Paperwork

Fix Wrong Health Insurance Paperwork

Introduction to Fixing Wrong Health Insurance Paperwork

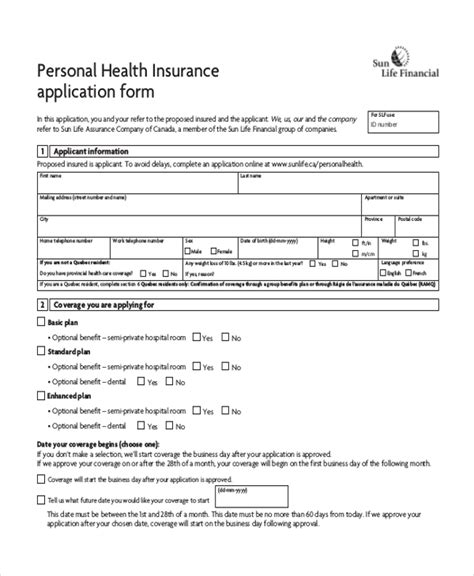

Dealing with health insurance can be a daunting task, especially when it comes to paperwork. With so many forms and documents to keep track of, it’s easy to make mistakes. However, incorrect health insurance paperwork can lead to delayed or denied claims, which can have serious consequences for your health and finances. In this article, we’ll guide you through the process of fixing wrong health insurance paperwork and provide you with the necessary tools to navigate the system.

Understanding the Importance of Accurate Paperwork

Accurate health insurance paperwork is crucial for several reasons. Firstly, it ensures that your claims are processed quickly and efficiently, allowing you to receive the medical care you need without delay. Secondly, it helps to prevent errors and discrepancies that can lead to denied claims or overpayment. Finally, it provides a clear record of your medical history and treatment, which can be useful in case of future claims or disputes. To avoid mistakes, it’s essential to double-check your paperwork before submitting it to your insurance provider.

Common Mistakes in Health Insurance Paperwork

There are several common mistakes that people make when filling out health insurance paperwork. These include: * Incomplete or missing information * Incorrect policy numbers or identification numbers * Misspelled names or addresses * Incorrect dates or timestamps * Failure to sign or date forms * Inconsistent information across multiple forms

How to Fix Wrong Health Insurance Paperwork

If you’ve discovered an error in your health insurance paperwork, don’t panic. The first step is to contact your insurance provider as soon as possible to report the mistake. They will guide you through the process of correcting the error and resubmitting the paperwork. Here are some general steps you can follow: * Review your paperwork carefully to identify the error * Gather any necessary documentation or information to support your correction * Contact your insurance provider to report the mistake and request guidance on how to proceed * Follow the provider’s instructions for resubmitting the corrected paperwork * Keep a record of all correspondence and documentation related to the correction

Tips for Avoiding Mistakes in Health Insurance Paperwork

To avoid mistakes in health insurance paperwork, follow these tips: * Read carefully: Take your time when reading and filling out forms to ensure you understand what’s being asked. * Double-check information: Verify that all information is accurate and complete before submitting forms. * Use a checklist: Create a checklist to ensure you’ve included all necessary documentation and information. * Keep records: Keep a record of all paperwork and correspondence related to your health insurance, including policy numbers, claim numbers, and dates. * Ask questions: Don’t hesitate to ask questions if you’re unsure about something.

Conclusion and Next Steps

Fixing wrong health insurance paperwork can be a frustrating and time-consuming process, but it’s essential to ensure that your claims are processed correctly and efficiently. By understanding the importance of accurate paperwork, being aware of common mistakes, and following the steps outlined in this article, you can navigate the system with confidence. Remember to stay organized, ask questions, and seek help when needed. With the right approach, you can avoid mistakes and ensure that your health insurance paperwork is accurate and complete.

What should I do if I discover an error in my health insurance paperwork?

+

Contact your insurance provider as soon as possible to report the mistake and follow their guidance on how to correct it.

How can I avoid mistakes in health insurance paperwork?

+

Read carefully, double-check information, use a checklist, keep records, and ask questions if you’re unsure about something.

What are the consequences of incorrect health insurance paperwork?

+

Incorrect health insurance paperwork can lead to delayed or denied claims, which can have serious consequences for your health and finances.