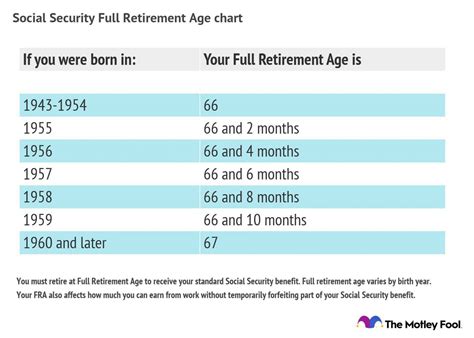

5 Tax Papers Needed

Understanding the Importance of Tax Papers

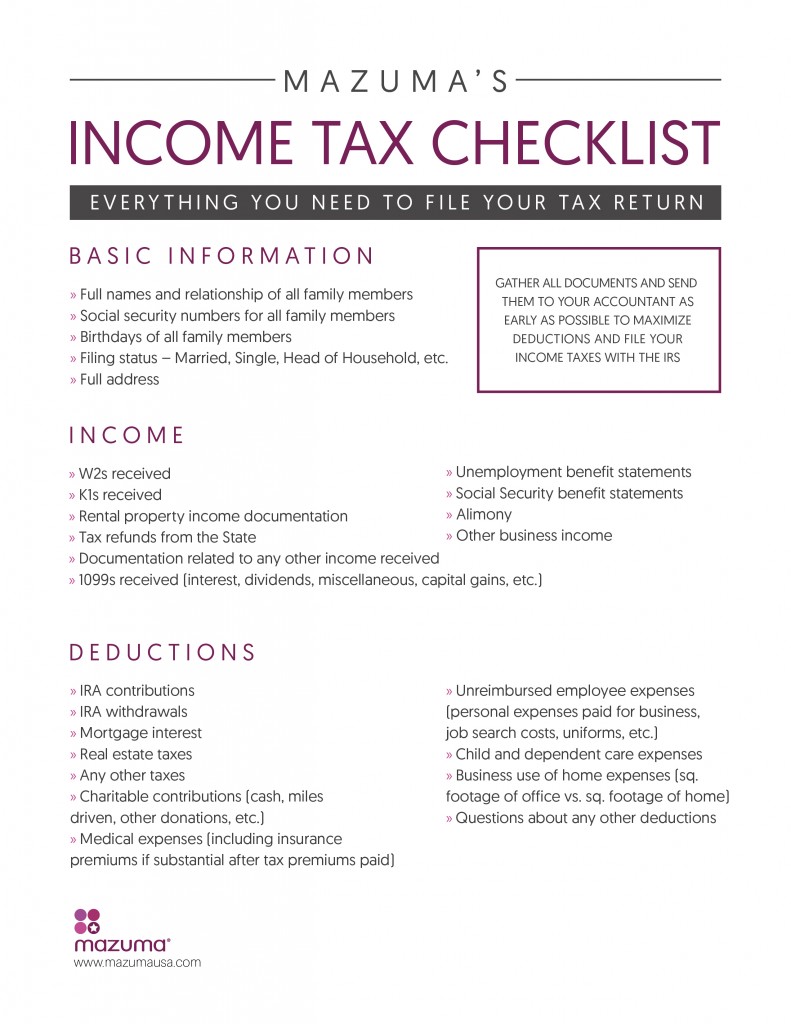

When it comes to managing your finances, especially during tax season, having the right documents is crucial. These papers serve as the foundation for your tax return, ensuring you claim the correct deductions and credits. In this article, we’ll explore five essential tax papers you need to have in order, along with a brief overview of their significance and how they impact your tax filing process.

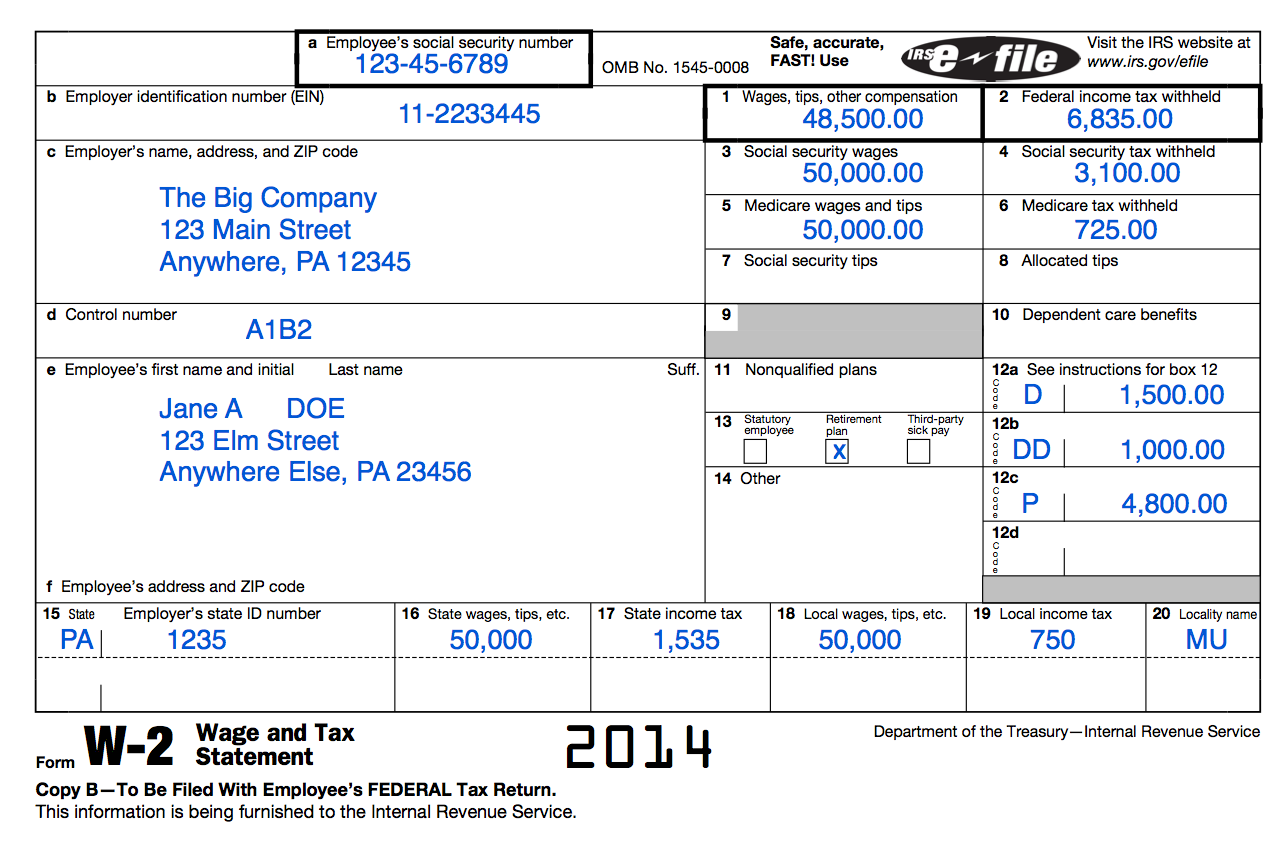

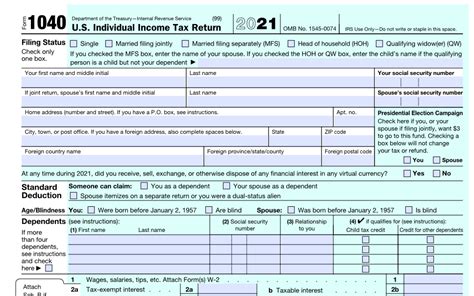

1. W-2 Forms: Reporting Your Income

Your W-2 form is one of the most critical documents you’ll receive at the beginning of each year. It’s provided by your employer and details your income and the taxes withheld from your paycheck. This form is essential for reporting your income accurately on your tax return. Ensure you receive a W-2 from each employer you’ve worked for during the tax year.

2. 1099 Forms: Income Beyond Salary

If you’ve worked as an independent contractor, freelancer, or have income from sources other than a salary, you’ll receive 1099 forms. These forms report income that isn’t subject to tax withholding, such as self-employment income, interest, dividends, and capital gains distributions. It’s crucial to gather all 1099 forms to report your total income accurately.

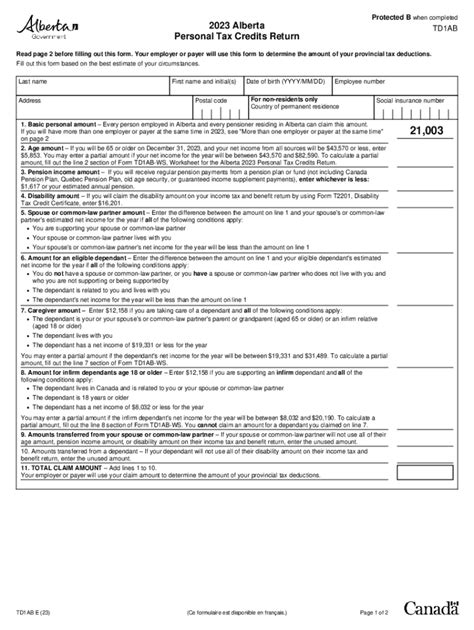

3. Interest Statements (1098 and 1099-INT): Reporting Interest Income

1098 and 1099-INT forms are used to report interest income. The 1098 form is specifically for mortgage interest, while the 1099-INT form reports interest from banks, bonds, and other investments. These documents are necessary for claiming deductions on mortgage interest and for reporting interest income.

4. Charitable Donation Receipts: Claiming Deductions

If you’ve made charitable donations throughout the year, you’re eligible to claim these as deductions on your tax return. Keep receipts for all donations, including cash, goods, and mileage for volunteer work. These receipts will help you calculate the total value of your donations and ensure you receive the deductions you’re entitled to.

5. Medical Expense Records: Claiming Medical Deductions

Medical expenses can add up quickly, and you may be able to claim some of these costs as deductions on your tax return. Keep detailed records of all medical expenses, including prescriptions, doctor visits, hospital stays, and any medical equipment or supplies. These records will help you calculate your total medical expenses and determine if you qualify for deductions.

📝 Note: Always keep your tax papers and related documents in a safe and secure location. Digital copies can be useful, but it's also a good idea to keep physical copies of important documents.

When organizing your tax papers, consider using a system that works for you, such as a folder for each type of document or a digital tool to store and categorize your tax-related information. This will make it easier to find the documents you need when filing your taxes.

In terms of organizing and keeping track of your tax papers, here are a few tips: - Use a Filing System: Whether physical or digital, having a dedicated space for your tax documents can save time and reduce stress. - Set Reminders: Mark your calendar for when you should receive important tax documents and when tax filing deadlines are approaching. - Seek Professional Help: If you’re unsure about any part of the tax filing process, consider consulting a tax professional.

To further illustrate the importance of these documents, let’s consider a scenario where an individual fails to report all their income due to missing a 1099 form. This oversight could lead to delays in their tax refund or even result in an audit. Thus, it’s paramount to be meticulous about gathering all necessary tax papers.

In summary, having the right tax papers is vital for a smooth and accurate tax filing process. From W-2 and 1099 forms to charitable donation receipts and medical expense records, each document plays a critical role in ensuring you claim the correct deductions and credits. By understanding the importance of these papers and staying organized, you can navigate the tax season with confidence.

What is the deadline for receiving all necessary tax papers?

+

Typically, you should receive most tax papers by the end of January or early February. However, the exact deadline can vary depending on the type of document and the issuer.

How long should I keep my tax papers and related documents?

+

It’s recommended to keep tax papers and related documents for at least three years from the date you filed your tax return. This duration allows for any potential audits or questions from the tax authority.

Can I file my taxes without all the necessary papers?

+

While it’s technically possible to start the tax filing process without all papers, it’s highly recommended to gather all necessary documents first. Missing documents can lead to inaccuracies, delays, or even audits.