5 Refinance Paper Tips

Introduction to Refinance Paper Tips

When considering refinancing a mortgage, it’s essential to understand the process and what to expect. Refinancing can be a great way to save money on interest, lower monthly payments, or tap into home equity. However, it’s crucial to approach the process with caution and be aware of the potential pitfalls. In this article, we will provide you with 5 refinance paper tips to help you navigate the process successfully.

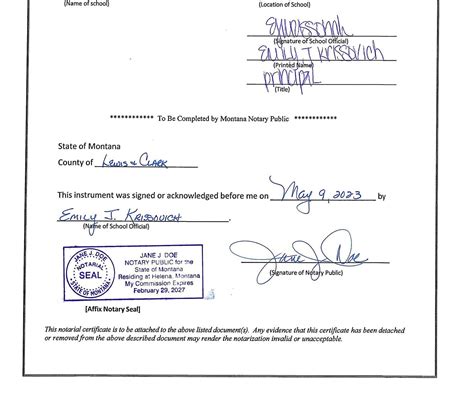

Understanding Refinance Papers

Before we dive into the tips, it’s essential to understand what refinance papers are. Refinance papers refer to the documents and paperwork required to refinance a mortgage. These papers typically include the loan application, credit report, appraisal, and title report. The lender will use these documents to evaluate your creditworthiness and determine the terms of the new loan.

Tip 1: Check Your Credit Score

Your credit score plays a significant role in determining the interest rate you’ll qualify for and whether you’ll be approved for the refinance. It’s essential to check your credit score before applying for a refinance. You can request a free credit report from the three major credit reporting agencies: Equifax, Experian, and TransUnion. Review your report for any errors or inaccuracies and work on improving your score if necessary.

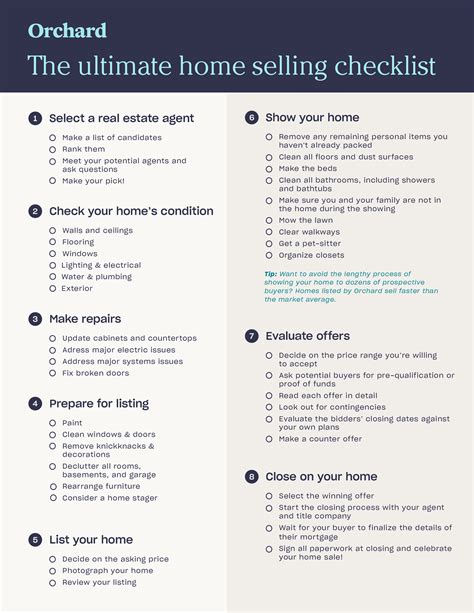

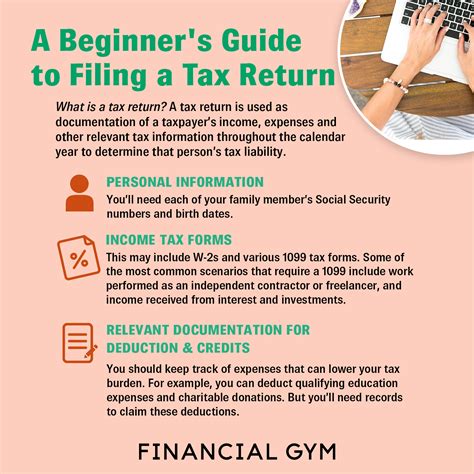

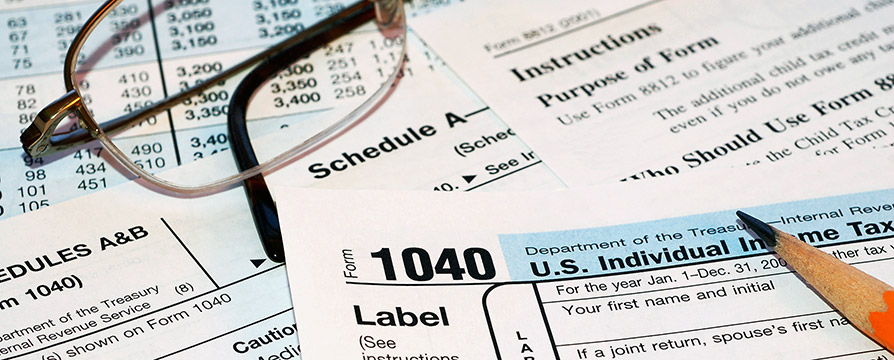

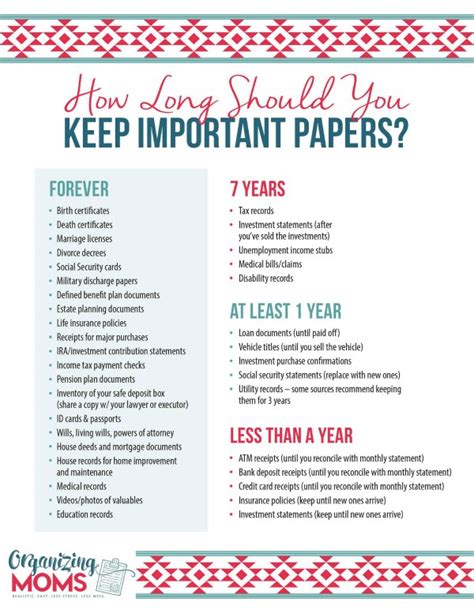

Tip 2: Gather All Necessary Documents

To avoid delays in the refinance process, it’s crucial to gather all necessary documents upfront. These documents typically include: * Pay stubs * Bank statements * Tax returns * Identification * Proof of insurance Make sure you have all the required documents ready and organized to ensure a smooth process.

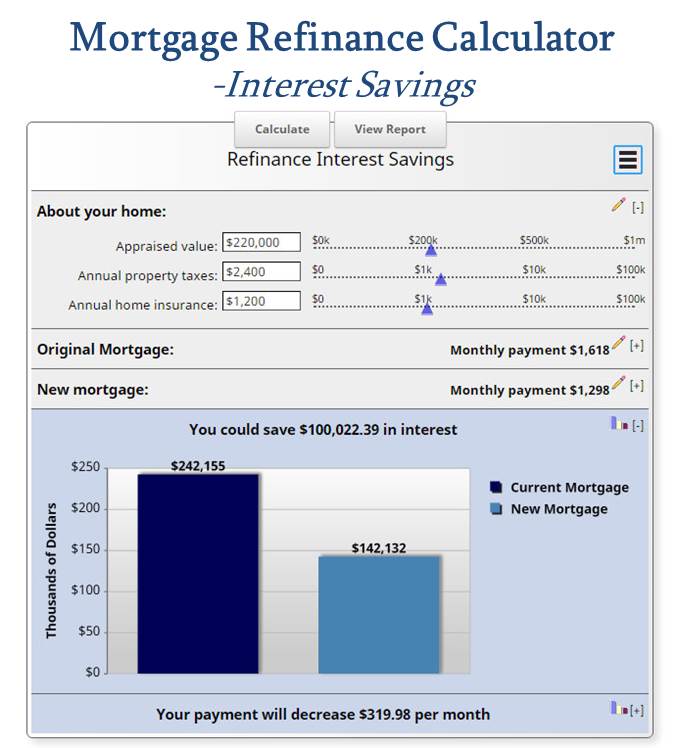

Tip 3: Compare Loan Options

When refinancing, you’ll have various loan options to choose from. It’s essential to compare loan options carefully to determine which one best suits your needs. Consider factors such as: * Interest rate * Loan term * Fees * Repayment terms Create a table to compare the different loan options:

| Loan Option | Interest Rate | Loan Term | Fees |

|---|---|---|---|

| Option 1 | 4% | 30 years | 1,000</td> </tr> <tr> <td>Option 2</td> <td>4.5%</td> <td>20 years</td> <td>500 |

Tip 4: Consider Working with a Mortgage Broker

A mortgage broker can help you navigate the refinance process and find the best loan option for your situation. They have access to multiple lenders and can help you compare rates and terms. However, be aware that mortgage brokers may charge fees for their services.

Tip 5: Review and Understand the Loan Terms

Before signing the refinance papers, it’s crucial to review and understand the loan terms. Make sure you understand the interest rate, loan term, fees, and repayment terms. Don’t hesitate to ask questions if you’re unsure about any aspect of the loan.

📝 Note: Carefully review the loan terms and ask questions if you're unsure about any aspect of the loan.

To summarize, refinancing a mortgage can be a great way to save money on interest or lower monthly payments. By following these 5 refinance paper tips, you’ll be well-prepared to navigate the process successfully. Remember to check your credit score, gather all necessary documents, compare loan options, consider working with a mortgage broker, and review and understand the loan terms. With the right approach, you can ensure a smooth and successful refinance process.

What is the main purpose of refinancing a mortgage?

+

The main purpose of refinancing a mortgage is to save money on interest, lower monthly payments, or tap into home equity.

What documents are typically required for a refinance?

+

The documents typically required for a refinance include pay stubs, bank statements, tax returns, identification, and proof of insurance.

How can I improve my credit score before refinancing?

+

You can improve your credit score by checking your credit report for errors, paying off debt, and making on-time payments.