Paperwork

LaSalle Network Payroll Paperwork Explained

Introduction to Payroll Paperwork

When it comes to managing a business, one of the most critical aspects is handling payroll. This includes not only paying employees but also dealing with the associated paperwork. For companies like LaSalle Network, a staffing and recruiting firm, understanding and efficiently managing payroll paperwork is crucial for smooth operations. In this article, we’ll delve into the world of payroll paperwork, exploring what it entails, its importance, and how it’s managed, especially in the context of a staffing agency.

Understanding Payroll Paperwork

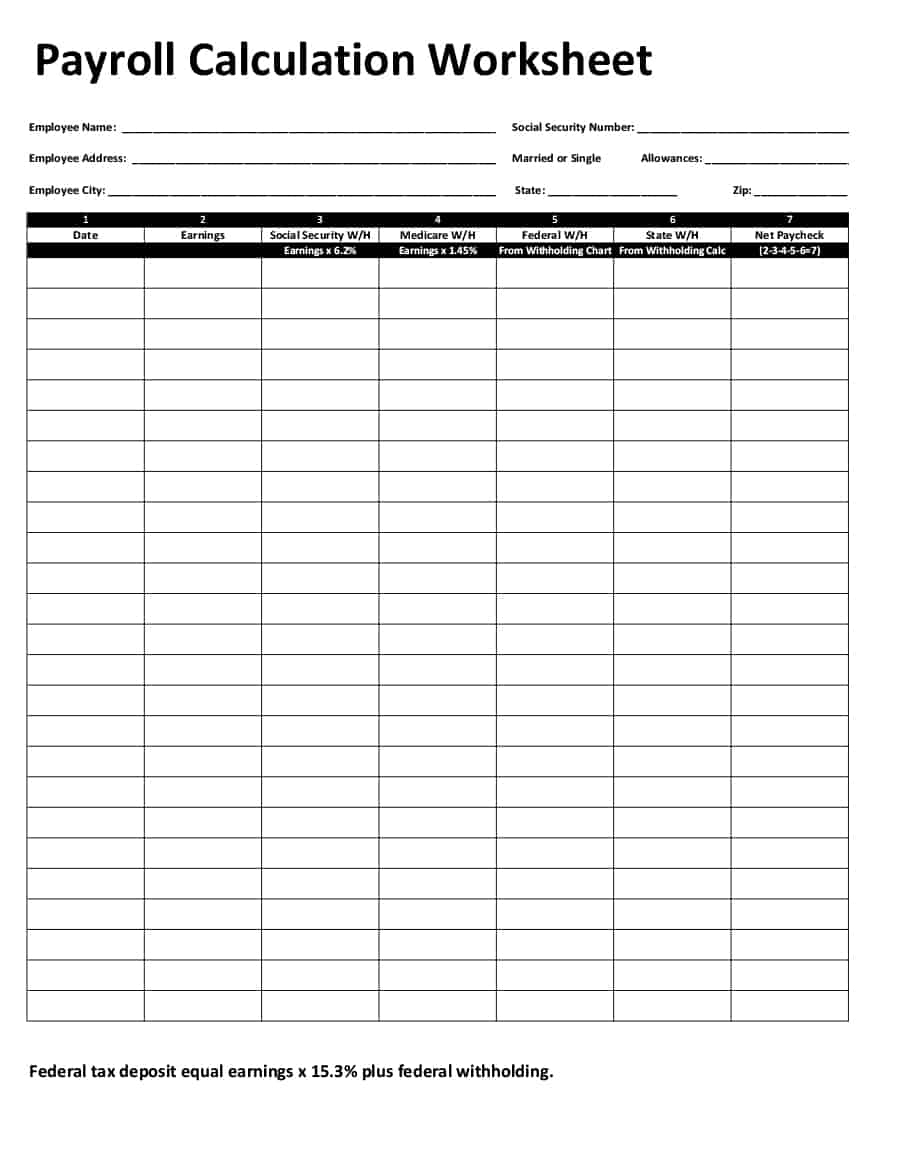

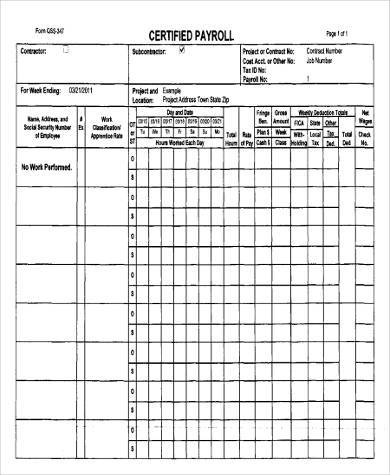

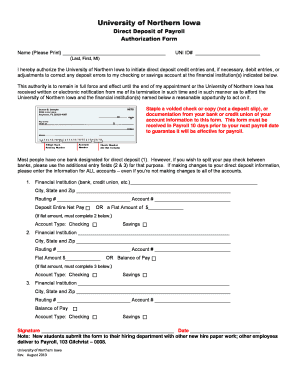

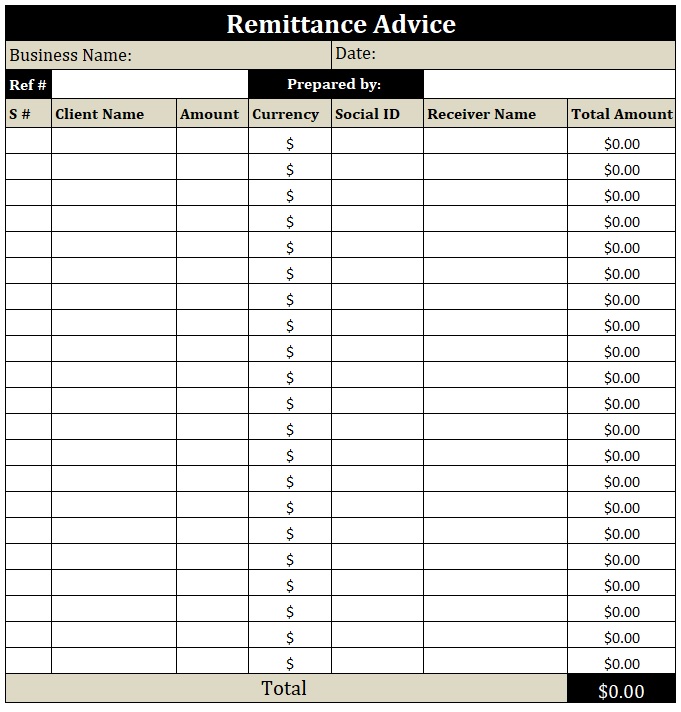

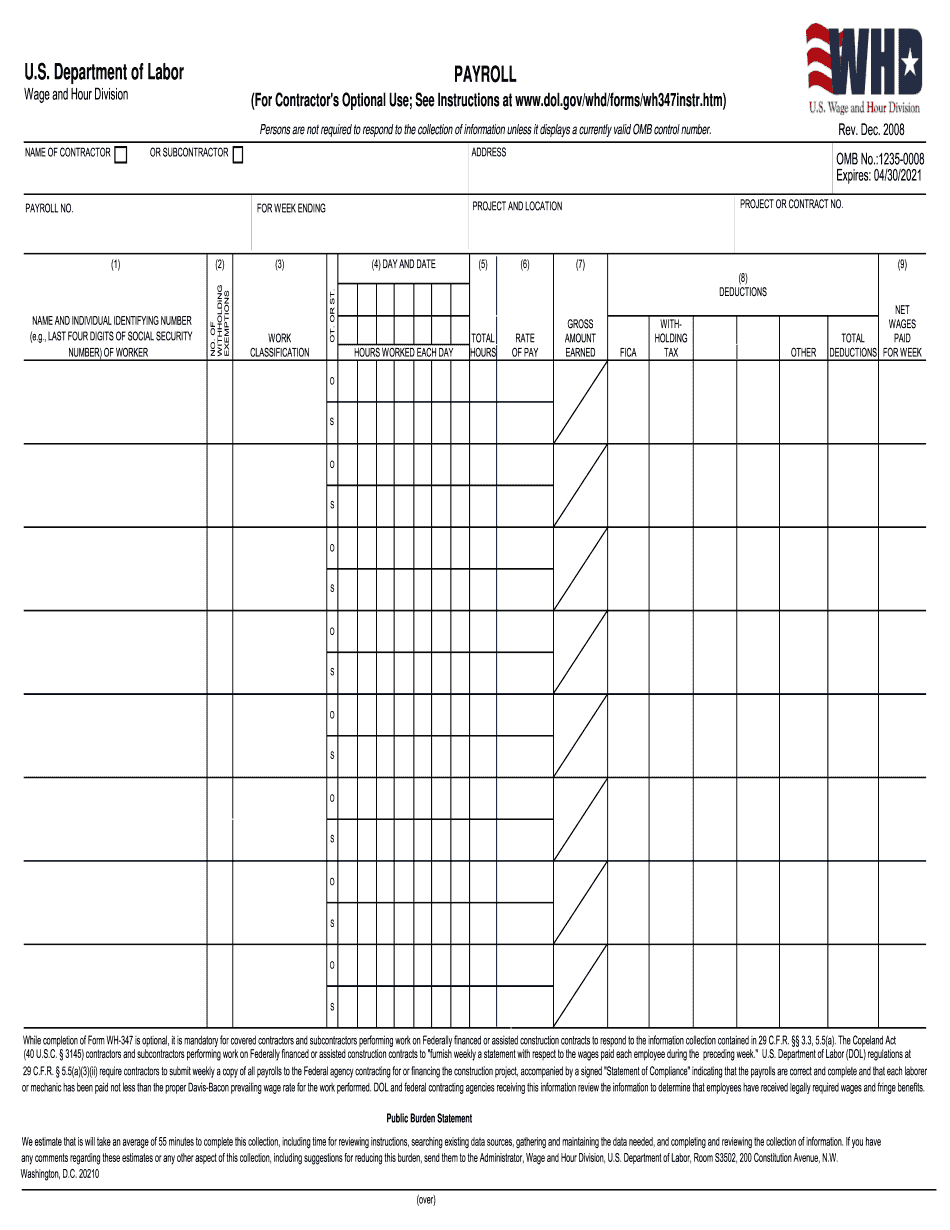

Payroll paperwork encompasses a wide range of documents and processes necessary for paying employees, filing taxes, and complying with labor laws. This can include W-4 forms for tax withholding, I-9 forms for employment verification, payroll tax returns, and benefits enrollment forms, among others. Each of these documents plays a vital role in ensuring that employees are paid correctly and that the company remains compliant with federal, state, and local regulations.

Importance of Accurate Payroll Paperwork

The importance of accurate and timely payroll paperwork cannot be overstated. Mistakes or delays in payroll processing can lead to unhappy employees, potential legal issues, and financial penalties. Moreover, accurate payroll records are essential for audits, compliance checks, and financial reporting. For a staffing agency like LaSalle Network, which deals with a significant number of employees and clients, maintaining precise payroll records is vital for building trust and ensuring the continuity of business operations.

Steps in Managing Payroll Paperwork

Managing payroll paperwork effectively involves several steps: - Gathering necessary documents: Ensuring all required forms are completed and collected from employees. - Verifying information: Confirming the accuracy of employee data, including names, addresses, and tax withholding information. - Processing payroll: Calculating pay, deducting taxes and benefits, and distributing payments. - Filing tax returns and compliance reports: Submitting payroll tax returns and other required reports to government agencies. - Maintaining records: Keeping accurate and accessible payroll records for future reference and audits.

Technological Solutions for Payroll Paperwork

In today’s digital age, numerous technological solutions can streamline payroll paperwork, making the process more efficient and reducing the likelihood of errors. Payroll software can automate many tasks, from calculating paychecks to filing tax returns. Additionally, cloud-based HR systems can securely store employee documents and provide easy access for authorized personnel. Implementing such technology can significantly reduce the administrative burden associated with payroll paperwork.

Best Practices for Payroll Paperwork Management

Several best practices can help in managing payroll paperwork effectively: - Stay updated with regulations: Regularly review changes in labor laws and tax regulations to ensure compliance. - Implement a robust payroll system: Utilize technology to automate and streamline payroll processes. - Train personnel: Ensure that staff responsible for payroll are well-trained and understand the importance of accuracy and timeliness. - Conduct regular audits: Periodically review payroll records to identify and correct any discrepancies or errors.

📝 Note: Regular training and updates are crucial for payroll personnel to handle the complexities of payroll paperwork efficiently and accurately.

Challenges in Payroll Paperwork Management

Despite the best efforts, challenges can arise in managing payroll paperwork. These can include compliance issues, data security concerns, and scalability problems as the business grows. Addressing these challenges requires a proactive approach, including investing in robust payroll systems, maintaining open communication with employees, and staying abreast of regulatory changes.

Conclusion

In essence, payroll paperwork is a critical component of business operations, particularly for staffing agencies like LaSalle Network. By understanding the importance of accurate and timely payroll paperwork, implementing technological solutions, and following best practices, companies can navigate the complexities of payroll management. This not only ensures compliance with regulations but also fosters a positive and productive work environment.

What is the primary purpose of payroll paperwork?

+

The primary purpose of payroll paperwork is to ensure accurate payment of employees, compliance with labor laws, and proper filing of tax returns.

How can technology help in managing payroll paperwork?

+

Technology, such as payroll software and cloud-based HR systems, can automate tasks, reduce errors, and securely store employee documents, making payroll paperwork more efficient.

What are some best practices for managing payroll paperwork?

+

Best practices include staying updated with regulations, implementing a robust payroll system, training personnel, and conducting regular audits to ensure accuracy and compliance.