Paperwork

Tax Paperwork Retention Period

Introduction to Tax Paperwork Retention

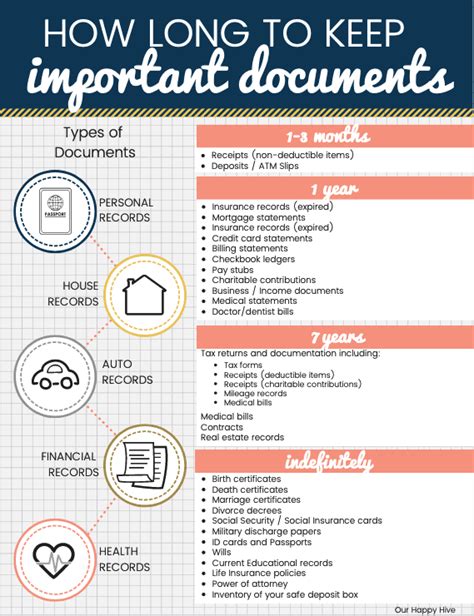

When it comes to tax paperwork, one of the most common questions taxpayers have is how long they should keep their tax-related documents. The answer to this question can vary depending on the type of document and the potential need for it in the future. Proper retention of tax paperwork is crucial for several reasons, including the possibility of an audit, the need to support deductions or credits claimed, and for personal financial record-keeping. In this article, we will delve into the world of tax paperwork retention, exploring the different types of documents, their retention periods, and why they are important.

Understanding Tax Paperwork

Tax paperwork encompasses a wide range of documents, including but not limited to: - Tax returns (personal and business) - W-2 forms - 1099 forms - Receipts for deductions (charitable donations, medical expenses, etc.) - Records of business expenses - Documents related to assets (purchase and sale agreements, etc.) Each of these documents plays a critical role in the tax filing process and may be necessary for future reference.

Retention Periods for Tax Documents

The retention period for tax documents can vary based on the document type and the taxpayer’s specific situation. Generally, the IRS recommends keeping tax returns and supporting documents for at least three years in case of an audit. However, some documents should be kept for longer periods. For example: - Employment tax records should be kept for at least four years. - Records related to assets (like stocks, bonds, and real estate) should be kept for as long as you own the asset plus three years after you dispose of it. - Records of gifts should be kept for as long as you might be asked to produce them in case of an audit, which could be several years.

📝 Note: The three-year rule is a general guideline. If you're concerned about specific documents, it's always better to err on the side of caution and retain them for a longer period.

Importance of Digital Storage

In today’s digital age, scanning and digitally storing your tax documents can be an efficient way to keep them organized and easily accessible. This method also helps in reducing physical storage space. When digitizing your documents, consider using a secure cloud storage service to protect against data loss due to physical damage or theft. Encryption and strong passwords can add an extra layer of security to your digital files.

Best Practices for Document Organization

Organizing your tax documents, whether physically or digitally, is crucial for easy access and to ensure you can find what you need quickly. Here are some best practices: - Categorize documents based on their type (e.g., income documents, deduction receipts, asset records). - Use clear and descriptive filenames for digital documents. - Store documents securely, whether in a safe or a secure digital storage service. - Regularly back up your digital files to prevent loss.

Conclusion and Future Considerations

In summary, the retention period for tax paperwork varies, but as a rule of thumb, keeping documents for at least three years is a good starting point. Understanding what needs to be kept and for how long can simplify your tax preparation process and protect you in case of an audit. As tax laws and personal financial situations evolve, it’s essential to revisit and adjust your document retention practices accordingly. Remember, being organized and prepared is key to navigating the complex world of taxation with ease.

What is the general retention period recommended by the IRS for tax returns and supporting documents?

+

The IRS generally recommends keeping tax returns and supporting documents for at least three years in case of an audit.

How long should employment tax records be kept?

+

Employment tax records should be kept for at least four years.

What is the best way to store tax documents to ensure they are secure and easily accessible?

+

Scanning and digitally storing tax documents in a secure cloud storage service, with consideration for encryption and strong passwords, can be an efficient and secure method.