Home Ownership Paperwork Needed

Introduction to Home Ownership Paperwork

When considering purchasing a home, it’s essential to understand the various types of paperwork involved in the process. Home ownership paperwork can be overwhelming, but being prepared and knowing what to expect can make the experience less stressful. Organizing and managing these documents is crucial for a smooth transaction. In this article, we will delve into the different types of paperwork needed for home ownership, highlighting key documents and their significance in the home buying process.

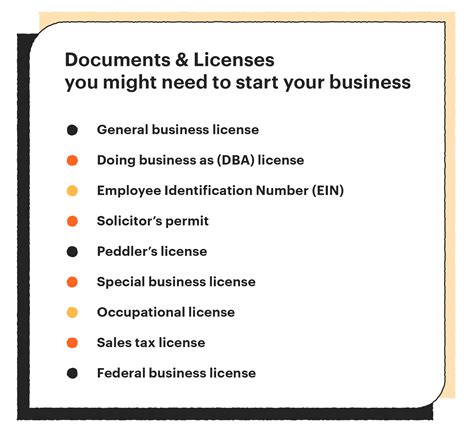

Pre-Approval and Pre-Qualification Documents

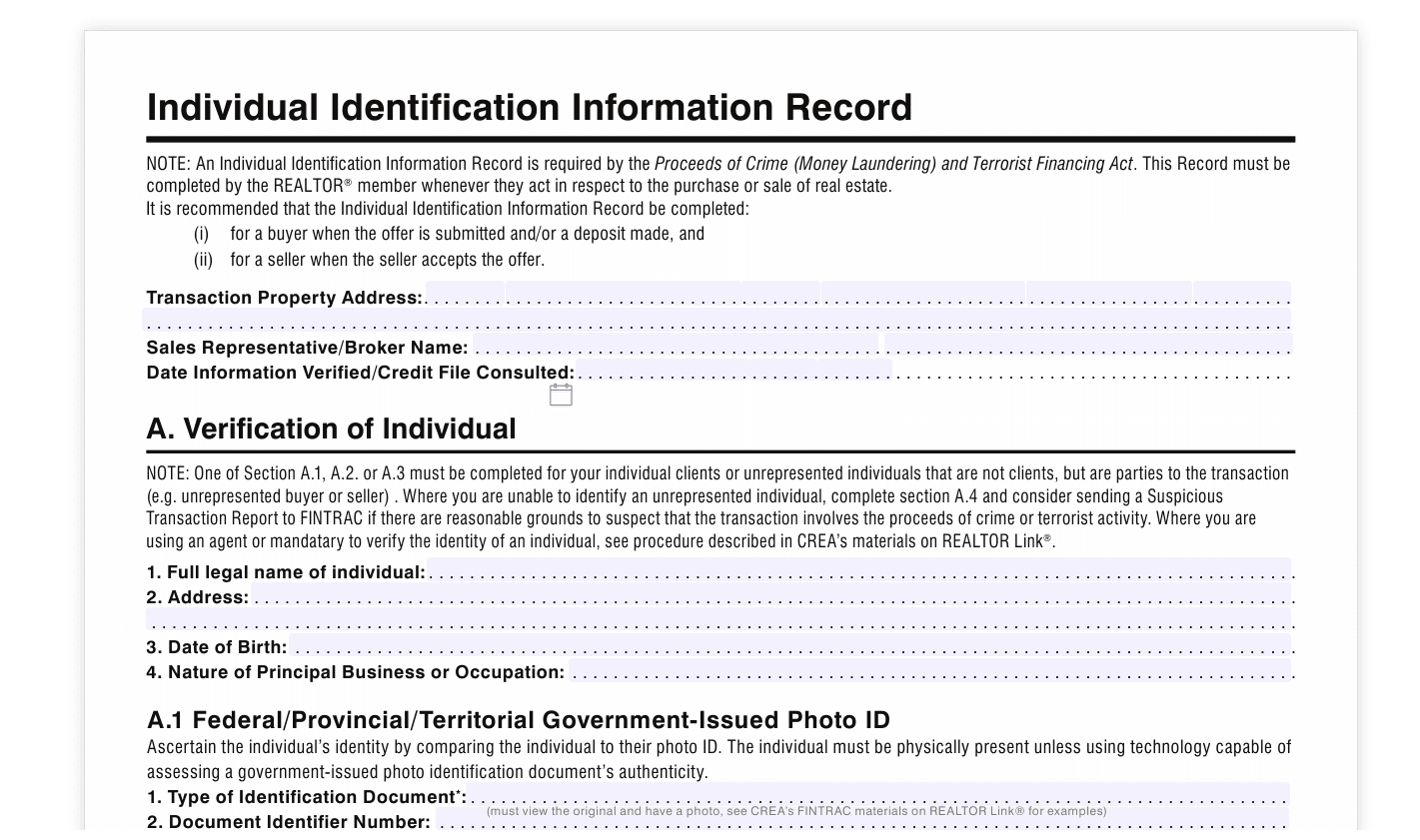

Before starting the home search, pre-approval and pre-qualification are necessary steps. These processes involve submitting financial documents to a lender to determine how much they are willing to lend. The required paperwork for pre-approval and pre-qualification includes: * Identification documents: Driver’s license, passport, or state ID * Income verification: Pay stubs, W-2 forms, and tax returns * Bank statements: To verify savings and assets * Credit reports: To check credit score and history

Offer and Acceptance Documents

Once a potential home is found, the next step is to make an offer. This involves submitting a purchase agreement that includes: * Offer price: The proposed purchase price * Contingencies: Conditions that must be met before the sale is finalized, such as a home inspection or financing * Closing date: The expected date of the sale * Deposit: A portion of the purchase price paid to secure the sale

Inspection and Due Diligence Documents

After the offer is accepted, the buyer will typically conduct a home inspection to identify any potential issues with the property. The inspection report will highlight any necessary repairs or concerns. Additionally, the buyer will review property records and title reports to ensure the seller has the right to sell the property.

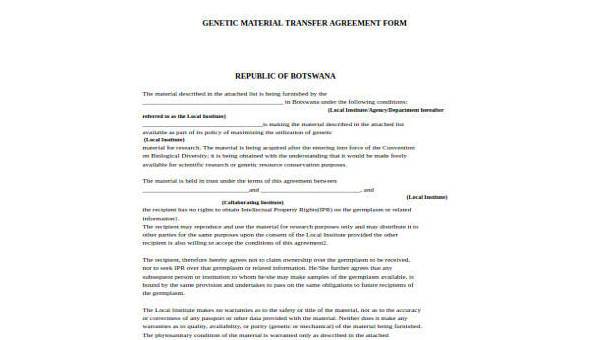

Mortgage and Financing Documents

To secure financing, the buyer will need to provide the lender with additional documentation, including: * Loan application: A detailed application outlining the borrower’s financial information * Appraisal report: An independent assessment of the property’s value * Title insurance: Protection against any issues with the property’s title * Homeowners insurance: Coverage for the property and its contents

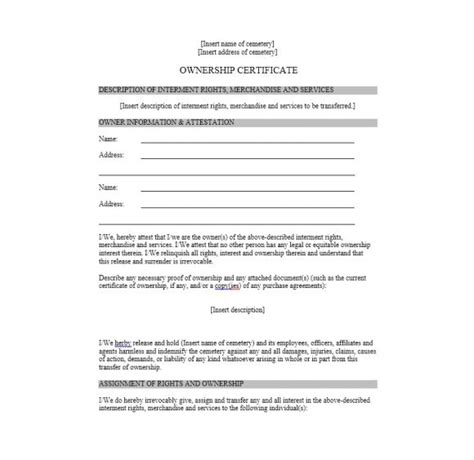

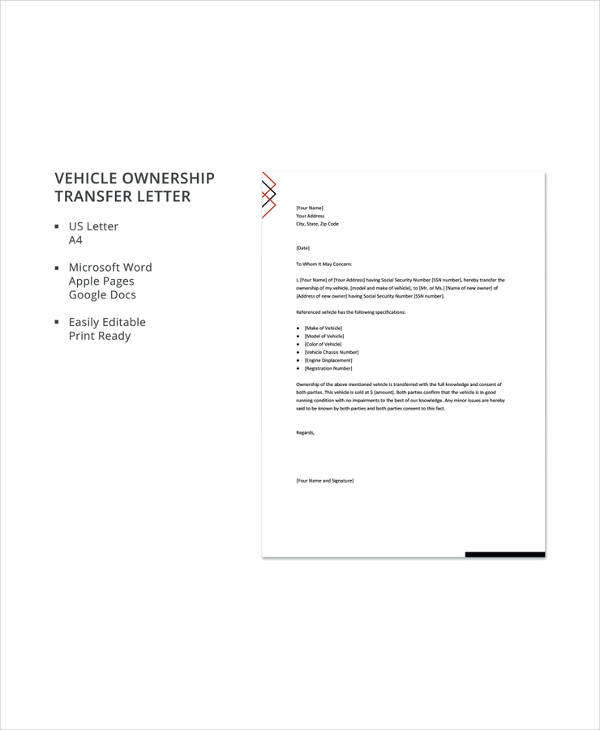

Closing Documents

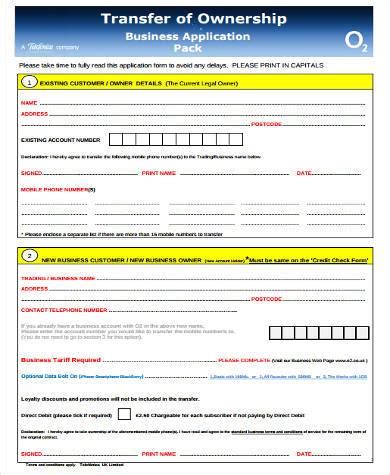

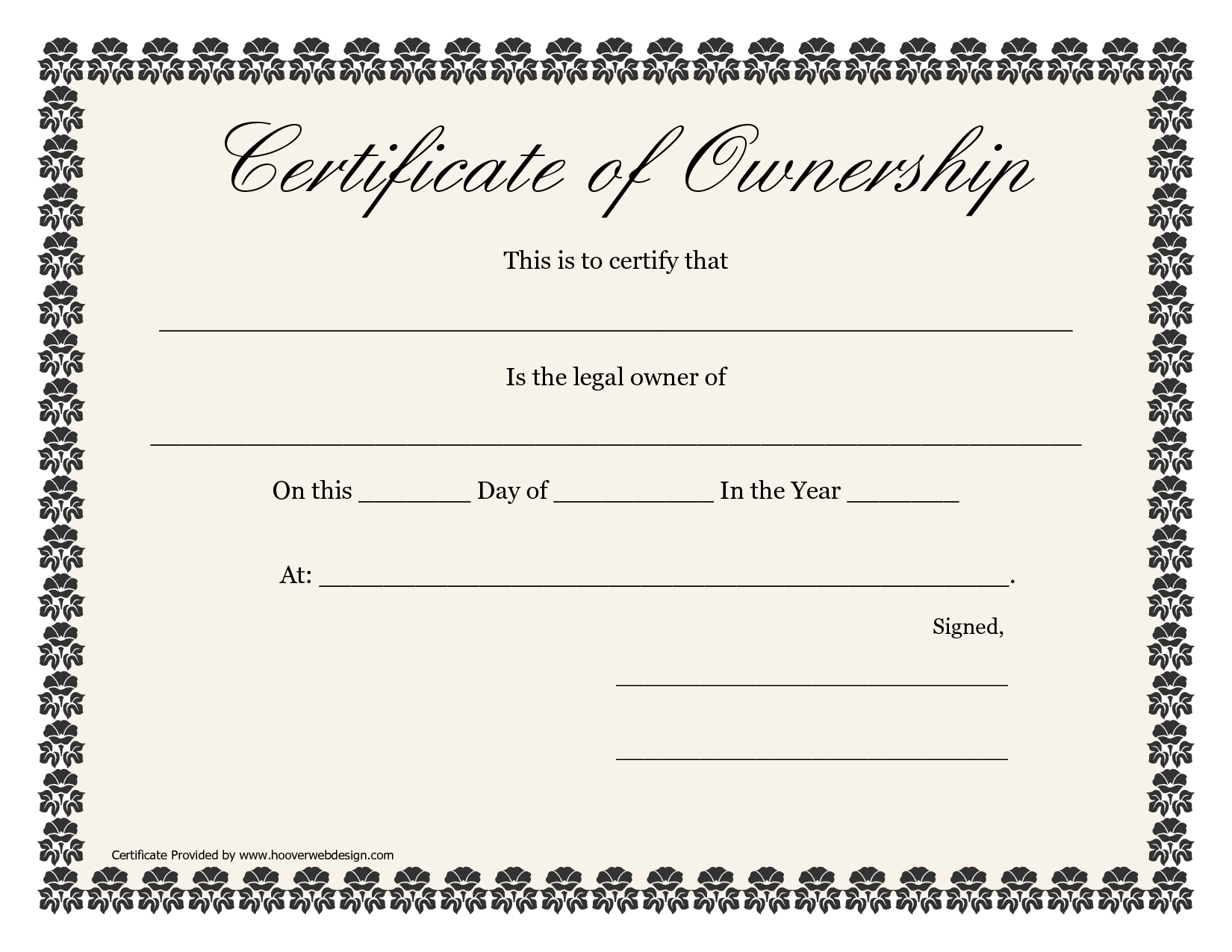

The final step in the home buying process is the closing, where the buyer and seller sign the necessary documents to transfer ownership. The closing documents include: * Deed: The document that transfers ownership of the property * Mortgage note: The agreement outlining the terms of the loan * Security instrument: The document that secures the loan, such as a mortgage or deed of trust * Closing statement: A detailed breakdown of the costs associated with the sale

| Document | Description |

|---|---|

| Pre-approval letter | A letter from the lender stating the approved loan amount |

| Purchase agreement | A contract outlining the terms of the sale |

| Inspection report | A document highlighting any issues with the property |

| Mortgage note | An agreement outlining the terms of the loan |

| Deed | A document that transfers ownership of the property |

📝 Note: It's essential to carefully review all documents before signing, as they are legally binding contracts.

As the home buying process comes to a close, it’s essential to review and understand all the paperwork involved. By being prepared and knowing what to expect, buyers can navigate the process with confidence. The key to a successful transaction lies in attention to detail and a thorough understanding of the necessary documents. In the end, the satisfaction of owning a home makes the paperwork worthwhile, and being well-informed can make all the difference in achieving this goal.

What is the difference between pre-approval and pre-qualification?

+

Pre-qualification is an initial assessment of a borrower’s creditworthiness, while pre-approval is a more formal commitment from the lender to provide financing.

What documents are required for a mortgage application?

+

The required documents include identification, income verification, bank statements, and credit reports.

What is the purpose of a home inspection?

+

A home inspection is conducted to identify any potential issues with the property, providing the buyer with a comprehensive understanding of the property’s condition.