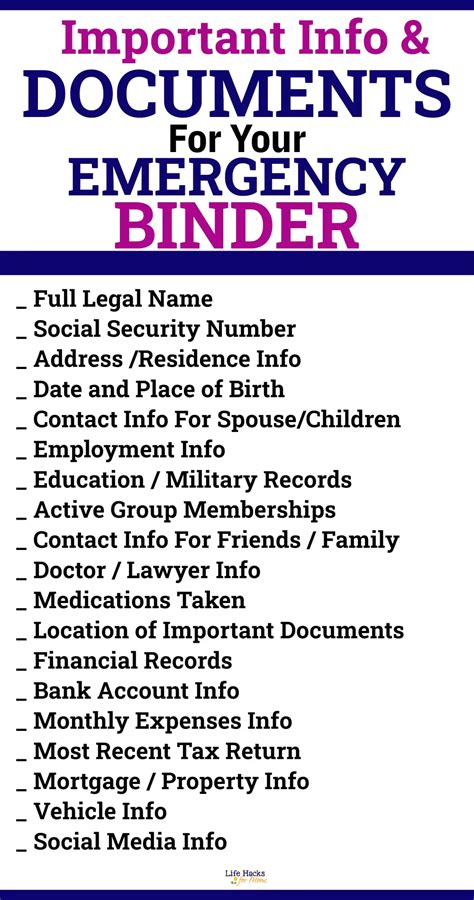

Once you have gathered all the necessary paperwork, it’s essential to organize it in a way that makes sense for your tax filing. You can use a folder or binder to keep all your documents together, or consider using tax software that allows you to upload and organize your documents digitally. Either way, make sure you have a system that works for you and helps you stay on top of your paperwork.

📝 Note: It's essential to keep your paperwork organized throughout the year, not just during tax season. This will help you stay on top of your finances and make the tax filing process much smoother.

Common Tax Credits and Deductions

Tax credits and deductions can help reduce your taxable income and lower your tax bill. Some common tax credits include:

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education credits, such as the American Opportunity Tax Credit or the Lifetime Learning Credit

- Itemized deductions, such as mortgage interest, property taxes, and medical expenses

- Standard deduction, which is a fixed amount that varies based on your filing status

- Business deductions, such as business use of your home or business-related travel expenses

| Credit/Deduction | Description |

|---|---|

| Earned Income Tax Credit (EITC) | A tax credit for low-to-moderate income working individuals and families |

| Child Tax Credit | A tax credit for families with qualifying children under the age of 17 |

| Itemized deductions | Deductions for specific expenses, such as mortgage interest, property taxes, and medical expenses |

Filing Your Taxes

Once you have gathered and organized all the necessary paperwork, you can begin the tax filing process. You can file your taxes electronically using tax software or by mailing in a paper return. If you’re unsure about any part of the process, consider consulting a tax professional for guidance.

In the end, filing taxes requires attention to detail and organization. By understanding what paperwork is needed and how to organize it, you can make the process much smoother and less stressful. Remember to take advantage of tax credits and deductions to reduce your taxable income and lower your tax bill. With the right approach, you can navigate the tax filing process with confidence and accuracy.

What is the deadline for filing taxes?

+

The deadline for filing taxes is typically April 15th of each year, but it may vary depending on your location and circumstances. It’s essential to check with the IRS or a tax professional to confirm the deadline for your specific situation.

What is the difference between a tax credit and a tax deduction?

+

A tax credit reduces your tax bill dollar-for-dollar, while a tax deduction reduces your taxable income. For example, a 1,000 tax credit would reduce your tax bill by 1,000, while a 1,000 tax deduction would reduce your taxable income by 1,000, resulting in a lower tax bill.

Do I need to file taxes if I’m self-employed?

+

Yes, if you’re self-employed, you will need to file taxes and report your business income and expenses. You may need to file additional forms, such as Schedule C, to report your business income and expenses. It’s recommended to consult a tax professional to ensure you’re meeting all the necessary tax requirements.